Digital lending is transforming the financial service sector. Innovations in this niche have allowed financial service providers (FSPs)—be it a digital-native fintech company or an incumbent bank—to provide effortless loan products that today’s market requires. Customers’ preferences today are dictated by the experience they have with mobile apps, fintech, and social media. Digital lending is a way for FSPs to satisfy those expectations.

This article explores common definitions and concerns related to digital lending, and offers insights into the digital lending framework that FSPs can use to enter into this market.

What is Digital Lending?

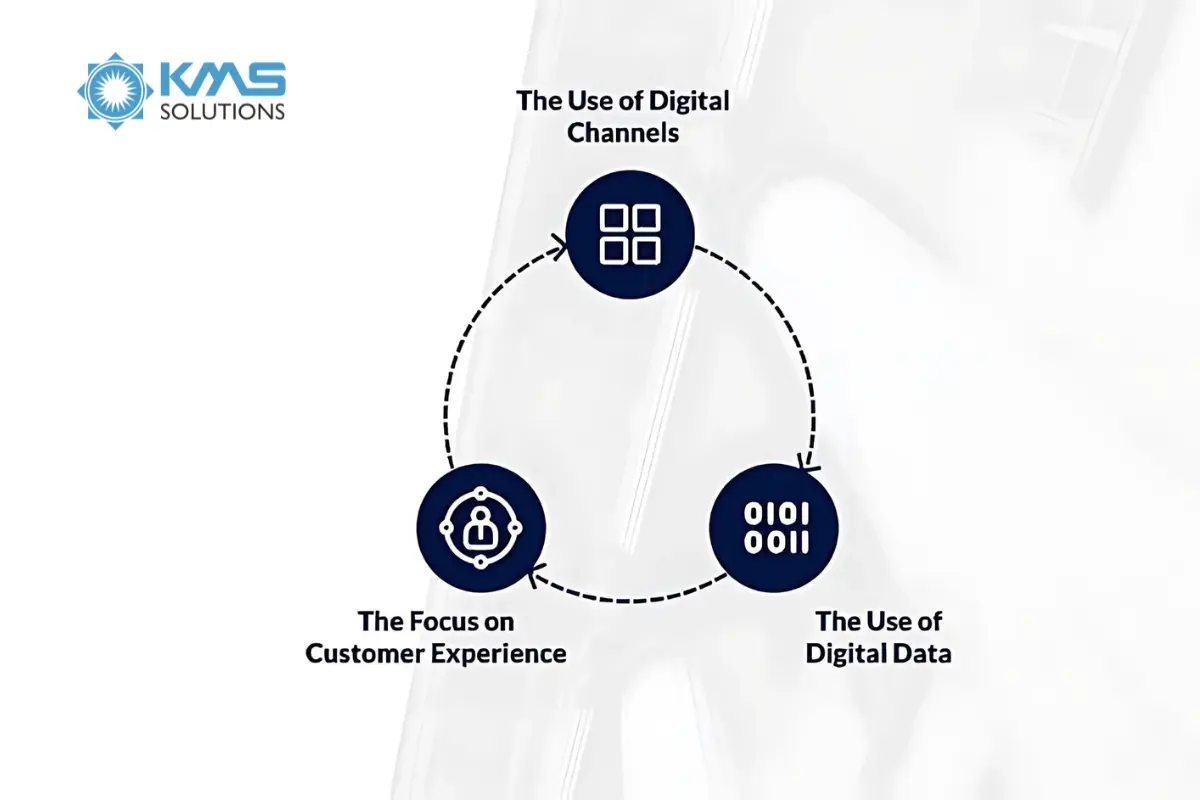

Digital lending refers to the form of lending that is applied for, disbursed, and monitored by digital channels such as mobile apps or desktop apps. In digital lending, the FSPs leverage digital data to inform credit decisions and deliver customer-centric experiences.

In terms of output, digital lending is all about enhanced operational efficiency and faster turnaround time. Regarding the technicality behind the process, digital lending is the automation of one or some parts, or the entirety of the lending process—from acquisition and servicing to post-disbursement.

More information: Digital Lending Software

Benefits of Digital Lending

More banks are considering the shift from the manual, paper-based lending model to digital lending platforms in recent years. This trend is understandable, given that a digital lending platform can offer numerous advantages that the conventional lending model lacks.

Some of the benefits of digital lending are as below:

1. Optimize Loan Cycle

The digital lending platform is all about speed. The platform starts with automating the submission of a digital loan application and uploading of relevant documents, which traditionally would take customers a day off from work to complete.

Digital lending platforms are integrated with decisions rules to help evaluate the application in seconds. Moreover, background checks can access 3rd party credit bureaus to assess applicants’ creditworthiness and financial health. Credit bureau reports display applicants’ credit history and past defaults which can be used to reduce lender risk.

The platform can also cross-check employment details in the background. Based on the borrowers’ details and risks, the platform comes up with the most appropriate loan terms.

The digital lending platform also has fraud analytics capabilities with diverse AI/ML-based technologies. It only takes seconds to create a new loan contract that accepts electronic signatures.

The entire process of lending money is automated and accelerated thanks to the seamless integration between all these functionalities, which leads to considerable cost and time savings.

2. Quicker Decision Making

The digital banking landscape is now more dynamic than ever. Every bank now wants everything, including loans, to be processed instantly in real-time. Customers are no longer willing to wait for days – not to mention to leave their homes – for a loan.

A digital lending platform enables lenders to automate the decision-making stage. It makes sure that banks can instantly automate the process of lending money with background checks and verifications. In addition, auto decisioning instantly responds to customers after applying. Besides a user-friendly interface and other modern features, the digital lending platform offers a convenient application and decision phase.

3. Compliance with Rules and Regulations

Most digital lendings abide by RBI’s regulations for Banks and NBFC’s for Lending. Providers of digital lending platforms are required to make their products in compliance with these regulations and help the lenders focus on their business only. Lenders also must make sure that the providers are updated with all the latest guidelines issued by the Regulators to quickly incorporate them into the digital lending platform.

4. Customer Experience

One obvious advantage of digital lending is that customers can apply for loans and get disbursement in just a couple of phone taps on the mobile apps, instead of having to visit bank branches multiple times. Customers can gain access to loans anytime and at any place. Digital Lending is so convenient for borrowers that financial institutions cannot afford to ignore it.

5. Minimal Documentation

Another benefit of digital lending is that lenders can eliminate most of the documents and paperwork associated with the traditional lending model. With digital lending, customers can apply for a loan conveniently without having to fill piles of papers.

6. Cost Efficiency

For lenders, digital lending cuts down on operational costs. Automated processes such as data collection, credit assessment, and customer service reduce the need for a large workforce and physical infrastructure, allowing financial institutions to offer more competitive loan products. By going digital, banks can improve their profitability while serving more customers faster.

How Digital Lending Works

Digital lending is transforming how financial services are provided, shifting traditional in-person processes to seamless, tech-enabled systems. At its core, digital lending refers to the online process where customers can apply for, receive, and manage loans entirely through digital platforms. Here is the Digital Lending Process:

- 1. Loan Application: The process begins when a borrower submits an online application through a digital lending platform. These platforms can range from traditional banks’ online portals to mobile-first fintech apps. The digital interface ensures that applicants can provide all necessary documentation online, including proof of income, identification, and bank details, eliminating the need for physical paperwork.

- 2. Data Collection and Verification: After the application is submitted, the lender uses various digital tools to verify the information. This includes the use of APIs that connect to external databases, allowing for real-time verification of identity, employment, credit history, and other critical data points. Automation plays a significant role here, reducing manual errors and accelerating the approval process.

- 3. Credit Scoring: One key differentiator of digital lending is the use of alternative credit scoring methods. Traditional credit scores like FICO might be supplemented by additional data sources such as utility bill payments, social media activity, and spending behavior. These alternative methods help increase financial inclusion, allowing individuals with little or no credit history to qualify for loans.

- 4. Loan Approval and Terms: Once the data is verified and creditworthiness assessed, the lender decides whether to approve the loan. This step is automated for many digital lending platforms, using pre-set algorithms to evaluate risk based on the gathered data. If approved, the borrower is presented with loan terms such as the interest rate, repayment period, and any additional fees. The transparency of digital lending ensures that borrowers can review and compare multiple offers before accepting one.

- 5. Fund Disbursement: If the borrower accepts the terms, funds are disbursed directly into their bank account. Digital lending platforms can transfer these funds quickly—sometimes within minutes—making this process far more efficient than traditional lending, which may take days or even weeks. For businesses, such speed can be crucial in managing working capital.

- 6. Repayment Management: Repayment in digital lending is typically automated. Borrowers can set up direct debits from their accounts, ensuring that payments are made on time without manual intervention. Many platforms also offer apps or online dashboards where borrowers can track their payments, view outstanding balances, and even apply for loan restructuring if necessary.

Types of Digital Lenders

Digital lending is not the arena for only fintech companies or traditional financial providers. Taking advantage of the changing market structure, regulatory environment, and customer experiences, many types of players have found their way into this niche.

There are many venues to becoming digital lenders. But the most popular ones are either by offering a comprehensive package of digital lending products, by digitizing only some lending products, or by partnering with other companies.

- Online lenders: FSPs that position digital lending as their core product, which is provided mainly via either mobile apps or web apps.

- P2P Lenders: digital platforms that act as an intermediary facilitating the provision of loans and the relationships between lenders and borrowers.

- e-Commerce and Social Platforms: lending is not the core product of these platforms; they leverage the strong brand, rich customer data, and powerful platforms to offer certain types of credit products to their customer base.

- Marketplace platforms: The key roles of these platforms are to originate loans and match one borrower with other lenders, and charge the origination fees.

- Supply Chain Lender: they offer non-cash loans for certain kinds of asset financing, invoice financing, or pay-as-you-go asset purchase within a supply chain or distribution network.

- Mobile Money Lender: this is where the lenders partner with mobile network operators (MNOs) to provide loan products to the network providers’ customers, where mobile phone data is used to calculate credit scores.

- Tech-enabled Lender: traditional financial service providers, such as banks and financial institutions, that have digitized parts or the entirety of the lending process. The digitization is done either by an in-house team or a partnership with an external service provider.

The above list is for reference only. Digital lenders are experimenting with new ideas, enhancing their existing products, and evolving with new models. It’s hard to find one FSP that fits exactly into a category. As a result, they are making the digital lending landscape more diversified and complex.

How Digital Lending Solutions is Changing the BFSI Industry

The BFSI sector is undergoing a digital transformation, and digital lending plays a pivotal role. Traditional financial institutions are adopting digital lending platforms to stay competitive. Here’s how digital lending is reshaping the BFSI industry:

- 1. Automated Underwriting: By leveraging AI and data analytics, banks can automate the underwriting process, cutting down approval times.

- 2. Expanded Access: Traditional banks are now able to extend loans to previously underserved populations, including SMEs and low-income individuals.

- 3. Customer Experience: Digital platforms offer a seamless user experience, reducing friction and ensuring satisfaction for both retail and business clients.

- 4. Cost Efficiency: Digital lending cuts down on paperwork and manual processes, resulting in cost savings for banks, which they can pass on to customers in the form of lower interest rates.

- 5. Risk Management: Through predictive analytics, banks can better assess risks and avoid defaults.

The adoption of digital lending in the BFSI sector demonstrates how technology can enhance financial services and create more inclusive and accessible lending options.

Digital Lending vs. Traditional Lending: Key Differences

With Digital Lending, documentation is reduced

Traditionally, hard-copy paperwork is a must when customers enter a bank. For most people, it’s a big problem to prepare complicated documents such as detailed business plans with financial data, business summaries, and investment information for businesses or personal income tax returns, legal documents, or other personal information for individuals.

But thanks to digital lending platforms with the data given by customers, borrowers’ creditworthiness can be easily accessed. Many predictive models and algorithms are used by these platforms to derive useful insights on the borrower to assess their creditworthiness and their ability to repay the loan. Furthermore, these digital lending platforms, with the help of eKYC solution, can considerably reduce the reverse time for processing loan applications by making the verification process paperless.

With Digital Lending Solutions, the loan process is now within minutes

The amount of time spent on traditional lending methods could take forever because of the wait for checking hard-copy documents’ authenticity or getting approval from many different departments.

But thanks to Digital Lending, that complicated process is no longer needed and the entire flow of lending could be completed in next to no time. For instance, Buy Now Pay Later is now a payment method that can provide users with a really quick process of lending and disbursal. With just a national ID and almost 15 minutes of processing, people can buy a thing they want without worrying about the available cash that they currently have.

With Digital Lending Solutions, the location is not really a matter

Another disadvantage of traditional lending is the distance. Back then, commuting between bank and house for paperwork does actually cause trouble for some people. It’s even worse if the borrowers are living in remote areas.

But now thanks to Digital Lending, borrowers sometimes don’t need to step out of the home. With just a few taps on their mobile banking application or clicks on a computer with an internet connection, now everything could be done from everywhere.

With Digital Lending Solutions, the flexibility of time is a revolution

In the past, when it come to transferring money or lending a loan, the first thing to be done was to commute to the digital banking system, in many cases, “physical presence” must be made in the bank’s office within business hours established by the bank. In reality, the “banking hours” are also coincided with the working hours of several companies or businesses. Because of that, asking for “work permit” to go to the bank could be a real barrier for many people.

But thanks to Digital Lending with round-the-clock service, the flexibility of time is a big plus point. Instead of going to the bank during business hours, borrowers can apply for a loan any time of the day without any time constraints.

With Digital Lending Solutions, the comparison between vendors is easier than ever

Just imagine this, in the conventional lending method, how much time will it take to go from bank to bank to get all information? Having to visit various banks to compare deals seem like a cumbersome process.

But thanks to Digital Lending, customers can access various lenders and as a result, they can compare deals easily before finally settling for the loan they find the best-suited.

With Digital Lending Solutions, the facility of re-payment is re-defined

Just come to think of it, besides many things people have to remember in their daily life, now the loan has appeared and become a burden in their memory. So, how can they remember all of the information about their loan and the date when they need to repay it? And another pertinent point is, the disadvantage of traveling between home (or even workplace) and bank to reimburse the loan could also bring a lot of additional problems for the end-user.

But thanks to Digital Lending, all of the aforementioned problems could be solved in just a blink of an eye. A notification reminding how much is the loan and when will it need to be repaid or a few clicks to process the re-payment could facilitate and make the life of customers much easier than before.

With Digital Lending Solutions, information security is on a new level

The more personal information and data stored in the paper, the greater the threat of losing information could happen. And besides the security issue, the problem of retrieving or restoring information under hard-copy form loan could be seen as a drawback as well.

But thanks to Digital Lending, a loan online is completely secure as customers don’t need to share any personal information with anyone. Additionally, two factors authentication required before processing anything stands a paramount position in the duty of customer information and monetary security.

| Aspect | Digital Lending | Traditional Lending |

| Application Process | The entire application process is online, usually through websites or apps, eliminating the frauds related to human interactions. | The application process is done manually and requires borrowers to go to bank branches or financial institutions for in-person appointments. |

| Approval Time | Instant or within hours, thanks to automated systems of digital lending platforms. | Days to weeks due to the manual review process. |

| Accessibility | Available to underserved markets globally. | Limited to regions with physical branches. |

| Cost | Lower operational costs and fees. | Higher due to overhead and manual processes. |

| Credit Assessment | Banks and traditional financial institutions rely on traditional credit scores and history to determine their eligibility for lending, which often results in a slow process. | Digital lending platforms utilize AI to evaluate creditworthiness. This automated approach accelerates the lending process compared to conventional methods. |

| Customer Experience | A smooth and user-friendly experience with self-service features, tailored loan offers, and 24/7 customer support availability. | Involves face-to-face interactions with bank representatives or loan officers. |

| Risk Management | Provide quicker loan approvals with more flexible criteria. | Uses well-established risk assessment models and tends to be more cautious in its lending approach, making it harder for applicants to obtain loans. |

Top 5 famous digital lending platforms

Digital lending has given rise to numerous successful platforms that cater to varying lending needs. Here are five notable digital lending platforms:

- Kabbage: Offers working capital loans to small businesses, with a simple online application process and fast disbursement.

- LendingClub: One of the largest peer-to-peer lending platforms in the U.S., providing personal and business loans.

- SoFi: Offers a variety of loans, including student loan refinancing, mortgages, and personal loans with competitive rates.

- Avant: Provides personal loans to borrowers with fair to good credit scores, emphasizing speed and convenience.

- Prosper: Another popular peer-to-peer lending platform that matches borrowers with investors, offering flexible loan amounts and terms.

These platforms exemplify how digital lending has democratized access to capital for both businesses and individuals.

Top 6 Digital Lending Platforms for Vietnam’s Banks

Within the next five years, digital lending is expected to be valued at $1 billion in consumer lending alone. This growing trend can be attributed to the shift towards digital banking, the pressure of losing wallet share to fintech counterparts, and the lingering effects of the epidemic. As a result, the banking industry has been gradually adopting digital lending to adapt

One strategy for banks to “digitize” their lending process is by using pre-built platforms from a third party. This tactic offers the best of both worlds. On the one hand, banks can save time developing new products because most commercial are “plug-and-play”, meaning they are ready for use immediately after deployment. Second, having platform-based nature, they often come with a configurable architecture and integration capabilities, on top of which banks can build new lending products.

However, with so many applications in the market, choosing one can be hard. The following article will recommend the 5 most popular digital lending and the technology behind them for banks to consider.

1. Axe Credit Portal

Axe Credit Portal (ACP) is an end-to-end loan origination software powered by axefinance, a global market-leading software provider concentrated on credit automation for lenders.

As a highly flexible Artificial Intelligence (AI)-based credit process automation platform, it covers the entire credit lifecycle, including KYC and Onboarding, Credit Origination and Scoring, Approval & Automatic Decision, Limits and Collateral management, Collection, Post-disbursement, and Loan Services.

ACP is available as a locally hosted or cloud-based solution that simplifies the lending process and gives borrowers transparency, resulting in substantial time savings and boosted likelihood of successful loan approval. Moroever, this solution also offers a seamless omnichannel financing journey while maximizing operational efficiency and adjusting to ever-changing regulations.

By adopting ACP, banks can speed up loan application and processing by 66% and from that, gaining competitive advantages through enhanced customer service & response time.

Discover more about Axe Credit Portal

2. Lend.In

Lend.In is the flag-ship product of Kuliza, a leading banking solution provider from India.

Unlike many products on the market that only support one or a few types of loan, Lend.In is essentially an end-to-end platform integrating a variety of digital lending. This includes many of the most popular types of loans today, such as Commercial Loans, Consumer Loans, and SME Loans.

Lend.In especially stands out with its extensive automation capabilities. There is the Omnichannel Workflow Manager that allows banks to design and deploy new loan products in just a few hours without having to write any line of code. Moreover, the Integration Broker can automatically aggregate customer data from various channels to improve the accuracy of credit operations and predict portfolio equity.

Lend.In’s customers reported that it took them only 3 weeks on average to launch a new loan product. In addition, application processing and approval time has been reduced by 800%, thereby improving the efficiency of disbursement up to 7 times.

Banks wishing to experience how Lend.In works in action can turn to KMS Solutions, the only and official partner of Kuliza in Vietnam.

Learn more about Lend.In.

3. Temenos Infinity Loan Origination

Many banks in Vietnam may have been familiar with Temenos as this is the creator behind the T24 Core Banking system (now renamed Temenos Transact). Temenos may not be so prominent in the digital lending arena. But as a leading financial solution provider, their products are another candidate to consider.

Temenos currently offers only Temenos Infinity Loan Origination. Similar to Lend.In, Temenos’ loan origination system has large customization capabilities. For one, it allows banks to set up an automatic workflow for application approval based on inputs such as loan policy, tolerance, and many other parameters. The available workflows can also be configured or developed to work in accordance with different lending products.

Thanks to Temenos Infinity Loan Origination, bank will longer worry about authentication and data security as it supports electronic signatures on mobile applications, and the ability to encrypt documents each time they are delivered to customers. Management is also ensured because the software can monitor and record the loan process in real-time. In addition, employees can easily report their work thanks to the integration with Microsoft® SQL Server Reporting Services that allows the export of popular files such as Microsoft® Excel®, HTML, XML, PDF.

However, this lending solution will be more suitable for existing Temenos customers, due to the high compatibility available between their solutions that otherwise cannot work so well with products from other vendors.

Learn more about Temenos Infinity Loan Origination.

4. Finastra Digital Lending Solutions

Finastra is a leading financial technology provider from the UK, known for its cloud-based banking solutions. In Vietnam, Finastra is a partner of many major banks such as Shinhan, Vietcombank, and HSBC.

Particularly in the digital lending niche, Finastra is well known for its rich product portfolio, which is constantly updated with new lending solutions such as Loan Origination, Syndicated Loans, Mortgage Loans, Commercial Loan, …. Along with them are value-added systems such as Cash & Liquidity Management, or Collateral Asset Management.

In terms of users, Finastra’s digital lending solutions can all be provided via mobile platforms, helping banks to reach and engage users through multiple channels and multiple media. Cloud architecture and high integration with modern API protocols will also simplify banks’ legacy systems.

Learn more about Finastra Digital Lending Solutions.

5. FIS Commercial Lending

Developed by FIS – a Fortune 500 enterprise, FIS Commercial Lending is also built as a digital platform, where there is a series of modules that take on different functions such as loan origination, underwriting, servicing, monitoring, and reporting.

With FIS Commercial Lending, banks can choose to deploy on-premises if they are not ready to store data in the cloud.

FIS Commercial Lending can digitize lending both front- and back-office. In addition to the ability to automatically approve loan applications when predefined eligibility criteria are met, FIS Commercial Lending also provides an online portal on mobile applications, allowing customers to easily search and retrieve data. In terms of operations, the platform offers a workflow designer for banks to speed up the time it takes to process applications. Information management and data processing will be simpler than ever because all processes, products, and systems are tightly connected via a single platform.

However, the platform is currently limited to commercial lending only. When compared with the solutions mentioned above, FIS Commercial Lending may not be enough for banks to expand their portfolio of digital lending products.

Learn more about FIS Commercial Lending.

6. Mambu SME Lending

Mambu’s digital lending platform is designed primarily for the SME niche. Basically, this product is a loan management technology. Features such as web-based customer identification, credit checking, and loan origination are integrated and provided by partners of Mambu, also leading financial technology companies. Mambu’s loan product supports many different types of loans such as Short-Term Loans, Interest-Free Loans, Revolving Credit, etc.

Mambu’s SME Lending system supports almost every stage of lending from loan origination, disbursement, to debt collection. The solution also provides the ability to adjust lending conditions and policies for banks to support businesses that are facing financial difficulties. This flexibility helps banks better serve small and medium enterprise clients.

Tide, an online bank, chose Mambu to expand its lending products. Taking just 3 months to test and deploy, the service is currently being used by 250,000 enterprise customers.

Learn more about Mambu’s SME Lending.

7 Key Requirements any digital lending platform must have

1. Seamless Customer Experience

Customer satisfaction is the key factor driving banks to use digital lending platforms. Today’s customers now demand seamless digital lending services that replicate the experience they have with super apps and eCommerce sites. Now that digital challengers such as fintech startups have entered the digital lending space, your digital lending platform’s efficiency and responsiveness are the key predictors of success. Borrowers now care less and less about the source of loans.

This is critical since borrowers are now able to easily and rapidly search for many offers and are more inclined to accept the first one they receive. Therefore, the customer experience and success of your digital lending platform are defined by speed, range of loan products, and simplicity of use.

Question to ask your potential vendors:

- How long does it take, on average, for a client to finish the application process?

- Is it possible to set up the system to handle automatic approvals?

2. Product Breadth

It’s vital for a digital lending platform to be able to handle numerous loan lines (secured and unsecured) across multiple geographies. The lending platform should evolve in tandem with the lending offerings.

From Commercial Lending, Business Lending, and SME Lending, to Invoice Financing, and more, your digital lending platform should have the ability to handle all of your banks’ existing and future lending products.

Question to ask potential vendors:

- How simple and quick would it be to add new products to the platform after it is launched?

3. Platform Flexibility

The flexibility of your digital lending platform is equally important as its product diversity.

Another requirement is to choose a digital platform that has microservice and configurable architecture, which can adapt to your institution’s policies and preferences.

This not only reduces the time it takes to launch and avoids the hidden costs of custom development, but it also gives you the flexibility you need to thrive in today’s fast-paced world.

For example, banks that were successful in launching commercial lending products under difficult conditions were able to do so on the formal start date if they had the digital right lending platform in place.

This enables banks to adjust the platform more swiftly to changing regulatory needs by leveraging current bank data, risk tools, and pre-existing platform interfaces.

Banks who didn’t have these platform capabilities when commercial lending originally started were either caught off guard when program regulations changed during the first two rounds, or were forced to return to manual and resource-intensive paper application processing.

You shouldn’t skip: Three strategies for incumbent banks to jump aboard Digital Lending

Question to ask potential vendors:

- How are rule changes made? Can they be defined by the digital lending platform?

4. Risk

Some of the most important aspects of a digital lending platform are risk mitigation and risk management. In addition, being able to evaluate at the portfolio level is only part of the picture. Market/crisis risk, as demonstrated by the COVID-19 crisis, has posed an unprecedented challenge to banks’ risk management capacities, effectively paralyzing underwriting desks.

Risk management in today’s world demands a structured process to thorough monitoring throughout the whole portfolio, which can only be accomplished with digital capabilities, including constant access to client bank accounts.

It’s also vital to have customizable scorecards that allow for real-time customer profile assessment. Recent cash flow information paired with 3rd party data sources that ease the application and underwriting process must now be included in your scorecards.

Real-time client evaluations are an essential tool for assessing risk profiles at the client level as well as across the portfolio during unexpected changes in the business environment. As these unexpected changes occur, banks may immediately adapt risk policies and procedures in real-time to account for changing risk factors.

Question to ask potential vendors:

- Is the platform capable of processing client cash flow data and incorporating this knowledge into risk decisions?

5. Implementation Speed

There are a lot of components to a digital lending platform, each of which requires different configuration. It’s impossible to have a one-size-fits-all solution. You should seriously reconsider your vendor if it ever tries to pull out such an absurd idea.

How fast do you anticipate launching your digital lending platform in the market? This is one of the first expectations you should make with your digital lending platform provider in advance. Thanks to digital technology, speed-to-market has become a competitive advantage unlike any other. Even if it’s just for a beta or trial period, you should set this launch date goal upfront to ensure your vendor doesn’t have any misunderstandings about the importance of delivering on time.

Question to ask potential vendors:

- How long does it take on average for an implementation to take place?

6. Ongoing Support

A support plan is only as good as the people who operate it. Look for support that is operated by a team that has experience in the lending business. Commercial lending involves a high degree of complexity and domain expertise.

You should seek out a company that has experience in a variety of commercial and business lending areas. Your platform vendor must have extensive experience with data management, access, and management.

Question to ask potential vendors:

- What kind of after-sales service can you expect from the vendor?

- What value-added services will they offer during the platform’s lifespan?

7. Customer Privacy

You should require SOC 2 and ISO 27001 certification from your providers. SOC 2 is an auditing technique that assures your service provider securely maintains your data in order to preserve your organization’s interests as well as its clients’ privacy.

SOC 2 compliance is a minimum criterion for security-conscious financial organizations when looking for a SaaS provider. Aside from technological and infrastructural security, your supplier must be able to comprehend and enable KYC and AML processes in real-time.

This will guarantee that your financial institution is set up for success and that it can securely acquire new bank clients while adhering to internal compliance standards and minimizing risk.

Question to ask potential vendors:

- Do your digital lending platform have any security certifications, such as SOC 2 and ISO 27001.

How Digital Lending Promotes Financial Inclusion

Digital lending is a game-changer for financial inclusion, especially for underserved markets such as rural populations, low-income individuals, and SMEs. Here’s how it contributes to financial inclusion:

- Geographical Reach: Unlike traditional banks, digital lending platforms can reach remote areas where physical branches are absent.

- Alternative Credit Scoring: These platforms use alternative data like mobile phone usage and utility payments to assess creditworthiness, allowing individuals without formal credit histories to access loans.

- Lower Barriers to Entry: Digital lenders can offer smaller loans at competitive rates, catering to populations that would typically be ignored by traditional banks.

- Faster Approvals: The speed of digital lending means that underserved populations can access loans quickly, allowing them to seize business or personal opportunities without delay.

- Digital lending is paving the way for more equitable access to finance, especially in emerging markets where access to traditional financial services is limited.

Introduction of Innovative Digital Lending Business Models

Various digital lending business models have been created to satisfy customers and meet regulatory needs. More and more digital lending models are being introduced to tackle the challenges related to geography, higher transaction costs, and transparency.

Loan Market places

This type of digital lending platform allows users to compare loans available from different banks and non-bank institutions. The embedded algorithms in this platform can match the borrowers with suitable lenders. Some examples of Digital Lending marketplaces are Bank Bazaar, Paisa Bazaar, etc.

Online and Mobile lending platforms

This model is typically a digital lending product offered through mobile or web-based platforms. In such digital lending apps, the entire loan cycle is automated from customer acquisition to loan distribution.

Peer to Peer lending

Peer-to-peer lending, also known as P2P lending, is the model of digital lending that match individual lender or small lending business with potential borrowers. A P2P lending platform typically leverages customer profiles and data to do so. Based on digital platforms, P2P lending is usually cheaper than conventional financial institutions. Some popular P2P lending platforms are Faircent, i2ifunding etc.

Supply chain Financing

These are non-banking financial companies (NBFC) that lend money to wholesalers and marketplaces. Its purpose is to target a huge number of merchants who source their products there.

Line of Credit

As a type of revolving credit, the line of credit allows the borrowers to draw and repay from the available funds. MoneyTap is one example of a Line of Credit. Its average interest rate is often between 15% to 17%. The minimum maturity date of a line of credit is two months and goes up till 36 months.

SME lending

The Small Medium Enterprises loans are a type of digital lending product for small businesses. It helps small enterprises solve problems related to applying for loans during the course of their operation. These problems include new product launches, relocation, recruiting, marketing, etc. Farmart, Flexiloans are some of the examples of this form of digital lending business model.

Invoice financing

Invoice financing is a short term working capital facility for Micro, Small, and Medium Enterprises based on their unpaid customer invoices. It is used to meet the short-term liquidity needs of Micro, Small, and Medium Enterprises. It enables them to speed up their accounts receivables.

Alternate Credit Scoring

This digital lending business model involves a broad range of credit scoring mechanisms that uses algorithms to analyze diverse factors such as payment history, spending habits of a borrower, etc.

Future Trends of Digital Lending

The future of digital lending is shaped by several transformative trends that are gaining momentum. Key developments like artificial intelligence (AI), blockchain, automation, and cloud computing are revolutionizing the way lenders operate, enabling quicker, more accurate, and more efficient loan processes.

1. Artificial Intelligence (AI)

According to Binariks, AI is playing a pivotal role in enhancing lending operations. By 2035, AI is projected to boost profit potential across financial sectors by 38%. AI systems can dynamically assess borrower solvency, minimizing delinquency rates and automating manual tasks, such as credit scoring and customer service through AI-powered chatbots. This helps streamline loan approvals and reduce the workload on lending teams, which in turn leads to faster decision-making and better customer experiences.

2. Cloud Technology

Cloud-based platforms are integral to digital lending, with over 90% of banks now using cloud solutions to some extent. These platforms allow lenders to release new technologies quickly, offer a consistent loan application experience across devices, and manage data more efficiently. Cloud technology also enhances operational flexibility, allowing loan officers to work from anywhere while maintaining high levels of security and compliance.

3. Automation

Following the data provided by Binariks, Automation is expected to save banks up to $70 billion by 2025. It significantly reduces the need for manual input in repetitive tasks, such as pre-filling loan applications and automatically verifying borrower information like payroll and assets. This ensures faster loan processing and improved accuracy, which is especially beneficial for high-volume digital lending platforms.

4. Customer-Centric Innovations

Customers are increasingly expecting faster, more personalized services. Automation of loan decisions is becoming more common, especially for simpler loan products. As consumer demand for seamless digital experiences grows, financial institutions are focusing on improving their digital offerings, making it easier for customers to apply for loans online and receive instant decisions.

These trends indicate that digital lending will continue to evolve, driven by the need for faster, more secure, and user-friendly lending processes. Lenders that embrace these technologies will be better positioned to meet the growing demand for digital loans, while also improving their operational efficiency and customer satisfaction. This shift toward AI, cloud, and blockchain in lending is expected to define the future of financial services as more institutions move to fully automate and optimize their lending practices

How KMS Solutions Embrace Digital Lending with Ease

Digital lending is redefining how loans are accessed, managed, and repaid. With its advantages in speed, convenience, and inclusivity, it’s no surprise that digital lending is becoming a dominant force in the financial industry. From reshaping BFSI solutions to promoting financial inclusion, digital lending is here to stay.

At KMS Solutions, we provide an end-to-end digital lending platform with pre-built products such as Business Lending, Commercial Lending, SME Lending, Invoice Financing, and Lending Analytics. Having microservice architecture, all of these capabilities are easy to configure, so that you can embed them into your existing ecosystems with fast time-to-market while ensuring customer experience and security.