The cost of building a mobile banking app is a spectrum, ranging from as little as a few thousand to millions of dollars. Naturally, the price will reflect certain influences on the app development process, such as its design complexity, the range and intricacy of its features, the platforms it will operate on, its refinement level, and the development team’s location.

As such, business owners and entrepreneurs interested in learning more about how much investment it takes to develop a banking app should first understand the factors at play. For example, a simpler, entry-level, proof-of-concept app versus a high-end, extensively featured app with scaled features and scope will require completely different mobile development processes.

As specialist app developers for BFSI clients across Sydney and around Australia, our team at KMS Solutions will explore the factors that influence the cost of app development in Australia, as well as strategic approaches to budget management in app development.

Introduction to Mobile Banking Services

Mobile banking has revolutionized how we manage our finances, transforming traditional banking into a convenient, 24/7 digital experience. Today’s mobile banking apps offer comprehensive financial management tools that put the power of a bank branch right in your pocket.

What is Mobile Banking App?

Mobile banking is a service provided by financial institutions that allows customers to conduct financial transactions remotely using a mobile device such as a smartphone or tablet. Modern mobile banking apps have evolved far beyond simple balance checks and transfers, now offering sophisticated features that can handle virtually all banking needs.

Evolution of Mobile Banking Applications

The journey of mobile banking applications has been remarkable:

- Early 2000s: Basic SMS banking services

- 2007-2010: First-generation banking apps with simple balance checks

- 2011-2015: Introduction of mobile check deposits and bill payments

- 2016-2020: Integration of biometric security and digital wallets

- 2021-Present: AI-powered financial insights and personalized banking experiences

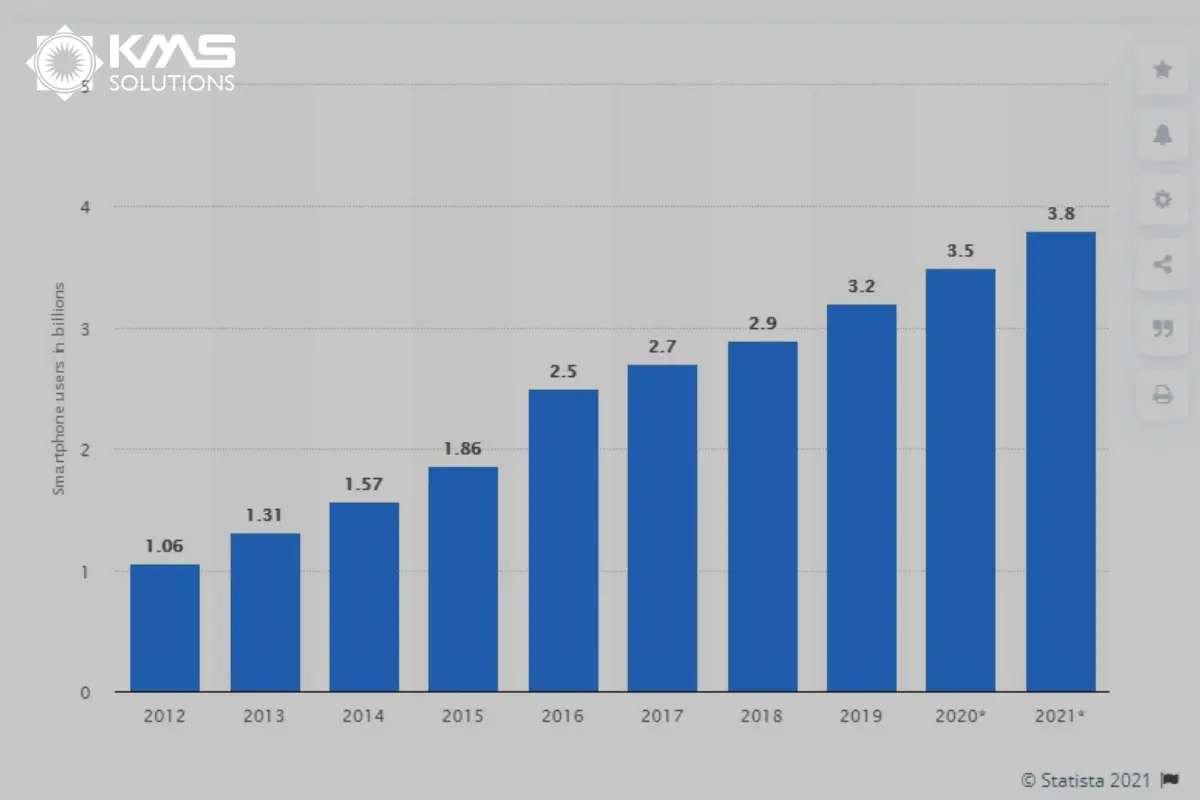

Mobile Banking Statistics 2024

Recent data shows the growing dominance of mobile banking:

- 89% of consumers now use mobile banking apps for regular transactions

- Mobile banking app usage increased by 35% in the last year

- 76% of millennials consider mobile banking features when choosing a bank

- Digital banking transactions have grown by 250% since 2020

Benefits of Using Mobile Banking Apps

- Convenience

- 24/7 access to banking services

- No need to visit physical branches

- Instant access to account information

- Quick bill payments and transfers

- Enhanced Security

- Biometric authentication

- Real-time fraud detection

- Instant transaction notifications

- Secure encryption protocols

- Cost Savings

- Reduced transaction fees

- No transportation costs to branches

- Better interest rates on digital accounts

- Free financial management tools

- Better Financial Management

- Real-time spending tracking

- Budgeting tools and insights

- Automated savings features

- Investment monitoring capabilities

Leading Mobile Banking Apps Comparison: Asia-Pacific Region

Australia

Commonwealth Bank (CommBank)

- Features:

- Cardless cash withdrawals

- Bill prediction and management

- Property insights and search tools

- AI-powered spending insights

- Security: Face ID, fingerprint, and PIN authentication

- User Rating: 4.7/5 stars (App Store)

Westpac

- Features:

- Instant digital card activation

- Smart payment scheduling

- Personal financial management tools

- Business banking integration

- Security: Multi-factor authentication and real-time fraud monitoring

- User Rating: 4.5/5 stars (App Store)

Malaysia

Maybank2u

- Features:

- QR pay functionality

- Instant fund transfers

- Zakat payment services

- Lifestyle rewards program

- Security: Secure2u authorization

- User Rating: 4.3/5 stars (App Store)

CIMB Clicks

- Features:

- DuitNow QR payments

- Goal savings accounts

- Investment platform integration

- Bill splitting functionality

- Security: SecureSign technology

- User Rating: 4.2/5 stars (App Store)

Singapore

DBS digibank

- Features:

- NAV financial planning

- Multi-currency accounts

- Marketplace integration

- Real-time currency exchange

- Security: Dynamic CVV technology

- User Rating: 4.6/5 stars (App Store)

OCBC Digital

- Features:

- Financial insights with AI

- Wealth management tools

- Digital wealth advisory

- PayAnyone integration

- Security: Voice biometrics

- User Rating: 4.4/5 stars (App Store)

New Zealand

ANZ goMoney

- Features:

- Apple Pay integration

- Automatic payment management

- Mortgage calculator

- International money transfers

- Security: Biometric authentication

- User Rating: 4.5/5 stars (App Store)

ASB Mobile Banking

- Features:

- FastNet Classic integration

- Track investments

- Foreign currency accounts

- Smart budgeting tools

- Security: Two-factor authentication

- User Rating: 4.6/5 stars (App Store)

Comparison Summary

| Feature | Australia | Malaysia | Singapore | New Zealand |

|---|---|---|---|---|

| Biometric Login | ✓ | ✓ | ✓ | ✓ |

| QR Payments | ✓ | ✓ | ✓ | Limited |

| International Transfers | ✓ | ✓ | ✓ | ✓ |

| Investment Integration | ✓ | ✓ | ✓ | ✓ |

| AI Financial Insights | ✓ | Limited | ✓ | Limited |

| Multi-currency | Limited | ✓ | ✓ | ✓ |

Mobile banking apps in the Asia-Pacific region showcase strong innovation in digital banking services, with Singapore and Australia leading in technological advancement. Malaysian apps excel in local payment integration, while New Zealand’s apps focus on user-friendly interfaces and robust security features.

How Much to Build a Banking App: Questions to Ask When You Make a App in Australia

What Type of Banking App Are You Building?

The app’s category, format, and operation significantly influence the overall app development cost in Australia.

Understanding the implications of your banking app’s category, such as the number of screens, diversity of user roles, backend structure, and integration of external services, can help you make more informed decisions about your budget and the mobile app development solutions required to bring your vision to life.

By incorporating the right mix of functionality and innovation, app developers in Sydney, Melbourne, and around Australia can deliver custom mobile app development solutions that meet business needs while aligning with budgetary constraints.

If you’re pondering how much to develop a banking app or looking to make an app in Australia, it’s crucial to consider these factors to estimate the potential investment accurately.

The type of banking app can be categorized into:

- Apps requiring more complex mobile development solutions: Artificial intelligence tools, Security-intensive applications, etc.

- More economical app development projects: Calculators, QR scanners, Apps with static content, etc.

These types offer streamlined functionality, which reduces mobile development overheads.

What Features and Functionalities Are You Integrating in Mobile Banking App?

The scope and sophistication of features will greatly determine the app development cost in Australia. Taking a banking app as an example, some features that you should consider include:

- Must-have features for banking app: these features are fundamental for enabling users to manage their finances, conduct transactions, and access banking services conveniently and securely from their mobile devices. Examples of must-have banking app features include payment, money transfer, account management, ATM/branch locator, budgeting and expense tracking features, etc.

- Innovative features for banking app: these features go beyond traditional banking functionalities and offer unique value propositions that empower users to manage their finances more effectively and conveniently. Examples of innovative banking app features include QR Code Payments, AI-powered Chatbots, Voice-activated Virtual Assistants, and many more.

Incorporating cutting-edge features like real-time data synchronisation, machine learning capabilities, or custom user interactions will significantly enhance the app’s user experience but will also reflect in the development costs. Your app developers need to be skilled at balancing feature complexity with cost efficiency, ensuring that businesses can achieve a high-performing app within their budget.

Moreover, businesses should also consider integrating external services, APIs (Application Programming Interfaces), or functionalities into the app to extend its capabilities and provide additional value to users. These integrations allow mobile apps to interact with other systems, or services seamlessly, enabling features that would otherwise be unavailable or impractical to develop from scratch. Examples of integrations in mobile banking apps include:

- Payment Gateway Integration: Enabling users to make purchases, donations, or transactions within the app using payment processors like PayPal, Stripe, or Square.

- Card management integration: Integrating with card management platforms to enable users to activate or deactivate debit or credit cards, set spending limits, and receive real-time notifications for card transactions.

- Cloud Integration: Allowing banks to store customer data securely in cloud storage services.

For businesses wondering how much to develop an app with specific functionalities, it’s important to consult with experienced mobile app developers who can offer detailed insights and transparent cost breakdowns. Doing so will allow you to make informed decisions, optimising their investment while tailoring the app to meet their unique needs.

What Supported Platforms to Include in Your Banking App?

Choosing between iOS and Android platforms—or opting for both—affects the amount of banking app development solutions your project requires. As iOS and Android apps are crafted using distinct programming languages for finance and fintech, targeting both can escalate the cost of developing an app.

If an app developer employs native coding practices, they will need to create the front-end interface twice—once using Java or Kotlin for Android, and again using Swift or Objective-C for iOS. Fortunately, the backend, which involves server and database interactions, can typically be shared across both platforms, reducing some of the digital banking app development workload.

A more budget-friendly option is to leverage a cross-platform framework that enables developers to write the code once and deploy it across multiple platforms, effectively reducing the front-end app development cost in Australia by avoiding duplication of effort. The approach simplifies development and speeds up the time to market, making it a popular choice among app developers.

What is Your App’s Level of Detail and Refinement?

The degree of detail and refinement applied to development significantly influences the wider banking app development cost in Australia.

Every aspect of the banking app—from the user interface (UI) design and server architecture to animations, interactive elements, and tablet optimisation—serves as a potential cost factor. Generally, the more enhancements and ‘polish’ an app undergoes, the higher the development and ongoing maintenance expenses.

In most projects, apps evolve through multiple stages of mobile development, each adding more sophistication. Rarely is the initial version released to the public and contains the final selection of features.

Instead, for most startups, the inaugural release is often a basic, cost-effective. Minimum-viable product for banks and financial services purely serve to validate the strategy of BFSI businesses, ensuring there is a potential market or user base before additional funds are invested in further development.

Understanding these stages is crucial for entities considering how much to develop an app. Mobile development strategies often require balancing immediate needs and long-term goals. Engaging with experienced app developers can help craft a development plan that aligns with financial constraints and market demands, providing tailored mobile app development solutions that grow with your business.

Where is Your App Development Team Based?

The geographic location of your app development team may also be an unexpected factor affecting the cost of app development in Australia.

App development is a labour-intensive process, and labour costs directly affect the overall expense of developing an app.

In Australia, labour costs are comparatively higher than in many other countries, likely leading some businesses to consider offshoring their app development to regions with lower labour costs, such as Vietnam, India, Mexico, Philipines. The expertise of these offshore teams can be comparable, provide greater flexibility across multiple time zones, ensure a faster method of scaling development, and more.

Why Build a Banking App: Benefits & Statistics

Prior to building a mobile banking app, you’ll need to consider its advantages to both the banks and customers. With a digital banking experience that utilizes the advantages of digital banking apps, financial institutions can have more opportunities to strengthen relationships with their business clients.

Build a Banking App: Benefits for users

With the service banking and finance app development, financial institutions will always be available within customers’ reach:

- Users can log in to their bank accounts, transfer money, manage their spending, and execute other financial activities anytime and anywhere, simply through a mobile device.

- Fast and secure access to the account with Face ID and Touch ID.

- Get immediate support without going to the branches.

- Provide a more personalized customer experience in comparison to branches. By implementing Machine Learning (ML) and Data Analytics (DA) to track and understand user behavior, banks have insights to improve their online services, such as user-friendly designs, more innovative features, etc.

Create a Banking App: Benefits for banks

There are several obvious reasons why traditional banks turn to innovative forms of providing financial services:

- Increase the ability to serve a larger number of customers.

- Reduce the time to approve the enterprise’s profile, work on related administrative tasks, etc.

- Reduce operational costs as banks can cut down the use of paper and costs associated with maintenance and staffing.

- Reach more users and communicate with them more effectively.

By implementing electronic Know Your Customer (e-KYC) technology in the online onboarding process, banks can minimize redundant tasks and bring customers smoother and quicker experiences.

How to Create A Banking App: 9 key steps Guide

Step 1. Market Research and Analysis

Market Overview

- Growing Adoption: Mobile banking apps have become indispensable, with 98% of Millennials and 99% of Gen Z using them for various financial tasks like budgeting and tracking savings goals. This shift emphasizes the crucial role mobile banking plays in modern financial management.

- Revenue Potential: The mobile banking market is experiencing significant growth, with revenues of $772.96 million in 2022, expected to reach $1.87 billion by 2030. This highlights the immense revenue opportunities for financial institutions investing in comprehensive, user-friendly banking apps.

- Trends in Mobile Banking: Key trends include AI integration for personalized banking, advanced security features such as biometric authentication, and seamless payment tools like NFC and digital wallets. Additionally, the rise of chatbots and voice payments enhances user convenience and interaction (Darya Efimova, 2024)

Understanding Your Target Audience

To create a banking app that truly connects with users, it’s crucial to deeply understand your target audience. KMS Solutions conducts thorough market research to identify the needs and preferences of your potential users. This involves analyzing demographic data, user behavior, and feedback from current banking app users to tailor your app’s features accordingly.

Analyzing Competitors

Analyzing competitors is crucial for identifying what works and what doesn’t in the current market. KMS Solutions evaluates the strengths and weaknesses of existing banking apps, helping you incorporate the best practices and avoid common pitfalls. This analysis helps ensure your app distinguishes itself in the competitive financial services market.

Identifying Market Gaps and Opportunities

By identifying gaps and opportunities in the market, KMS Solutions helps you develop unique selling points for your app. This might involve offering innovative features that competitors lack or improving on existing functionalities to provide a superior user experience.

Step 2. Setting the Foundation for Security

Given the sensitive information contained in banking apps, security is a top priority. Essential security measures include:

- Secure passwords: Encrypt all passwords before storing them to prevent unauthorized access. Implement solid validation processes for password recovery to ensure that users can securely change their login credentials.

- Auto logout: Automatically log users out from the system after a period of inactivity on both the front end and back end. This reduces the risk of unauthorized access if a device is left unattended.

- Secure authentication: Employ robust methods such as one-time passwords (OTP), message confirmations, encrypted PINs, biometrics, and two-factor authentication (2FA) to verify user identity securely.

- Data privacy: Restrict developers’ access to sensitive information such as user tokens and passwords. Ensure that all customer data is stored on secure platforms to maintain privacy and security.

Ensuring the security of banking apps is crucial, as these applications handle highly sensitive information. Encryption, secure authentication methods, and stringent data privacy measures are vital to protect users’ financial data. KMS Solutions integrates these security measures into their app development process to provide clients with robust and secure banking applications.

Step 3. Defining Features of a Banking App

Essential Features to Build a Banking App

To build a successful banking app, certain core features are non-negotiable:

- Account Management: Users should easily manage their accounts, view balances, and track transactions.

- Fund Transfers: Seamless fund transfers between accounts and to other users are essential.

- Bill Payments: The ability to pay bills directly from the app adds significant convenience.

Advanced Features to Create a Banking App

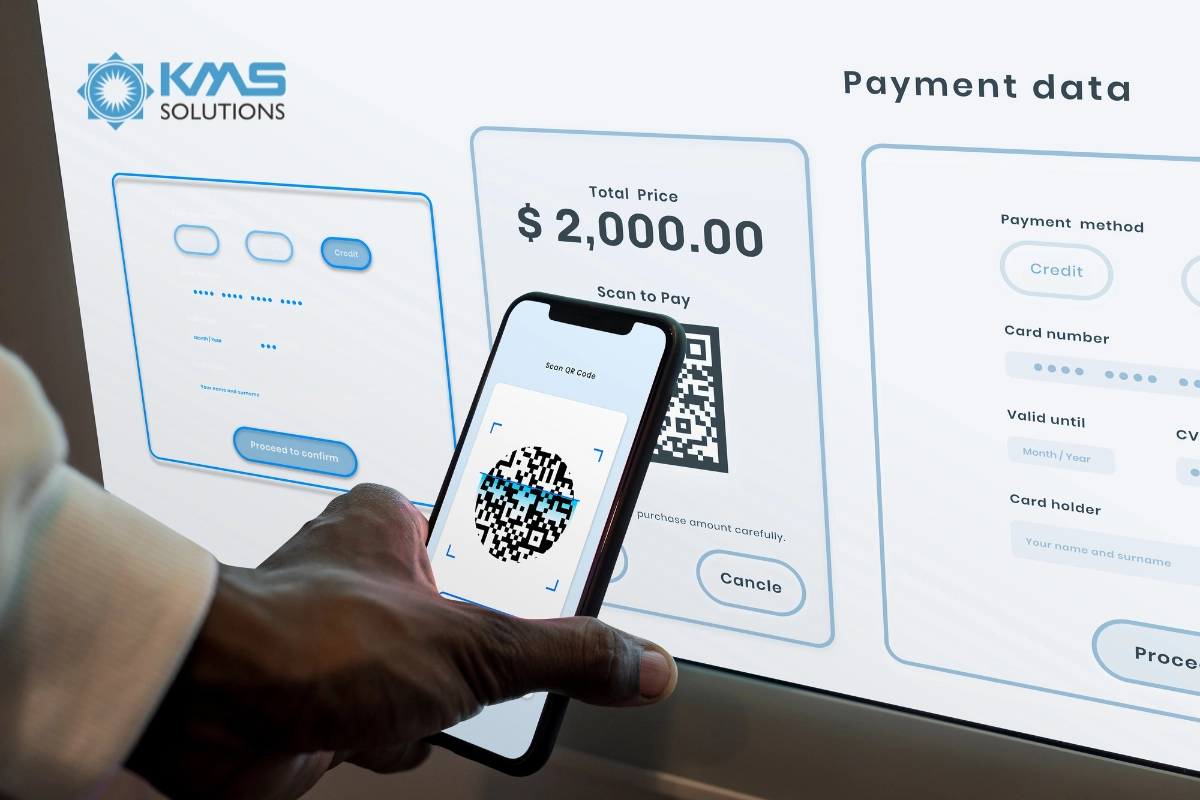

To stand out in today’s competitive financial landscape, a banking app must incorporate advanced features that enhance user experience, security, and convenience. Key must-have features for a modern banking app include QR Code Payments, AI-powered Chatbots, Cardless ATM Withdrawals, and Voice-activated Virtual Assistants.

- QR Code Payments: This feature simplifies transactions by allowing users to scan a QR code for payments, eliminating the need for physical cards and enhancing security and convenience.

- AI-powered Chatbots: These provide instant, 24/7 customer support, handling various queries from balance checks to complex banking services. They offer personalized recommendations and insights into spending patterns.

- Cardless ATM Withdrawal: Users can withdraw cash from ATMs without a physical card, using a code or QR code generated by the app. This adds a layer of security and convenience.

- Voice-activated Virtual Assistants: These allow users to perform banking transactions and inquiries using voice commands, providing a hands-free, user-friendly experience and improving accessibility.

Integrating these innovative features not only meets the evolving demands of tech-savvy customers but also positions the bank as a forward-thinking institution, driving greater customer satisfaction and engagement.

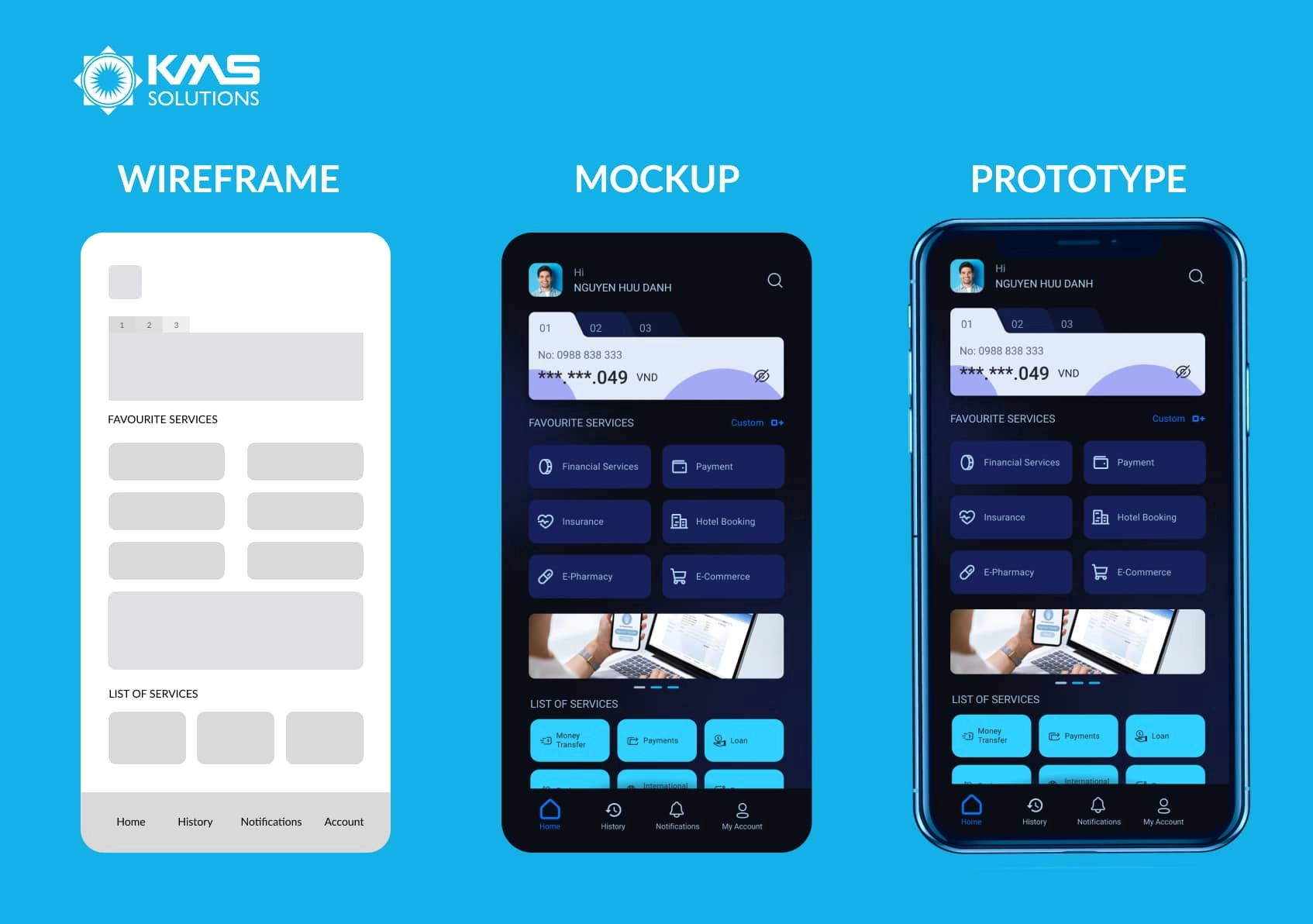

Step 4. Developing/Building a Prototype for the Banking App

Developing a prototype is crucial for a successful banking app. A prototype serves as an early model, simulating the app’s design and functionality. Start with a low-fidelity wireframe that outlines the app’s structure and core elements. This allows for quick delivery and initial feedback, enabling rapid iterations based on user input. The focus here is on core functionalities and user flow rather than design specifics.

Once the wireframe is approved, transform it into a high-fidelity digital prototype. This version should include detailed graphics, navigation components, color schemes, animations, and micro-interactions. High-fidelity prototypes provide a realistic representation of the final product, facilitating detailed user feedback on both the interface and functionality.

Testing the prototype with real users is essential. Conduct usability tests to observe interactions, identify pain points, and gather improvement suggestions. Analyzing this feedback allows for refining the interface and enhancing the user experience, ensuring the final product aligns with user expectations. This iterative approach increases the likelihood of delivering an intuitive and functional banking app that stands out in a competitive market.

Step 5. Designing the Banking App’s UX & UI

Creating an intuitive UI design for a banking app involves ensuring consistency and ease of use, which helps in building trust and providing a seamless user experience.

Brand Consistency

- Ensure layout, colors, icons, buttons, and forms align with the bank’s brand guidelines.

- Enhance visual appeal and foster user familiarity and trust through consistent design elements.

Logical Navigation Architecture

- Implement a flat menu hierarchy for simplified navigation.

- Enable users to access various activities from a single page without getting lost in multiple menu layers.

- Provide a high-level overview of the app’s logical architecture for easy feature location.

Responsive Design

- Ensure the app functions seamlessly across different devices and operating systems, particularly iOS and Android.

- Offer a consistent user experience regardless of the device used.

- Focus on making the app responsive to different screen sizes and resolutions.

Secure and Accessible Account Information

- Make the account balance feature easily accessible yet secure.

- Provide quick access to financial information while ensuring protection from unauthorized access.

Ensuring these best practices are followed during the design phase is essential for creating a banking app that meets user expectations and regulatory requirements. By focusing on a consistent, logical, and responsive design, banks can provide a more engaging and secure user experience. This approach not only helps in retaining existing customers but also attracts new users by offering a reliable and user-friendly banking solution.

Explore more: UX/UI case studies for Mobile Banking App

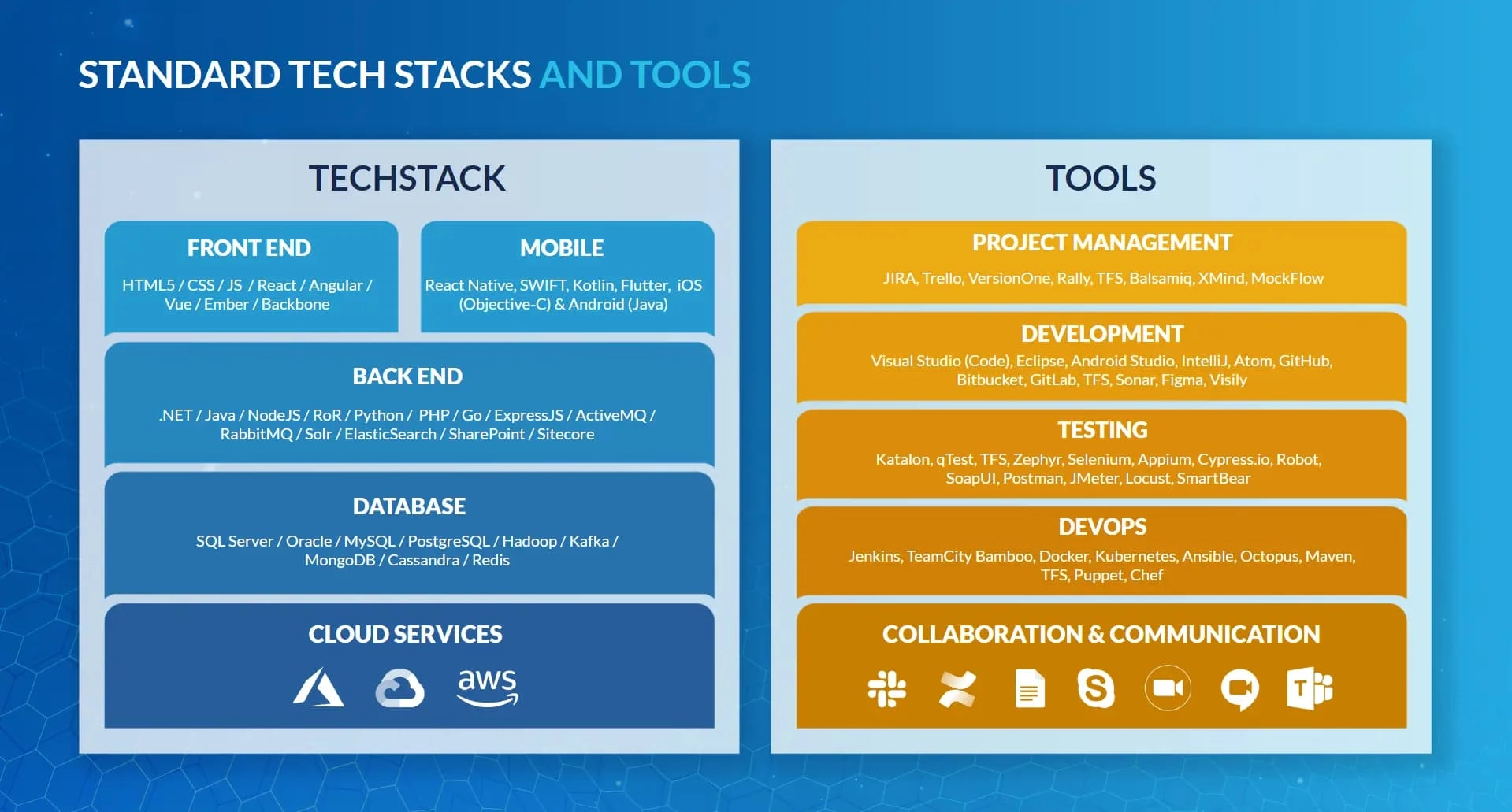

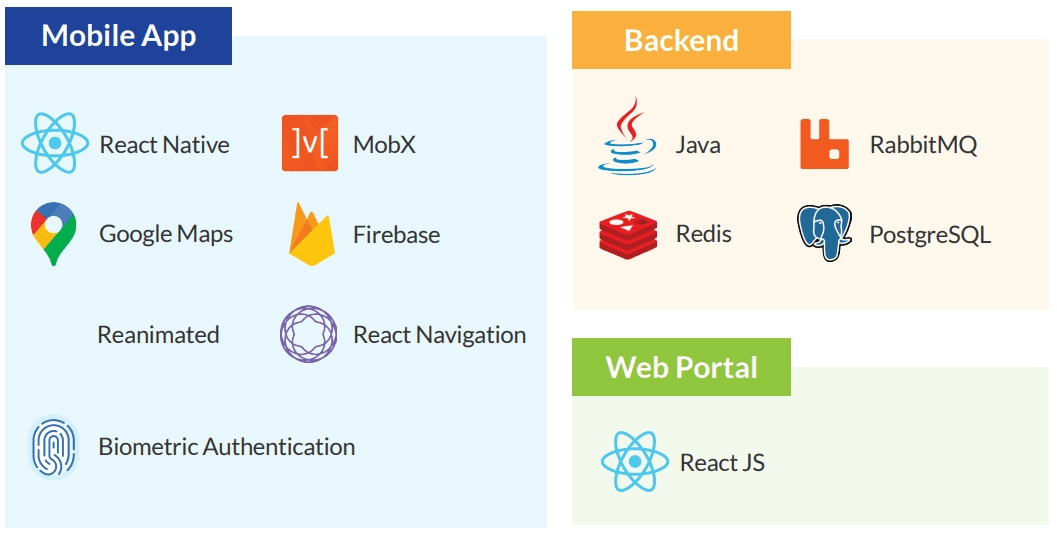

Step 6: Choosing the Optimal Technology Stack to Develop a Banking App

Frontend Technologies

The frontend technology stack determines how users interact with your app. KMS Solutions recommends using robust and scalable technologies like React Native or Flutter to ensure a seamless and responsive user experience across all devices.

Backend Technologies

The backend is where the core operations and data management take place. It is crucial for the app’s reliability, security, and overall performance. Using reliable technologies such as Node.js, Ruby on Rails, or Python ensures that your app can handle large volumes of transactions securely and efficiently. KMS Solutions ensures your backend is optimized for performance and scalability.

Security Technologies to Create Mobile Banking App

Security is paramount in banking apps. KMS Solutions incorporates advanced security technologies such as encryption, multi-factor authentication, and secure API integrations to protect user data and ensure compliance with financial regulations.

In the case of Asia Commercial Bank (ACB), the bank’s internal development team and KMS Solution’s digital team, after a thorough discussion, came up with the tech stack decision of React Native, Java Back-end, Monitoring & Log Tracing with ELK, Sentry, APM, K8s (Kubernetes), Gitlab CI.

Step 7. Development and Testing in Banking App Development

Third-party Integrations

To provide a seamless customer experience with a more user-friendly app flow, your app will certainly need to integrate with several different financial services. Therefore, you should carefully plan any APIs required to achieve this. This API enables safe data retrieval from large financial institutions via third-party applications.Agile Development Methodologies

KMS Solutions employs agile methodologies to ensure flexibility and responsiveness throughout the development process. This involves breaking down the project into manageable sprints, allowing for continuous improvement and iteration based on user feedback.Continuous Integration and Deployment (CI/CD)

Continuous integration and deployment streamline development by automating testing and deployment processes. KMS Solutions uses CI/CD pipelines to ensure that new features are tested and deployed efficiently, reducing time-to-market and improving quality.Testing Strategies

Rigorous testing is essential for ensuring the app’s reliability and performance. KMS Solutions employs various testing strategies, including unit testing, security testing, performance testing, integration testing, and user acceptance testing, to identify and address any issues before the app goes live.Step 8. Deployment and Maintenance to Boost User Retention

Launching Your App

A successful launch involves careful planning and execution. KMS Solutions ensures your app is ready for deployment, providing support throughout the launch process to address any issues that may arise.Post-Launch Support and Maintenance

Ongoing support and maintenance are crucial for the continued success of your app. KMS Solutions offers comprehensive post-launch services, including regular updates, bug fixes, and feature enhancements to keep your app running smoothly.Gathering User Feedback and Iterating

User feedback is invaluable for improving your app. KMS Solutions collects and analyzes user feedback to identify areas for improvement and implement necessary changes, ensuring your app continues to meet user needs.Step 9. Focus on User Growth Strategy

Launching the app is just a start. After the development steps, you will need to work with the marketing team to gain valuable feedback from users to improve and update the app. By analyzing user behavior and their journey while using the app, you can understand their conversion points, features that need improvement, and offers that engage more users. Since the work of tracking user interactions and collecting their data is time-consuming, you can adopt solutions such as Mixpanel to build custom reports and measure user engagement and retention effortlessly.

Besides, to have a good influence on business growth, banks should also consider the Growth Hacking strategy. One of the first steps in growth hacking is to concentrate on customers’ requirements and have a clear vision of them and how you’re meeting their necessities. App proprietors and developers can come up with solutions to promote and get more users:

- Affiliate Marketing: you can use tools such as Accesstrade to connect with thousands of publishers to promote your banking app.

- In-app Analysis: Insider’s technology connects customer data across digital channels to find the most optimal touch points and predicts future customer behavior. Or by using Mixpanel – Product Analytics Solutions, you can have insights regarding how people are using the app, what is and isn’t working, and from that, prioritize the product roadmap, accelerate innovation, and improve the app.

Want to Learn More About the Cost of App Development in Australia?

Selecting a trustworthy app development partner can be challenging. As you may need to consider many factors, including app performance, security, and more, it can be challenging to consider all at once. The mobile app developers at KMS Solutions can help you in building a secure and scalable mobile app on your requested budget.

Not only does KMS Solutions provide top-tier IT specialists for every phase of app development, but it also operates from Melbourne, ensuring excellence in every project from a premier Australian app development company.

If your organisation is interested in custom mobile app development from an experienced team of developers, speak with our experts at KMS Solutions today.