Within the context of severe competition in the digital banking space, banks should consider two main strategies: a customer-centric approach and mobile app innovation. According to a report from Citi, 80% of mobile banking users with high-functioning apps are more likely to remain loyal to the service providers. Moreover, the study also indicates that companies that do not invest in mobile app capabilities may fall behind those who prioritize the enhancements and features that align with customer expectations from a mobile banking app.

Therefore, mobile banking app design is now a competitive necessity for financial institutions to engage and retain users, accelerate financial inclusion and gain new global opportunities.

Mobile Banking Market - Features of mobile banking

- Innovative Banking Solutions: Mobile banking apps today offer far more than simple balance checks or money transfers. Financial institutions have incorporated features such as biometric authentication, AI-driven financial advice, budgeting tools, and integration with mobile wallets.

- Security and Fraud Prevention: As mobile banking has grown, so too has the sophistication of cyber threats. However, banks are constantly investing in advanced security measures to protect user data. Biometrics, multi-factor authentication, and blockchain are some of the technologies being used to ensure transactions remain secure. These security upgrades help build consumer trust, which is critical for further growth.

- Faster, Easier Payments: The mobile banking landscape has evolved to include seamless payment systems like Apple Pay, Google Pay, and other mobile wallets, which make cashless transactions more convenient.

- Rise of Neobanks: Neobanks, or digital-only banks, have significantly disrupted the traditional banking ecosystem. These institutions operate without physical branches and offer a purely online banking experience. They are often more agile than legacy banks, enabling them to provide lower fees, higher interest rates on savings, and more user-friendly app experiences.

Benefits of Mobile Banking Apps – Features of mobile banking

24/7 Account Accessibility

The cornerstone advantage of mobile banking lies in its round-the-clock accessibility. Gone are the days of rushing to beat bank closing times or planning your schedule around branch hours. Mobile banking puts your entire financial world at your fingertips, regardless of time or location. Whether you’re checking your balance at midnight, transferring funds during your lunch break, or reviewing transactions while traveling abroad, your bank account remains just a tap away. This constant connectivity ensures you’re always in control of your finances, requiring only a secure internet connection to manage your money effectively.

Enhanced Security Features

Modern mobile banking apps prioritize security through sophisticated protection measures. Advanced encryption technology safeguards your financial information, while biometric authentication through fingerprint scanning and facial recognition provides both convenience and enhanced security. Two-factor authentication adds an extra layer of protection, and real-time transaction alerts keep you informed of any account activity. These comprehensive security features work together seamlessly to ensure your banking experience remains both safe and accessible, giving you peace of mind while managing your finances digitally.

Seamless Money Transfer Options

Mobile banking has revolutionized how we move money between accounts and individuals. The platform supports various transfer methods, from instant domestic transfers through UPI and IMPS to international remittances. These digital transactions eliminate the need for physical visits to bank branches or ATMs, saving valuable time and effort. Most banks offer these services with minimal fees, making digital transfers both convenient and cost-effective. The ability to schedule recurring transfers and save beneficiary information further streamlines the process, making financial management more efficient than ever.

Comprehensive Bill Payment Solutions

Managing regular payments and financial commitments becomes effortless through mobile banking apps. The platform enables users to handle everything from utility bills and loan EMIs to mobile recharges and DTH services. Advanced features allow for scheduling recurring payments and setting up auto-pay options, ensuring you never miss a due date. This automation not only saves time but also helps avoid late payment penalties, contributing to better financial management and peace of mind.

Investment and Wealth Management Tools

Modern mobile banking apps serve as comprehensive investment platforms, transforming how users manage and grow their wealth. These applications provide direct access to various investment options, from mutual funds to fixed deposits. Users can monitor their investment portfolio, track performance metrics, and make informed financial decisions all from one centralized platform. The integration of investment tools with regular banking features creates a seamless experience for both everyday transactions and long-term financial planning.

Personalized Banking Experience

Today’s mobile banking apps offer highly customizable interfaces that adapt to individual user preferences and priorities. Smart dashboards provide insights into spending patterns, while customizable alerts keep you informed about important account activities. The ability to arrange features based on frequency of use and set up shortcuts for common transactions makes banking more efficient and user-friendly. This personalization extends to receiving tailored financial advice and relevant service recommendations based on your banking behavior.

Instant Customer Support Access

Mobile banking apps have transformed how users receive assistance with their banking needs. Instead of waiting in phone queues or visiting branches, customers can access support services directly through their apps. Whether through chat functions, virtual assistants, or direct communication channels, help is always readily available. This immediate access to support enhances the overall banking experience and provides reassurance when questions or concerns arise.

Digital Wallet Integration

The integration of digital wallet features has further enhanced the convenience of mobile banking apps. Users can make contactless payments, scan QR codes for transactions, and manage their digital payment options all from one platform. This seamless integration with various payment systems makes everyday transactions more convenient while maintaining robust security measures. The ability to track digital spending and manage payment preferences adds another layer of control to your financial management.

Travel-Friendly Features

For frequent travelers, mobile banking apps offer specialized features that make international banking hassle-free. Users can easily activate international usage, set travel notifications, and manage foreign currency transactions. The ability to instantly block lost cards and track international spending provides security and control while abroad. Many apps also offer preferential foreign exchange rates and travel insurance services, making them invaluable companions for international journeys.

Advanced Financial Analytics

Mobile banking apps now include sophisticated tools for tracking and analyzing your financial behavior. These analytics features provide detailed insights into spending patterns, help create and monitor budgets, and offer personalized recommendations for better financial management. Through interactive charts and reports, users can better understand their financial habits and make more informed decisions about their money. This data-driven approach to personal finance helps users achieve their financial goals more effectively.

Through these comprehensive benefits, mobile banking apps have established themselves as essential tools for modern financial management. Their combination of convenience, security, and advanced features continues to evolve, making traditional banking methods increasingly obsolete. As technology advances, we can expect these applications to become even more integral to our financial lives, offering new innovations and enhanced capabilities for managing our money effectively.

Key Considerations of Mobile Banking Features

While there is a broad range of features that banks can consider adding to their mobile apps, not all are suitable. Service providers need to analyze market requirements carefully and make a concise list of mobile banking features that are:

- Highly demanded: Some mobile banking services are more prevalent to customers than others, and this typically varies with the location of your target market. Banks and financial institutions should prioritize features matching customers’ expectations and have substantial market demand in the future.

- Easy to navigate: Among tons of mobile banking apps, you only have a few seconds to gain people’s attention and retain them on your product. Concentrating on features that can be used with simple clicks will help banks improve customer experience and lessen their work in instructing processes.

- Risk-mitigated: Banking services need rigorous, sometimes complicated management processes comprising technology and database management, security, legal compliance, and more. It’s essential to ensure the features can reduce fraud and keep user data well-protected.

Top 7 Innovative Mobile Banking Features in 2025

As the majority of customers nowadays often use mobile apps for their daily financial activities, besides some must-have mobile banking app features, banks need to regularly update apps with the newest innovations emerging in the mobile development sector to maintain their services at a high standard. By keeping up with mobile banking industry trends, they can attract more customers with expanded service offerings, resulting in new streams of revenue.

Below are some innovative features that can be rapidly and effortlessly integrated into digital banking platforms.

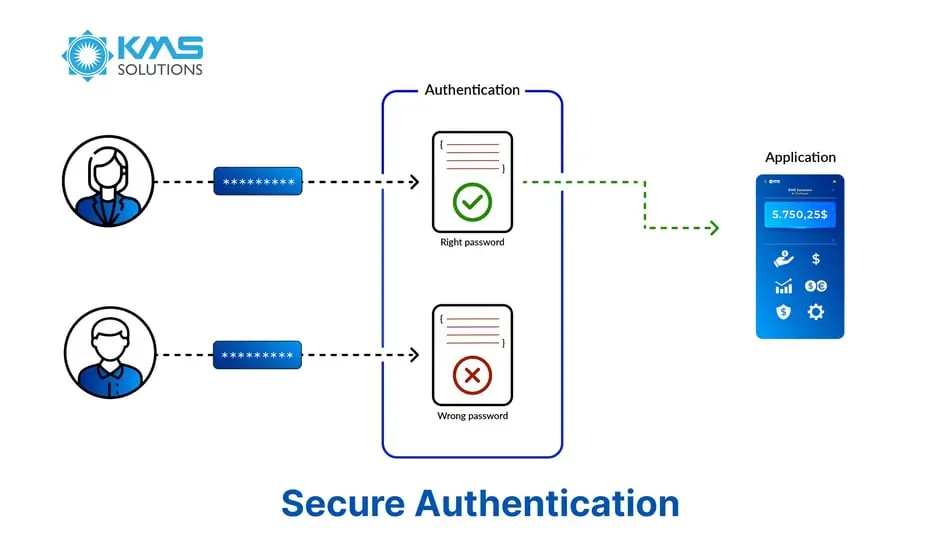

1. Secure Authentication - An important feature in developing mobile banking app

The research from Verizon regarding a data breach investigation indicates that approximately 86% of all cyber crimes are undertaken with the intent to steal money, and mobile banking apps are a common target of fraudsters. Given this, service providers should pay more attention to security features during app signup or onboarding – for instance, multi-factor authentication. This identity verification process, which often involves several steps, should not only be secure but also convenient and time-efficient. One-time password (OTP), message confirmation, and encrypted PINs are the widely-used authentication steps in many apps.

To prevent accounts and devices from unauthorized access, mobile banking development corporations have gradually implemented biometric authentication to their apps, which verifies customers based on their physical characteristics: face, fingerprints, voice, and others. By investing in eye scanning technology, Well Fargo bank can improve user security through the recognition of unique details such as blood vessels.

Moreover, to balance security and user experience during the onboarding process, electronic Know-your-Customer (eKYC) with biometric selfie verification is powerfully on the rise. In digital banking, this technology not only helps digitize the manual KYC process but also prevents identity fraud.

Biometric authentication is also one of the essential banking app features to improve user experience.

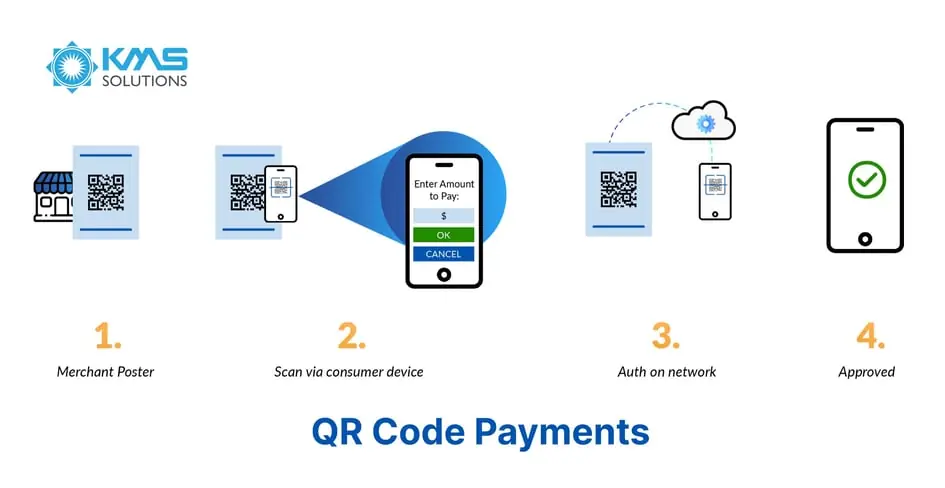

2. QR Code Payments

Today, this black-and-white square is gaining tremendous popularity among diverse industries, including banking and retails, since it provides users with quicker contactless payments. Using a QR code, customers may make purchases without using bank cards. With this feature, you only need to spend a few seconds scanning the code and confirming payment with your data securely encrypted.

The recent QR payment surveys conducted in China reveal that a third of citizens are currently using QR codes to make their daily purchases, and the number of QR code transactions are anticipated to grow by 16.4% between 2020-2024. Besides, this trend is also recognized to spread in the Asia Pacific region in Singapore since retailers and restaurants print a QR code on every slip and bill or offer it so travellers can effortlessly scan and pay in their local currency.

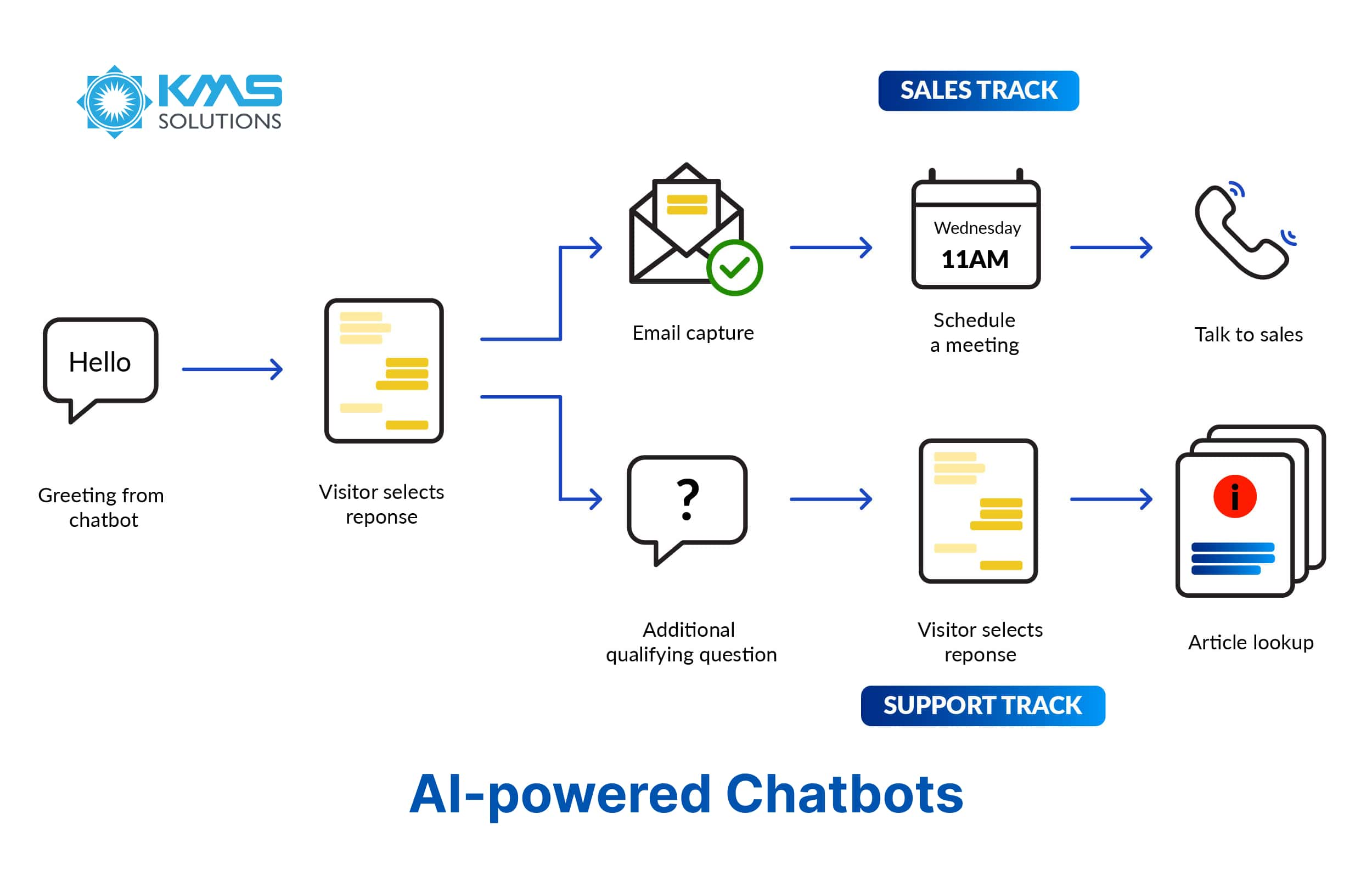

3. AI-powered Chatbots

Customer service is one of the main factors influencing loyalty, regardless of the industry. To make banking apps more personalized and raise service availability, banks and financial institutions can consider providing support 24/7. By implementing conversational technology such as the Chatbot feature, they can simultaneously process multiple incoming requests, reducing response waiting time from an hour to seconds.

AI-powered chatbots can simulate human reactions, such as responding to consumer inquiries in real time, monitoring recurring customer issues, and providing a personalized experience. Moreover, this feature also helps improve the customer experience since it services people across different languages at any time. Additionally, to handle more complicated cases, banks can consider analyzing customer data and implementing algorithms. This type of deployment can be essential in digital transformation, permitting better competition against challenger banks.

4. Voice-activated Virtual Assistants

With 75% of iPhone users having communicated with Siri and 63% of Android owners have done the same with a virtual assistant on their smartphones, it’s evident that using digital assistants is becoming a trend.

According to Grand View Research, the worldwide voice-based payments market is forecasted to grow by 10.9% from 2022 to 2030 at a compound annual growth rate (CAGR). This is the opportunity for banks and financial institutions to lead market trends and improve customer experience by concentrating on voice-based transaction features.

With this touchless payment feature, users can order the virtual assistant to pay their bills or checkout a particular transaction. Following this trend, Bank of America recently developed Erica, a virtual voice assistant that helps check account balances and make purchases easily with a voice command.

As a great number of customers have already gotten used to this technology, the adoption of voice banking is a natural evolutionary step for them. Banks can take advantage of this innovative feature to boost the brand’s overall value and build a robust connection with their other mobile banking services.

5. Cardless ATM Withdrawal

One of the excellent mobile-based branchless banking solutions that are trending in 2021 and in years to come is cardless ATM withdrawal. With innovations in NFC technology and QR code scanning, users can interact with banking ATMs simply through their mobile phones. With this feature in the mobile banking app, customers can make contactless payments and withdraw cash from the ATM machine without using their cards.

This feature can be implemented differently based on separate banks’ strategies. Here are a few types of cardless ATM withdrawal options offered by different banks:

- The cardless ATM withdrawal service in Commonwealth Back requires customers to submit a transaction amount and confirm it online to receive the transaction code before entering it into the ATM machine to withdraw cash.

- Well Fargo Bank introduced a card-free access feature in its app but somewhat distinctly: implementing NFC technology to read the card information through a symbol in mobile apps. However, users will need to initially transfer the amount they want to withdraw from the bank account to the digital wallet.

6. Investment Management

Many people are now seeking passive income besides their salaries, and investing is one of the possible choices. Understanding this increasingly common demand, mobile banking apps can include investment services as a value-added feature. With investments in assets like stocks, exchange-traded funds (ETFs), real estate, and cryptocurrencies now readily accessible to many, a prevalent innovative banking idea for many service providers can be enabled to allow the acquisition and management of investments.

The investment management feature can be designed for customers to manage their portfolios or obtain real-time insights. In such manner, users can invest in their desirable securities effortlessly by just making a few taps over their phones.

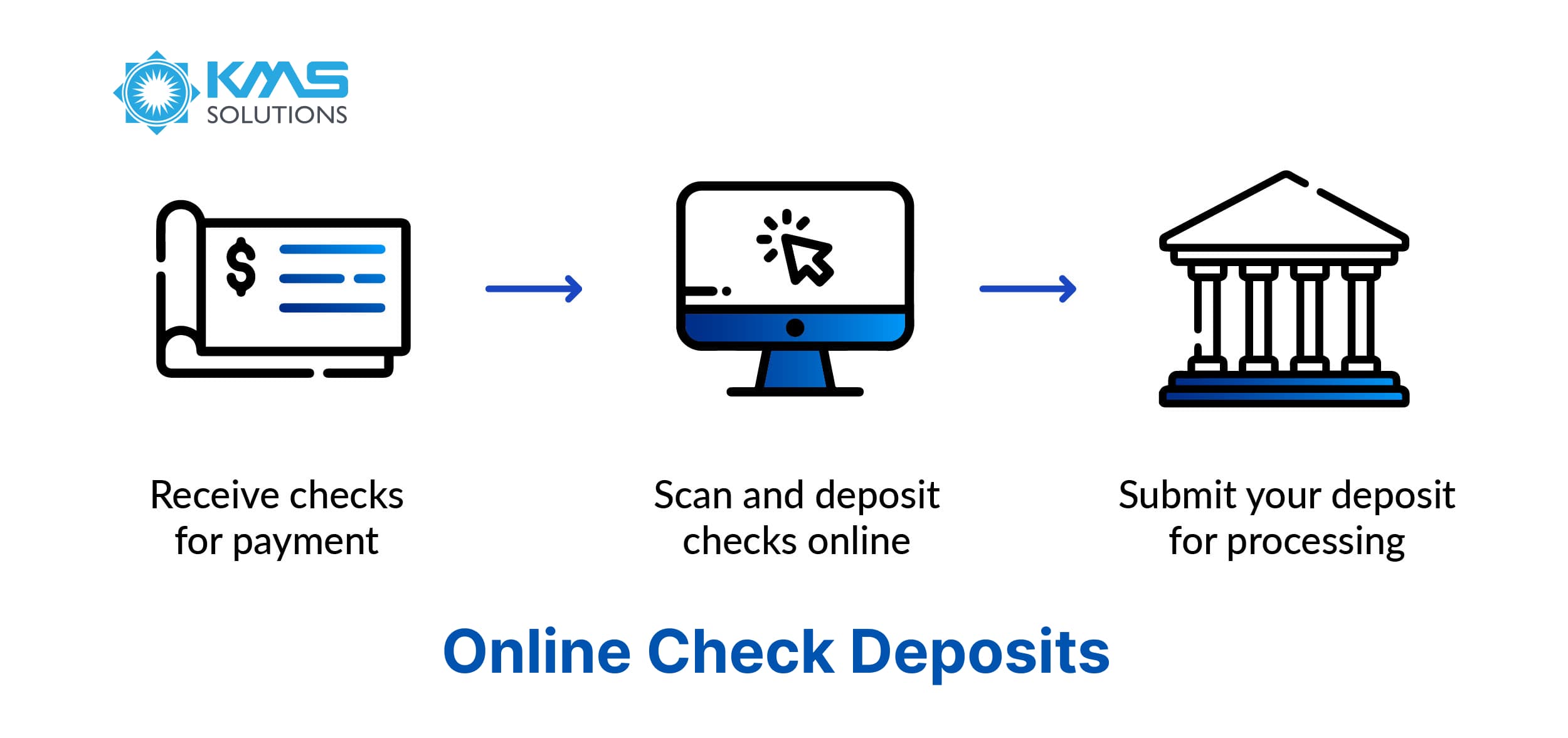

7. Online Check Deposits

The use of traditional branches is slowly decreasing. Mobile banking apps have already supplanted several services provided in brick-and-mortar facilities, yet not all can be done digitally. Although some banks in America and Europe have implemented this feature in mobile banking apps, it’s still new in other regions. Recently, online mobile check deposits have become available digitally, considering the rising demand for these services in the APAC.

With the OCR (Optical Character Recognition) technology, consumers can use a smartphone camera and a portable scanner in the banking app to scan their checks and submit the documents with a digital image and recognized text to the banks. The deposit data goes directly to the user’s account, and they can save time visiting branches to complete this simple task.

Conclusion

Banks and credit unions often focus solely on the features of their mobile apps or enhancements needed to boost profitability. However, evolving customer demands prioritize care and retention in the banking industry.

Integrating innovative banking features not only enhances competitive advantages but also elevates customer experience, fostering greater loyalty and driving revenue growth. By incorporating these advanced banking features, you can significantly boost your competitive edge while improving customer satisfaction, leading to higher loyalty and increased revenues.

Developing a mobile banking app project with these considerations can significantly impact success in today’s dynamic market, resulting in higher loyalty and increased revenues.