Today, the tech-savvy generations are drawn to the convenience and immediacy offered by mobile trading platforms, enabling them to participate in the financial markets more efficiently and accessibly just by using mobile devices. Taking CommSec as an example, the footprint of Millenials and Gen Z in this trading platform doubled within a year, and these young investors plowed a total of $1.2b into CommSec Pocket since it was launched.

Moreover, it is anticipated that the global online trading market will increase at a CAGR of 6.4 percent per year and reach 13.3 billion U.S. dollars in 2026. Hence, opting to develop a brokerage app in a market with such promising potential is a highly profitable choice. In this article, our expert will share a comprehensive guide to developing an innovative trading platform, a bridge between users and the world of finance.

What is a Trading Platform?

A trading platform (or trading application) serves as a digital hub where investors, traders, and financial intermediaries converge to engage in buying, selling, and exchanging stocks, bonds, exchange-traded commodities, currencies, and derivatives.

Some common types of trading platforms include:

- Online Brokerage Platforms: brokerage firms offer online portals that grant retail investors accessibility to financial markets. Examples include E*TRADE and TD Ameritrade, which provide trading in securities such as stocks, bonds, and options.

- Peer-To-Peer Trading Platforms: enable direct trading between users without intermediaries. They are well-known in the cryptocurrency space, with platforms such as Local Bitcoins and Paxful taking the forefront.

- Direct Access Trading (DAT) Platforms: these are designed for day traders requiring swift transactions. These systems provide direct access to market exchanges, eliminating the need for conventional brokerages and facilitating faster trade executions. SpeedTrader and Interactive Brokers are prominent examples.

Best Share Trading Platforms in Australia

The competition in the trading apps market is tight. Thus, before entering the market, it’s crucial to understand and be aware of your competitors.

Here are the top most popular trading platforms available in Australia so far:

1. CommSec

CommSec stands as Australia’s largest online trading platform, requiring no monthly account-keeping or subscription fee. With an industry-standard minimum initial trade set at $500, the platform offers access to both the ASX (Australian Securities Exchange) and 25 international markets.

Moreover, CommSec offers a comprehensive array of educational tools designed to assist users, catering to both beginner traders and experienced investors to enhance their understanding of investment strategies —whether in the Australian market or further afield.

2. CMC Markets

By offering a broad spectrum of trading options for its users beyond simply trading shares, this CFD trading platform is trusted by many Australian traders. The platform enables trading in CFDs, forex, commodities, indices, options, cryptocurrencies, and share baskets. Additionally, CMC Markets offers numerous educational tools, including demo accounts for practice trading and even junior accounts available to kids.

3. NABtrade

The NABtrade platform is accessible to all Australians without any monthly or subscription charges. However, for keen traders seeking a more advanced model, there are higher service levels that come with subscription fees. This higher tier offers access to premium charting, comparisons, immediate company announcements, and alerts, ensuring traders stay informed about market fluctuations.

This platform grants access to the ASX and four international markets, including the US, UK, Hong Kong, and Germany.

Custom Trading Platform Development Trends To Watch Out For In 2025

Since the landscape of custom trading software development is poised for notable advancements and transformative shifts, here are the top trends to forecast for 2025:

Artificial Intelligence and Machine Learning (AI/ML)

According to Google Cloud research, 50% of trading systems and data providers are providing data services powered by AI/ML.

AI-based assistants in the trading platform can play a crucial role in automating investment processes. The fundamental process involves users inputting their desired return and risk tolerance into the application, after which AI creates and manages a customized portfolio. This AI-driven advisor can make investment and savings recommendations based on users’ short- and long-term goals.

Besides, ML algorithms also play a pivotal role in refining algorithmic trading strategies, adapting to market changes, and optimizing performance.

Read more: The CIO’s Guide: Implementing Generative AI in Financial Software Development

Cloud Computing

In today’s modern era saturated with data, cloud computing emerges as a boon for retail traders, institutions, and any parties involved in financial markets. A Google Cloud study indicates that 93% of exchanges and trading systems provide cloud-based data and services. Banks (commercial, investment) and buy-side firms are actively transitioning to cloud-based solutions.

Leading players such as Eikon, Trayport, and OpenLink have introduced cloud-based solutions that enable traders to access real-time market data, execute trades, and manage risk from anywhere in the world.

Embraced Safety and Security

Similar to banking apps, trading platforms are also vulnerable to cyber threats due to their characteristics. Taking an instance, when users download an app or sign up with a broker, all their shared information is stored on servers. Even if the broker uses cloud services, there are still risks. These issues may come from mistakes in how the servers are set up (that’s server or cloud misconfiguration) and also from trickery attempts like phishing.

Thus, it’s essential to implement encryption (HTTPS, SSL, and TLS), 2FA, biometric authentication, and comply with anti-money laundering laws.

Adaptation to Unique Requirements

As the customers’ requirements change continuously, the software trading solution also needs to be flexible and scalable to adapt. Therefore, when developing trading software, it’s essential to create a product that offers customizable functionality to adapt to the specific requirements of the trading industry.

Key Features For Innovative Forex Trading Platform

Deciding what features to include in the trading platform has been a vital step of the mobile app development strategy since there are tons of features to include. The process involves conducting research, analyzing competitors, interviewing prospects, and ultimately brainstorming the fundamental features that a trading app should include.

To create an innovative trading app, here’s a stable list of crucial features that you can consider:

User Registration

Since the registration form serves as the initial point of user interaction on the trading platform, it should be flawless. Users may leave the app immediately if they encounter complications right at the initial phase.

To prevent user confusion, it’s worth considering designing the form in a minimalistic approach with simple steps to sign up/log in. Additionally, to ensure a seamless user experience, your trading platform should offer sign-up options via email, mobile numbers, and social media accounts.

User Profile

Every user should have a profile within the system where personal details, transaction history, and trading activity statistics are stored. Additionally, the platform needs to offer flexible portfolio investment settings, tools, page layouts, etc.

Dashboard

Users should be capable of configuring dashboards according to their needs and trading stocks to access essential data quickly. The information displayed on a dashboard needs to be updated in real time. On their dashboard, the user should see:

- Account Summary: An overview of account balances, available funds, margin status, and other account-related information.

- Market Data: Real-time data on various financial instruments, such as stock prices, indices, commodities, and currency pairs, are often presented through charts, graphs, or tables.

- Watchlists: Customizable lists of securities or assets that users are monitoring, allowing quick access to their performance and relevant data.

- Performance Metrics: Visual representations of trading performance, including portfolio growth, returns, risk metrics, and other key performance indicators.

Multiple Payment Gateways

Multiple payment gateway integration within a trading platform offers users diverse options for depositing and withdrawing funds, enhancing convenience and accessibility.

To run safe payments on the trading platform, you can consider integrating certified payment gateway providers for secured transactions and user data, such as Stripe, Braintree, PayPal, and Google Pay.

Security

As users nowadays are more concerned about the level of safety and security when using digital platforms (which is also mentioned as the next trend in 2025), here’s a list of instruments that you can consider when developing a trading system:

- Multi-Factor authentication

- End-to-end encryption for internal transactions

- Instant alerts and notifications for detecting unusual activity

- Robust and secure electronic Know Your Customer (e-KYC) verification processes.

7-Steps Guide for Developing Trading Platform

Step 1: Do Market Research And Regulatory Analysis

In this phase, you can start by analyzing comparable platforms and exploring their strengths, weaknesses, features, and tools. identify unique features that can enhance your online stock trading app, tailoring it to meet your specific needs.

It’s also important to delve into the legal landscape of FinTech and trading. For instance, if your concentration is on the Australian market, ensure compliance with regulatory bodies such as the Australian Financial Services Licence (AFSL), Australian Securities Exchange (ASX) regulatory framework, etc.

Step 2: Plan Your Minimum Viable Product (MVP)

Our experts advise that it’s best to begin with the MVP version, in which you only need to incorporate must-have features and, from that, accelerate the development process to ensure the product meets the market requirements instantly.

Hence, you need to plan the first release and compose a coherent plan to develop an MVP.

Step 3: Create UI/UX Design

The main objective of UX design is to support achieving business goals. Hence, it’s crucial to analyze business requirements to generate a prototype for your trading app.

Additionally, designers need to establish the company’s logo, select a color palette, and define design standards since this practice ensures consistency throughout the development of the online trading platform’s UI/UX design. If you’re unsure about how to craft a design for automated trading software, consider creating multiple mockups to explore various options and select the most suitable one.

Step 4: Choose Tech Stack and API Integrations

Depending on the type of project, infrastructure, and unique characteristics, the software development team should pick the right technology stack to build a brokerage app. The best practice here is to analyze the top programming languages for finance and fintech and consider the best for your project.

For mobile app development, some technology can be considered, including SWIFT, Kotlin, Xamarin, and Mobile Angular UI. When aiming to build cross-platform apps, software engineers often consider React Native, Flutter, or Ionic.

As trading platforms require numerous features and integrations with other services, choosing the required application programming interface (API) integrations is also worth considering. Some favored API integrations used for building custom software include Yahoo Finance API, Alpha Vantage API, Finage API, etc.

Also, it’s essential to implement database security practices and choose the appropriate database solution to keep confidential and payment information safe from leaks. You can consider some popular database options for trading app development, such as PostgreSQL, MySQL, and Oracle.

Step 5: Develop the MVP

In this phase, it’s crucial to ensure the must-have features of the trading platform that you’ve analyzed above are all included. Moreover, ensure some key features such as Registration, Dashboard, Buy & Sell, Manage Payment, and Withdraw are all performing perfectly, as they will significantly impact to your customers’ experience. It’s worth considering that all features that your target audience requires should be effortless to find and use.

Besides, software engineers can consider integrating communication solutions such as Twilio, payment processing services (Stripe), and analytical tools like Firebase by Google Analytics or Mixpanel.

Step 6: Plan the Security of the Trading Platform

Trading platforms handle and exchange sensitive data of countless individuals, so prioritizing platform security is paramount during the software development process.

To ensure the confidentiality and security of data, security analysts can effectively address security challenges inherent in stock trading platforms using these methods:

- Encryption based on HTTPS, SSL, and TLS;

- Authentication (2FA, password-based, biometric);

- Access control, e.g., based on roles;

- Hardware or software-based firewalls;

- Monitoring (intrusion detection systems, network monitoring tools).

Step 7: Conduct Frequent Testing

After completing the development phase, it’s essential to proceed with testing the functionality thoroughly. Disregarding this phase can lead to significant financial losses and damage to your reputation due to critical bugs and security vulnerabilities.

Therefore, we strongly advise performing a security audit and evaluating code quality before the platform’s launch. This involves subjecting your platform to both manual and automated tests.

Step 8: Release, Maintain, and Upgrade

After deploying the platform, work does not end. You should provide regular updates and maintenance. It’s time to consider other innovative and nice-to-have features to improve your customers’ experience.

The best practice here is having a software development team that knows how to upgrade the trading platform to a new level and keep your platform functional effectively for users.

How KMS Solutions Helped Axi Improve Its Trading Platform

Axi is an Australian-based Forex and CFD trading corporation trusted by over 60,000 ambitious customers from over 100 countries worldwide. As a global top broker, the company recorded $2.5 trillion in trades in 2020. With the growing number of trades annually, Axi needed to provide lightning-fast e-FX services and a seamless trading experience. Therefore, the corporation has decided to integrate with more Payment Services Providers (PSPs) to address the unmet requirements of traders worldwide.

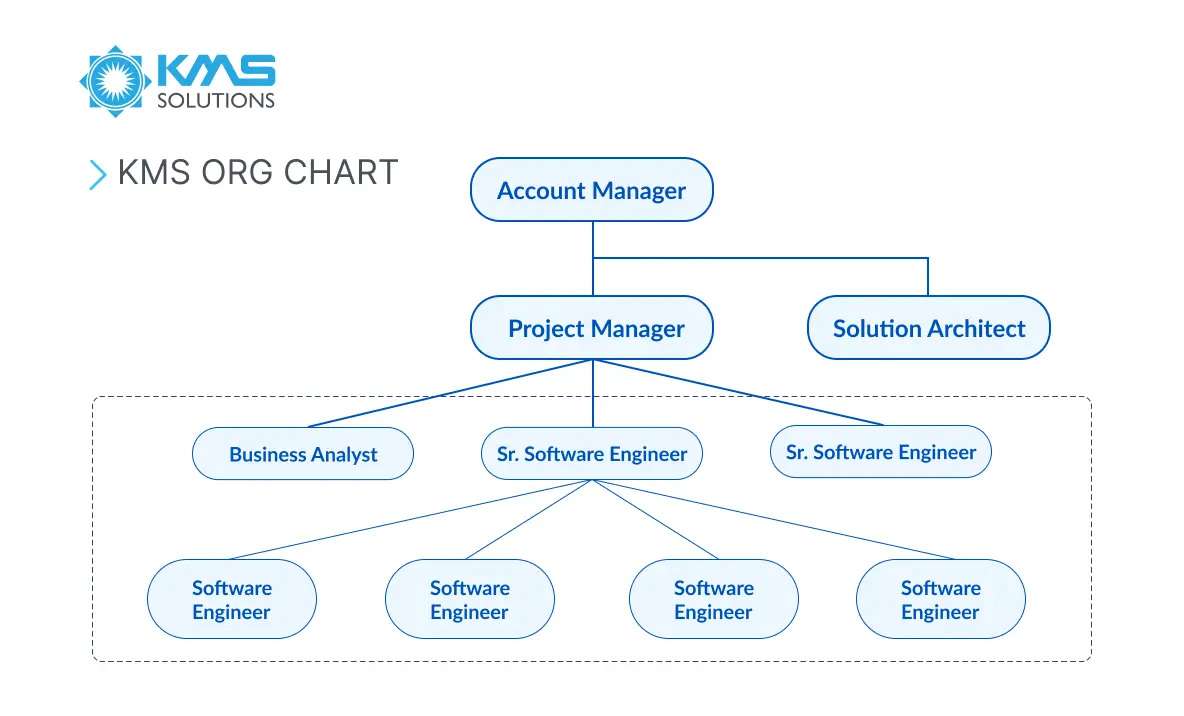

To cover the requirements of Axi, KMS Solutions proposed a software development team of 7 dedicated members responsible for installing and ensuring flawless integration with new PSPs, including eWallets, Crypto and Bank Transfer on Azure Service Bus.

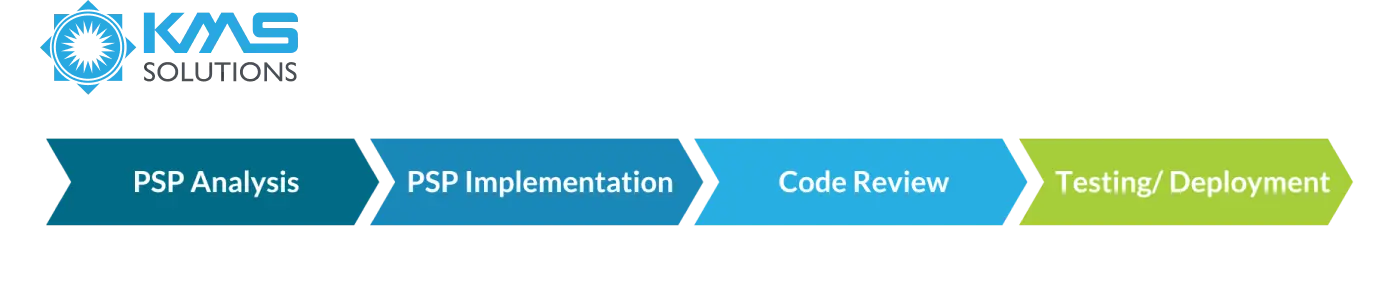

Moreover, with domain knowledge and expertise in financial services, KMS is well-knowledged that brokers can be a vulnerable target of cybercriminals. Thus, the KMS dedicated software development team has prioritised security and compliance, ensuring that payment gateway integration systems are secure and comply with industry standards. During this collaboration, the team has undertaken a four-stage process for PSP implementation consisting of PSP Analysis, PSP Implementation, Code Review, and Testing & Deployment.

Within 5 months, the KMS’ dedicated software development team has successfully configured, tested, and deployed 9 PSPs in LATAM (Latin America), the UK, Bulgari, Nigeria, South Korea, Japan, Hongkong, Malaysia, etc. The services provided by KMS Solutions also ensure a secure payment process and provide a seamless user experience.

With the PSP integration services delivered by KMS Solutions’ dedicated software development team, Axi is able to meet the demands of its growing user base while prioritizing platform security. This partnership has facilitated the ability to provide various options for conducting online transactions, fastening turnaround and improving customer conversion.

Drawing Up

The trading industry is increasingly appealing to individuals, comprising those without expertise in finance. Consequently, the demand for user-friendly and uncomplicated trading platforms is rising substantially, making the development of trading apps a lucrative business proposition.

There are a number of factors to consider when developing the trading platform, such as competitors, development trends, key features, and especially the team’s capabilities and skills. Leveraging our expertise in software development and financial technology, KMS Solutions can consult your business and help you expand your development team to build the desired trading platform.

Contact our expert to discuss how to build your trading platform.