Constantly evolving digital context, cutting-edge competition, and ever-changing customer expectations are challenges that almost every industry is facing, comprising banking and financial institutions. In response to those obstacles, digital transformation is necessary. According to the Market&Market report, the size of the worldwide Digital Banking Platforms Market is anticipated to reach USD 13.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.3% during the predicted period. Moreover, the significant traction in the digital banking platforms market is the result of the rising need among banks to provide an enhanced customer experience.

Client experience is an essential aspect of every bank’s approach to fulfilling customer demands. By analyzing customers’ perspectives, banks can understand their expectations and have an appropriate strategy to keep on top of customers’ preferences. Let’s discover our best tips for banks to improve customers’ online banking experience and increase their loyalty.

What is Customer Experience in Digital Banking?

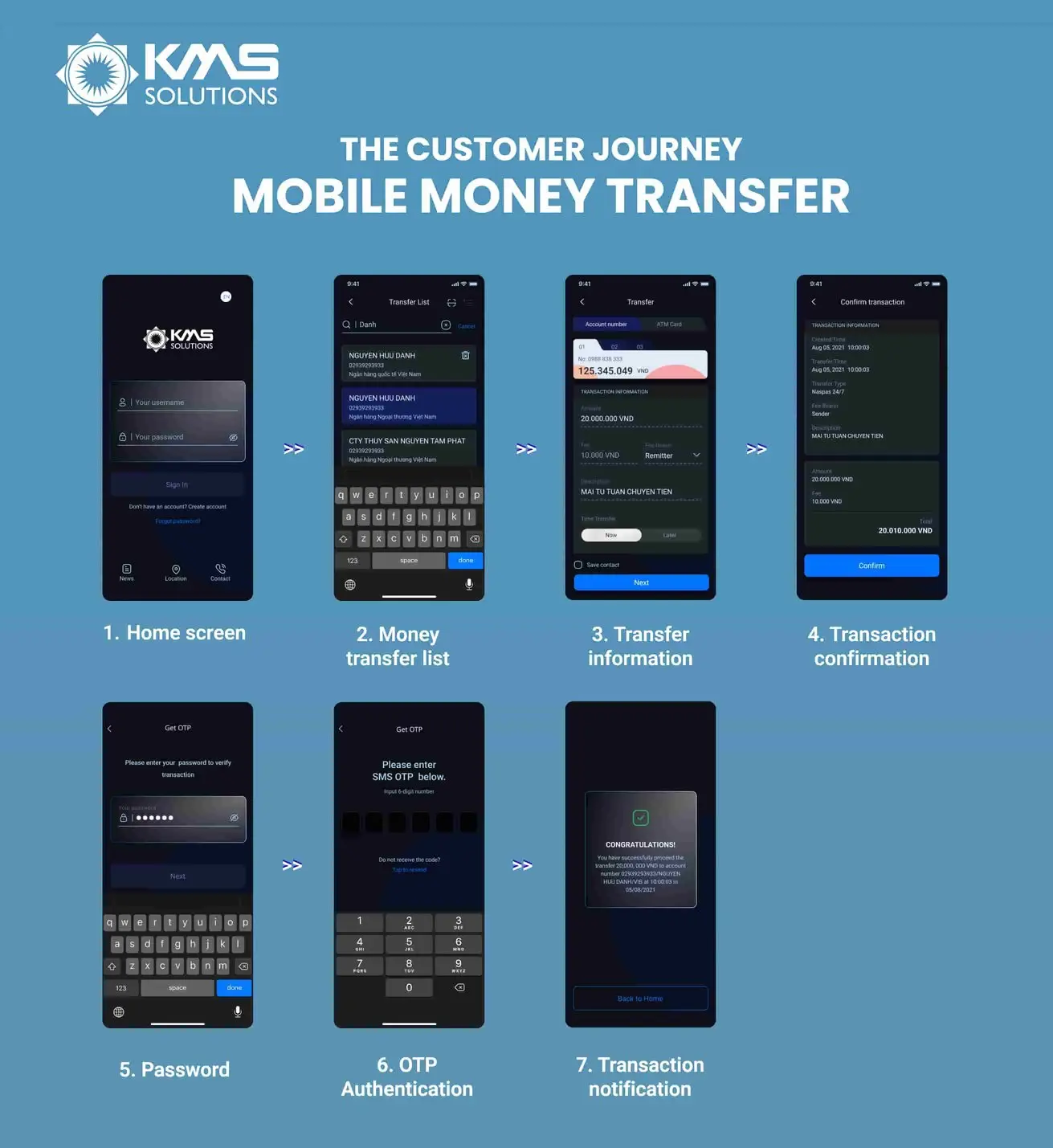

Customer experience (CX) in digital banking includes all the efforts that banks and financial institutions put into their products to increase customer satisfaction. It’s also the cumulation of all the interactions that customers have along their entire usage journey, such as: login, transferring money, confirming transactions, and receiving notifications.

The customer journey for transferring money via Mobile Banking App

Considering the correlated relationship between digital customer experience and bank revenue, the research of Markets&Markets also shows that: “digital banking enables personalization at scale can grow revenue by 5 to 15% for businesses in the financial services sectors.”

What are Customer Expectations from Digital Banking Experience?

Recently, CX has reached a particular level of critical significance since various businesses are adopting a customer-centric approach to retain users. In fact, customers expect that banks can concentrate more on creating an experience culture that is personalized, tailored to their specific requirements, and trustworthy.

The main customer expectations when it comes to digitized banking experience are:

- Simple account opening process: as the traditional onboarding process often requires multiple paper forms and in-person checks, customers expect an optimized way to go through those steps remotely. For the banking and finance industry, digitalizing the way customers onboard is a game-changer as it minimizes time and effort spent on the initial session.

- Effortless accessibility: according to Google’s report, 60% of smartphone users prefer checking their financial activities through mobile apps. Thus, banks and financial institutions need to develop easy-to-use digital platforms that can be simply accessed across multiple devices, especially via mobile phones. Usually, users look for a broad range of banking features, seamless experiences, and convenient monitoring of all financial transactions.

- Tailor-made services: users are always behind personalized services and relevance. They are more likely to engage with the products that match their needs, such as credit, investment, savings, and more. You can identify customers’ major requirements and provide personalized support to help shape their banking experience.

- Data security: undeniable, the BFSI sector is sensitive to security. When sharing personal information and data, banking users usually want to keep it confidential. Hence, it’s vital for you to build trust to withstand a healthy relationship with them.

Emerging Ways to Enhance the Digital Banking Experience

Considering the fact that half of the global population is using online banking nowadays, banks need to put considerable effort into improving their digital platforms to retain current users and attract new ones. Although customer experience is the key to scaling the revenue growth of financial service providers, improving it isn’t an easy task, especially when customers are getting more conscious of top-notch digital banking services. So, what can be done when digital banking CX obstacles are escalating every day?

Let’s discover our hand-picked trends to implement digital customer experience in banking:

1. Enable the online onboarding process

The onboarding process for new customers often starts with the application for a new account/ service and continues until the consumer is highly engaged in this relationship. For some institutions that have digitized their application processes, they can reduce redundant tasks and provide customers with smoother and faster experiences compared to those who haven’t.

By applying cutting-edge technology such as eKYC (electronic Know Your Customer), banks are able to become agile and provide customers with an instantaneous and seamless onboarding experience. As customers’ expectations are ease of completion, authentication, and digital documentation capabilities that can simplify the account opening step, eKYC will help with:

- Self-service onboarding: users can complete the entire process at home and at any time since the system is operated 24/7, 365 days, and automatically.

- Offers: product offerings are personalized to specific customer needs.

- Channels: customers can access all banking services via a mobile app.

However, due to the limited credit amounts through the eKYC process, customers who wish to increase their line of credit still need to come to the representative offices.

Learn how to apply this solution: eKYC Process: Onboard your customers in 10 steps

2. Prioritize a seamless omnichannel experience

Customers now seek to interact with businesses through several platforms such as websites, mobile apps, call centers, bank branches, or any other channels. The banking industry is required to move beyond finding the optimal channel mix to determine what is suitable for each individual customer.

Providing omnichannel banking customer experience involves having the same set of services accessible across all channels, both online and offline. The true omnichannel banking platform also enables real-time data synchronization across multi-channels. For instance, customers may begin the onboarding process through one channel and complete it via another without having to provide the same information repeatedly.

3. Emphasize the product design

In recent years, banks and financial institutions have incorporated a variety of features into their mobile applications. To avoid confusing their consumers, you must concentrate on the design of their platforms to ensure that they are user-friendly and feature-rich.

The recent finding of Money Summit shows that 34% of customers have switched financial service providers due to their frustrating experiences related to the app interface. As cluttered product design may be partly attributable to the poor experience of the app users, banks can resolve issues by following these best practices for designing banking apps:

- Make application registration simple: reduce the number of unnecessary or duplicated steps and create a straightforward design that releases stress for users while registering.

- Design clear transaction history: checking balance is one of the preferable activities of banking customers when using mobile apps. So, it’s vital to make this section clear and easy to understand.

- Build on customers’ familiarity with smart devices: based on the operating systems (iOS or Android) that the app is designed for, you can build banking apps with patterns familiar to users.

Moreover, banks also need to keep up with the latest product design trends to attract more new customers. Check out our innovative ideas for your banking app design here!

4. Utilize big data and analytics

Improving the retail banking experience requires you to understand customers’ needs and expectations thoroughly. This consists of taking a 360-degree perspective of your banking users such as their habits, incomes, and expenses, and leveraging the available data.

Big data analytics is essential for enhancing the financial services experience and making important business choices. The escalating fluctuations in user requirements bring in the vitality of using big data analytics to get an in-depth understanding of these alterations. Based on these insights, banks can update their digital banking services to meet customers’ unmet needs and give out various tailor-made promotions. Moreover, the implementation of big data analytics can assist financial service providers in analyzing users’ conversion rate (CR) to have appropriate marketing campaigns respectively. The result is a three-stage personalization strategy backed by advanced data & analytics:

- Stage 1 – Personalize intelligence: utilize advanced data & analytics on transactions, customers, and other data types in order to get a comprehensive insight into consumers’ needs.

- Stage 2 – Personalize services: supply services and content that are hyper-relevant.

- Stage 3 – Personalize interactions: create an intuitive interface and engaging CX across all touchpoints.

5. Automate digital customer support

To serve the digital customer more effectively, banks will need to move beyond traditional customer support to chatbots, customer relationship management (CRM) and automation workflows. As customer inquiries can be countless and repetitive, solving case-by-case manually can unnecessarily consume time and resources. Automating the customer support process with pre-built scenarios can help you manage numerous users’ issues in real-time while reducing headcount and manual customer support dependency. Meanwhile, the customer services department can concentrate on solving important cases, leading to more streamlined processes.

Secure chatbots are expected to become a core component of many digital banking propositions, especially when FAQs are getting less convenient. AI chatbots can use your existing database, such as common inquiries from customers, their most-used services, etc. to prepare some relevant answers and suggest them to users proactively.

Access to the full report: How Changes in Asia Pacific’s Customer Behaviour Accelerate Digital Banking?

How to Improve Your Bank Customer Service with KMS Solutions?

In response to customers’ increasingly high expectations, banks and financial institutions need to invest heavily in the development of customer-centric mobile banking apps. The importance of the digital banking experience can be related to its several advantages, such as lower operational costs, customer retention, and staying ahead of competitors by using the latest technologies.

Ready to deliver a better customer experience in digital banking? Our Digital Technology Consulting Services are here to help! We’ve over 12 years of experience in developing digital apps and platforms for the BFSI sector and have collaborated with many leading banks in digital transformation.

If you’re still doubting, let’s see how KMS Solutions map the customer journey to help ACB embrace mobile banking to embrace the new gen of customers!

If not, don’t hesitate to click the button below and let our teams contact you instantly!