Over the past decade, the finance industry has experienced remarkable growth, with advancements ranging from innovative mobile banking apps to blockchain-encrypted data storage. Banks and Fintech have always been continuously receptive to new technologies driven by the need for handling the sheer volume of transactions, managing risks, and immediate processing.

Finance has been at the forefront of technology through internal team development or by forming partnerships with reliable, dedicated software development teams such as KMS Solutions, DXC Technology, etc. When analysing the earnings reports of these IT firms, banks are one of their most prominent clients.

To help banks constantly stay competitive in the digital race, the dedicated software team should be proficient in some advanced programming languages for Fintech. Considering the specificity of the banking industry, such as stringent security standards and the demand for compliance with legislation, we have identified seven technologies widely utilised in the banking and finance sector.

1. Java

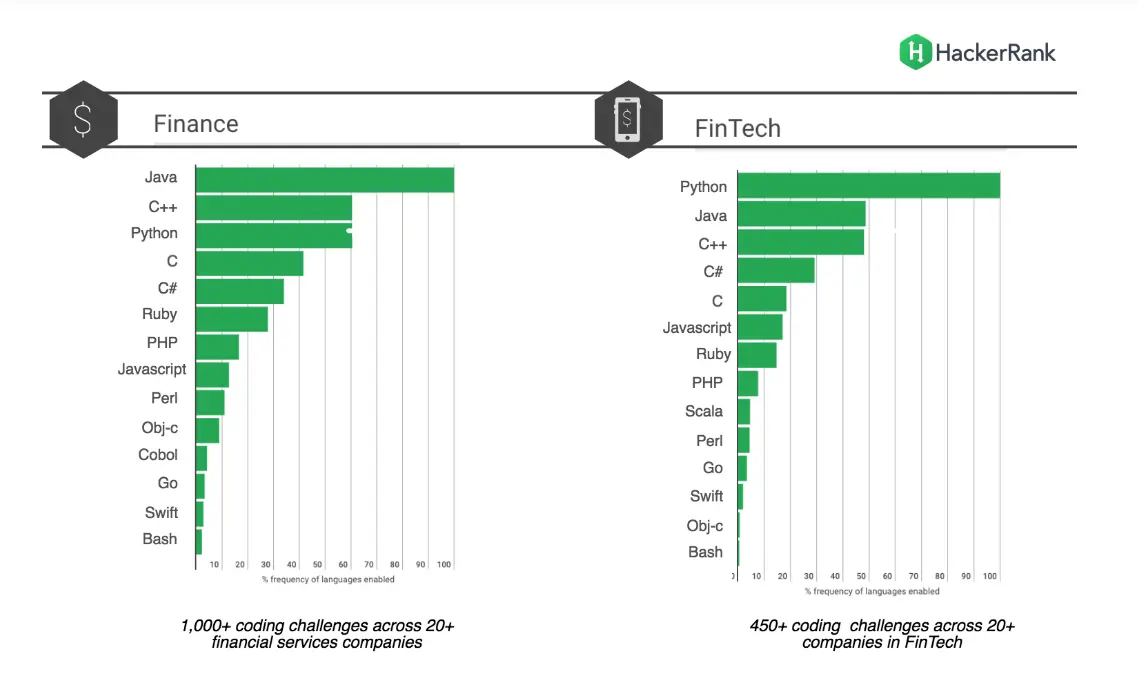

From the HackerRank survey, Java ranks first among finance interviews and second in Fintech, emphasising its dominance among other programming languages. Java has been utilised by some of the biggest banks globally for more than 25 years – and since it has been popular for so long, Java remains a critical fintech programming language of choice even as new technology emerges.

Java has a friendly learning curve, can handle considerable amounts of data and boasts rigid security features, contributing to its popularity in the BFSI sector. In finance, security is paramount, and providing the platform to users on multiple platforms is essential. Java provides a solution with its robust security APIs and security manager, which can segregate questionable code, virtual machines, and other security measures that are user-friendly and effective.

Moreover, this finance coding language is also unparalleled, making it ideal for mission-critical financial applications. Not to mention its capability to run on any device due to the use of virtual environments.

Java is also well-known for its extensive library of open-source tools and frameworks. These tools include frameworks for building web applications like Spring and Hibernate and data analysis tools like Apache, Hadoop and Spark. The wide variety of tools and frameworks available makes it less complicated for developers to build and maintain financial applications and systems.

2. Python

Python is widely used in Fintech and is among the most popular programming languages for finance due to its accessibility, simplicity, and flexibility.

Some few reasons that collectively make Python a favourite coding language for financial enterprise include:

- Clean, easy syntax (i.e. 4 lines of Python can draw 10,000 pseudo-random numbers)

- Strong financial algorithm performance

- It has a massive collection of libraries and frameworks that can be used for various purposes.

Some implementations of Python’s libraries are:

- Data Analysis: Python provides various libraries, such as Pandas and NumPy, that enable efficient and easy data analysis. These libraries allow data to be cleaned, transformed, and analysed in a way that makes it easier to extract insights and make informed business decisions. Software engineers can analyse financial data to develop financial models that can predict trends and patterns in the market.

- Quantitative finance: it can be used for quantitative finance applications such as portfolio optimisation, risk management, and financial modelling. Libraries such as QuantLib, Pyfolio, and PyAlgoTrade provide helpful tools for these types of applications.

- Financial Data Visualisation: Python has several libraries for data visualisation, such as Matplotlib and Seaborn. These libraries enable the creation of interactive and informative charts, graphs, and other visualisations that can help stakeholders understand complex financial data.

Python is a programming language well-suited for finance due to its ability to handle mathematical operations. Given the rising demand for technological collaboration between the banking industry and other quasi-financial institutions, Python’s popularity in finance coding is expected to increase. If you look at finance technologies, large banks like Bank of America have worked hard to transform their tech stack from legacy code to Python.

3. C++

Although C/C++ was created in the late 1970s, it is a common choice of finance coding language for Fintech businesses that prioritise speed. With its specific compiler, C++ is distinguished by its capacity to develop intricate and multi-level systems.

The language compiler enforces type compliance stringently, making it less prone to errors and offering greater security to the applications written in this language. Thus, C++ is utilised in the financial services industry, which is essential to manage and mitigate various types of risks, including market, credit, and operational risks. This programming language allows developers to create robust systems capable of analysing and modelling large datasets to identify potential risks and take corrective measures.

Low-latency programming for finance is crucial in online trading and foreign exchange, and as a result, C++ is a popular choice for companies operating in these fields. Its ability to create programs with high-speed performance, coupled with its strong memory management and optimisation capabilities, make it an ideal language for building financial trading systems that require fast and efficient processing of huge amounts of data in real-time.

Moreover, C++ can be used to generate algorithmic trading in Fintech since it can handle large datasets and executes trades quickly.

4. C#

C# is a next-generation of C++ that retains a significant presence in Fintech (the fourth-ranked language) and finance (the fifth-ranked), according to HackerRank. This high-level, object-oriented programming language is used to build dynamic apps running in the Microsoft and .NET ecosystem.

Since Java is considered a “legacy language for finance” and developers tend to create psychological bias to move to something more modern with better enterprise support, C# is the best alternative. For example, Java developers who routinely use Eclipse will be able to see right away how Visual Studio- the most popular C# IDE – is superior to Eclipse.

C# is often used in finance and Fintech because it is a powerful, flexible, and reliable language that can handle complex calculations and data analysis. It has a strong set of libraries and frameworks for working with data, including LINQ, a language-integrated query system that makes it easy to manipulate data from various sources.

5. Ruby/ Ruby on Rails

Ruby’s creators describe it as a language that emphasises “simplicity and productivity.” Perhaps this is the reason why businesses in the realm of digital banking use Ruby in conjunction with its Ruby on Rails framework. Software developers indicate ease of use (which saves time and money), and the framework’s built-in security features are the top reasons for their preference.

Ruby shares numerous programming traits relevant to Fintech and finance – notably speed, security, and flexibility. This finance coding language can be used to create a variety of financial solutions:

- Build Dashboard Components: Design and implement the components of your financial dashboard. This can include features like charts, tables, graphs, and key performance indicators (KPIs) to visualise financial data. Gems like Chartkick, Highcharts, or D3.js can help with data visualisation.

- Payment Gateway Integration: Ruby offers libraries and APIs that facilitate integration with popular payment gateways. For example, gems like Stripe, PayPal, and Braintree provide Ruby bindings for interacting with their respective payment APIs. These libraries simplify payment processing tasks, including creating payment forms, handling payment responses, and managing transactions securely.

6. SQL

SQL is distinct from other programming languages mentioned above. However, it is crucial to the BFSI sector since it harnesses the power of databases, making it a key tool for those working in a given industry.

Financial institutions generate vast quantities of data that require thorough analysis. Professionals in various fields, such as business, marketing, sales, and finance, recognise the significance of practical data analysis for achieving success. SQL is a crucial tool in this process, acting as a pathway to success. This programming language is integrated into data processing platforms, utilised in statistical modelling, and has become an increasingly valuable skill among financial analysts.

Moreover, since the finance world has a lot of structured data with complex relationships – perhaps more so than any other industry, enterprise and financial analysts use SQL to find patterns and turn mountains of data into useful information.

7. ReactJS

React is a Javascript library that front-end developers have used widely and is not a full-fledged programming language of its own. However, it still deserves a spot on this list because of the large number of tech jobs in finance that ask for this skill.

React Native, an open-source mobile development framework built on React allows for cross-platform mobile applications for both iOS and Android. This can be advantageous for finance and fintech companies aiming to provide mobile applications to their clients, such as banking apps, investment platforms, or payment solutions.

Besides, this language also supports the enterprise testing process since it offers a range of testing utilities, such as Jest and React Testing Library, which help ensure the quality and reliability of financial applications. During programming for finance, these tools facilitate unit testing, integration testing, and component testing, enabling developers to identify and fix issues early in the development cycle.

Find the Right Dedicated Software Development Team that Offers the Proper Tech Stack

These programming languages provide the necessary tools and frameworks for tasks ranging from data analysis, algorithmic trading, and risk management to building financial dashboards, payment systems, and blockchain applications. They enable professionals in the BFSI sector and related fields to leverage technology and effectively manage vast amounts of data, automate processes, and make data-driven decisions.

Therefore, when finding a dedicated software development team, it is vital to consider the software engineers’ familiarity with the tech stack mentioned above. In KMS Solutions, our developers are experts in building finance and fintech solutions using the proper programming languages to ensure the high performance of the software.

We also have 180+ resources supporting multiple clients in the BFSI sector and have helped more than 250+ enterprises develop software solutions across various sectors, such as ACB, Discover Market, Axi, etc., to develop financial software and build engineering teams.