The landscape of banking software is undergoing a dramatic shift. Gone are the days of isolated systems struggling to keep pace with evolving customer demands. Today, 3rd Party API Integration has become a game-changer for the banking sector, providing unprecedented opportunities for innovation and efficiency. By leveraging third-party APIs, banks and financial institutions can connect their systems with external applications, enhancing functionality and improving customer experiences.

This comprehensive guide on 3rd party API integration explores essential concepts and implementation strategies, serving as your roadmap to modernize banking systems. By mastering API integration, you’ll build a future-ready platform that adapts to evolving customer needs while maintaining security and scalability.

1. What is 3rd Party API Integration?

A third-party API (Application Programming Interface) refers to an API developed by an external entity, which exposes its functionalities and data to be accessed and utilized by other applications. Through API Integration Services, you can connect external applications, services, or platforms to your existing systems using APIs.

In banking and finance, third-party API integration connects banking systems with external services like payment gateways and financial platforms, enhancing functionality and client services.

This process enables the BFSI businesses to leverage specialized capabilities and resources without having to build everything from scratch, thereby accelerating development cycles and minimizing costs.

Examples of Third-Party Applications

Third-party applications are tools developed by external providers that integrate with primary systems to enhance functionality or offer additional features.

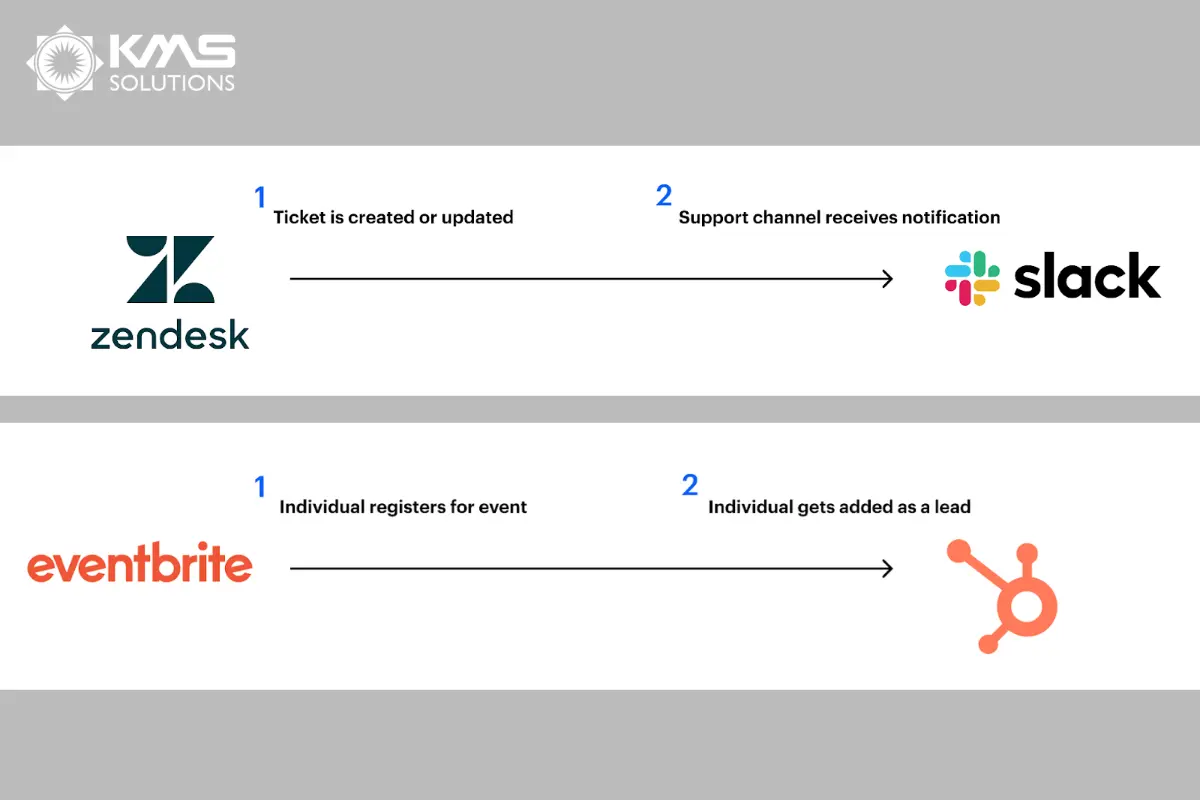

Zendesk and Slack Integration: Streamlining Customer Support

One of the most effective examples of third-party API integration is between Zendesk, a leading ticketing and customer service platform, and Slack, a popular team communication tool. This integration ensures that support teams can monitor and respond to tickets in real time, improving response times and overall customer satisfaction.

For example, integrating Zendesk with Slack sends ticket updates directly to Slack. Key details like ticket ID, customer name, and issue summary are shared in real-time. This enables support agents to collaborate effectively, address issues promptly, and even assign tickets directly through Slack commands. This seamless workflow not only saves time but also ensures that no ticket falls through the cracks.

Eventbrite and HubSpot: Automating Lead Management

For businesses hosting events, the integration of Eventbrite with HubSpot simplifies lead tracking and nurturing. Eventbrite handles event registrations, while HubSpot focuses on marketing automation and customer relationship management (CRM).

With this integration, whenever a participant registers for an event through Eventbrite, their details are automatically added to HubSpot’s lead database. If the contact already exists, the system updates their record with new information, such as the event they registered for, which is added to their activity log. This automation ensures accurate lead scoring and allows marketing teams to send tailored follow-ups, such as event reminders, thank-you emails, or relevant offers, based on participant behavior.

Hotjar: Enhancing User Experience with Actionable Insights

Hotjar, an analytics tool, integrates seamlessly with various platforms to provide businesses with granular insights into user behavior. By embedding a simple tracking code into a website or app, Hotjar gathers real-time data about user interactions.

One of Hotjar’s most notable features is its heatmaps, which provide a visual representation of user clicks, scrolling behavior, and hover activity on a webpage. For example, an e-commerce company integrating Hotjar with its website can analyze how users navigate the product pages. If users consistently abandon their carts after visiting the payment page, businesses can use Hotjar’s session recordings to identify bottlenecks, such as a slow-loading checkout or confusing design. This actionable data helps teams make data-driven improvements to boost conversions.

Pipedrive and Codebots: Optimizing CRM Workflows

Pipedrive, a CRM platform, enhances customer relationship management by integrating with Codebots, a software development tool. This integration automates the process of tracking deals and managing customer data.

When users interact with a Codebots app, their actions trigger automatic updates in Pipedrive. For instance, new signups or completed transactions instantly sync with customer records. Deals are advanced through pipeline stages without manual intervention, giving sales teams clear visibility into customer journeys. This automation minimizes human error, improves efficiency, and enables teams to focus on building relationships rather than managing data.

2. Benefits of 3rd Party API Integration

Third-party API integration offers numerous benefits that can transform the way banks and financial institutions operate. Here are some key advantages:

2.1 Enhanced Connectivity and Interoperability

One of the main benefits is improved connectivity and the ability for different systems to work together seamlessly. By integrating with various external systems, banks can offer a wider range of services to their customers without having to develop these services in-house.

For instance, payment gateway integration allows banks to offer seamless online transactions, while linking with financial planning tools can provide customers with comprehensive financial management services.

2.2 Streamlined Business Processes

Third-party API integration significantly streamlines business processes by automating and simplifying various operations. For example, integrating APIs for customer verification can expedite the onboarding process, reducing the time and effort required to verify new customers. Similarly, APIs can automate payment processing, loan approval workflows, and other routine tasks, freeing up valuable time for bank employees to focus on more strategic activities.

2.3 Cost Savings and Scalability

Utilizing pre-built functionalities through APIs can save money and help your system grow without the need to build new features from scratch.

Moreover, APIs can easily scale to accommodate growing user bases and evolving business needs. As customer demands grow, banks can integrate additional APIs to expand their service portfolio, ensuring they can meet evolving needs without significant infrastructure changes.

3. How to Integrate Third-Party APIs into Your Banking Systems

Integrating third-party APIs into banking systems can seem complex, but breaking it down into clear steps makes the process manageable. Here’s a step-by-step guide to help you navigate through the integration process efficiently:

3.1 Understanding API Basics

Before diving into the integration process, it’s crucial to grasp the fundamentals of APIs. APIs come with documentation that outlines how to use them, including details on available endpoints, request/response formats, and error codes. It is better to familiarize yourself with these concepts to understand how the API will interact with your banking system integration.

3.2 Choosing The Right APIs with Architecture Planning

Selecting the right APIs is critical. Start by identifying the specific functionalities you need, such as payment processing, customer verification, or data analytics. Once chosen, plan your architecture to ensure seamless integration. This includes deciding where the API will fit within your system, how data will flow, and ensuring there is minimal disruption to existing services.

3.3 Setting Up API Authentication

Security is paramount in banking. Globally, some authentication methods include API keys, OAuth tokens, and JWT (JSON Web Tokens). You should implement robust authentication and authorization mechanisms to protect sensitive data and maintain compliance with industry standards.

3.4 Configuring API Endpoints

Your system interacts with third-party APIs via specific URLs known as API endpoints. Ensure that your system can handle requests and responses efficiently, and that it can manage different types of data formats (e.g., JSON, XML).

3.5 API Testing

API testing is an essential component of the third-party API integration process, ensuring that the integrated APIs function as expected, maintain data integrity, and provide secure and reliable services. Here’re how KMS Solutions’ testing team aids banks and fintech companies in performing API testing:

- Ensure secure handling and transmission of data between various banking systems.

- Verify the reliability, functionality, security, and performance of financial software.

- Utilize a combination of manual and automated testing for thorough API tests.

- Support crucial financial services operations efficiently.

- Ensure compliance with industry regulations.

4. Best Practices for API Security

We’ve prepared three essential practices that every institution should prioritize to safeguard their API ecosystems:

4.1 Implementing OAuth Authentication

OAuth authentication stands as a gold standard in API security for its ability to grant limited access to user data without exposing credentials. By adopting OAuth, institutions can mitigate risks associated with unauthorized access and phishing attacks, thereby fortifying their API infrastructure against evolving cyber threats.

4.2 Data Encryption Techniques

Think of data encryption as turning your sensitive information into an unreadable secret code that only your authorized systems can decode. In banking and finance, where customer data protection is paramount, robust encryption methods like AES (Advanced Encryption Standard) act as an essential shield against data breaches and cyber threats. Encryption, coupled with key management best practices, guarantees end-to-end security.

4.3 Regular Security Audits

Just like how you check your home for vulnerabilities, regular security audits help banks and financial institutions identify and fix potential weak spots in their API security. These audits not only ensure compliance with industry standards but also proactively strengthen defences against evolving cyber threats.

5. Essential Tools for Successful API Integration

Here are some vital tools that can help streamline and enhance your API integration processes:

5.1 API Management Tools

API Management Tools are designed to handle specific aspects of managing APIs, such as security, monitoring, or analytics.

Popular tools like Apigee, MuleSoft Anypoint Platform, and AWS API Gateway provide features like traffic control, usage analytics, and developer portal management. Choosing the right tool depends on aligning technical needs with business goals to improve efficiency and speed up digital service deployment.

5.2 API Management Platforms

API Management Platforms offer end-to-end solutions for managing APIs throughout their lifecycle, from creation to retirement. Platforms like Apigee, Kong, and Azure API Management provide robust security measures, such as OAuth and role-based access controls, ensuring data protection and compliance with regulations like GDPR and PCI DSS. Additional features like API versioning, caching, and real-time analytics help optimize performance, ensure reliability, and enhance customer experiences.

5.3 API Testing Frameworks and Tools

Testing frameworks and tools are essential for verifying API functionality, performance, and security before deployment. These tools enable automated testing and validation to ensure API reliability and compliance:

- Postman: Automates testing of API endpoints, simulates various usage scenarios, and validates response data integrity.

- SoapUI: Conducts comprehensive testing to ensure API functionality and performance under varying conditions.

- JMeter: Performs API Load Testing to assess API scalability and performance under peak usage.

- Katalon: the leading test automation solution for mobile apps and API. It offers effortless API testing with up to 3 testing modes: no-code, low-code and full-code.

6. Choosing the Right 3rd API Integration Tool

Selecting the appropriate third-party API integration tool is crucial for ensuring smooth and efficient operation within your banking systems.

6.1 Features

Characterized by its range of features, a robust API integration tool should include versatility in API endpoints supported. This includes coverage for popular services like payment gateways, social media platforms, or CRM systems. Additionally, advanced features like webhook support for instant data updates and pre-built connectors for major services can streamline integration workflows, reducing development time and costs.

6.2 Ease of Use

Integrating APIs shouldn’t present a daunting task. Seek out tools with user-friendly interfaces, intuitive workflows, and comprehensive documentation for a seamless integration experience. A well-designed dashboard providing actionable insights into API usage and performance can further enhance usability, enabling proactive optimization by your team.

6.3 Scalability

As your business expands, so should your integration capabilities. Integration with cloud-native architectures or containerized environments enables flexible scaling without compromising security or regulatory compliance. Flexible deployment options—on-premises, private cloud, or hybrid models—ensure that the integration strategy aligns with evolving business needs and regulatory requirements.

6.4 Pricing

Cost-effectiveness is a crucial consideration in selecting an API integration tool for banking. Some tools offer flexible pricing models based on transaction volumes or API calls, while others may require upfront investments or charge based on the number of integrations or users. Transparent pricing and a clear understanding of the tool’s total cost of ownership, including support and maintenance, are essential for making informed financial decisions.

7. Common API Integration Challenges and Solutions

API integration in the banking sector poses several challenges that demand careful consideration and robust solutions to ensure seamless operation and data security. Here’s a detailed exploration of common challenges and their corresponding solutions:

7.1 Overcoming Compatibility Issues

Compatibility issues often arise when integrating APIs from different systems, platforms, or versions within banking infrastructure. These issues can manifest as data format mismatches, protocol conflicts, or functionality discrepancies, hindering smooth communication and interoperability.

To address these challenges, adopting industry standards such as RESTful APIs, JSON, and XML is crucial. These standards provide a common language for different systems to communicate, reducing compatibility issues.

7.2 Managing API Rate Limits

API rate limits are restrictions set by API providers to control the number of requests a client can make within a specified timeframe. In the banking sector, exceeding these limits can result in service disruptions and degraded performance.

To manage these rate limits, banks can implement client-side rate limiting strategies such as exponential backoff and request throttling. Partnering with specialists who offer advanced tools and strategies for managing API rate limits can ensure uninterrupted service and optimal performance.

7.3 Ensuring Data Consistency

Data consistency is crucial where transactions and customer information must remain accurate and up-to-date across all systems. Inconsistent data can lead to errors, security vulnerabilities, and compliance issues.

For banks looking for comprehensive solutions, KMS Solutions offers tailored strategies to maintain data consistency, leveraging advanced technologies and processes to ensure accurate and secure data management. Their expertise in atomic transactions, data synchronization, and distributed ledger technology ensures that banking systems remain consistent and reliable.

8. Case Study: Successful API Integrations in Banking and Finance

Case Study: Axis Bank and Postman API Platform

Background: Axis Bank, one of India’s largest private sector banks, sought to improve its digital banking services by streamlining its API development and management processes.

Challenges:

- Disparate API documentation spread across multiple platforms.

- Slow onboarding processes for new APIs and developers.

- Need for a more efficient and collaborative development environment

Solution: Axis Bank implemented the Postman API Platform to centralize API documentation and streamline the API development pipeline. The platform provided tools for testing, monitoring, and collaboration, allowing teams to work more efficiently.

Results: Overall, the integration led to quicker product releases and improved developer collaboration

- Development pipelines were reduced from six months to one for some products.

- Onboarding time for new APIs was cut from 10 days to 2 days.

Case Study: Federal Bank and IBM API Connect

Background: Federal Bank, a leading private sector bank in India, aimed to enhance its digital transformation initiatives by integrating various systems and improving operational efficiency.

Challenges:

- Integration with multiple organizations and ecosystems was complex and time-consuming.

- The need to streamline operations and enhance customer experience through better connectivity.

Solution: Federal Bank adopted IBM API Connect to develop an API banking system. The platform facilitated secure and efficient integration with external systems, improving connectivity and data exchange.

Results: The bank saw a significant increase in new customer conversion rates.

- Onboarding processes became more efficient, enabling quicker integration of new services and partners.

- Enhanced customer experience through improved digital services.

Conclusion

Facing the competitive financial landscape, innovation is key to attracting and retaining customers. 3rd party API integration is a game-changer for banking software, providing unparalleled opportunities for innovation and efficiency. By leveraging third-party API integration, your banking software can unlock a world of possibilities, from enhanced financial services to streamlined operations.

Contact KMS Solutions today to learn more about how we can help you revolutionize third-party API integration to propel your banking software to the next level.

FAQs

Why is 3rd party API integration important for businesses in 2024?

Integrating third-party APIs allows businesses to expand their service offerings, improve efficiency, and enhance user experiences by leveraging external functionalities without having to develop them in-house. Therefore, businesses can be benefited by cost savings, faster implementation times, and access to advanced technologies by integrating 3rd party API.

How can security concerns be mitigated during third-party API integration?

Security concerns can be mitigated by using secure communication protocols (like HTTPS), implementing robust authentication and authorization mechanisms (such as OAuth), regularly auditing API usage, and ensuring compliance with relevant data protection regulations.

How can businesses choose the right third-party API integration tool?

Businesses should consider factors such as the tool’s features, ease of use, scalability, pricing, compatibility with existing systems, support and documentation, and the specific needs of the business. Evaluating case studies, user reviews, and conducting trials can also aid in making an informed decision.