Similar to other industries, the digitalisation of the banking industry has brought a significant shift in the way financial services are provided. Millions of individuals with bank accounts now consider mobile banking applications as indispensable companions, relying on them for a diverse array of services.

However, as banking apps handle the most sensitive human data, which comprises financial information, testing scenarios for them must be meticulously designed. Nothing can be left to chance, and inadequate test coverage could result in potential risks and vulnerabilities.

In this article, we will explore the various aspects of banking domain application testing, including a comprehensive checklist and sample test cases to ensure the robustness and security of these applications.

What is Banking Domain Application Testing?

A banking domain encompasses all the essential elements required to execute a financial service end-to-end. This includes the entire transaction and distribution process, the various methods through which customers interact with the business’s system, products, and services, as well as the technology involved.

In simple words, the bank domain is a single system that comprises internal processes designed for staff members and external services dedicated to the end users. Typically, a banking system includes the following elements:

- Market segments – The primary business lines the bank engages in, such as consumer banking, retail banking, investment banking, and others.

- Target customers – Corporate clients and individuals using banking products.

- Banking products – All revenue-generating operations for the bank, including loans, deposits, investments, and more.

- Sales campaigns – The methods of delivering banking products to clients, both online and offline.

- Business processes – Internal and external processes that occur as the bank operates.

- Technologies – all technologies used to facilitate banking services.

#PRO TIP: To ensure the app runs smoothly, you will need to understand the entire banking ecosystem and collect enough information about each service you check.

Functions Of Banking Domain

The banking domain encompasses a wide range of functions and services that financial institutions provide to individuals and businesses. There are two main functions of the banking domain:

Primary Function – Traditional Banking

The Primary Function involves facilitating transactions between depositors and borrowers. This core function can be categorized into savings and lending, which maintain the cash flow in the economy and market.

- Core Banking

- Retail Banking

- Corporate Banking

Secondary Functions- Service-Based Banking

The non-banking functions in the banking sector, often referred to as secondary functions, involve additional services that contribute to profit generation. These functions encompass tasks such as overseeing payables, collecting checks, and managing portfolios.

- Loan

- Trade and Stacks

- Private Banking

- Front End Delivery

Characteristics of Banking Domain Applications

The landscape of banking has undergone a dramatic transformation in recent years, driven by the rapid adoption of digital technologies and the evolving expectations of consumers. Today, banking domain applications serve as the primary interface between financial institutions and their customers.

The complexity of the financial sector, coupled with the need for compliance with stringent regulatory requirements, means that these applications must be meticulously designed and managed. Understanding about some characteristics of banking domain applications will give you the basic foundation.

- Support for Multiple User Sessions with Multi-Tier Functionalities: A banking application must be capable of supporting multiple user sessions simultaneously, ensuring that each user can access their account, initiate transactions, and interact with the bank’s services without experiencing delays or interruptions. Multi-tier functionalities play a pivotal role in this by separating the user interface, business logic, and data storage layers. This architectural approach both enhances the application’s scalability and improves its maintainability.

- Large-Scale Integration of Multiple Programs: Modern banking customers often have diverse financial needs. The large-scale integration will create a cohesive ecosystem where data flows effortlessly between different systems.

- Management of Complex Workflows: Banking operations often involve intricate processes that require careful management to ensure accuracy and compliance. A banking application must be designed to handle complex workflows, such as loan approvals, compliance checks, and fraud detection, with ease and efficiency.

- Bulk and Real-Time Processing Capabilities: Real-time processing capabilities ensure that customers can see the results of their transactions instantly, whether they’re transferring money between accounts or making a purchase. If the system cannot process this in real-time, it can lead to delays, frustration, and potentially lost sales.

- Day-to-Day Transaction Monitoring: Both operational management and customer service need to keep track of daily transactions. Banking domain applications can monitor and log all transactions in real-time, providing a clear and accessible record for both the bank and its customers.

- Effective Troubleshooting for Client Difficulties: This can be achieved through built-in help features, AI-powered chatbots, or easy access to live customer support.

- Multi-Platform User Support: In today’s multi-device world, a banking application must provide seamless user support across various platforms, including Mac, Linux, Unix, and Windows.

Challenges of automation in Testing for Banking Domain Applications

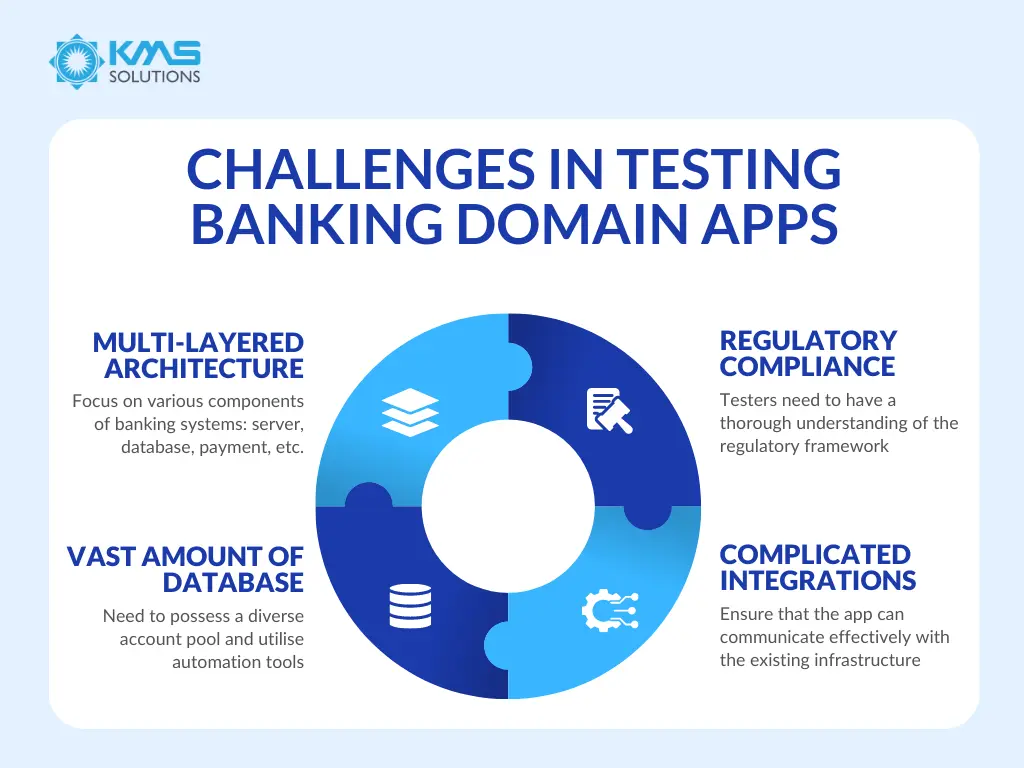

Testing applications in the banking industry presents its fair share of challenges. Assessing the performance of such complex apps demands a high level of financial expertise and a robust understanding of QA tools. Here are some of the key obstacles faced during the testing process:

1. Multi-Layered Architecture

Typically, banking apps have several tiers to organise their functionalities and services:

- A server that implements the app logic

- A database for storing user information

- A payment processor that handles financial transactions

- A client interface that accepts and redirects users’ inputs

It’s crucial to ensure that all these components work seamlessly together to provide a unified banking experience. Therefore, testers will need to run different tests through the mobile app and report bugs to the responsible developers: server, front-end, database, etc.

2. Regulatory Compliance

The banking industry is highly regulated, with various laws and regulations in place to protect customers’ interests and ensure fair practices. Testing banking apps for compliance with these regulations is a complex task because testers need to have a thorough understanding of the regulatory framework and ensure that the app adheres to all relevant guidelines. This comprises testing for anti-money laundering (AML) measures, electronic know your customer (e-KYC) protocols, and data protection regulations, among others.

3. Complicated Integrations

Most banking institutions have a legacy IT infrastructure that has been built over the years. Testing new banking apps for seamless integration with these legacy systems is a significant challenge. Hence, QA experts need to ensure that the app can communicate effectively with the existing infrastructure, including core banking systems, payment gateways, and CRM tools.

Additionally, banking apps often require to interact with external systems, such as payment gateways, third-party APIs, and core banking systems. Thus, testers need to consider API testing to verify the seamless functioning of third-party connections and perform manual checks on individual data entries.

4. Vast Amount of Database

For one thing, a testing team needs to possess a diverse account pool to effectively test a banking domain app. Moreover, QA specialists should utilise automation testing tools to verify database connectivity and manage its logical functions. Since the security of user data is of utmost importance, testers commonly employ VPNs to ensure secure testing practices.

Checklist for Banking Domain Testing Process

To ensure thorough testing of banking applications, it’s essential to follow this checklist of important phases:

Defining Requirements

Testers need to record each detailed requirement and categorise them as use cases or functional specifications. These requirements are typically divided into modules, each focusing on specific aspects of the app, including money transfers, bill payments, mortgages, loans, and deposits.

Reviewing Requirements

Once the requirements documents are gathered, it’s crucial to review the listed requirements to ensure testing cases don’t compromise with each other.

For finance-related and banking projects, testers must possess sufficient domain knowledge. They should be capable of adopting perspectives from both stakeholders and end-users. During this phase, analysts collect and understand the requirements, conducting reviews with relevant stakeholders such as Business Analysts, Development leaders, and QA experts as necessary.

Building a Test Case Suite for Banking Software Testing

As the banking app requires a broad spectrum of test cases, it’s important to clarify which should be tested manually and automatically.

#PRO TIP: There should be an automation tester in a software development team to create custom scripts, run automation test generation and apply automated testing framework effectively.

Selecting the right APIs is critical. Start by identifying the specific functionalities you need, such as payment processing, customer verification, or data analytics. Once chosen, plan your architecture to ensure seamless integration. This includes deciding where the API will fit within your system, how data will flow, and ensuring there is minimal disruption to existing services.

Why Test Banking Applications?

- Security stands as the cornerstone of banking application development. Stringent testing protocols safeguard sensitive customer information from emerging security vulnerabilities.

- In banking applications, security reigns supreme. Meticulous testing processes shield confidential client data from potential security breaches.

- Bank apps prioritize security above all else. Rigorous testing methodology ensures customer data remains protected against evolving security threats.

- The foundation of banking applications rests on robust security measures. Comprehensive testing frameworks defend sensitive user information from potential security risks.

- Security takes precedence in banking application design. Through extensive testing procedures, we ensure confidential customer information stays protected from security vulnerabilities.

- In the realm of banking applications, security is paramount. Thorough testing protocols act as a shield, protecting valuable customer data from emerging security challenges.

- Banking applications place an unwavering focus on security. Advanced testing mechanisms work tirelessly to protect sensitive client information from potential threats.

- At the heart of banking applications lies uncompromising security. Detailed testing processes ensure the utmost protection of confidential customer data against security risks.

- Banking apps maintain security as their highest priority. Intensive testing safeguards critical customer information from potential security compromises.

- Security excellence defines banking application development. Sophisticated testing protocols ensure the complete protection of sensitive customer data from evolving threats.

Test cases for Banking application in software testing

In this stage, test scenarios and test cases are developed based on the requirements document. The testing team must be meticulous in encompassing all relevant scenarios, consisting of functional, security, performance, and other nonfunctional aspects.

Here’re some test cases that you can consider implementing at different testing stages:

Database testing

In a banking app, intricate transactions occur at both the UI and Database levels, making database testing essential. The database represents a complex and distinct layer within the software. To run database testing effectively, banks will need to build a high-functioning testing team that has in-depth knowledge of the database procedures, functions, indexes, keys, and sound practical SQL.

- Verify that the data fields have the appropriate format.

- Check the values of the computed field (e.g. DoB and Age).

- Evaluate whether each table has all primary keys, foreign keys, and unique index constraints.

- Check for any redundant and duplicate data.

- Verify the banking app’s performance when the database server is inaccessible.

- Examine database performance when numerous customers use the app at the same time (e.g. Multiple users try to transfer money simultaneously).

- Ensure the database backup is taken regularly.

Functional Testing of Banking Applications

As digital user experience is the top priority of the banking app, this type of testing is performed to ensure all the internal and external operations within the banking chain are effectively developed, incorporated, updated, and deleted.

- Check login functionality with valid and invalid data.

- Review how the banking app behaves if the accounts/roles/branches are generated/adjusted with invalid data.

- Check whether all the fields have a valid character limit (e.g. The ‘Credit Card Number’ field should accept values between 16 to 19 digits).

- Verify the functionality of all buttons to ensure they are clickable and perform as intended.

- Ensure that the credit/debit calculations are performed as expected.

- Evaluate the banking app installation, uninstallation, and update processes.

Security testing for Banking Apps

Due to the sensitive nature of the banking app, developers must make additional efforts to safeguard user data against cyber attacks and fraudulent activities. A QA team conducting security testing must ensure that the application complies with security regulations and standards such as OWASP.

- Verify how the app responds to numerous invalid logins.

- Check whether password requirements are strong enough.

- Check whether all the user IDs and passwords are encrypted.

- Verify if the app has a robust user authentication process in place (e.g. Besides the traditional User ID and Password, users may be prompted to enter CAPTCHA as an additional security measure).

- Ensure proper session timeout mechanisms are implemented (e.g. users should be automatically logged out after a period of inactivity).

- Check whether the URLs have sensitive information.

Performance testing for Banking Apps

During specific time frames, such as payday, the end of the financial year, and festive seasons, there may be fluctuations or surges in-app traffic. To ensure customers do not experience performance failures during these periods, comprehensive performance testing should be conducted.

- Check app performance when numerous banking users log in at the same time or use the same functionality simultaneously (e.g. All the users try to transfer the money).

- Ensure the app runs smoothly when network connectivity is slow/ goes down/ keeps fluctuating between low and high speed (e.g. During an ongoing transaction if the network has a sudden fluctuation).

- Evaluate the app’s performance when the battery is low, medium, high, or charging.

Usability testing

Usability testing is essential for any banking app, as it caters to a diverse range of users, from tech-savvy individuals to those less familiar with technology. The objective of this kind of testing is to check the level of app ergonomics and assess how well it is prepared for users with particular needs.

- Check whether the user is able to navigate through the app smoothly.

- Verify the visibility and clarity of important messages and buttons on the page (e.g. During the transaction process, essential messages should be displayed clearly using larger fonts and darker colours, to enhance visibility and user comprehension).

- Ensure all the links and buttons have text that is easy to understand.

- Verify whether error and warning messages are self-explanatory.

User acceptance testing (UAT)

UAT ensures that the developed banking system meets the specified business requirements. Moreoevr, as banking systems often deal with sensitive financial data, and any flaws or errors in the system can pose significant risks, UAT helps identify and mitigate these risks before the system is deployed.

- Verify whether the banking apps run smoothly in any environment.

- Ensure the app performs as anticipated when dealing with real-world scenarios.

- Check whether the app allows utility payments and many other third-party integrations payments.

Unit & Integration testing

It’s essential to assess each individual unit in isolation to verify its proper functionality. Besdies, we need to integrate these units and evaluate how they interact with one another. Integration testing verifies the interfaces between modules, ensuring that the system works as a whole.

- Test for correct handling of various types of accounts (e.g. savings, checking).

- Verify that users can customize settings in the banking app

- Validate interactions with external systems for services like currency conversion, international transactions, or third-party integrations.

- Ensure that data remains consistent across different modules.

Compliance testing for Banking Domain

Banks typically contend with intricate regulations governing their banking applications. These regulations are in place to prevent errors within the application, as any identified mistakes may result in substantial fines for the bank, potentially impacting both profits and reputation.

Compliance testing ensures that the banking application adheres to all relevant regulatory requirements.

- Confirm that the application monitors transactions for unusual patterns or high-risk activities.

- Test the application’s ability to decrypt and access encrypted data as needed.

- Test for unauthorized access attempts.

Is Automated Testing a Solution for Banking Domain?

Given the complexity of banking systems and the volume of transactions processed daily, automated testing offers a way to efficiently manage these challenges by enabling continuous, consistent, and repeatable API testing in banking domain processes.

Compared to the manual testing, automated testing brings many advantages:

- Regulatory compliance: Banks must adhere to stringent regulations and standards, such as PCI DSS for payment processing security or GDPR for data protection. Automated testing ensures that applications meet these regulatory requirements by consistently verifying that all security measures are in place and functioning as intended.

- Speed and efficiency: In an industry where time-to-market can impact most things, automated testing allows for rapid iterations of software releases. Continuous integration and delivery (CI/CD) pipelines, powered by automated tests, enable banks to release updates and new features more frequently while ensuring that each release is thoroughly tested.

- Greater test coverage: Unlike manual testing, which is often limited by time, resources, and human capacity, automated testing can systematically and consistently execute a vast array of test cases across different environments, scenarios, and configurations.

Test automation in banking has become a strategic enabler that transforms the way financial institutions operate. It offers a multitude of benefits that extend beyond traditional cost savings and efficiency gains. Here are some key benefits:

- Enhanced Accuracy and Reduced Human Error: Manual testing, while essential, is prone to human error, especially when dealing with complex banking applications that require repetitive testing across multiple platforms and environments. Test automation eliminates the risk of human error by executing predefined test scripts with precision.

- Cost Efficiency and Resource Optimization: Automated testing reduces the need for large testing teams and minimizes the resources required for repetitive test execution. This frees up human resources to focus on more complex and strategic tasks, such as test planning and risk assessment.

- Accelerated Time-to-Market: Automated tests can be run 24/7, providing rapid feedback and allowing for quicker iterations.

Success Factors for Test Automation in Banking

Strategic Alignment and Customization

The foundation of successful test automation in banking lies in aligning the automation strategy with the institution’s broader business goals and operational requirements. This begins with developing a tailored test automation roadmap that reflects the unique challenges and opportunities within the banking environment.

Unlike generic automation strategies, this approach requires a deep understanding of the bank’s core systems, regulatory obligations, and customer expectations. A customized test automation framework confirms that automation initiatives directly contribute to enhancing service quality, reducing operational risks, and driving digital transformation.

4.2 Integration of AI and Machine Learning for Enhanced Test Coverage

The terms “AI” and “machine learning” have become quite familiar to us in the digital world. These advanced technologies can analyze vast amounts of data to identify patterns, predict potential failures, and optimize test case selection.

The adoption of AI-driven test automation is particularly beneficial in areas such as fraud detection, where dynamic and evolving threats require continuous monitoring and rapid response.

4.3 Proactive Test Data Management and Compliance Assurance

Banks must implement robust data masking, anonymization, and encryption techniques to safeguard customer information during testing. Additionally, they should establish automated processes for generating synthetic test data that closely mirrors real-world scenarios while remaining compliant with regulatory requirements.

4.4 Cultivating a Culture of Continuous Improvement and Innovation

Successful test automation in banking is not a one-time effort but an ongoing journey of continuous improvement and innovation. Banks must foster a culture that encourages experimentation, learning, and collaboration across teams.

Moreover, embracing agile methodologies and DevOps practices can further enhance collaboration, ensuring that test automation evolves in tandem with the bank’s broader digital transformation efforts.

Solutions for Automation Testing in Banking Domain

- Tailored Automation Frameworks: KMS Solutions emphasizes the development of customized automation frameworks that align with the specific needs of banking applications. These frameworks are designed to handle complex business logic, diverse technology stacks, and high transaction volumes.

- Integration with Legacy Systems: One of the significant challenges in banking automation is integrating with legacy systems. KMS Solutions addresses this challenge by developing specialized adapters and interfaces that facilitate seamless communication between modern automation tools and older systems.

- Robust Performance Testing: To address the high transaction volumes and dynamic nature of banking applications, KMS Solutions offers robust performance testing services. Our automation tools are capable of simulating peak transaction loads and stress conditions, providing valuable insights into system performance and reliability.

- Agile and Scalable Solutions: In a rapidly evolving technological landscape, agility and scalability must be a priority. KMS Solutions provides automation testing services that are adaptable to changes in technology and business processes. Our frameworks are designed to be scalable, allowing banking institutions to easily accommodate new technologies.

Practical Test Cases for Banking Domain Applications

To ensure comprehensive testing of banking domain apps, it’s crucial to generate test cases that cover all key functionalities.

Use Case 1: New Account Opening

- Test that the app captures all required information properly when a customer requests to open a new account.

- Check to see whether the customer’s data is available from all branches and synchronised with the current system.

- In the banking app, it’s essential to verify that a special account number is generated for the new account.

- Ensure the customer gets a notification indicating the account was opened successfully.

Use Case 2: Fund Transfer

- Ensure the app allows users to transfer funds between their own accounts.

- Check to see whether the banking app imposes transaction limits depending on the balance of the user’s account.

- Test that the app displays proper error messages when inadequate funds are available for a transfer.

- Verify the accuracy of the transaction information, including the transferred amount and the recipient’s account information.

Use Case 3: Bill Payment

- Test that the app allows users to pay bills to third-party service providers.

- Verify that the app displays a list of available billers and their corresponding payment options.

- Check that the software accurately calculates the total amount due and displays it to the user.

- Verify that the app records the bill payment transaction and updates the user’s account balance accordingly.

Use Case 4: Account Statement Generation

- Verify that users may produce account statements for a certain time period using the app.

- Verify that all relevant transactions, including deposits, withdrawals, and transfers, are included in the produced statement.

- Check to see whether the statement was created in a legible format, such as PDF or HTML.

- Check to see whether the statement may be downloaded or printed by the user.

Bottom Line

App testing is an essential aspect of the development lifecycle as it guarantees that software operates smoothly or almost flawlessly when deployed in the real world. In the case of banking applications, testing involves a range of techniques and test cases to assess usability, performance, and security. It is crucial to refine all intricacies, ensuring that vital data remains intact even if server disruptions or internet outages occur. Additionally, the application’s intuitiveness for all user groups needs to be verified.

In KMS Solutions, our specialisation lies in the development and testing of fintech and banking apps. We’ve worked with many businesses in the BFSI sector, such as Discovermarket, TPBank, ACB, Axi, and more, to deliver fir-for-purpose banking domain application testing strategies. Discover how our Banking Software Development services can elevate your app’s performance and security today!