The rise of insurtechs and parallel trends in other consumer-facing industries has users expecting a higher standard of digital experience with effective, user-friendly insurance mobile apps across the customer value chain.

An insurance mobile product is certainly a powerful tool that assists with building engagement for consumers. Especially since mobile applications are anticipated by many of them – 40% of insurance search time is already being spent on mobile devices and 45 – 62% of insurance users seek to purchase new insurance via messenger app.

When it comes to consistently addressing consumers’ needs, insurers surely have a long way to go. While many incumbent insurers have been generating some specific insurance products in response to changes in behavior of economic agents, they are still trailing behind in providing such products to users with the convenience and ease that mobile technologies can offer.

How do insurance providers benefit from mobile apps?

1. Meeting customer demands

Modern clients appreciate the ability to research, purchase the most appropriate insurance packaging and manage insurance accounts using their mobile devices. Since consumer demand will most likely continue rising, digital insurance platforms become the ideal ally for satisfying these needs by making customer interactions far more meaningful.

2. Building a competitive edge

Mobile applications combined with attractive services can easily provide a competitive advantage. Let’s take the health insurance industry as an example. By creating an insurance app that is user-friendly and provides various useful features like e-prescriptions, treatment history or appointment scheduler, health insurance providers can make their services much more appealing in the long run as such ecosystem services are highly demanded by clients.

In addition to facilitating communication between an organization and its consumers, insurance mobile apps can also automate some business processes, saving time for agents to find new clients. Finally, mobile insurance solutions allow insurance companies to reach a larger customer base by advertising their mobile insurance platform in related apps.

3. Increasing customer touchpoints and loyalty

Currently, one of the biggest challenges for insurance providers is to maximize the number of touchpoints with their clients. The average interactions between insurance clients and insurers are 2.7 per year and these communications concern mostly extending the insurance or reporting damages.

In such events, an engaging and convenient insurance app is much needed for meaningful customer interaction. Logically, if the app doesn’t disappoint the users in these ‘’moments of truth’’, they may as well be inclined to check out other functionalities too. A well-made mobile application can prolong customers’ attention span and stimulate them to try more products.

4. Customer data analytics

The insurance sector can benefit from mobile analytics which allows for unprecedented analysis. With apps, companies can easily gather more information on each client

Identity data: This involves name, date of birth, home/email address, phone number, and links to social media profiles like LinkedIn or Facebook.

Quantitative data: Transactional information like credit score, payment frequencies, bank account details, etc.

Descriptive data: Users might disclose property or car ownership along with educational background

Qualitative data: Subjective/behavioral details like hobbies and favorite color can be collected

Having such detailed information, corporations operating in the insurance market can obtain better insights into customer behavior and attitudes. Subsequently, insurers can enhance the quality of personalized offers and further improve the digital customer experience.

Types of mobile insurance apps

Mobile apps will differ based on the niche your insurance firm serves. Here are popular categories of mobile apps that can be built in the insurtech domain:

- Health insurance

- Car insurance

- Life insurance

- Travel insurance

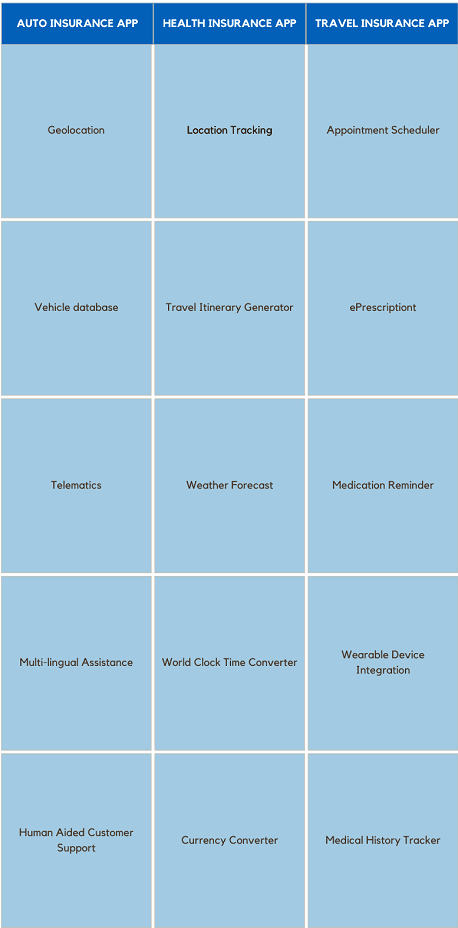

App features that need to develop depend heavily on the insurance business types. Yet, there are still essential elements that can be seen in all these categories, regardless of which section of the insurance market your firm operates in. Let’s have a look at those.

Core features for successful insurance mobile apps

1. User panel

This is the opening page where details about the insured user are exhibited. It should be lean and clean together with clear call-to-action buttons. With a car insurance app, for instance, the profile page will show information related to roadside assistance, vehicle IDs, payment buttons and the ability to swap policies.

2. Policy details

This page presents information of policies, manners as well as the extent of an insurer’s benefits. Here, customers should be able to seek policies by chosen parameters, particularly if the insurance firm provides several options. Lastly, clients will surely value tailored recommendations – policies that suit them best depending on their earnings, health, premises, etc.

3. Quotes

This quote feature enables the app to fetch users’ data from its records and either directly present a policy price or connect clients to an insurance agent. With Big Data integration, insurance corporations can also pitch discounted prices or more benefits to consumers according to their regularity of exploring new policies.

4. File a claim

Building a claims-filing tab remains the most important stage of developing applications for the insurance industry. The run-around days to submit claims are long gone. Filling a claim in the event of an undesirable incident must be simple and easy. With that being said, uploading evidence should be as easy as taking a picture, either from the app scanner or the phone camera. It’s recommended that the entire procedure can be completed in a single page.

5. Payment gateway

It’s no argument that a payment gateway is extremely important for financial application development. The in-app payments shall accept payments from major service providers like MasterCard, Visa, Amex, etc. Furthermore, automated billing for EMIs or a one-click payment process should be incorporated.

6. Customer support

Chatbots are no longer exceptional. Automated answers serve as a quick fix for routine questions. But what about unplanned situations? You can’t expect a stranded client with a broken vehicle to rely on pre-programmed responses. Thus, a Request Callback or Connect with a Customer Service Representative option is highly recommended. Such in-app call capabilities fulfill the purpose of the app – a disaster-avoidance and quick reaction machinery.

7. Notifications

Insurance organizations, generally, don’t overlook chances to enter a new market sector. You will need a reason for giveaways and so do the clients for purchasing your products/services. Thus, send frequent push notifications reminding people of their outstanding balance, limited-time discounts as well as any new policies they can replace their current ones with.

8. Document Upload/Storage

How would the user submit their papers, let alone a picture, if the insurance app didn’t integrate it? The mobile application must not only support document upload from local file directories but also import from third-party services if necessary, such as emails

Besides those commonly found features in insurtech apps, here are a few in-app features for domain-specific areas at a B2C level.

How much does it cost to develop an insurance app?

There is no such thing as a one-size-fits-all solution when it comes to mobile app development. In fact, it varies widely depending on numerous components.

- App developer experience, expertise and rates: regarding app developers, price and experience usually go hand in hand. The more experienced, the higher salaries. Also, rates are determined by expertise – the specific technical skills an app developer is competent in.

- Choice of development platform: rates charged by developers might vary slightly depending on the target platform, whether it’s iOS, Android, or both.

- Type of mobile app development technologies: the tech tree you select as the base of your project of developing insurance app has a significant effect on the overall cost of the app. Selection ranges from web app, native app, hybrid app to cross-platform app and components-oriented JavaScript frameworks.

How KMS Solutions can help with your process of developing insurance app

Adopting lean business operations and a customer-centric approach, we strive to generate value for customers with industry best practices and leading-edge technologies. For optimal mobile application development, digital technology consulting is offered to help clients acquire innovative insights into market changes and seize new opportunities.

Using Lean-Agile frameworks and migrating applications with scalable Cloud-native architecture, KMS Solutions is well-equipped to develop next-gen mobile apps to up your digital game. Our APIs and Microservices based also enable you to connect legacy and new enterprise systems altogether for seamless and frictionless alignment across the business and with customers.

Ready to build your insurance mobile app? Connect with us for a quick and smooth digital transformation journey.