The use of artificial intelligence (AI) in the BFSI industry is growing in popularity, changing how financial institutions operate, engage with clients, and manage daily transactions and monetary regulations. It’s unsurprised that an impressive 71% of the 500 senior executives in the financial services participating in the survey believe that AI has considerably altered how their enterprises work.

Since the BFSI industry is data-driven, AI can make the process of analysing vast amounts of data become effortless, providing valuable insights to help financial institutions make better decisions. As reported by Business Insider, approximately 80% of banks are cognisant of the potential benefits that AI delivers to their sector, and they are anticipated to save $447 billion by 2023 through the utilisation of AI applications.

These figures demonstrate that the BFSI sector is quickly advancing AI to enhance efficiency, service, and productivity while reducing costs. This article will delve into the potential use cases of AI in banking and finance software, the benefits and future trends in the industry.

Table of Content

Generative AI-Powered Solutions in Financial Software Development

1. Conversational Finance Software

3. Financial Analysis and Forecasting

4. Portfolio Optimisation and Risk Management

5. Generating Applicant-Friendly Denial Explanations

Limitations of Generative AI when Developing Financial Software

The Future of Generative AI in the Banking and Financial Industry?

Generative AI-Powered Solutions in Financial Software Development

The finance sector is already on its way to implementing generative AI models for particular financial tasks. The exploratory progress is taking multiple forms. For instance, Morgan Stanley has recently leveraged OpenAI-powered chatbots to assist financial advisors by utilising the corporation’s internal collection of research and data as a knowledge resource. This is also employed by B2B FinTech startup Brex.

More interestingly, Bloomberg has introduced BloombergGPT, a finance-specific generative model that has undergone fine-tuning. This model showcases its capabilities of making sentiment analysis, news classification, and other financial applications, successfully surpassing established benchmarks.

Remarkably, the BloombergGPT model demonstrates significant superiority over existing open models of comparable size on financial tasks by large margins while still performing on par or better on general NLP benchmarks.

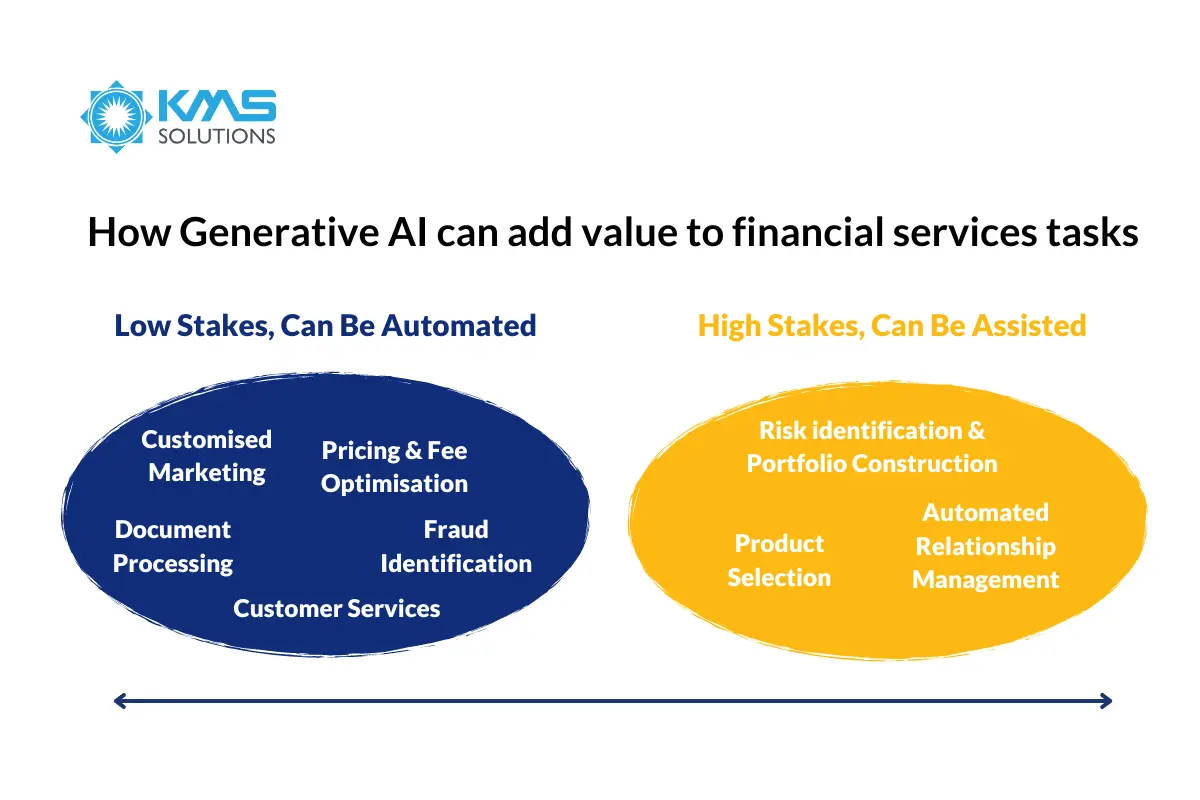

Moreover, if properly implemented, generative AI offers a greater potential to streamline several financial processes. Here are the top 6 potential use cases:

1. Conversational Finance Software

Generative AI refers to a category of AI models that can generate new data by learning from existing data and, from that, produce human-like text based on the given input. By using natural language processing (NLP), natural language understanding (NLU) and natural language generation (NLG), conversational AI is specifically designed to simulate human-like conversations through the utilisation of AI-powered chatbots or virtual assistants.

Conversational finance is on the brink of a substantial transformation due to the potential impact of generative AI. Currently, AI-powered chatbots implemented in financial software can respond to a variety of questions quickly, effectively, and individually, enabling users to see information and conduct transactions using conversational interfaces. Customer service is a low-risk financial activity that can be automated. Since finance-specific conversational AIs emerge, organisations can improve customer services significantly through financial software development.

Well-known conversational AI solutions in the finance industry include Bank of America’s Erica (with a user base of over 25 million) and turnkey conversational bots for enterprises provided by FinnAI, which has the ability to respond to 80% of customer queries and resolve 55% of conversations.

However, it’s worth noticing that conversational AI has both pros and cons:

Advantages | Disadvantages |

Improved customer experience: A conversational AI chatbot in financial software can handle more complicated enquiries and deliver personalised, context-aware replies, resulting in higher levels of customer satisfaction. | Strong investment in development maintenance: Developing and maintaining conversational AI systems can be more complex and resource-intensive than traditional chatbots. |

Scalability: Handle larger volumes of simultaneous transactions and adapt to a broader range of topics. | Data privacy concerns: Since conversational AI require access to sensitive customer data, financial institutions must ensure that the chatbot is equipped with robust security measures. |

Constant learning: Machine learning models can learn user behaviours while using financial software to improve their understanding and provide better context-based responses. | Misunderstanding: Despite NLP advancements, conversational AI might still misread user inputs or provide inaccurate answers, potentially leading to frustration. |

Integrations with other systems: When developing, engineers realise that generative AI can be simply integrated with other financial data sources and systems to provide more holistic support and deeper insights. |

Here is an example of the difference between a Traditional chatbot and a Conversational AI chatbot in a financial customer inquiry

Source: Yellow.ai

2. Synthetic Data Generation

As customer information is considered proprietary data within finance teams; there are challenges related to its utilisation and regulation when developing financial software.

To address this problem, businesses can leverage generative AI to generate synthetic data that comply with privacy regulations like GDPR and CCPA. Synthetic data generation refers to the process of creating artificial or simulated data that mimics the characteristics and patterns of real-world data. Generative AI models, such as generative adversarial networks (GANs) or variational autoencoders (VAEs), can be trained to generate synthetic data points that closely resemble actual financial data, including transaction records, customer profiles, market prices, or any other relevant financial information.

The advantages of synthetic data generation in financial software development are numerous, including:

- Privacy preservation: Financial data often contains sensitive information, such as personally identifiable information (PII). Synthetic data generation allows developers to create and update software without compromising privacy or breaching regulatory requirements, enabling more secure and compliant software development processes.

- Data diversity: Generative AI can provide engineers with the ability to create diverse datasets that cover a wide range of scenarios. This helps in testing and validating the software’s performance across different market conditions, customer profiles, and transaction types.

- Edge Case Simulation: By creating Ai-generated synthetic data that represent rare or extreme scenarios that may not frequently occur in real data, developers can thoroughly test the software’s performance and resilience under challenging circumstances, leading to more robust and adaptive financial solutions.

3. Financial Analysis and Forecasting

By leveraging historical financial data, generative AI models can effectively capture intricate patterns and correlations within the data. This enables them to perform predictive analytics, offering valuable insights into future trends, asset prices, and economic indicators. Generative AI models, such as recurrent neural networks (RNNs) or long short-term memory (LSTM) networks, can be trained on large datasets of financial data to learn the underlying patterns and relationships.

Developers can utilise generative AI to simulate and analyse various hypothetical scenarios. By simulating market conditions, macroeconomic influences, and other relevant variables, decision-makers are able to make informed choices in the dynamic financial landscape. Some key features include:

- Statistical analysis: Developers employ Generative AI to analyse financial data, identify patterns, and calculate statistical measures such as averages, correlations, and variances. These analyses provide insights into risk assessment and performance evaluation, helping users make better financial decisions. Nowadays, some businesses also consider adding analysis dashboards in their financial software to provide users with comprehensive insights about their financial activities and performance.

- Forecasting models: Financial software may incorporate forecasting models, such as time series analysis, regression analysis, or machine learning algorithms, to predict future financial outcomes.

4. Portfolio Optimisation and Risk Management

Portfolio optimisation is another financial application of generative AI. Generative AI models may assist asset managers and investors in identifying optimal assets and wealth management by analysing historical financial data and producing numerous investment scenarios.

Within the context of financial services, generative AI plays an essential role in identifying and managing risk and threats efficiently:

- Risk tolerance assessment: Generative AI can assess credit risk by analysing credit scores, a borrower’s financial history, asset correlations, and past investment behaviours. This enables financial institutions to make more informed lending decisions and reduce their exposure to risk by default.

- Expected returns estimation: By capturing complex patterns and relationships within the data, generative AI can generate forecasts and predictions for future investment performance.

- Investment horizon: Generative AI can develop and fine-tune investment strategies, optimise risk-adjusted returns, and make more informed decisions about managing users’ portfolios.

5. Generating Applicant-Friendly Denial Explanations

This technology is especially beneficial in determining reasonable credit limits and risk-based loan pricing for consumers. However, to encourage trust and enhance customer awareness for future applications, both decision-makers and loan applicants need clear explanations of AI-based decisions, such as reasons for application denials.

To develop user-friendly denial justifications in financial software, a conditional generative adversarial network (GAN) – a generative AI variation, was deployed. Two-level conditioning is used to produce better clear explanations for applicants by organising refusal reasons hierarchically from basic to complicated. Thus, without going to the branch, users can receive a detailed notification regarding their application process and also reasons for being denied via mobile app.

6. Fraud Detection

Financial services are all about speed and security. By generating synthetic examples of fraudulent transactions or activities, you can train and augment machine learning (ML) algorithms to recognise and distinguish between legitimate and fraudulent patterns in financial data.

A generative AI model can help identify suspicious activities more quickly and precisely when developing financial software. Some fraud detection use cases comprise:

- Anomaly detection: by learning patterns in huge data sets, such as user behaviour and transaction history, generative AI algorithms can detect anomalies or unusual behaviour that may cause fraud and alerts to take accurate action.

- Alerts of frauds: by implementing generative AI in financial software development, notifications regarding real-time frauds are sent to people immediately, noticing them take critical action to protect and guard their finances in due time.

Limitations of Generative AI when Developing Financial Software

- Data quality: As mentioned above, generative AI requires vast amounts of high-quality data to process effectively. However, in the financial services industry, data may need to be completed, updated, or consistent, affecting the reliability and precision of Generative AI models.

- Human expertise: not every software engineer is proficient in this new technology. Therefore, to develop successful AI-based financial software, businesses need developers with experience working with emerging technology. Moreover, the developers are also required to have a strong domain and knowledge of financial services.

- Bias suggestions: The effectiveness of generative AI models relies heavily on the quality and accuracy of the training data. Suppose the data used to train these models contains biases or inaccuracies. In that case, the generative AI model can inadvertently amplify these biases, leading to incorrect analyses and potentially resulting in discriminatory loan decisions or other negative consequences.

The Future of Generative AI in the Banking and Financial Industry?

As technology improves continuously, we can expect to witness even more advanced implementations of Generative AI in financial software development in the future. Consequently, generative AI enhances the banking experience for customers by making it more efficient, secure, and personalised. Generative AI plays a vital role in minimising the risk of errors by identifying inconsistencies and enhancing the quality of work related to banking and finance and the practices of experts by bringing valuable insights into complex financial matters.

Given the recent rise in the popularity of generative AI, it becomes imperative to identify professionals who possess both expertise in generative AI and hands-on experience in effectively applying this technology in financial software development. For banks and financial institutions lacking the necessary time and resources to establish an in-house software development team, an alternative approach would be to engage a reputable offshore technology centre to handle all the complex technical tasks.

In KMS Solutions, we have skilled technology experts who specialise in generative AI. Our dedicated software development team that have sufficient knowledge to help consult business strategy, deliver different AI-based solutions and offer a wide range of rigorous training courses, ensuring that financial enterprises stay updated with the latest advancements in the field. See how our software development team can help you with fit-for-purpose advanced solutions.