Mobile application development has rapidly become a cornerstone of innovation in the banking industry. For banks looking to break into this space with their own offerings for clients and users, developing robust, secure, and user-friendly banking applications is necessary to stay competitive.

As experts in mobile banking app development, our team has compiled some insights on the best development frameworks for building banking apps, providing actionable insights and information to help you choose the right tools for your next project.

What is Mobile Banking App Development?

While the process and potential user cases are quite lengthy, mobile app development in the banking sector ultimately involves creating software applications that enable customers to perform banking transactions & tasks on their mobile devices.

The significance of mobile banking solutions cannot be overstated, as they offer numerous benefits:

- Convenience: Customers can access banking services anytime, anywhere.

- Enhanced Customer Experience: Intuitive and responsive apps improve customer satisfaction.

- Cost Efficiency: Reduces the need for physical branches and staff.

- Increased Engagement: Mobile apps facilitate better communication and personalised services.

In 2020, 1.9 billion people worldwide were considered active users of digital banking products. In just four years, this has exploded to over 3.6 billion users worldwide, underscoring the growing importance of mobile banking solutions.

Key Features of Banking Application Development Frameworks

When developing banking apps, certain features are paramount to ensure the app will meet industry standards and customer expectations:

- Security: Protecting customer data and ensuring regulatory compliance is critical. This includes implementing encryption, multi-factor authentication, and secure APIs.

- User Interface & Experience (UI/UX): Designing intuitive and user-friendly interfaces that enhance the user journey is essential for customer retention.

- Performance: Banking apps must be fast, responsive, and reliable to handle high volumes of transactions and user interactions.

- Integration: Seamless integration with existing banking systems and third-party services is necessary to provide a comprehensive banking experience.

Top Mobile Development Frameworks for Banking

React Native

React Native, developed by Facebook, is a popular framework for building cross-platform mobile applications using JavaScript and React.

Benefits

- Cross-Platform Development: Allows developers to write code once and deploy it on both iOS and Android, reducing development time and costs.

- Performance: Offers near-native performance with a responsive user interface.

- User Interface Support: Provides a wide range of UI libraries and components for creating sophisticated and intuitive user interfaces, essential for banking applications where user experience and accessibility are paramount.

- Integration Capabilities: Easily integrates with various third-party APIs such as payment gateways, analytics, and customer support tools.

- Community Support: Extensive libraries and tools, backed by a large developer community.

Example

Revolut is a digital banking and financial services provider that provides features such as money transfers, currency exchange, budgeting tools, and investment options. Built with React Native, their app delivers an intuitive interface for managing personal finances.

Flutter

Google created Flutter, an open-source UI toolkit for building natively compiled applications for mobile, web, and desktop from a single codebase.

Benefits

- Fast Development: Features like hot reload help developers see changes instantly, without needing to restart the application, speeding up the development and testing process.

- Widget-Based Architecture: Everything in Flutter is a widget, allowing for a highly customizable and flexible UI design. Flutter comes with a wide range of pre-designed widgets that allow banks to create attractive interfaces consistently across platforms.

- Performance: Compiles to native ARM code, providing near-native performance and ensuring a smooth, responsive user experience.

- Secure Data Handling: Supports secure data storage and encryption practices, crucial for handling sensitive financial data.

Example

Nubank, a major digital bank based in Brazil, has utilized Flutter to build its mobile app. This has enabled them to offer a range of banking services, including credit card management and personal loans, to millions of customers with a consistent and high-quality mobile experience.

Swift and Objective-C (for iOS)

Swift and Objective-C are the primary languages for native iOS app development.

- Swift is a modern programming language developed by Apple, designed to be fast, safe, and expressive. It has become the preferred language for iOS app development since its introduction in 2014.

- Objective-C is an older programming language that has been used for iOS and macOS development

Benefits

- Performance: Native development ensures optimal performance and access to the latest iOS features.

- Modern Syntax and Safety: Swift has a clean and modern syntax that makes code easier to read and write. It includes features that enhance safety, such as optionals and type inference, which help prevent common programming errors.

- Interoperability: Swift can coexist with Objective-C within the same project, allowing for gradual migration of codebases from Objective-C to Swift. Developers can leverage existing Objective-C libraries and frameworks while writing new features in Swift.

- Ecosystem: Extensive libraries and Apple support.

Example

Many prominent banking apps, such as those from Bank of America and Wells Fargo, are developed using Swift and Objective-C. These languages empower the bank to offer a comprehensive range of banking services to its users such as account management, fund transfers, and mobile check deposit.

Kotlin and Java (for Android)

Kotlin and Java are the main languages used in native Android app development.

- Kotlin is a modern programming language developed by JetBrains, designed to be concise, expressive, and interoperable with existing Java code.

- Java continues to be a preferred choice for developing Android applications, especially in legacy projects.

Benefits

- Concise syntax: Reduces boilerplate code, making codebases more readable and maintainable. This enhances developer productivity and reduces the risk of errors.

- Flexibility: Provides access to the full range of Android features.

- Community Support: Kotlin is supported by a robust set of development tools, including IntelliJ IDEA, Android Studio, and Gradle. The Kotlin community is active and growing, with extensive documentation, tutorials, and resources available to assist developers.

- Compatibility: Java code can seamlessly integrate with Kotlin, allowing developers to gradually adopt Kotlin in existing Java projects. Java libraries, frameworks, and tools can be used alongside Kotlin code, promoting interoperability and code reuse.

Example

HSBC, one of the largest banking and financial services organizations globally, utilizes Kotlin and Java for its mobile banking app development. These languages enable HSBC to provide a seamless and feature-rich banking experience to its customers, Capital One, a prominent financial services company, also relies on Kotlin and Java for its mobile banking app development efforts.

Choosing the Right Development Framework for Your Banking Application

Selecting the appropriate development framework for your banking application depends on several factors:

- Project Requirements: Assess the specific needs of your project, including performance, security, and user experience.

- Team Expertise: Consider the skills and experience of your development team.

- Budget: Evaluate the costs associated with each framework, including development and maintenance expenses.

- Target Audience: Understand the preferences and behaviours of your target users.

Comparative Analysis:

- React Native: Best for cross-platform development with a balance of performance and cost-efficiency.

- Flutter: Ideal for creating visually appealing apps with rapid development cycles.

- Xamarin: Suitable for leveraging Microsoft tools and services with extensive code sharing.

- Swift/Objective-C: Optimal for high-performance, secure native iOS applications.

- Kotlin/Java: Perfect for developing robust and feature-rich native Android apps.

Work with the Experts to Develop the Most Effective Banking Software

Choosing the right development framework is going to directly impact the success of your banking application. By understanding each framework’s strengths and limitations, you can make an informed decision that aligns with your business goals and user needs.

Our team of experts has deep knowledge and hands-on experience with various development frameworks that can analyze the bank’s specific requirements and provide tailored suggestions for your business. Moreover, we also offer ongoing consultation and mobile banking app modernisation services to help banks and financial institutions improve customer experience and gain competitive advantages.

- KMS Solutions adheres to regulatory compliance such as PCI DSS, ISOC 2, ISO 27001, and more to ensure secured banking apps. Moreover, our experts are certified with 12 AWS certifications, CBDP, PSM, PMP, and Scale Agile.

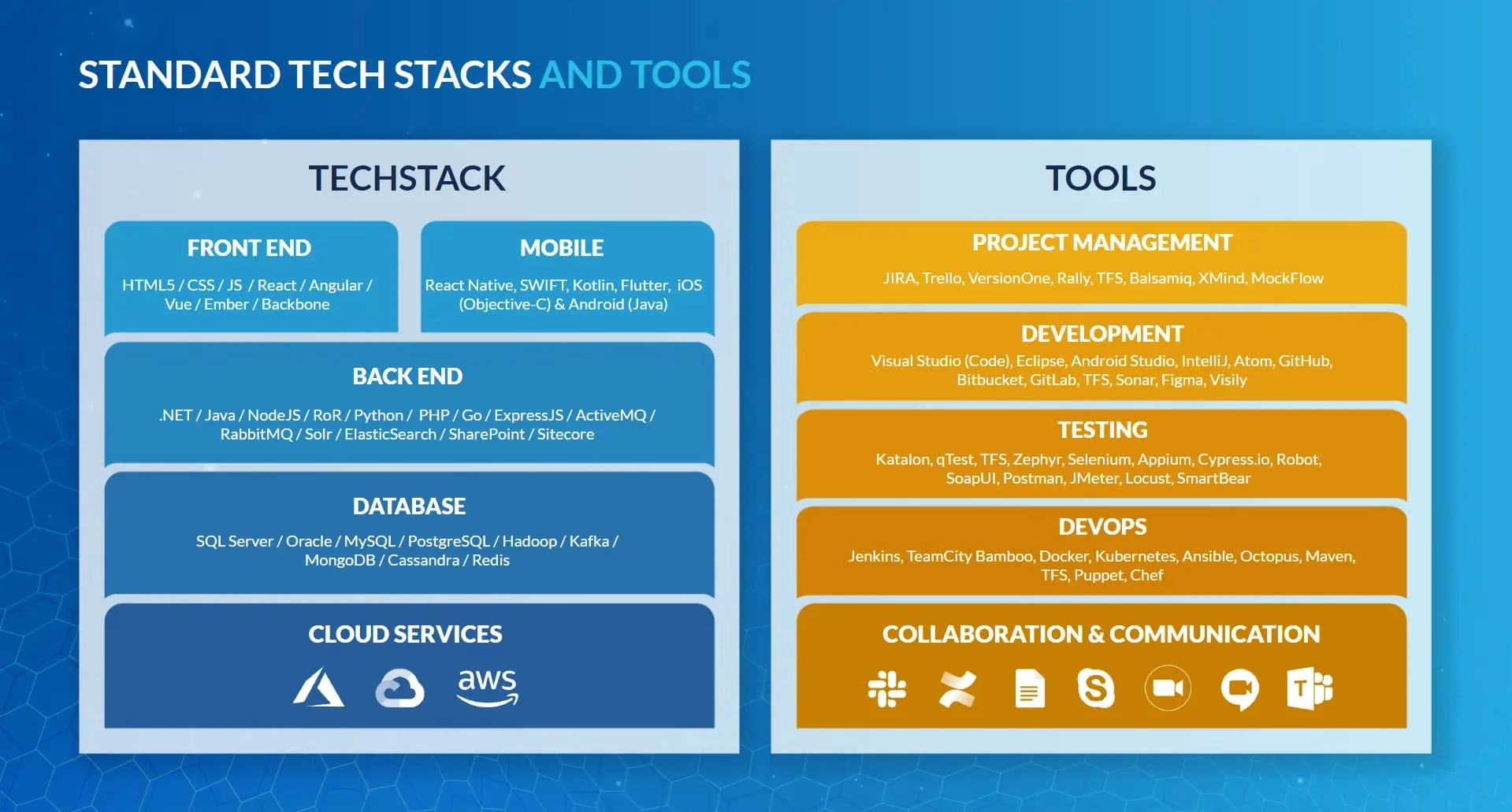

- We’re proficient in more than 50 tech stack for digital banking, including Python, Java, and Kotlin, React Native, Flutter, etc.

- We have worked on over 100 projects with an amazing 98% project satisfaction. We have collaborated with some giants in the BFSI industry including a Big Four Australian bank, ACB, HDBank, Discovermarket, Axi Trading, and many more.

If you would like to learn more about banking and wider software development services, speak with our experts at KMS Solutions today.