One of the most critical steps in creating a successful financial services application is selecting the right technology stack.

Why? Building software extends beyond the creation of an intuitive UI/UX; it encompasses designing a stable, secure, and maintainable product that not only attracts customers but also facilitates business scalability. This is where the right technology may help.

When collaborating with various banks and financial institutions, we recognise that some of our clients often have difficulty in choosing the suitable tech stack for developing banking apps. Hence, in this article, we’ll discuss how to choose the right tools for success and explore the most effective tech stack.

Key Considerations When Choosing Tech Stack for Banking App

A technology stack is a set of tools, including programming languages, frameworks, libraries, etc. that are particularly used to create a software product.

However, it’s worth noting that there is no one-size-fits-all kit. Distinct projects will require different tech stacks based on the specific needs of the project. Therefore, before delving into the specifics of technology, it’s essential to understand the criteria behind selecting a tech stack for a banking app development project.

1. Project Complexity

It goes without saying that the more features you wish to include in your banking app, the more technology will be needed for this. Furthermore, if you plan to integrate third-party APIs, the complexity of the software increases significantly, making it impractical to manage effectively with only a limited set of technologies.

When it comes to software development, a simple one only requires necessary UI solutions and must-have features for banking apps. Otherwise, an average level demands a more complicated tech stack with various layers and a combination of programming languages as these apps encompass innovative features, more synchronisation, more complex screens, custom UI, and API integrations. As your banking app development project scale, it requires a versatile and well-suited tech stack.

2. Time to Market

The speed of a financial services app development not only influences the time to market but also the development cost. It’s evident that as the duration of the process extends, the associated costs also increase. If you have tight deadlines, consider using technologies that provide ready-made solutions and simplify the development process, minimising time spent on building functionality from scratch.

For instance, Python and Django can be combined to produce quick code and solve basic tasks. By using this programming language and framework, you can take advantage of code reuse and simple maintenance. In contrast, if the speed of software development is not an essential constraint, you should consider implementing a more complicated yet flexible tech stack such as Java and Spring framework.

3. Security

In the realm of banking app development, security emerges as a paramount concern. One of the effective ways to protect the system is by leveraging secure frameworks and libraries. The chosen tech stack must not be vulnerable to cyber fraud and threats. Moreover, it’s vital to ensure the chosen technologies comply with industry standards (e.g. PCI DSS, CBDP, etc.) to provide a trusted and scalable digital banking system.

Additionally, the incorporation of cutting-edge technologies like AI and blockchain can offer a substantial edge, providing a high level of security in data storage and the execution of transactions.

4. Product Architecture

During the phase of constructing an app’s architecture, a team of developers determines how components in the product will interact with others.

Many financial institutions choose to develop their banking software on a microservices architecture due to the scalability opportunities and allowance for third-party integrations. Therefore, if you want to maintain a microservices architecture, you look for a highly scalable programming language such as Ruby to handle large numbers of concurrent users.

See more: Cost to Develop a Banking App

Popular Technology Stack for Digital Banking

After understanding the key components and factors to consider when building a tech stack for banking apps, it’s time to move to the stage of exploring the most popular technologies used in Fintech. Since security and performance play a necessary role in the development of banking apps, technologies for banking and payment solutions need to tackle these two notable challenges effectively. Here’s some common technology stack for the idea of banking app development:

1. Front-end Technologies

The front end of an app, or client-side, is the component where end users have direct engagement, making it essential to choose the appropriate technologies for a smooth and intuitive user experience. Typically, front-end developers often utilise a combination of HTML, CSS, and JavaScript for web app development.

- HTML aids in structuring page elements like paragraphs and headings

- CSS is used to visualise a document crafted through HTML

- JavaScript empowers the incorporation of dynamic features such as animations and interactive forms into the user interface.

To accelerate the development process, frameworks are taken into place. Among the most popular frameworks for web app development are Angular, React, and Vue.js, allowing for the creation of responsive and dynamic user interfaces

Read more: Forefront Technologies to Elevate your Mobile Banking App

2. Back-end Technologies

The back end, also known as the server side of your app, handles the operational logic, data storage, and processing. Within the fintech sphere, Python, Java, and Kotlin stand out as some of the widely used technologies for back-end development.

- Python

Python ranks among the top choices of programming languages within the fintech sector. It is actively utilised by asset management businesses, banks, and fintech startups. In fact, Python can handle several banking obstacles, such as data efficiency, compliance, and predictive analytics. Furthermore, this programming language provides a plethora of Fintech-focused libraries meant to help businesses accomplish various business objectives more easily and quickly.

Benefits | Drawbacks |

– Python is a straightforward and adaptable programming language. – It decreases the costs of software development and time to market. – Sustains a multitude of libraries tailored for fintech purposes. – Provides high productivity of apps. | – It’s inadequate for mobile computing. – It has some design constraints. – Python uses a lot of RAM. |

- Java

For more than 25 years, Java has been utilised by some of the biggest banks worldwide. and despite the emergence of new technologies, it continues to be an essential programming language. It emerges as the favoured technology owing to a high level of security and efficient processing of substantial volumes of data.

Java’s flexibility makes it an attractive option for a broad range of financial projects, from commercial software to Android apps, big data apps, or IoT devices.

Benefits | Drawbacks |

– Java is platform-independent. – It ensures high security. – Java comes with cost-effective maintenance. – Java apps are stable and robust. – It enhances system performance and efficiency. | – Java consumes a significant amount of memory. – Java code is usually verbose and complex. – It may not offer a native desktop appearance but is well-suited for mobile apps. |

- Kotlin

While the verbosity of Java code causes considerable argument among software engineers, Kotlin has gradually become the main alternative to this programming language. Kotlin emerges as a more modern and streamlined technology that includes the best Java features and addresses its primary drawbacks. This programming language is widely utilised to develop both web and mobile apps for Android.

Benefits | Drawbacks |

– Kotlin offers cleaner code. – It contains more features than Java. – It is one of the highly secure programming languages. | – As the language is particularly new, it lacks ready-made solutions and Kotlin professionals. |

Besides, C++ and C# have extensive implementations in analytical solutions and in scenarios demanding quick and effective analysis. Ruby emerges as a scalable and robust language that is widely used in the BFSI sector. Some prominent applications of Ruby include digital payment systems, analytical platforms, and digital wallets.

3. Mobile Development

For digital banking app development, some technology can be considered including SWIFT, Kotlin, Xamarin, and Mobile Angular UI. Each tool possesses its unique advantages and constraints that can be used to develop different types of apps. For instance, when aiming to build cross-platform apps, software engineers usually use React Native, Flutter, or Ionic.

- Flutter

Flutter, a versatile open-source framework developed by Google, is increasingly chosen for banking app development due to its unique advantages and capabilities. This programming language enables developers to build apps that work seamlessly across platform frameworks like React Native or Xamarin.

In the context of banking apps, Futter’s use of the Skia graphics engine ensures high-performance rendering of UI elements, resulting in smooth animations and fast response times.

Benefits | Drawbacks |

– Flutter is a ready-made widget for quicker UI coding. – It has great development support. – It enables Android and iOS app development using a single codebase. | – The developer community of Flutter is still small. |

Native apps use the official software development kits (SDKs) and integrate with a set of distinct native frameworks and libraries for the specific platform development (iOS or Android).

- For an Android banking app development, you can consider choosing Java -a programming language that has been utilised by many banks globally for more than 25 years – as well as the Android UI or Jetpack Compose frameworks to generate an intuitive UI.

- To develop an iOS app, some possible choices include the main development environment – Xcode, Objective-C, iOS SDK, and UIKit.

4. Database

In the realm of financial services, where data accuracy and reliability are paramount, the choice of database technology is of utmost importance. As your user base grows, the database should seamlessly scale to accommodate grown data and user activity. The database technology should provide horizontal scalability to handle higher loads without compromising performance.

In addition, since eKYC (electronic Know-Your-Customer) feature has emerged recently, banking apps require fast and efficient data processing. Therefore, databases for fintech projects must be reliable. Here’re popular database options for banking app development:

Database | Benefits | Drawbacks |

PostgreSQL | – Has strong analytical capabilities. – Quick processing of massive volumes of data. – Well-supported programming language. | – Comparatively low reading speed. .- Slow performance. |

MySQL | – High performance – Supports cross-platform database – Highly secure because it has complicated encryption algorithms | – It’s difficult to scale – Cannot handle large-sized data effectively, resulting in decreased performance. |

MongoDB | – Highly scalable – Offers quick query response – Flexible | – Memory-consuming – Transactions using MongoDB are complicated |

Oracle | – High performance and portability capacities. – Supports a wide range of databases. – Offers great security features. | – High price – Requires extensive knowledge to use. |

Summary

Building a cutting-edge tech stack for seamless digital banking apps requires careful consideration of various key components. If you are choosing a technology stack for the development of a digital banking app or other fintech product, it’s advisable to seek guidance from technical experts to make an informed decision.

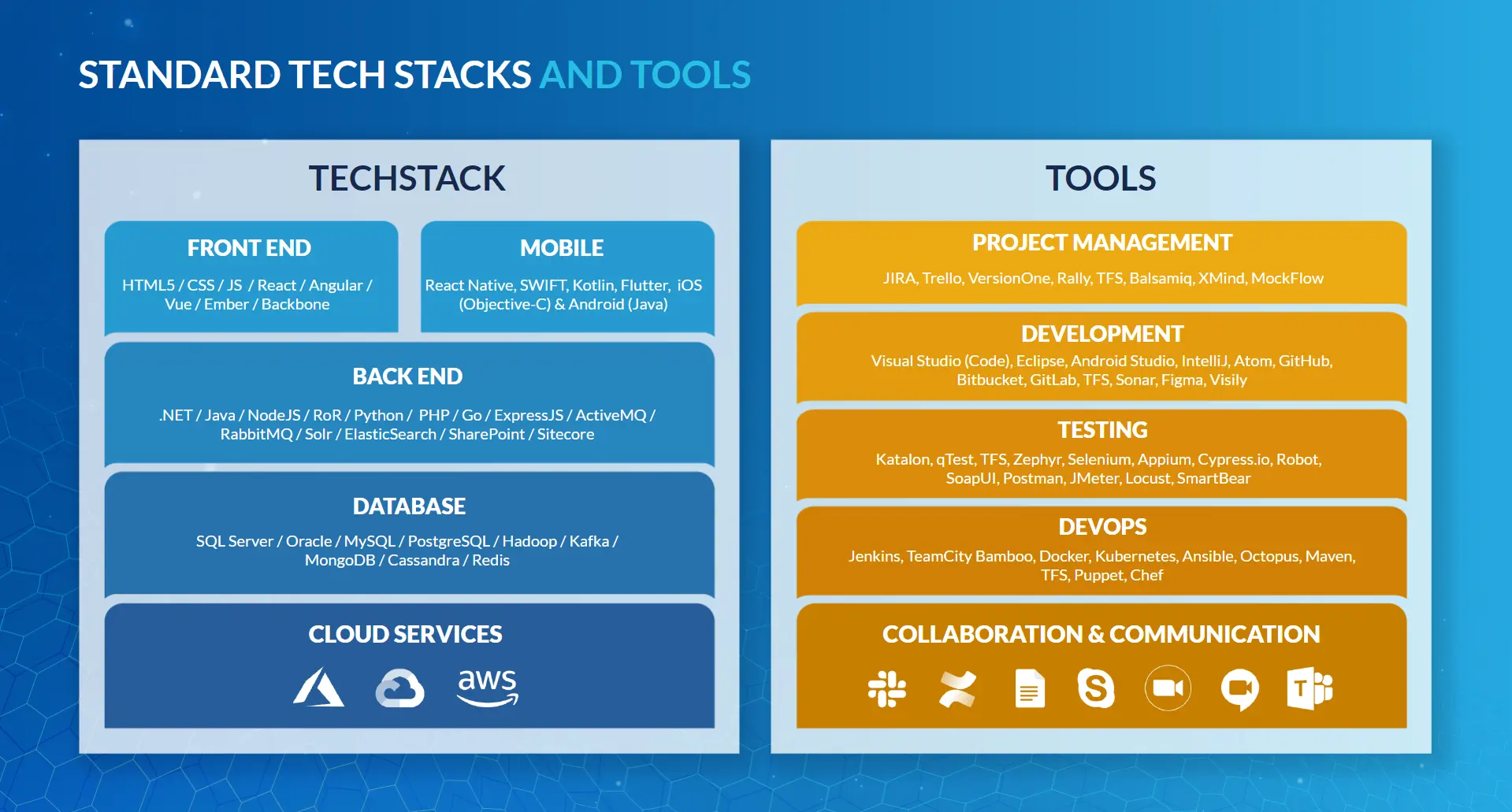

In this pursuit, KMS Solutions emerges as a valuable partner. With a team of proficient professionals dedicated to specializing in the creation of financial services software, our track record spanning four years is a testament to our expertise. We’ve experts who carefully review business requirements and are proficient in more than 50 technologies. Discover our projects to understand more about how we can help BFSI businesses successfully embrace digital transformation.

Feel free to contact us to discuss the technical details of your project. We’ll be happy to help you choose the best tech stack for a digital banking app.