Fintech businesses are facing intense pressure from digital disruption, striving to meet the demands of today’s competitive market and ever-changing customer demands. To lead the charge, these companies are progressively adopting DevOps as a strategic practice for software development and IT operations.

DevOps not only accelerates the Fintech software development process but also improves security and compliance. In this article, we’ll explore the 10 best practices for fintech companies to effectively leverage DevOps, helping them achieve operational excellence and drive sustainable growth in the digital era.

Understanding DevOps in the Context of Fintech

Nowadays, we have witnessed the remarkable growth in the Fintech market, increasing from a value of $110 billion in 2020 to an expected $700 billion by 2030.

One major change that financial organizations are anticipating is the automation of their processes. A Deloitte survey found that DevOps plays a crucial role in facilitating the automation of routine processes, with nearly 29% of financial firms having already experienced significant impacts from automation, and over 51% expect such effects within the next five years.

An Atlassian study also highlights that 99% of organizations report positive outcomes from implementing DevOps. Specifically, 69% of companies cite significant impacts, while 30% mention more moderate positive changes.

Key Benefits of Using DevOps in FinTech

Customers expect stability from financial services, which means that FinTech products must be reliable, high-performing, and continually updated.

DevOps can help achieve these goals by ensuring a stable digital solution that receives ongoing improvements without issues. Here are some key benefits of DevOps engineering for FinTech:

- Faster Time-to-Market: DevOps automates repetitive tasks such as software development, testing, updates, and maintenance, allowing FinTech companies to deliver updates and products to market faster.

- Enhanced Collaboration: DevOps fosters improved communication and collaboration between development and operations teams, ensuring transparency and reducing misunderstandings, which leads to smoother product development and deployment.

- Improved Security: Rapidly deploying new features can sometimes compromise security.With DevOps, security is integrated into the development cycle (DevSecOps), ensuring that software is thoroughly tested for vulnerabilities before deployment, reducing the risk of data breaches and cyberattacks.

- Scalability and Flexibility: DevOps enables scalable and flexible infrastructure, allowing FinTech companies to quickly adapt to changing demands and new market conditions, which is vital for long-term success.

- Continuous Improvement: DevOps encourages a culture of continuous improvement, enabling FinTech companies to constantly optimize their processes, products, and services, leading to enhanced customer satisfaction and business performance.

Top 10 DevOps Strategies that Fintech Companies Should Follow

Implementing effective DevOps strategies can give financial companies a competitive edge in a market that demands innovation and rapid adaptability. Below are 10 key DevOps best practices specifically tailored for the FinTech sector:

#1. Embrace CI/CD for Financial Institutions

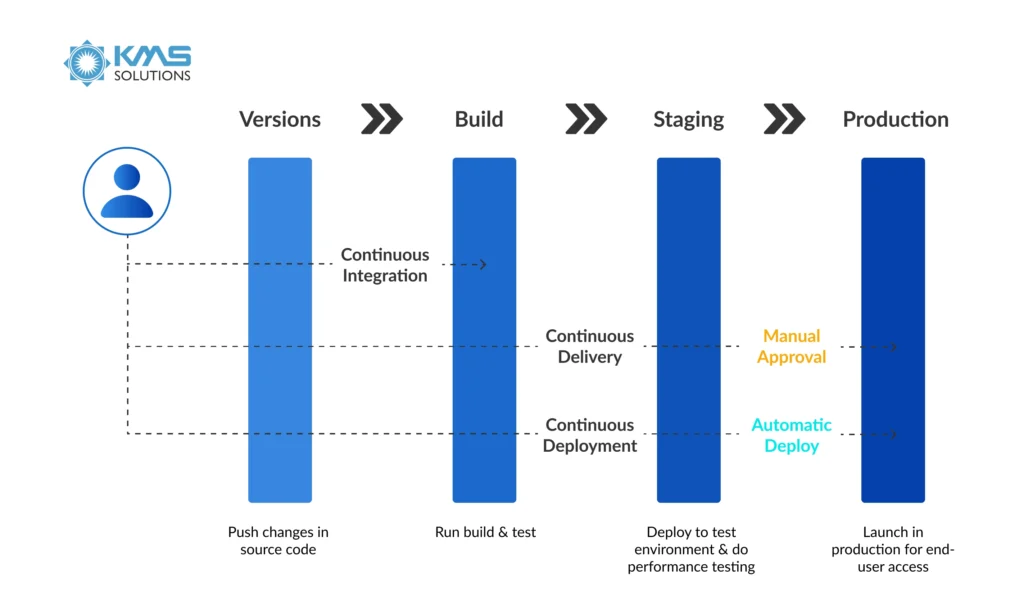

Continuous Integration (CI) and Continuous Deployment (CD) are fundamental DevOps practices that allow for frequent and reliable software updates. By integrating code changes regularly and deploying them automatically, FinTech companies can reduce the time it takes to introduce new features and fixes. CI/CD pipelines ensure that code is automatically tested, built, and deployed, improving the software’s quality and reducing manual errors.

Moreover, CI/CD also enables software development teams to experiment, identify, and address defects and integration issues instantly, ensuring the release of polished and fully operational software. This approach facilitates more efficient updates and helps minimize service disruptions.

#2. Adopt DevSecOps for Enhanced Security

Security is a top priority for financial companies due to the sensitivity of customer data and regulatory requirements. Integrating security practices throughout the software development lifecycle (SDLC) —known as DevSecOps—helps identify and mitigate security vulnerabilities early.

By embedding security measures into the CI/CD pipeline, FinTech firms can automate security checks, such as code scanning for vulnerabilities and compliance verification. According to WorldMetrics, the adoption of DevSecOps has been shown to reduce security vulnerabilities by 50%, further enhancing software reliability and security.

#3. Automate Everything

Automation should be an integral part of a DevOps strategy. Implementing automated tests for various stages of the SDLC ensures that code meets quality standards before deployment. FinTech firms should automate key processes such as software testing, deployment, configuration, infrastructure provisioning, and monitoring.

- Automated testing for financial services: This includes unit tests, integration tests, and performance tests, which identify bugs and vulnerabilities early. Popular automation tools for automation testing include Jenkins, Katalon, and Selenium.

- CI/CD process automation: Automation enables frequent and reliable code deployments through CI/CD pipelines, ensuring that new features and updates are rolled out quickly without disruptions.

#4. Implement Infrastructure as Code (IaC)

Infrastructure as Code (IaC) is an approach that enables automated infrastructure management. Thanks to it, Fintech businesses can develop and deploy cloud software much faster and with lower security risks.

IaC tools like Terraform, Ansible, and AWS CloudFormation can help set up and manage infrastructure in a repeatable and reliable manner. This approach ensures scalability and reduces the likelihood of configuration drift, which can cause security and performance issues.

#5. Adopt Monitoring and Real-Time Analytics

In a DevOps environment, continuous monitoring is essential to track the performance and health of systems, applications, and infrastructure. For FinTech companies, monitoring is critical to ensure that systems are operating smoothly and that any issues are detected early.

- Real-time Monitoring: Tools should be in place to monitor application performance, user activity, and system health and to provide real-time alerts for any issues that arise.

- Log Management: Proper log management helps FinTech companies trace issues back to their source, understand customer behavior, and perform forensic analysis after incidents.

Effective monitoring ensures system reliability and performance, which is vital for maintaining customer trust and satisfaction in FinTech services.

#6. Foster a Culture of Collaboration and Communication

DevOps is not just a set of tools and practices; it’s a culture that emphasizes collaboration and open communication between development, operations, and other stakeholders. Thus, establishing cross-functional teams that include developers, IT operations, and security experts helps FinTech companies work more efficiently and respond to issues faster.

Moreover, implementing agile methodologies, regular stand-up meetings, and collaborative tools like Slack and Jira can help maintain a connected and efficient workforce.

#7. Leverage Continuous Feedback Loops for Continuous Improvement

Continuous feedback loops involve gathering feedback from users and monitoring systems to make real-time adjustments. DevOps practices should include mechanisms for collecting user feedback after every release, using it to inform the next iteration.

This approach helps FinTech companies keep track of customer satisfaction and adapt products to better meet user needs. Integrating feedback loops into the CI/CD pipeline can help prioritize and streamline development efforts.

#8. Focus on Cloud Infrastructure

Cloud infrastructure is a cornerstone of DevOps practices, and it offers FinTech companies the flexibility to scale their operations quickly, reduce infrastructure costs, and enhance collaboration.

- Cloud-Native Technologies: FinTech companies should embrace cloud-native technologies such as containers (e.g., Docker) and container orchestration platforms (e.g., Kubernetes) to improve the scalability and portability of their applications.

- Cloud Providers: Major cloud providers like AWS, Azure, and Google Cloud offer tools and services that integrate seamlessly with DevOps workflows, making it easier to automate deployments and manage infrastructure.

Leveraging cloud infrastructure supports flexibility, scalability, and the efficient use of resources, enabling FinTech companies to remain competitive in a fast-paced market.

#9. Backup and Disaster Recovery

Establish comprehensive backup and disaster recovery strategies to protect critical data and maintain business continuity during unexpected disruptions.

Consistently test your disaster recovery plans to ensure the ability to quickly restore and sustain financial operations in the face of major interruptions. DevOps practices should support automated failover mechanisms and efficient recovery processes for minimal downtime.

#10. Leverage Artificial Intelligence (AI) in DevOps

The integration of AI has revolutionized DevOps in the financial services sector, enabling FinTech companies to enhance efficiency, improve software quality, and address industry-specific challenges. AI makes CI/CD processes more efficient through machine learning (ML). It manages data and risks, eases code generation and review, provides activities’ real-time tracking, and more. Therefore, implementing AI-powered QA tools helps analyze previous test data and enhance test accuracy.

Adopting these strategies ensures efficient software development and deployment while driving the overall success of FinTech companies. By embracing DevOps, FinTech businesses can maintain a competitive edge, meet strict regulatory standards, and deliver secure, dependable, and cutting-edge financial solutions to their customers. Integrating DevOps seamlessly into the FinTech landscape is crucial for thriving in this fast-paced and dynamic industry.

When Should Fintech Companies Choose DevOps Outsourcing?

Outsourcing DevOps can provide significant benefits to FinTech companies, especially in a highly competitive and regulated environment. Below are detailed scenarios when DevOps outsourcing is the right choice for FinTech businesses:

- Lack of In-House Expertise

Many FinTech companies face challenges in recruiting skilled DevOps professionals due to high demand and competitive salaries. If a company lacks the expertise to handle complex DevOps processes such as automation, CI/CD pipelines, or cloud infrastructure, outsourcing becomes an attractive option. External partners bring a wealth of experience and deep knowledge of the latest tools, ensuring seamless operations and reducing learning curves for internal teams.

- Need for Faster Time-to-Market

Speed is a critical factor in the FinTech industry. Whether launching a new app, updating existing platforms, or rolling out new features, delays can mean losing customers or market share. Outsourcing DevOps enables FinTech companies to leverage experienced teams who can rapidly set up pipelines, integrate tools, and optimize processes, thus accelerating time-to-market without compromising quality.

- Cost Efficiency Goals

Building an in-house DevOps team requires significant investment in hiring, training, and retaining talent, as well as acquiring tools and infrastructure. For small-to-medium FinTech companies or startups with limited budgets, outsourcing provides a cost-effective alternative. It allows businesses to pay only for the services they need, reducing fixed overhead costs and freeing up funds for core operations.

- Scaling Operations

As FinTech companies grow, their infrastructure needs scale as well. Outsourcing DevOps provides the flexibility to scale resources up or down depending on project requirements. This is particularly useful during periods of rapid growth, where additional expertise and manpower are required to meet increased demands, or during slow periods when downsizing resources is necessary to control costs.

- Compliance with Regulations

FinTech companies must adhere to strict regulatory frameworks concerning data security, privacy, and operational transparency. Outsourcing DevOps to a vendor with domain expertise in financial regulations ensures that the company stays compliant while maintaining high operational standards. Reliable DevOps partners can also streamline audits by ensuring detailed logging, monitoring, and reporting capabilities.

Final Thoughts

DevOps serves as a catalyst for innovation and efficiency in the FinTech sector. By adopting this methodology, financial organizations can optimize the development process for their digital products while ensuring the delivery of high-quality, regulatory-compliant software.

Additionally, DevOps enables FinTech companies to respond effectively to market demands and customer expectations. Its flexibility and speed foster seamless product innovation, empowering businesses to stay ahead in a competitive landscape.

If you’re seeking a dependable DevOps partner to elevate your financial services, look no further. At KMS Solutions, we specialize in FinTech solutions powered by DevOps, delivering reliable, high-performing products that meet global standards. Join our roster of satisfied clients—contact us today to begin your journey!