Recent years have witnessed a remarkable growth of Natural Language Processing (NLP) in all sectors, fueled by technological advancements and an increasing recognition of its benefits. So as the banking and finance industry!

Have you ever considered how financial institutions can quickly process vast amounts of textual data? By utilizing NLP, businesses can interpret and analyze text far more efficiently than humans, allowing them to stay ahead in a competitive financial market.

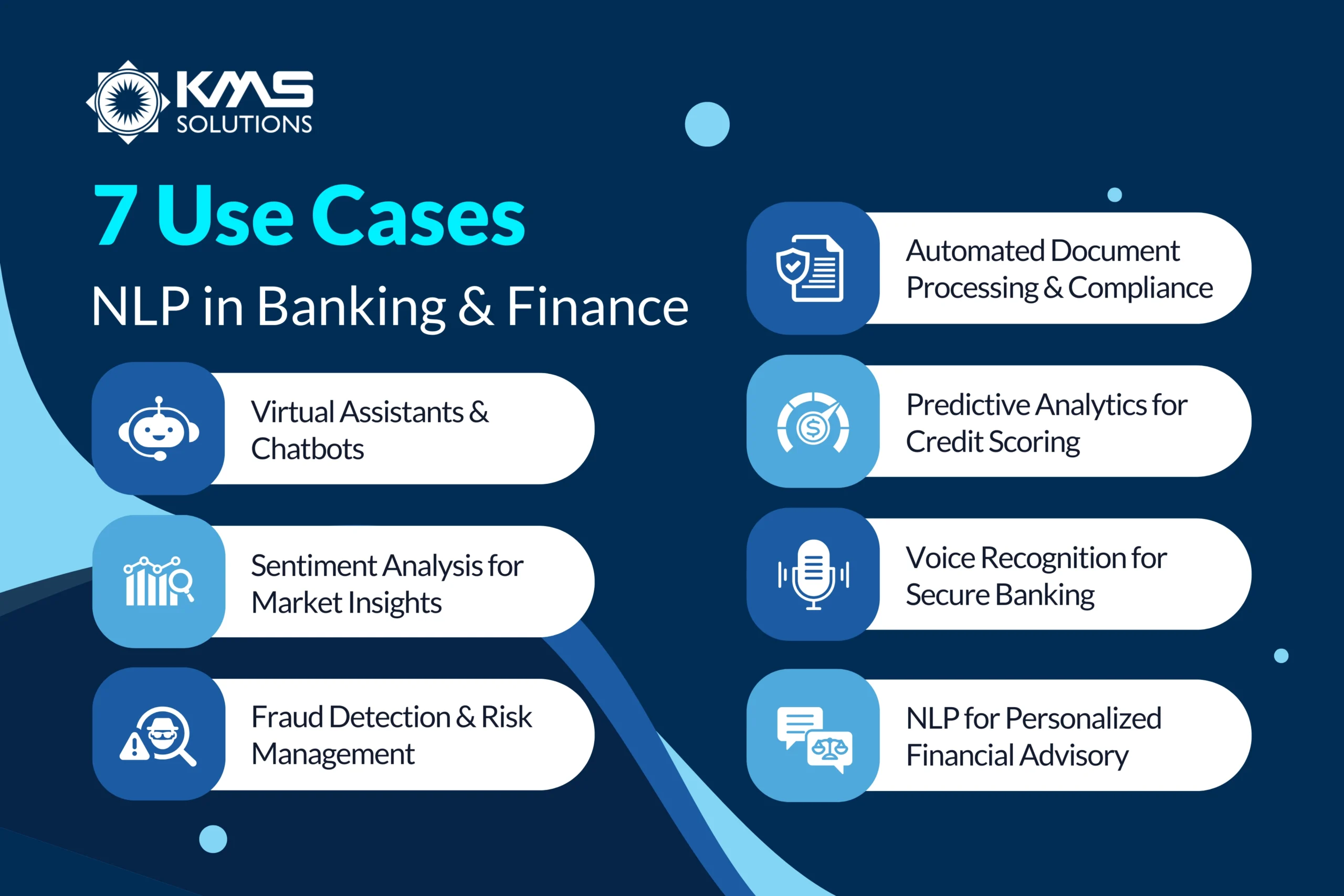

What’s even more exciting is that advanced NLP tools are becoming more accessible, allowing even smaller financial firms to harness their power. Read the article to identify 7 key use cases where NLP is making significant inroads in the banking and finance sectors, demonstrating its potential to transform traditional operations and strategies.

Understanding Natural Language Processing in Banking & Finance

Natural Language Processing (NLP) is an essential part of artificial intelligence that enables machines to interpret and analyze human-like language, both written and spoken, with accuracy. With unstructured data in finance growing by 55–65% annually, financial institutions are increasingly relying on NLP to manage vast volumes of unstructured data.

Looking ahead, by 2025, nearly 30% of NLP adoptions will be in the Banking, Financial Services, and Insurance (BFSI) sector. The impact of NLP in banking and finance is significant. A study by Markets and Markets projects that the global NLP market in finance will grow from $5.5 billion in 2023 to $18.8 billion by 2028, at a CAGR of 27.6%. This explosive growth highlights how financial institutions are rapidly adopting NLP to gain a competitive edge.

By integrating diverse NLP approaches—including both rule-based systems and advanced machine learning models—financial firms are not only improving operational efficiency and reducing costs but also enhancing overall decision-making and customer service.

7 Key Use Cases of NLP in Banking & Finance

NLP is changing banking and financial services with its ability to analyze and interpret complex financial data. Let’s discover 7 compelling use cases that highlight its influence on this field.

1. Virtual Assistants and Chatbots

Banks and financial institutions handle a massive volume of customer queries daily. Traditional customer service models struggle to keep up with demand, often leading to long wait times and inconsistent responses.

NLP-powered chatbots and virtual assistants are used to deliver personalized customer support, address inquiries, and facilitate financial transactions. These AI-driven bots can interpret natural language inputs, enabling them to engage in human-like conversations, which enhances customer satisfaction while significantly reducing response times.

How it Works:

- NLP chatbots analyze customer queries using sentiment analysis and intent recognition.

- They provide personalized responses based on historical interactions and context.

- Virtual assistants use voice recognition to help customers via phone calls.

Key Benefits:

- 24/7 customer support, reducing dependency on human agents.

- Faster resolution of common banking issues (e.g., account inquiries, fraud alerts).

- Cost savings by automating repetitive tasks

Real-word use case: Bank of America’s Erica

Erica, Bank of America’s AI-driven virtual assistant, is a prime example of natural language processing-powered chatbots in action. Erica’s advanced NLP technology allows users to access assistance 24/7 through the Bank of America app, helping them manage everyday banking tasks such as searching past transactions, checking bills, and transferring funds between accounts.

Additionally, its predictive analytics engine provides personalized insights, merchant refunds, and opportunities to optimize excess cash flow, ensuring smarter financial management. Since its launch, Erica has handled over 100 million interactions, proving its effectiveness in enhancing customer experience while reducing the workload on human agents.

2. Sentiment Analysis for Market Insights

Understanding customer sentiment and market trends is crucial for financial institutions. By leveraging NLP-powered sentiment analysis, banks and hedge funds can monitor public opinion on financial services, investments, and economic trends by analyzing large volumes of textual data from social media, news articles, and customer feedback.

By allowing customers to use this information to make informed decisions, banks can stay in line with what the public wants.

How it Works:

- NLP models scan and classify text into positive, neutral, or negative sentiment.

- Institutions analyze investor sentiment to anticipate stock market trends.

- Banks use customer feedback to enhance products and services.

Key Benefits:

- Provides real-time insights into financial markets and customer perceptions.

- It helps in proactive risk assessment and crisis management.

- Enhances customer experience by addressing pain points.

Real-word use case: HSBC’s Earnings Call Analysis

HSBC utilizes NLP to analyze corporate earnings calls, assessing the sentiment of company executives. This analysis revealed a rise in positive sentiment regarding financial performance metrics such as earnings, revenue, and margins, alongside a decrease in negative sentiment concerning potential recessions. These insights align with recent economic performances, as evidenced by significant gains in indices like the S&P 500 and Stoxx Europe 600.

3. Fraud Detection and Risk Management

Financial fraud is a growing concern, with global fraud losses reaching $41 billion in 2022. Traditional fraud detection methods struggle with the complexity of modern cyber threats. NLP is increasingly utilized by financial institutions to analyze patterns and detect anomalies indicative of fraudulent activities. This enables financial firms to enhance security by swiftly identifying and preventing potential fraudulent transactions, effectively protecting both customers and themselves.

How it Works:

- NLP scans customer communication (emails, chats, and calls) for suspicious language.

- It detects unusual transaction patterns using anomaly detection algorithms.

- NLP helps in KYC (Know Your Customer) compliance by verifying identity documents.

Key Benefits:

- Faster fraud detection and prevention.

- Reduces false positives in fraud alerts, improving accuracy.

- Enhances compliance with regulatory requirements.

Example: JPMorgan Chase’s AI Fraud Detection System

JPMorgan Chase uses AI-driven fraud detection models that leverage NLP to analyze customer behavior patterns. By examining transaction history, NLP detects anomalies such as unusual purchases or login attempts from different locations.

For example, if a customer typically makes transactions within New York and suddenly an expensive purchase occurs in Hong Kong, the system flags it for immediate review. This real-time fraud detection has helped prevent thousands of fraudulent transactions, saving the bank millions of dollars annually.

4. Automated Document Processing and Compliance

Every day, banks have to deal with millions of documents daily, from loan applications to regulatory reports. Manually processing these documents is slow, costly, and error-prone.

NLP techniques streamline compliance processes by automating the analysis of legal and regulatory documents. They can recognize relevant sections, extract crucial details, and verify adherence to industry regulations. Additionally, NLP enhances risk assessment by processing textual data to detect potential threats and fraudulent activities, helping financial institutions proactively manage compliance and security challenges.

How it Works:

- NLP models extract key data from unstructured text (e.g., contracts, legal documents).

- Named Entity Recognition (NER) identifies crucial data like customer names, amounts, and dates.

- Compliance officers use NLP to track regulatory changes and ensure adherence.

Key Benefits:

- Saves time and reduces manual effort in processing financial documents.

- Minimizes compliance risks by ensuring regulatory adherence.

- Enhances accuracy and reduces operational costs.

Example: HSBC’s NLP for Contract Analysis

HSBC has integrated NLP-based automation into its compliance and contract analysis processes. The bank uses NLP models to scan through thousands of loan agreements and financial contracts, extracting key terms, clauses, and risk factors.

By automating contract reviews, HSBC reduced manual processing time by 40%, improved accuracy, and ensured compliance with ever-changing financial regulations.

5. Predictive Analytics for Credit Scoring

Accurate credit scoring is essential for financial institutions to assess borrowers’ creditworthiness and reduce default risks. NLP is now widely utilized in credit scoring and automated financial advisories by leveraging non-traditional data sources to enhance the assessment of an individual’s creditworthiness.

Additionally, NLP plays a key role in sentiment analysis, extracting insights from textual data to evaluate a borrower’s attitude, financial habits, and overall credit risk profile.

How it Works:

- NLP algorithms extract insights from loan applications and financial statements.

- Sentiment analysis helps assess a borrower’s financial behavior based on past communication with banks.

- Machine learning models predict credit risk based on historical lending trends.

Key Benefits:

- More accurate risk assessment for lending decisions.

- Faster loan approval processes through automated document analysis.

- Improved financial inclusion by considering alternative data sources.

Example: Lenddo Applies NLP to Transform Traditional Credit Assessments

Lenddo utilizes NLP to assess creditworthiness by analyzing applicants’ digital footprints, including social media activity, browsing behavior, and geolocation data. By extracting and evaluating this alternative data, Lenddo provides banks with insights into potential borrowers’ reliability, enabling more informed lending decisions.

6. Voice Recognition for Secure Banking

With increasing cybersecurity threats, financial institutions are leveraging NLP-driven voice recognition to enhance security and improve customer authentication processes. Voice recognition technology enables financial institutions to interact with users through spoken language, providing a more convenient and secure communication channel. By leveraging biometric authentication during phone-based transactions or customer support interactions, banks enhance security and streamline the verification process.

Additionally, voice-activated banking allows users to conduct transactions, check account balances, and perform various financial activities using voice commands.

How it Works:

- NLP-powered voice biometrics verify a customer’s identity based on speech patterns.

- Banks use speech-to-text conversion to analyze voice commands and detect fraudulent attempts.

- Advanced systems can differentiate between a real voice and synthetic or recorded voices.

Key Benefits:

- Enhanced security through biometric authentication.

- Faster and more convenient customer authentication.

- Reduces phishing and identity fraud risks.

Example: HSBC’s Voice ID

HSBC introduced its Voice ID system, allowing customers to verify their identity using their voice instead of passwords. The system detects over 100 unique vocal traits, making authentication highly secure while improving the user experience.

7. NLP for Personalized Financial Advisory

Financial institutions are using NLP to provide tailored financial advice by analyzing customer interactions, transaction histories, and financial goals. NLP models can extract insights from financial statements, chat conversations, and behavioral data to suggest investment opportunities and budgeting strategies.

How it Works:

- NLP algorithms process customer conversations to identify financial needs and preferences.

- Sentiment analysis assesses customer attitudes toward risk and investment strategies.

- Automated financial advisors generate customized portfolio recommendations based on market trends and user data.

Key Benefits:

- Enhances customer engagement by providing personalized insights.

- Helps customers make informed financial decisions.

- Improves financial literacy with automated recommendations.

Example: Morgan Stanley’s AI Financial Advisor

Morgan Stanley leverages NLP technology to analyze client interactions, ensuring interactions are both efficient and personalized. By processing vast amounts of data, these tools can anticipate client needs, improve customer experience, and strengthen relationships between financial advisors and their clients.

Additionally, AI enables financial institutions to build stronger client connections through timely and customized communication, enhancing engagement and trust.

It’s Time to Invest in NLP Solutions for the Banking & Finance

Many businesses are wondering when the right time is to invest in AI, particularly in NLP solutions. The answer is clear: now is the ideal moment. With rapidly increasing data volumes, evolving regulations, and a growing demand for personalized services, financial institutions that adopt NLP will gain a competitive advantage and stay ahead in the market.

If you’re unsure where to start or which NLP solutions would be the best fit for your needs, feel free to reach out to our team. We would be happy to assess your current situation and, leveraging our extensive experience in AI and ML development for financial services and FinTechs, provide you with a tailored solution to help you achieve your business goals!