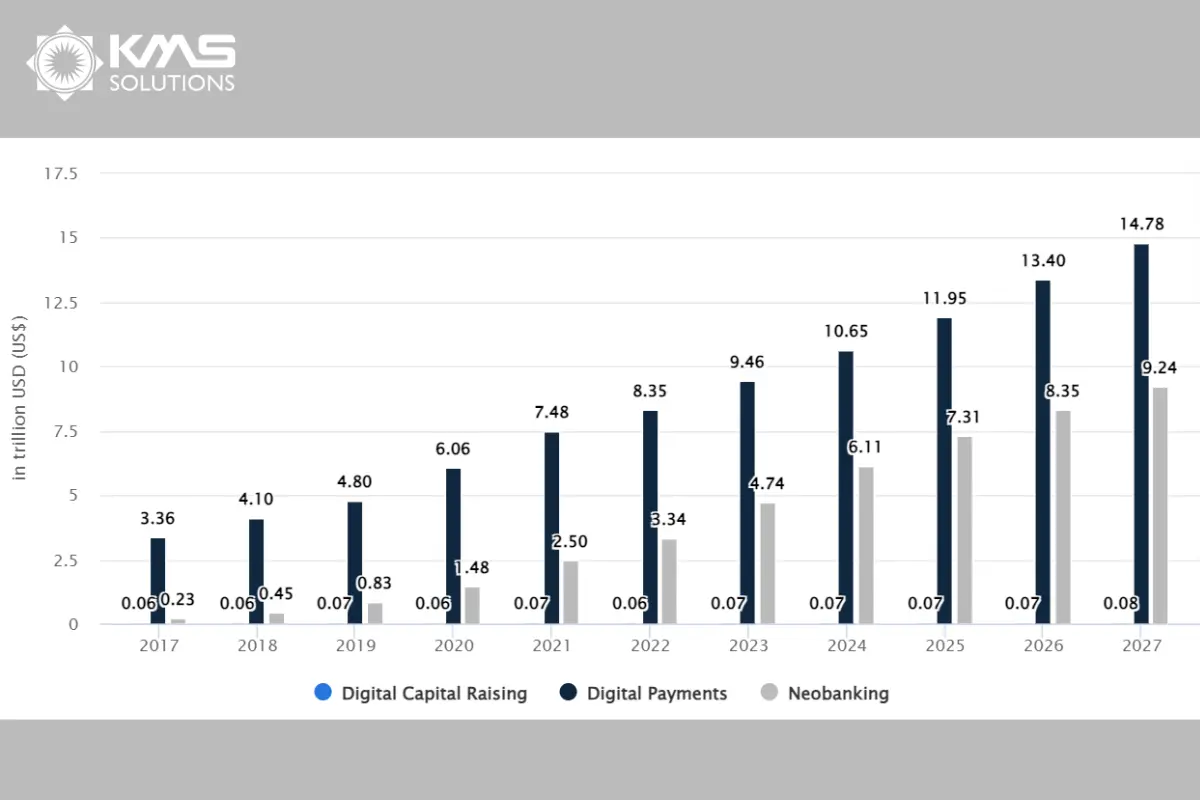

The financial services world is changing fast, and Fintech app development companies are at the forefront of this revolution. These corporations leverage cutting-edge technology to provide a wide range of financial services expertise, from creating secure payment solutions to developing advanced banking applications that cater to the evolving digital demands of consumers and businesses.

The Australian fintech market is experiencing unprecedented growth, with total transaction value projected to reach AUD 150 billion by 2025. With over 800 fintech companies operating in the country, Australia is steadily establishing itself as one of the leading fintech hubs in the Asia-Pacific region.

As we look ahead to 2025, certain firms stand out for their exceptional contributions and leadership in the fintech space. In this article, we will highlight the top 15 fintech app development companies that are leading the charge in this dynamic industry.

Overview of Australia’s Fintech Market

The Australian fintech landscape is undergoing significant transformation. Mobile banking adoption has surged to 85% of the population, while digital payments now account for 70% of all transactions. Sectors such as peer-to-peer lending, digital asset management, and neobanking are experiencing rapid growth, creating substantial demand for professional fintech solutions.

The Importance of Choosing a Professional Fintech App Development Company

In an increasingly competitive landscape, selecting the right fintech app development partner has become more critical than ever:

- Regulatory Compliance: Australia’s financial regulations and security requirements are becoming more stringent, demanding fintech solutions that meet high safety and security standards.

- User Experience Excellence: Australian users have high expectations for UX/UI, requiring fintech apps to be developed by experts who understand the local market.

- Advanced Technology Integration: Professional companies possess the capability to integrate cutting-edge technologies like AI, blockchain, and open banking APIs.

Key Fintech Trends in 2025 – Fintech product development company

1. Super-Apps and Service Integration

- Development of platforms integrating multiple financial services under one roof

- Enhanced connectivity between traditional and digital financial services

- Seamless cross-service user experiences

2. Open Banking and Banking-as-a-Service

- Expanded data sharing capabilities between financial institutions

- Development of open APIs enabling banking service integration

- Increased financial service accessibility and innovation

3. AI and Machine Learning Applications

- AI-driven risk analysis and fraud detection

- Personalized user experiences based on machine learning

- Automated customer service and financial advisory

4. Embedded Finance and BNPL Solutions

- Integration of financial services into e-commerce platforms

- Development of digital installment payment solutions

- Contextual financial services delivery

5. Cryptocurrency and Blockchain Integration

- Cryptocurrency integration with traditional financial services

- Blockchain solutions for cross-border payments

- Smart contract implementation for financial transactions

The rapid evolution of Australia’s fintech market makes selecting an experienced and technically proficient app development company crucial for project success. The right partner should not only possess technical expertise but also demonstrate a deep understanding of local market dynamics and regulatory requirements.

This comprehensive understanding translates into:

- Faster time-to-market

- Reduced development risks

- Enhanced compliance adherence

- Superior user experience

- Future-proof solutions

As we delve deeper into the subsequent sections, we’ll explore the specific criteria for evaluating and selecting the most suitable development partner for your fintech project, ensuring your solution stands out in Australia’s competitive financial technology landscape.

How to Choose the Right Fintech App Development Company

Selecting the ideal fintech app development partner requires careful consideration of multiple essential factors. The right choice can significantly impact your project’s success, while a poor selection could lead to costly setbacks and missed opportunities in the competitive Australian fintech market.

Essential Services to Look For

When evaluating potential fintech app development companies, core development capabilities should be at the forefront of your assessment. A competent partner should demonstrate extensive experience in mobile app development, particularly in native iOS and Android platforms. They should possess a robust understanding of financial technology architectures and the ability to implement secure payment gateways, banking APIs, and complex financial algorithms.

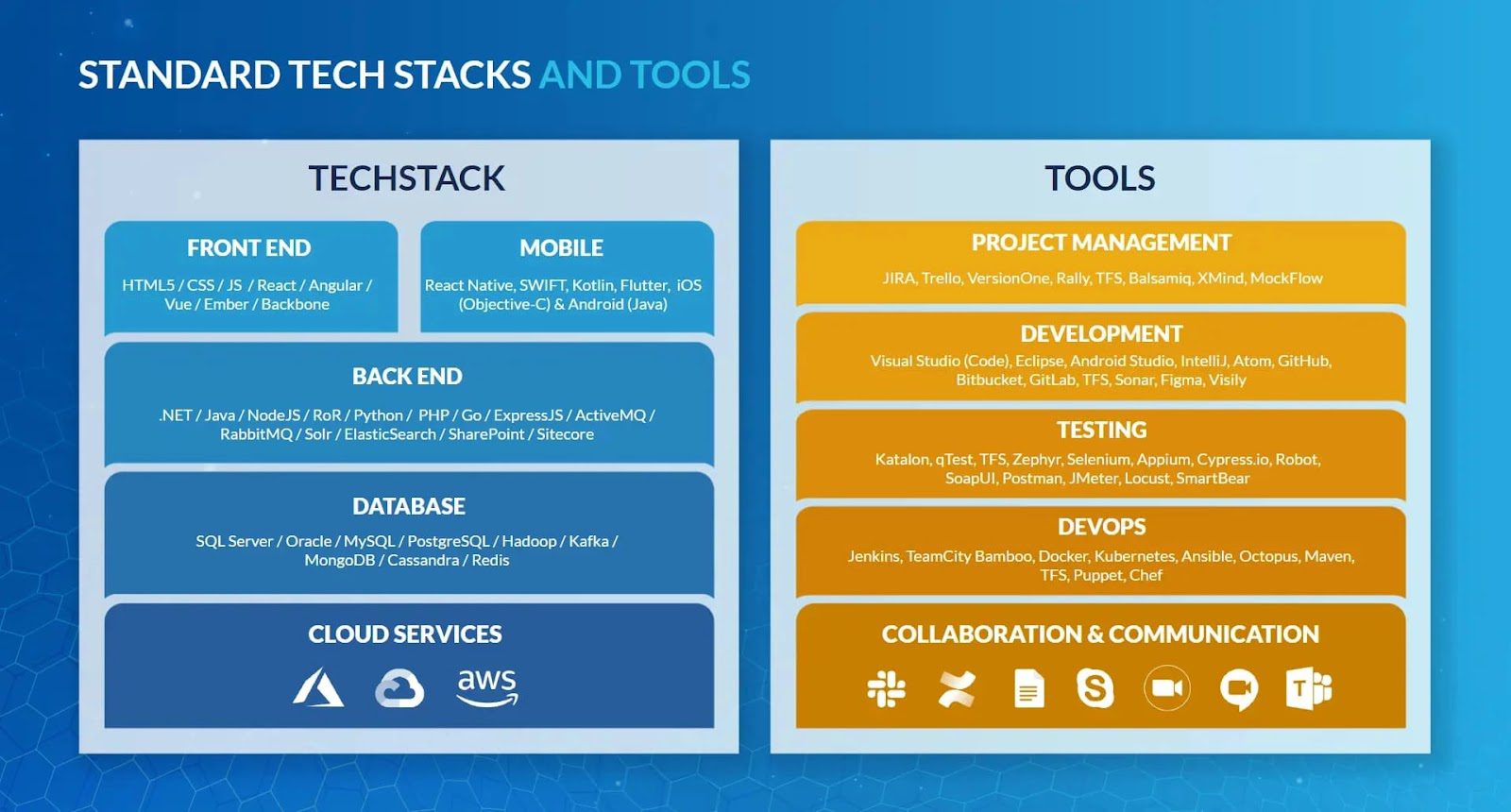

The technology stack expertise is another crucial consideration. Look for companies well-versed in modern development frameworks and languages suitable for fintech applications. Experience with React Native, Flutter, or native development tools demonstrates technical versatility. Additionally, proficiency in backend technologies like Node.js, Python, or Java, coupled with cloud infrastructure expertise, indicates a comprehensive development capability.

Security and compliance knowledge are non-negotiable in fintech development. Your chosen partner must demonstrate thorough understanding of Australian financial regulations, including APRA guidelines, AML requirements, and data protection standards. They should have experience implementing robust security measures such as end-to-end encryption, secure authentication systems, and regular security audits.

Key Evaluation Criteria

Portfolio analysis serves as a window into a company’s capabilities and experience. Examine their past fintech projects, paying particular attention to solutions similar to your requirements. Case studies should demonstrate not only technical proficiency but also problem-solving abilities and innovation in addressing unique challenges.

Technical expertise assessment should go beyond surface-level capabilities. Investigate their experience with critical fintech components such as payment processing, digital wallet integration, and real-time transaction handling. Their team should possess knowledge of financial industry standards and best practices for developing secure, scalable applications.

Industry certifications provide tangible proof of a company’s commitment to quality and security. Look for relevant ISO certifications, particularly ISO 27001 for information security management. Additional certifications in financial technology standards and cloud platforms add further credibility to their capabilities.

Warning Signs to Watch For

During your evaluation process, remain vigilant for potential red flags that might indicate unsuitable partners. Poor communication practices, such as delayed responses or unclear project timelines, often signal broader organizational issues. Vague or inconsistent pricing structures might suggest inexperience with fintech projects or potential hidden costs.

Technical inflexibility or reluctance to discuss security measures in detail should raise concerns. A competent fintech development partner should readily explain their security protocols and demonstrate adaptability to specific project requirements. Similarly, lack of local market understanding or unfamiliarity with Australian financial regulations might compromise your project’s compliance and success.

The right fintech app development company should function as more than just a service provider – they should serve as a strategic partner invested in your project’s success. Look for companies that demonstrate proactive problem-solving, offer innovative solutions, and maintain transparent communication throughout the development process. Their approach should align with your business objectives while ensuring technical excellence and regulatory compliance in the Australian fintech landscape.

Remember that cost should not be the primary deciding factor. While budget considerations are important, the long-term benefits of working with a highly qualified and experienced development partner often outweigh initial cost savings. Focus on finding a balance between expertise, cost, and capacity to deliver a successful fintech solution that meets your specific requirements and market demands.

List of fintech app development companies in Australia 2025

1. KMS Solutions- Fintech product development company

Founded in 2019 as a verticalized business of KMS Technology, KMS Solutions revolutionizes the delivery of financial services in the digital age. Specializing in comprehensive software testing, KMS Solutions ensures the quality, functionality, security, and performance of financial applications.

With the main focus on the BFSI industry, KMS Solutions provides a broad spectrum of Fintech solutions including mobile banking apps, trading and insurance platforms, crowdfunding platforms, wealth management software, digital lending platforms, Fintech MVP software, e-wallets, etc.

Our expertise includes automation, security, performance, mobile, accessibility, and API testing across various platforms. Supporting financial projects throughout the software development lifecycle (SDLC), from requirements to user acceptance testing, we ensure apps are polished and ready for launch.

The company receives significant recognition for its client-focused strategy and adeptness in incorporating emerging technologies, such as AI/ML RPA, open banking, API integration, cloud computing, cybersecurity, etc.

Integrating smoothly with Agile and DevOps methodologies, KMS Solutions provides continuous integration/continuous development (CI/CD), adapting to any development process. We have collaborated successfully with major BFSI companies worldwide, including Asia Commercial Bank (ACB), TPBank, a top Australian “Big Four” bank, Discovermarket, HDBank, GIC, and others.

- Clutch Rating: 4.8

- Established In: 2019

- Min Project: $100,000+

- Employees: 1,600+

2. Appinventiv- Fintech product development company

Appinventiv excels in creating cutting-edge fintech apps known for their user-centric design and superior functionality. They are a fintech mobile app development company that ensures intuitive interfaces and reliable performance, enhancing the user experience.

- Clutch Rating: 4.7

- Established In: 2014

- Price: $25 – $49/ hr

- Min Project: $50,000+

- Employees: 1000+

3. Fueled

Fueled stands out for its creative approach to fintech app development, blending sleek design with advanced technology. They specialize in crafting personalized fintech app development solutions that resonate with users, driving engagement and loyalty.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $150 – $199/ hr

- Min Project: $75,000+

- Employees: 50 – 249

- Time Zone Availability: AGT, BET, CST, EST, GMT, IST, MST, PST

4. Intellectsoft

Intellectsoft is recognized for its comprehensive fintech services, offering end-to-end solutions from ideation to deployment. Their strength lies in leveraging AI and blockchain to deliver secure and scalable applications that redefine financial services.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $50 – $99/ hr

- Min Project: $50,000+

- Employees: 50 – 249

5. WillowTree

WillowTree is known for its proficiency in UX/UI design for fintech apps, creating intuitive interfaces that enhance usability and customer satisfaction. They prioritize user research and data-driven insights to optimize app performance.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $150 – $199/ hr

- Min Project: $250,000+

- Employees: 1000+

6. KindGeek

KindGeek differentiates itself through mastery of UX/UI design and strong development methodologies for FinTech apps. They emphasize user experience and security, ensuring apps are both intuitive and robust in functionality.

- Clutch Rating: 4.8

- Established In: 2013

- Price: $50 – $99/ hr

- Min Project: $50,000+

- Employees: 50 – 249

7. Cleveroad

Cleveroad excels in cross-platform fintech mobile app development services using React Native and Flutter. Their agile approach allows for rapid deployment of scalable solutions that cater to diverse market needs, ensuring cost efficiency and flexibility.

- Clutch Rating: 4.9

- Established In: 2011

- Price: $25 – $49/ hr

- Min Project: $10,000+

- Employees: 50 – 249

- Time Zone Availability: CET, EET, MET, PST, PNT, MST, CST

8. Miquido

Miquido specializes in creating AI-driven fintech solutions that streamline financial processes and enhance decision-making. They combine machine learning with intuitive design, enabling clients to leverage data for competitive advantage.

- Clutch Rating: 4.9

- Established In: 2011

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 50 – 249

9. Dataart

Dataart offers expertise in building custom fintech solutions that integrate seamlessly with existing systems. They focus on scalability and interoperability, providing tailored solutions that meet specific business objectives and regulatory requirements.

- Clutch Rating: 4.9

- Established In: 1997

- Price: $50 – $99/ hr

- Min Project: $100,000+

- Employees: 1000+

10. Netguru

Netguru is known for its expertise in agile fintech development, delivering responsive and scalable applications. They prioritize collaborative development processes and continuous improvement, ensuring clients stay ahead in a competitive market.

- Clutch Rating: 4.9

- Established In: 2008

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 250 – 999

- Time Zone Availability: GMT, CET, EET, EST

11. Inoxoft

Inoxoft specializes in secure fintech app development, focusing on robust cybersecurity measures and regulatory compliance. They ensure data integrity and user trust, making them a reliable partner for sensitive financial applications.

- Clutch Rating: 5.0

- Established In: 2014

- Price: $25 – $49/ hr

- Min Project: $25,000+

- Employees: 50 – 249

- Time Zone Availability: PST, CET, CST, EST

12. ELEKS

ELEKS offers comprehensive fintech solutions powered by innovation and technology. They excel in digital transformation for financial services, leveraging emerging technologies to drive efficiency and customer engagement.

- Clutch Rating: 4.8

- Price: $59 – $99/ hr

- Min Project: $50,000+

- Employees: 1000+

13. ArcTouch

ArcTouch is recognized for its expertise in creating impactful fintech apps through a user-centered design approach. They emphasize usability and performance optimization, delivering apps that exceed user expectations and industry standards.

- Clutch Rating: 5.0

- Established In: 2009

- Price: $50 – $99/ hr

- Min Project: $100,000+

- Employees: 250 – 999

- Time Zone Availability: CST, PST, PRT, MST, IET, HST, GMT, EET, CNT, CET, BET, AGT, COT, EST, IDT, MET

14. Merixstudio

Merixstudio specializes in crafting scalable fintech solutions with a focus on UI/UX excellence. They combine creative design with agile development, ensuring rapid deployment and market readiness for fintech innovations.

- Clutch Rating: 4.8

- Established In: 1999

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 50 – 249

- Time Zone Availability: GMT, UTC, CET, EET, ART, MET, NET, ACT, AET, NST, PST, PNT, MST, CST, EST, CNT

15. Elixel

Elixel excels at developing secure and compliant fintech apps tailored to the needs of the financial industry. They prioritize robust security measures and regulatory adherence, ensuring clients’ apps meet stringent legal requirements and user expectations.

- Clutch Rating: 4.9

- Established In: 2012

- Price: $100 – $149/ hr

- Min Project: $25,000+

- Employees: 2-9

Essential Services Offered by Leading Fintech Developers

Mobile Banking Solutions

Australian fintech developers are pioneering advanced mobile banking solutions that transform traditional banking experiences. These solutions encompass comprehensive features from account management to advanced transaction capabilities. Modern mobile banking platforms now integrate biometric authentication, real-time transaction monitoring, and AI-powered personal financial management tools. Developers focus on creating intuitive interfaces while maintaining bank-grade security protocols and compliance with Australian banking regulations.

Payment Gateway Integration

Leading fintech developers excel in creating robust payment gateway solutions that support multiple payment methods and currencies. These integrations handle everything from traditional credit card processing to modern payment methods like digital wallets and cryptocurrencies. Advanced features include fraud detection systems, automated reconciliation, and real-time transaction monitoring. Developers ensure compliance with PCI DSS standards while optimizing for both security and transaction speed.

Digital Wallet Development

The digital wallet sector has evolved beyond simple payment storage solutions. Modern digital wallets developed by Australian fintech companies now incorporate features like loyalty program integration, peer-to-peer transfers, and cryptocurrency storage. These solutions employ sophisticated encryption techniques and secure element storage for sensitive financial data. Developers focus on creating seamless experiences across multiple devices while maintaining strict security standards.

Lending Platform Development

Fintech developers are revolutionizing lending with platforms that automate loan processing and risk assessment. These platforms incorporate AI-driven credit scoring systems, automated document verification, and real-time risk analysis. Features include customizable loan products, automated underwriting processes, and integrated collection management systems. Developers ensure compliance with Australian lending regulations while optimizing for both lender and borrower experiences.

Investment & Trading Platforms

Modern investment platforms developed by fintech companies combine sophisticated trading capabilities with user-friendly interfaces. These solutions include real-time market data integration, automated trading systems, and portfolio management tools. Advanced features incorporate AI-powered market analysis, robo-advisory services, and social trading capabilities. Developers focus on creating responsive interfaces that can handle high-frequency trading while maintaining security and regulatory compliance.

Blockchain Integration Services

Leading developers are integrating blockchain technology into traditional financial services. This includes developing smart contracts for automated financial agreements, creating secure digital asset management systems, and implementing blockchain-based payment solutions. These services focus on improving transaction transparency, reducing costs, and enhancing security through distributed ledger technology.

Insurance Technology Solutions

Insurtech solutions developed by fintech companies are transforming the insurance industry. These platforms incorporate automated claims processing, AI-driven risk assessment, and real-time policy management. Features include usage-based insurance products, automated underwriting systems, and integrated customer relationship management tools. Developers ensure compliance with insurance regulations while optimizing for both insurer and policyholder experiences.

Regulatory Technology Integration

Fintech developers provide comprehensive RegTech solutions to ensure compliance with Australian financial regulations. These solutions include automated compliance monitoring, risk management systems, and regulatory reporting tools. Advanced features incorporate AI-powered fraud detection, AML screening, and automated audit trail generation. Developers focus on creating solutions that adapt to changing regulatory requirements while maintaining operational efficiency.

Data Analytics and Reporting

Modern fintech solutions incorporate sophisticated data analytics capabilities. These systems provide real-time business intelligence, predictive analytics, and customizable reporting tools. Features include AI-powered trend analysis, customer behavior tracking, and automated report generation. Developers ensure data security and privacy compliance while delivering actionable insights through intuitive dashboards.

Security and Authentication Services

Security remains paramount in fintech development. Services include implementing multi-factor authentication systems, biometric verification, and encrypted communication channels. Developers focus on creating robust security frameworks that protect against emerging cyber threats while maintaining user convenience. These solutions often incorporate AI-powered fraud detection and real-time security monitoring.

API Development and Integration

Fintech developers excel in creating and integrating APIs that enable seamless communication between different financial systems. This includes developing custom APIs for specific financial services, integrating with existing banking systems, and creating API gateways for secure data exchange. These solutions focus on maintaining high performance and security while enabling easy integration with third-party services.

Through these essential services, Australian fintech developers are driving innovation in the financial sector while maintaining the highest standards of security and regulatory compliance. Their expertise helps businesses transform traditional financial services into modern, efficient, and user-friendly digital solutions that meet the evolving needs of the Australian market.

Domain Expertise in the Fintech App Development Services

Security and Compliance

Security is paramount in fintech. Ensure the company follows best practices in data security and compliance with financial regulations like GDPR, PCI-DSS, and other relevant financial regulations in your target market.

As banking and financial services are the common targets of cybercrimes, you should look for companies that prioritize robust security measures to protect sensitive financial data and user privacy.

For instance, KMS Solutions exemplifies excellence with its array of prestigious certifications.

- We are ISO/IEC 27001:2013 certified, ensuring adherence to international standards for information security management systems (ISMS).

- Comply with the Payment Card Industry Data Security Standard (PCI DSS) and hold Certified Banking Domain Professional (CBDP) credentials, offering trusted digital banking systems.

- KMS experts with 12 AWS certifications optimize cloud infrastructure performance, while PSM knowledge enables effective Scrum framework application.

- Additionally, KMS boasts certifications such as Project Management Professional, SOC2 TYPE II, and Scaled Agile, highlighting our comprehensive expertise and commitment to quality.

Development Methodology and Technological Proficiency

Agile development methodologies offer flexibility and transparency, allowing for iterative improvements and faster time-to-market. Look for a company that embraces agile practices to adapt to changing project requirements effectively.

Moreover, it’s essential to assess the company’s proficiency in relevant technologies such as AI/ML, cloud computing and cybersecurity. A strong grasp of these technologies ensures they can build scalable, secure, and innovative solutions tailored to your business needs.

KMS Solutions software engineers are proficient in a wide range of programming languages and frameworks, including Java, Python, C#, Swift, and Kotlin. Moreover, the company’s development process is rooted in Agile and DevOps methodologies, promoting collaboration, continuous integration, and rapid delivery.

Communication and Cultural Fit of the Fintech App Development Services

Effective communication is essential for successful project outcomes. Choose a company that values clear communication channels, regular updates, and collaboration throughout the development lifecycle.

KMS Solutions, with headquarters in Atlanta, Sydney-Australia, and Vietnam, possesses a deep understanding of the diverse cultures within the APAC region. This strategic presence enables KMS to effectively bridge cultural gaps and cater to the unique needs and preferences of clients across these countries. Our expertise in navigating the cultural nuances of the APAC region positions us as a reliable partner for businesses looking to expand and thrive in this dynamic market.

Scalability and Future-Proofing

Consider the company’s ability to scale the application as your business grows. They should offer scalable solutions that can accommodate increased user demand and evolving technological trends. Future-proofing ensures that your application remains competitive and relevant in the long term.

For businesses seeking the optimal banking solution, KMS Solutions stands out as a reliable choice. Leveraging our deep domain expertise in financial services and a proven track record of delivering innovative solutions, KMS Solutions is adept at crafting bespoke fintech applications tailored to meet specific industry needs.

Case Studies about Fintech App Development Services

A “Big Four” Australian Bank Case Study

While developing their “Shout” fundraising platform, one of the big four Australian banks encountered several challenges: an unguaranteed time-to-market, a lack of focus on the operational process, and difficulty in building a skillful technical team in Australia. To overcome these hurdles, the bank looked for an experienced and cost-effective IT team to manage the entire software development cycle of the platform.

KMS Solutions stepped in to deliver comprehensive solutions, managing the entire software development life cycle and delineating a product roadmap for the following year. To meet the goal of expanding product offerings to serve various businesses and organizations, and to develop a new user-friendly website along with an updated mobile application, our team had grown significantly, increasing sixfold to our current size of twenty members.

To ensure a stable development process for the platform, we recommended team involvement at every stage: Requirements, Implementation, Testing, and Production Deployment. Impressed by our dedication and expertise, the bank entrusted us with end-to-end engineering solutions, from product development to operational support. This partnership has lasted over 8 years, with the bank trusting KMS Solutions to continue maintaining and upgrading the platform.

ACB Successful Story of KMS’s Fintech App Development Services

Asia Commercial Bank (ACB) aimed to attract its increasingly digital-savvy customers by prioritizing a mobile-first strategy. Before the collaboration with KMS, the bank had challenges in modernizing legacy systems and integrations, as well as attracting and engaging mobile-savvy customers.

To achieve this, ACB partnered with KMS Solutions to develop customer-centric mobile banking applications. KMS Solutions provided detailed advice on Mobile-first Design, a strategic product roadmap, and the necessary tools and personnel to execute the plan. Within just four months, the collaboration resulted in the successful release of the first version of the mobile banking app to the production environment.

Conclusion

The right fintech app development company can significantly impact the success of the company’s fintech venture. Whether you’re aiming to streamline financial services, enhance the user experience, or innovate with new technologies, choosing a reputable partner is key to achieving your business objectives effectively.

For further insights into fintech app development services and to explore cutting-edge solutions, consider partnering with KMS Solutions. We offer a range of services tailored to fintech businesses, ensuring robust, secure, and scalable applications that meet the demands of today’s digital economy.

FAQs

1. What are fintech app development services?

Fintech app development services involve the creation and customization of mobile and web applications specifically designed for financial technology (fintech) purposes. These apps can range from mobile banking solutions and payment gateways to investment platforms and financial management tools.

Many customers are also concerned and asking us “How much does it cost to develop a FinTech app?“. The total cost can vary widely based on several factors. Factors such as the app’s complexity, desired features, platform compatibility, and the development team’s expertise all play a role in determining the final price. Additionally, ongoing maintenance and updates can influence the overall expense.

2. Why choose KMS Solutions for fintech app development?

KMS Solutions stands out for its deep expertise in fintech, offering tailored solutions that prioritize scalability, security, and compliance with industry regulations. With a proven track record of collaborating with leading BFSI companies globally, KMS ensures innovative and effective fintech app solutions.

3. What services does KMS Solutions offer throughout the software development lifecycle (SDLC) for BFSI companies?

KMS Solutions provides comprehensive support across all stages of the SDLC, starting from consulting to design, development, testing, deployment, and ongoing maintenance.

Our specialized team excels in developing a range of financial software, including mobile banking apps, digital platforms tailored for the BFSI sector, trading platforms, and insurance software.

Additionally, we offer a wide array of technology expertise, such as technology consulting, digital banking systems transformation, software quality services, advanced application management, app migration, and seamless integration solutions.

This ensures that BFSI companies receive end-to-end support in implementing robust and innovative software solutions that meet their specific business needs and regulatory requirements.

4. How does KMS Solutions ensure compliance with stringent regulations in BFSI applications?

KMS Solutions excels at adhering to industry standards like PCI DSS and understands the unique compliance requirements of the BFSI sector. We emphasize our expertise in regulatory compliance to ensure our fintech solutions meet all necessary standards.

5. What are KMS Solutions' software testing partners?

KMS Solutions partners with leading software testing platforms such as Katalon and Kobiton to enhance testing capabilities for BFSI (banking, financial services, and insurance) companies.