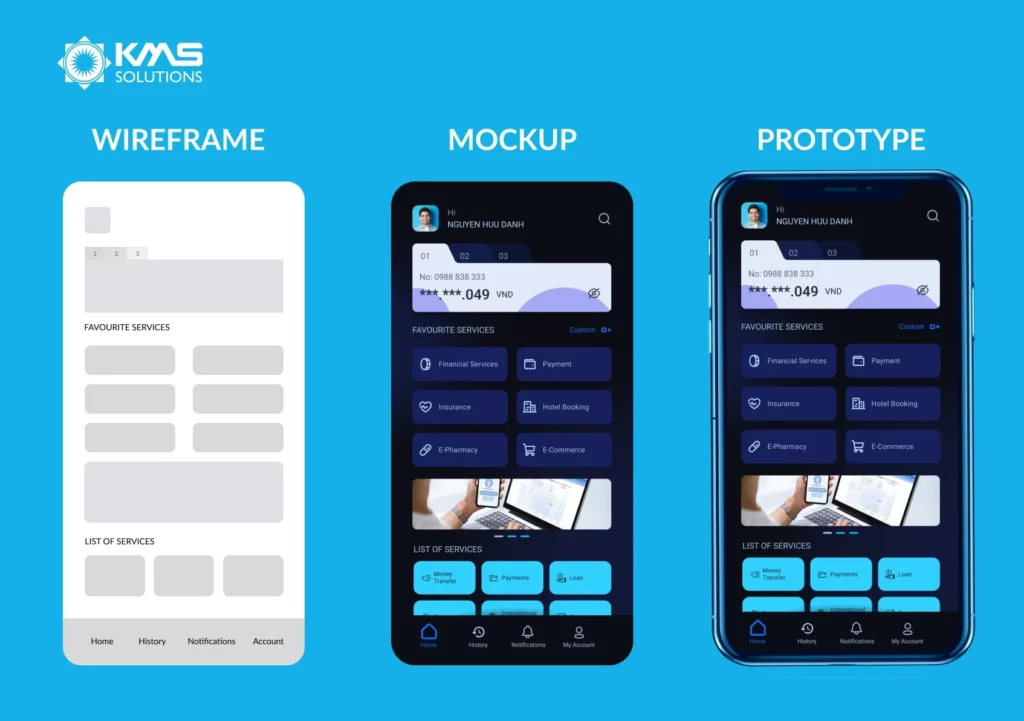

Our Approach to Creating Advanced Banking Applications

KMS Solutions' series of phases that helps your team build desired mobile banking applications

Our development team leverages the latest tools, practices, and frameworks to create innovative solutions that enhance the experience of BFSI users

In today’s rapidly evolving financial landscape, having a robust and intuitive mobile banking app is more critical than ever. Our mobile banking app development services are crafted to provide secure, scalable, and user-centric solutions that not only enhance customer engagement but also streamline operational efficiencies.

Our team boasts extensive experience in developing sophisticated banking and financial services applications, ensuring that we understand the unique challenges and requirements of the financial sector.

Security is at the core of everything we do. We adhere to PCI DSS, CBDP, ISO/IEC 27001:2013 standards and ensure that all your apps meet the highest levels of security

Our portfolio showcases successful projects with measurable outcomes. We are proud of our track record and the positive feedback from our satisfied clients

We deliver excellence through rigorous quality assurance at every stage of development projects, ensuring your banking software meet the highest standards of performance, security, and user satisfaction.

Our experts combine expertise in both financial services and emerging technologies to smooth digital transformation and scalable and sustainable banking app development.

Our ongoing support and willingness to adapt to ever-changing mobile banking development frameworks and markets ensure your banking applications remains relevant and successful.

KMS Solutions' series of phases that helps your team build desired mobile banking applications

We thoroughly analyze clients' business and the BFSI market landscape to grasp their needs, followed by strategic planning to ensure that the mobile banking app is in sync with business goals and meets customer expectations.

Our team of mobile banking app developers work closely together to turn your idea into reality. We prioritize robust coding practices and tech stacks, utilizing the latest frameworks to ensure a responsive and intuitive app.

Our commitment to quality includes numerous rounds of testing, such as functionality, usability, performance, and security, ensuring the banking app is dependable, effective, and safe for users.

In this phase, our software team guarantee your mobile banking application continuously remains up to date with the latest trends and technologies and can meet changing market demands.

Our mobile developers utilize these tools and technologies to optimize development and guarantee high app quality

Partner with us to develop a high-performing banking app that enhances operational efficiency and customer satisfaction.

Your information has been sent to KMS Solutions team. Our team will contact you shortly!

For direct contact, drop us a line here:

We implement industry-standard security measures, such as encryption, multi-factor authentication, and compliance with regulations like PCI DSS, CBDP, ISO/IEC 27001:2013 and more. Regular security audits are also conducted.

The timeline varies depending on the project scope, but it typically ranges from 4 to 6 months.

We provide continuous support, including updates, bug fixes, and performance monitoring to ensure your app remains secure and efficient.

Common technology stacks include Swift for iOS, Kotlin for Android, and backend technologies like Node.js, Java, or .NET. Cloud platforms like AWS or Azure are also used.

The cost of developing a custom mobile banking application varies based on several factors, including the complexity of the app features, the requirements for UX/UI design, the security mechanisms needed, and the level of integration with other systems. Each project is unique, so we recommend discussing your specific needs with our team to receive a tailored estimate.