As banks and financial institutions seek to stay competitive, the development of digital banking solutions has become a strategic priority. But what does it truly take to build a robust and effective digital banking platform?

Today, we’ll explore the step-by-step guide as well as some key elements of digital banking platform development. After reading this article, you’ll have a detailed roadmap to stay innovative and lead in the digital banking space.

What Is Digital Banking Development?

Digital banking development refers to the process of creating and enhancing financial services that are delivered through digital channels, such as mobile applications, web applications, and other online platforms. It encompasses the fusion of cutting-edge technologies and novel solutions, all designed to elevate the whole user experience.

Nowadays, there are more customers turned to online channels for their financial needs. This change has sparked a rise in digital banking innovation, transforming the financial industry. However, it also poses challenges, such as the need to stay ahead of rapidly changing technology and the ever-present risk of cyberthreats.

Types of Digital Banks

Digital banking has evolved to offer a range of services that cater to different customer needs. From traditional online and mobile banking to more advanced methods like card payments and the United Payment Interface (UPI), the landscape of digital banking is diverse and continually innovating.

| Feature | Neobank | Challenger bank | New bank | Nonbank |

| Overview | Digital-only banks, often without physical branches. Focused on mobile and online banking services | Banks that challenge traditional banks, often offering innovative services and technologies | Recently established banks, which may have physical and digital presence | Financial institutions that provide financial services but are not licensed as banks |

| Target Audience | Tech-savvy individuals, millennials, and younger generations | Consumers looking for alternatives to traditional banks, often tech-savvy | General public, including those who prefer newer institutions | Consumers looking for specific financial products, like loans or payments |

| Personalization | High level of personalization through app-based services, tailored to individual needs | Moderate to high, often offering personalized financial products and services | Varies, but often includes personalized financial planning and services | Generally lower, but some nonbanks offer tailored financial products |

| Integration with Other Services | Strong integration with fintech apps, budgeting tools, and investment platforms | Strong integration, often with fintech and other innovative services | Moderate to strong, integrating with traditional and some fintech services | Typically lower, focusing on specific services rather than broad integrations |

| Security Features | High, with a focus on cybersecurity, encryption, and secure app-based transactions | High, often with advanced security protocols to compete with traditional banks | High, adhering to regulatory standards, but varies by institution | Varies widely, with some nonbanks offering robust security, while others may be less secure |

| Cost and Fees | Generally low fees, with many services offered for free or at a lower cost compared to traditional banks | Competitive fees, often lower than traditional banks, with innovative pricing models | Varies, may offer competitive pricing, but not always lower than traditional banks | Varies significantly, depending on the type of service; may include fees for specific services |

Step by Step On How to Develop A Digital Banking Platform

Building a digital banking platform is a complex and multi-faceted process. It involves several key stages to ensure that the final product is functional, secure, and user-friendly:

Step 1: Pre-Development

The pre-development stage is foundational and involves meticulous planning and strategy formulation. This step involves assessing market demands, outlining project aims, and crafting a detailed strategy.

Key activities include:

- Market Research: When conducting market research in the digital banking sector, it’s essential to analyze customer needs and market trends to identify gaps and opportunities. Several key trends are shaping the future of digital banking:

- AI-led Banking Platforms: Banking systems that use Gen AI to provide personalized services, enhance security, and streamline operations. GenAI can be implemented in complex processes such as credit scoring, risk assessment, fraud detection, and compliance management.

- Open Banking This technology allows third-party apps to access financial data through open APIs, giving users the ability to access a wide range of financial services via one single platform

- Embedded Finance: By integrating financial services into non-financial platforms, it allows banks to expand their services via digital ecosystems.

- Cybersecurity and Privacy: Measures to protect customer data and financial transactions from cyber threats and ensure privacy.

- Requirement Collection: Working with stakeholders to collect comprehensive needs.

- Project Planning: Developing a comprehensive banking product roadmap that outlines timelines for each sprint of the development process, resource allocation, and budget.

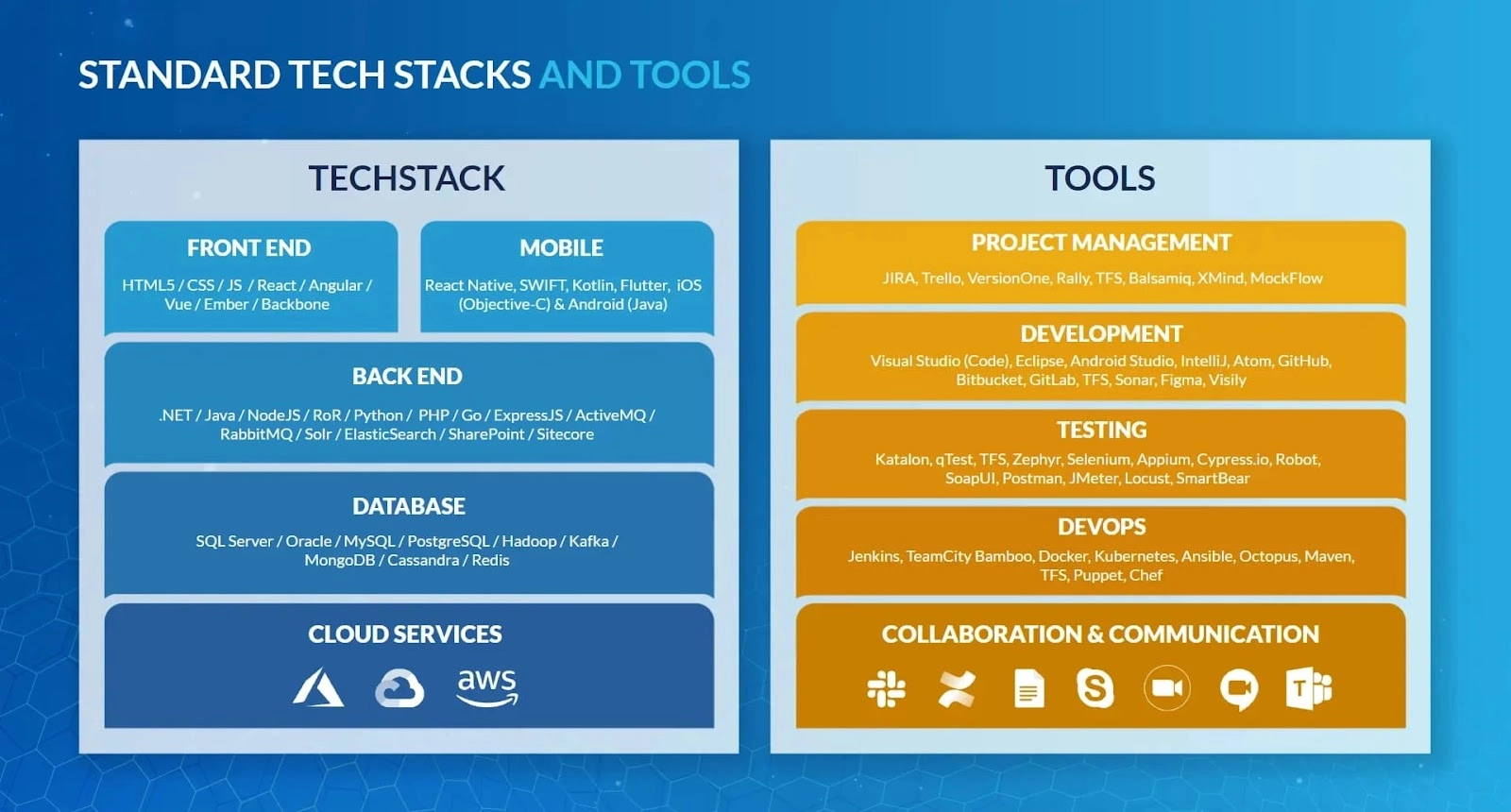

- Technology Selection: Choosing the right technology stack and tools that align with the platform’s needs and future scalability. When making this decision, several key criteria should be considered:

- Project Scope and Complexity: Assess the project’s size and intricacy to determine if a lightweight or robust technology stack is needed.

- Number of Professionals and Competence: Select technologies that align with the team’s expertise to maximize efficiency and effectiveness.

- Tools and Software Required: Decide between building in-house or purchasing tools, based on budget, time, and project needs.

- Relevant Documents and Specifications: Ensure the technology stack aligns with technical requirements, compliance standards, and long-term goals.

Step 2: Prototype Building

Once the groundwork is laid, it’s time to bring ideas to life with a prototype. It means developing an initial version of the digital banking platform to preview and test key features.

- Design and Wireframing: Start with creating wireframes—simple, black-and-white layouts that map out the basic structure of the platform. These should focus on user navigation and interface flow. Next, move to detailed design mockups, incorporating brand elements, colors, and interactive components. Tools like Sketch, Figma, or Adobe XD can be invaluable here.

- Design Testing: Gather a group of target users and let them interact with the prototype. This step helps you identify and address potential problems early.

Step 3: Platform Development & Testing

Now comes the heart of the development process: writing the code that will power your digital banking platform.

- Backend Development: The backend is the engine that drives your platform that develops server-side logic, databases, and APIs. Common backend frameworks include Node.js, Django, Ruby on Rails, and Spring Boot, which offer scalable and efficient solutions for building the core functionalities of your system.

- Frontend Development: This is the part of the system that users interact with and see. Develop a responsive and intuitive interface that works seamlessly across devices. You can use frameworks like React, Angular, or Vue.js to build dynamic, high-performance user interfaces.

- Databases: Databases are crucial for storing and managing data efficiently. Whether you choose a relational database like PostgreSQL and MySQL, or a NoSQL solution like MongoDB or Cassandra, the database should be selected based on the specific needs of your application, such as data structure, scalability, and consistency requirements.

- Cloud Integration: Integrating cloud services can enhance your platform’s scalability, reliability, and performance. Cloud providers like AWS, Google Cloud, and Microsoft Azure offer a range of services, including computing power, storage, and database management.

Next, thorough testing can ensure the reliability and security of your platform. Incorporate various types of testing, such as:

- Security Testing: To identify vulnerabilities and protect against threats.

- Performance Testing: To ensure the platform can handle expected user loads without compromising performance.

- Automation Testing: Automate manual test cases to streamline the testing process, improve accuracy, and reduce manual intervention.

Step 4: Platform Launching

With development complete, it’s time to launch your platform and make it available to users. This phase is dedicated to guaranteeing a smooth shift from the development phase to operational status.

- Post-Launch Monitoring: Once the platform is live, continuous monitoring is essential. Track performance metrics, user interactions, and system health. You can seek some tools like New Relic, Datadog, or Splunk.

- Continuous Improvement: Launching the platform isn’t the end—it’s the beginning of an ongoing journey. Obtain user feedback through questionnaires, evaluations, and personal discussions.

Benefits Of Digital Banking

As we navigate through an increasingly digital world, understanding these benefits is crucial for appreciating the impact and potential of digital banking:

Convenience and Accessibility

Digital banking offers unparalleled convenience by allowing customers to perform banking activities from anywhere, at any time. These actions can be done with only a few touches on a mobile device.

For businesses, this means meeting customers where they are—online. By providing 24/7 access to banking services, financial institutions can enhance customer satisfaction and loyalty. Moreover, digital platforms can reach underserved or remote areas, expanding the customer base.

Cost Efficiency

Digital banking significantly reduces operational costs for financial institutions. By automating processes and minimizing the need for physical branches and manual interventions, banks can save on overhead expenses such as staffing, utilities, and real estate.

Additionally, digital banking streamlines workflows and improves efficiency. Tasks that once required substantial manual effort, like processing transactions or managing accounts, can now be handled swiftly through automated systems.

Personalized Services

One of the standout benefits of digital banking is the ability to offer personalized services. Through data analytics and machine learning, banks can gain deep insights into customer behaviors and preferences. For example, digital platforms can recommend investment opportunities, provide customized financial advice, or alert customers to potential overdrafts.

These personalized services enhance the user experience by delivering relevant recommendations and timely alerts that help users make informed financial decisions and manage their finances effectively.

For banks, personalization increases customer engagement and satisfaction, creates opportunities for cross-selling products, improves risk management, and optimizes resource allocation.

Main Features and Challenges of Digital Banking Development

Developing a robust digital banking platform involves integrating several critical features, each with its own set of challenges. Below, we explore the main features of digital banking development and the associated challenges:

Payments

Digital banking platforms must support a wide range of payment functionalities, including peer-to-peer transfers, bill payments, international remittances, and merchant transactions.

Challenges:

- High Security: Protecting against fraud and unauthorized transactions requires cutting-edge encryption and constant monitoring. According to a report by Accenture, financial services firms face an average of 85 serious cyberattacks per year, with a 36% increase in successful breaches.

- Regulatory Hurdles: Navigating different regulatory standards across regions can be daunting, such as ensuring compliance with PCI DSS while meeting local regulations elsewhere.

- Legacy Systems: Many organizations are still reliant on outdated technology, which can complicate integration efforts. Legacy systems often lack compatibility with modern payment gateways, resulting in increased complexity and potential data inconsistencies.

- Lack of Technical Expertise: Insufficient expertise among the development team can lead to integration challenges, such as improper configuration, which may result in transaction errors, security vulnerabilities, or operational inefficiencies.

Digital Signup

- Ease and Protection: A complicated registration process might drive away potential users, while an overly simplistic one could jeopardize security.

- Data Protection: Safeguarding sensitive user information during signup is crucial to build trust and comply with privacy regulations. Data breaches can cost companies an average of $3.86 million.

Notifications

Real-time notifications keep users informed about their account activities, such as transaction alerts, balance updates, and security warnings.

Challenges:

- Timely Delivery: Delayed notifications can lead to missed alerts about suspicious activities.

- Relevance and Engagement: Avoiding notification fatigue by sending only relevant alerts to keep users engaged without overwhelming them.

Secure Authentication

Secure authentication ensures that only authorized individuals access the banking platform. This includes multi-factor authentication (MFA), biometric verification (like fingerprints or facial recognition), and regular password updates.

Challenges:

- Technological Compatibility: Integrating these technologies can be challenging, especially given the diversity of devices and operating systems used by customers.

- Continuous Security Updates: Keeping up with evolving security threats requires ongoing updates and improvements to verification processes.

Card Management

Card management allows users to handle their debit or credit cards through the digital banking platform.

Challenges:

Real-Time Processing: Users expect real-time changes, and delays can lead to security vulnerabilities or customer dissatisfaction.

Activity Monitoring

Activity monitoring tracks user transactions and account activities to detect suspicious behavior and prevent fraud. Advanced analytics and AI can identify patterns and anomalies in real-time.

Challenges:

- Sophisticated Data Analysis: Processing large volumes of transaction data in real-time requires advanced analytics capabilities. According to IBM, companies using data analytics can reduce fraud losses by 37%.

- False Positives: False positives can lead to legitimate transactions being flagged, which can frustrate customers and impact their trust.

Additional Features

Additional features can include budgeting tools, financial advice, investment options, and loyalty programs. For instance, a digital banking app might offer personalized financial advice based on your spending habits.

Challenges:

Staying Innovative: This requires a commitment to ongoing research and development to keep the platform relevant and competitive.

Digital Banking Trends for 2025

Closing the year 2021, the banking sector has managed to turn the pandemic into growth opportunities. Most domestic banks have achieved 20% pre-tax profit growth despite the unprecedented challenge brought by Covid-19 being at its peak. That’s good news, a clear sign that digital transformation can safeguard banks against the current uncertain and volatile landscape.

In this article, let’s examine some of the most prominent digital banking trends for 2022.

1. Focusing on Banking UX

Back then, banks look at UI/UX merely as a marketing aspect of their digital products rather than a core part that reinforces all features and experiences that users have with the bank. But recently, a market threat called fintech companies has changed all that. With their user-centric and simple-but-not-simplistic product design, fintech forces banks to rediscover the value of a cleverly designed interface and user experience.

Bad banking UI/UX is partly why today’s customers are disappointed with banks. A survey by GMS Software Technology points out that 73% of respondents feel that banks do not value their customers.

In 2022, all banks’ digital strategies need to be driven by UI/UX, guided by these dominant trends

- UI/UX embodies the bank’s promises. Banking UI/UX is beyond pleasing logos and color schemes. The best banking UI/UX design reflects the bank’s personality by communicating with users in a unique voice and tone. More importantly, it achieves that without compromising customers’ trust and security.

- Consistent experience across the ecosystem. Banks should be able to deliver the same brand experience across all channels, whether it’s in-branch, mobile apps, or ATMs. This is more about strategies and less about technologies, requiring additional investments into marketing efforts.

- Human-centric banking experience. Banking UI/UX is not just about fast transaction processing. Today, it must be about delivering meaningful engagement that’s relevant to users’ life and preferences. This can be achieved through a design method called Design Thinking, coupled with advanced analytics technologies.

2. Embedded Finance will be everywhere.

Embedded finance allows banks to embed products directly into other non-financial platforms to promote and provide their digital services such as P2P Payment, Buy Now Pay Later, Digital Lending, or Financial management.

A report by Lightyear Capital predicted that the embedded finance market will contribute $230 billion of revenue by 2025, which is a tenfold growth compared to 2020 ($22.5 billion).

Potential partnerships for embedded finance could be the e-commerce sites, ride-hailing apps, streaming services, or e-wallets that modern consumers cannot live without. Behind embedded finance are a Banking-as-a-Service (BaaS) and Open Banking infrastructure. Thanks to embedded finance, banks can now promote their products on these popular platforms and explore new revenue streams at a meager cost.

According to Galileo’s findings, consumers have become more receptive to financial services offered by non-financial companies.

In 2022, the boundaries between pure banking services and non–banking ones will keep blurring. Already, non-financial players such as Grab or Shopee have entered into partnerships with fintech companies to embrace embedded finance. Banks cannot afford to ignore this trend. Embedded finance can be an opportunity for banks to be involved in customers’ every aspect of life.

3. Open Banking will continue to expand.

More and more banks are opening their data, allowing third-party companies to access customers’ transactions and financial data – with customers’ permission. Across the BFSI landscape, we can see more APIs are being built, and partnerships signed to enrich banks’ ecosystems.

Open banking has been the foundation of most banking innovations today. In 2022, more digital banking trends will come from open banking. Even Forrester agrees. In Forrester’s latest blog, the enterprise predicts that next year will witness more banks taking an open, collaborative approach to their platforms. By integrating data from third-party partners, open banking helps banks deliver more value to their customers while achieving a holistic view of customers’ finances.

4. Physical channels are still important.

The ongoing pandemics with branch closings and consolidations lead many banking executives to think that physical channels no longer work. Still, in the competition against digital-only financial institutions, brick-and-mortar can help banks stand out.

Because, in fact, people still want physical channels. In a survey by Deloitte, 64% of Baby Boomers, 54% of Gen Xers, 48% of millennials, and 58% of Gen Z said they would choose to visit physical branches when opening accounts. Also, according to a report by Financial Brand, up to 80% of customers say they visited bank branches in the last year, and 35% do that at least monthly.

The most substantial reason is trust. People feel closer to physical branches since they have existed since the very first day of bank. It’s a place where people can come down to take out real cash and talk to real people. While digital-only banking services save time and money, people are not ready to trust those emotionless algorithms fully. And when problems happen, they want to complain face-to-face to humans, not a chatbot.

In addition, the bank branch still is a space for maintaining brand identity. Having an eye-catching branch or headquarter on a busy road or shopping district will differentiate your banks from the digital-only counterparts that exist only online.

5. Customer verification will move away from SMS

Thanks to the convenient contactless mobile technologies, customers can perform transactions online without having to be physically present at banks’ branches.

The problem is how banks can authenticate the identity of these “digital customers”.

Conventionally, banks use OTP via SMS to ensure customers are who they claim to be. But it has been proven times and again that this method is not secure at all. SMS has numerous technical vulnerabilities, which fraudsters can easily exploit and hijack customers’ confidential information through their clever schemes using social engineering, phishing, … Even Microsoft concurs that SMS is the worst regarding digital security.

In addition, SMS is prohibitively costly. It is reported that 11,000 billion VND is what the 4 state-owned banks have to spend every year on sending SMS.

The future of digital banking will need integrated and more secure customer verification technologies. And eKYC (electronic Know-your-Customer) is one of them. Today’s eKYC solutions are integrated with digital signatures, liveness detection, biometric authentication, face matching, fraud prevention, and OCR (Optical Character Recognition). These features make sure that banks can accurately verify customers and provide a seamless digital experience while not compromising security.

6. Digital Banking drives Financial Inclusion.

In 2017, up to 1.7 billion adults were unbanked, according to World Bank. Digital banking tools such as mobile apps and web portals allowed people without access to branches or ATMs to enjoy formal financial services, such as securities, payments, credit, savings, and insurance.

Also, according to a recent study cited by the U.N. Environment Programme, enhancing financial products’ affordability, availability, and accessibility can increase 14% GDP in developing countries and 30% in developed ones.

Next year in 2022, digital banking will continue to be the strongest force for financial inclusion worldwide. People in many lower-income areas have started to use mobile phones to send, receive, and manage money. During economic crises, digital banking tools can help people stay resilient.

7. Integrating financial wellness into digital products

Aside from the big corporations and VIP clients, banks also have middle- and low-income customers. They can struggle to pay bills and save money. Part of the reason is that nobody gives them financial advice. According to the Result of Vietnam Household Living standards, monthly income in urban and rural areas are respectively 5.7 million VND and 3.9 million VND.

Financial wellness and financial education are not just a matter of customer experience. It’s an essential part of the larger economy and society. More than any industry, banks are responsible for providing financial wellness support to customers. Successful wellness programs can only make banks appear more trustworthy and accountable in the public’s eyes. Fortunately, this has become easier than ever with digital tools.

Socially responsible banks are doing this by integrating financial wellness features into their mobile apps, where customers can set and progress to their individual financial goals. An example is from a foreign bank – Bank of America’s Life Plan. By October 2021, one year after the program was launched, Life Plan has attracted more than 5 million users. Moreover, Bank of America now has 1 million appointments from those customers. This shows how digital tools with financial wellness can help banks improve digital and personal interactions.

8. ESG Banking Products will be more popular

Banks are under increasing pressure from consumers and environments to responsibly follow environmental, social, and governance (ESG) principles. In addition, banks are also demanded to design eco-friendly products and services – the so-called green banking – to fight climate change.

One popular trend in green banking is carbon footprint tracking. Many eco-conscious banks are launching carbon tracking features into their mobile app. It displays and gives customer reports on their purchases’ carbon impact.

Today’s generations care more about the environment. A Carbon Trust survey revealed that 67% of consumers support carbon tracking, and 64% perceive brands more positively when they can prove that they are reducing their products’ carbon footprints.

In 2022, digital banking features that help customers make better-informed choices about how their spending affects their carbon footprints will become more prevalent. When banks enable consumers to see the climate impact of their everyday spending, they can be empowered to make greener choices.

How KMS Solutions' Digital Banking Development Solve the Problems?

Comprehensive digital banking development services are indispensable to address the critical challenges of security, compliance, innovation, and technology adoption:

- Security and Compliance: KMS Solutions employs advanced security measures, including encryption, multi-factor authentication, and real-time monitoring, to safeguard customer data and prevent unauthorized access. In addition, KMS Solutions complies with various regulations and standards, including ISO/IEC 27001:2013 certification for information security management systems (ISMS) and the Payment Card Industry Data Security Standard (PCI DSS). Additionally, our Certified Banking Domain Professional (CBDP) credentials enable us to deliver trusted digital banking systems.

- New Technologies: Adopting new technologies is crucial for modern digital banking, yet it can be challenging due to legacy systems and integration complexities. KMS Solutions offers expertise in integrating cutting-edge technologies such as AI/ ML, cloud computing, open banking API, etc. into existing banking systems.

- Risk Management: Managing risk is a fundamental aspect of digital banking. KMS Solutions uses predictive analytics to identify potential threats and mitigate risks before they escalate.

KMS: Digital Banking App Development

The banking sector is undergoing a remarkable transformation. To stay ahead in this competitive market, it’s advised to have a reliable partner guiding you along the way.

KMS Solutions stands at the forefront of this digital revolution, offering comprehensive mobile banking app development services that cater to the dynamic needs of modern consumers and banks alike. Our expertise lies in developing robust, secure, and scalable banking platforms that enable seamless transactions, real-time account management, and personalized financial services.