Did you know that the global e-wallet market is projected to reach $163.43 billion by 2027?

With such explosive growth, developing a successful e-wallet in 2024 signals immense opportunities for developers and businesses. The landscape of e-wallet development is more competitive and innovative than ever before, demanding a strategic approach that leverages the latest technologies and prioritizes user experience.

In this article, we’ll delve into the top strategies for successful e-wallet development in 2024, as well as the essential development processes that can transform your e-wallet from a mere digital payment tool into a market leader.

1. What is an e-Wallet: Overview and Types

| Feature | Open e-Wallets | Semi-Closed e-Wallets | Closed e-Wallets |

| Overview | Open e-wallets are those that allow users to conduct a wide range of transactions, including cash withdrawals from ATMs or banks, transfers to other accounts, and payments. | Semi-closed e-wallets allow users to make transactions with a specified list of merchants and services. | Closed e-wallets are issued by companies for use exclusively within their ecosystem. |

| Issuer | Banks or partnered financial institutions | Specific companies or service providers | Specific companies or brands |

| Usability | Broad, including ATMs | Limited to listed merchants | Restricted to issuer’s products/services |

| Example Transactions | Retail purchases, online shopping, ATM withdrawals | E-commerce, utility bill payments, retail purchases | In-app purchases, loyalty programs |

| Security Features | High (multi-factor authentication, encryption) | Moderate (encryption, secure gateways) | Moderate (encryption, secure gateways) |

| User Base | Large and diverse | Growing among e-commerce users | Limited to brand customers |

| Example Providers | PayPal, Apple Pay, Google Pay | Paytm, MobiKwik, Beem It (Australia) | Amazon Pay, Starbucks app |

| Acceptance Level | Widely accepted by merchants and service providers both online and offline | Accepted by a specific network of merchants and service providers | Restricted to a specific company or service, limited to internal use |

| Regulations | Heavily regulated by financial authorities, must comply with KYC and AML norms | Regulated but with fewer requirements compared to open e-wallets, still must comply with basic KYC norms | Least regulated, mainly internal company policies, limited KYC requirements |

| Advantages | Versatility, wide acceptance, ATM access | Convenience for online and retail payments | Enhances customer loyalty and in-app experience |

| Disadvantages | Regulatory requirements, potential fees | Limited usability, no cash withdrawals | Limited scope, no external transfers |

2. Strategies For a Successful E-Wallet Development

E-wallets have revolutionized how we handle transactions, offering convenience, security, and a seamless user experience. Developing a successful e-wallet in 2024 requires a multifaceted approach.

2.1 User-Centric Design

A successful e-wallet starts with a user-centric design. Understanding the target audience’s needs and preferences impacts your e-wallet development. It ensures that the e-wallet meets the actual needs of its users, leading to higher adoption rates and customer satisfaction.

For example, Apple Pay’s success is partly due to its intuitive interface and seamless integration with Apple devices. By prioritizing ease of use and accessibility, e-wallet developers can create a product that users will find indispensable.

2.2 Robust Security Measures

Implementing advanced security protocols such as biometric authentication (fingerprint, facial recognition), encryption, and two-factor authentication (2FA) can protect users from fraud and unauthorized access. Additionally, integrating AI-based fraud detection systems can monitor and identify suspicious activities, preventing unauthorized transactions.

Currently, PayPal incorporates multiple layers of security. These include robust encryption technology to protect personal and financial information during transactions, and two-factor authentication (2FA) which requires users to provide two forms of identification. The measures have established PayPal as a trusted platform for millions of users worldwide.

2.3 Improved Personalization with AI Adoption

Customization fosters a richer and more tailored interaction for users. Tailored experiences make users feel valued and understood, which can lead to increased usage and retention rates.

By implementing AI, banks and financial institutions analyze user behavior to offer tailored recommendations, detect unusual activity, and provide personalized financial insights. This technology also helps provide intelligent financial insights and tailored notifications.

Meanwhile, machine learning algorithms can predict user needs and automate routine transactions, making the e-wallet more intuitive.

2.4 Broad Integrations

Another critical component of an effective e-wallet is its integration with multiple payment gateways. This diversity in payment options caters to different user preferences and needs. When users encounter multiple choices for completing their transactions, such as credit and debit cards, bank transfers, and digital payment platforms, they are more likely to find the transaction straightforward to complete.

For businesses looking to develop a successful e-wallet, partnering with experts in payment gateway integration can be beneficial. Services like those offered by KMS Solutions provide the necessary expertise to ensure seamless integration with multiple payment gateways, enhancing transaction efficiency and user satisfaction.

2.5 Compliance and Regulations

Developing a successful e-wallet requires not just advanced technology, but also strict adherence to various regulatory standards. Key regulatory areas include PCI DSS (robust security measures to protect cardholder data), KYC (regulations necessitate verifying customer identities), and AML (guidelines require monitoring transactions for suspicious activities).

3. E-Wallet Development Process: Step-By-Step

Developing an e-wallet involves a structured approach to ensure that the final product meets user needs and industry standards. This step-by-step guide outlines the key phases in the e-wallet development process.

3.1 Define Objectives and Target Audience

The initial phase of crafting an e-wallet involves outlining the goals and pinpointing the specific user base.

- What problems will the e-wallet solve?

- Who will use the e-wallet?

- What features will differentiate it from existing solutions?

Start by clearly defining the primary goals for the e-wallet. These could include facilitating peer-to-peer payments, integrating with bank accounts, etc. Subsequently, analyze the market to comprehend the characteristics, preferences, and behaviors of potential users. For instance, millennials and Gen Z users might prioritize features like social media integration and cryptocurrency support.

Tip: Involve potential users in the early stages by conducting surveys or focus groups.

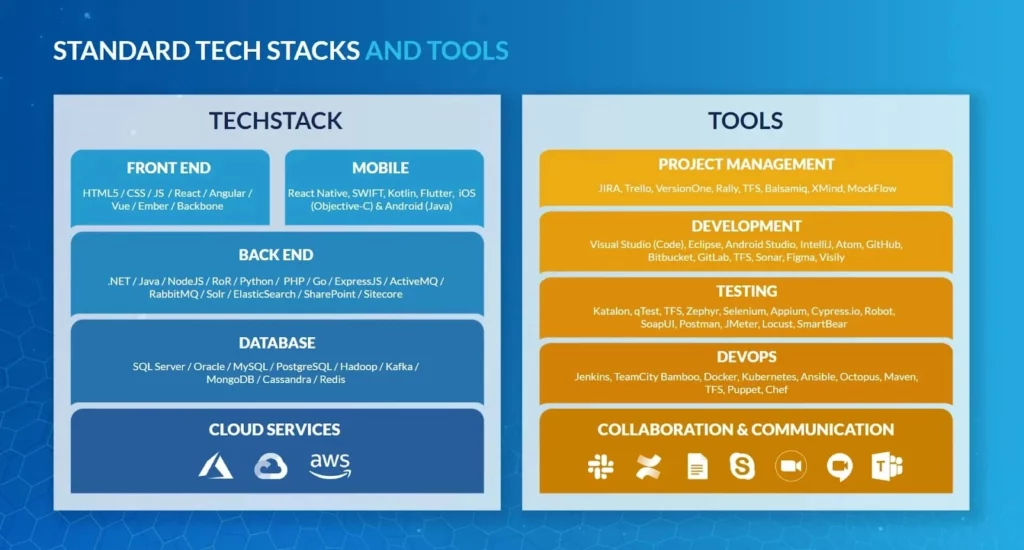

3.2 Choose the Right Technology Stack

The technology stack includes programming languages, frameworks, and tools used for development.

- Frontend development: Choose frameworks like HTML5, CSS, JavaScript, or React to develop a robust, responsive, and user-friendly interface for end-users.

- Mobile: Technologies such as Native (objective-c or Swift, Kotlin) and Cross-Platform (React Native, Flutter, and Xmarin) are commonly used. They can enable the creation of high-performance mobile applications for both iOS and Android platforms.

- Backend development: You can explore Node.js, Django, .NET for robust enterprise solutions or Go for high-performance applications.

- Database: Options like Oracle, SQL Server, MySQL, and PostgreSQL offer reliable and scalable data storage solutions.

- Cloud Services: AWS, Azure, and Google Cloud bring services like virtual machines, storage, databases, and more, enabling developers to focus on building applications.

Tip: Keep yourself informed about the latest tech innovations and exemplary industry methods.

3.3 Design the e-Wallet Architecture

This step involves creating a blueprint for how the e-wallet will function. You must examine the flow of data, system components, and interactions between different modules.

- API gateway: It handles routing, authentication, rate limiting, and load balancing. By centralizing these concerns, the API Gateway simplifies the client interface and secures backend services.

- Database: The database must support high availability and quick access times to ensure a smooth user experience.

Tips: Use of SQL or NoSQL databases depends on specific requirements such as transaction consistency and scalability needs.

- Microservices: The e-wallet architecture leverages microservices to achieve modularity, scalability, and resilience. Each microservice is responsible for a specific business function and can be developed, deployed, and scaled independently.

3.4 Develop and Test the e-Wallet

Writing code, integrating components, and creating features based on the design specifications all based on the development phase. Testing ensures that the e-wallet functions correctly and meets quality standards.

- Integration Testing: Verifying that different modules or services used by the application work well together.

- API Testing: Ensuring that the API endpoints are functioning correctly and handling requests and responses as expected.

- Security Testing: Assessing the application for potential vulnerabilities and ensuring data protection.

- Performance Testing: Evaluating the application’s responsiveness, stability, and speed under various conditions.

Tip: Ensure regular engagement with both the development team and key stakeholders. Regular updates and demonstrations of progress can keep everyone aligned and motivated.

3.5 Deploy and Launch the e-Wallet

Deploying and launching an e-wallet involves a series of critical steps to ensure the product is not only ready for market but also poised for success. The first step in this phase is setting up the infrastructure. Choosing a reliable cloud services provider, such as AWS, Google Cloud, or Azure, is essential for hosting the e-wallet.

Next, continuous deployment practices should be implemented to streamline the process of deploying updates and new features. Tools like Jenkins, CircleCI, or GitLab CI/CD can automate the deployment pipeline.

Finally, marketing and promotion are essential for attracting users and driving adoption.

Tip: Launch the e-wallet with a beta testing phase to gather initial user feedback and address any issues before the full release.

4. Advantages of E-Wallet Development

- Convenience: With an e-wallet, users can make transactions anytime and anywhere using their smartphones. This eliminates the need to carry physical cash or cards.

- Intelligent Financial Management: Users can track their spending, set budgets, and receive alerts for transactions. This real-time insight into financial activities helps users make informed decisions.

5. Key Features of a Successful e-Wallet

A successful e-wallet needs to stand out in a crowded digital payment market. This is why you can’t meet these key features in the process of developing e-wallet:

5.1 Security Features

Cybercrime threat is increasing every day. Users need assurance that their financial and personal data are secure.

- Encryption and Tokenization: These technologies ensure that sensitive information is protected during transactions, reducing the risk of data breaches.

- Biometric Authentication: Fingerprint, facial, and voice recognition add a robust layer of security that is difficult for unauthorized users to bypass.

- Two-Factor Authentication (2FA): By requiring a second form of verification, 2FA significantly enhances account security, even if passwords are compromised.

5.2 Payment and Transaction Capabilities

An e-wallet’s core function is to facilitate seamless transactions. To be successful, it must support a wide range of payment and transaction capabilities.

- Multi-Currency Support: Enables users to transact in different currencies, which is essential for international users and businesses.

- Instant Transfers: Users expect fast and efficient money transfers without delays, whether for personal or business purposes.

- Bill Payments and Recurring Transactions: Simplifies managing regular expenses by allowing users to pay bills and set up automatic payments directly from the e-wallet.

- Multiple Payment Options: Provides users with flexibility by supporting various payment methods such as credit/debit cards.

- QR Code Payments: Allows users to make quick and secure payments by scanning QR codes.

5.3 Transaction History and Real-Time Analytics

6. Future Trends in E-Wallet Development

The landscape of e-wallet development is rapidly evolving, driven by technological advancements and changing consumer behaviors.

AI-Powered Hyper-Personalization

Artificial intelligence (AI) is revolutionizing e-wallets by offering hyper-personalized experiences. This level of customization enhances user engagement and satisfaction. For instance, AI-powered financial bots can automate budgeting and investing spare change, making financial management more intuitive and efficient.

Integration with the Internet of Things (IoT)

IoT integration is set to transform e-wallets by enabling seamless transactions through smart devices. Users can make payments using smartwatches, fitness trackers, or even smart home devices without needing their phones.

Growth of Super Apps

Particularly in Asia, super apps like Alipay and WeChat integrate multiple services such as payments, social media, and e-commerce into one platform. This trend is likely to spread globally, with e-wallets becoming part of larger ecosystems offering a wide range of services beyond just payments.

7. Sump Up

In summary, the key to successful e-wallet development in 2024 lies in embracing user-centric design, innovative technologies, and robust security. As we look to the future of digital payments, implementing these advanced features can set your e-wallet apart.

After this article, are you prepared to take steps and revolutionize digital payments?

With a deep understanding of the fintech industry, KMS Solutions can significantly enhance the e-wallet development process. Their expertise spans the entire development lifecycle, from initial concept through to final deployment. They provide tailored solutions that align with specific business goals, ensuring each e-wallet developed is unique and effective.

By partnering with us, businesses can leverage their expertise to develop advanced, secure, and user-friendly e-wallets.

rvices.