Historically, the financial industry has depended on manual testing due to the highly sensitive nature of its data and the constraints of legacy systems. With the rise of mobile banking, online transactions, and fintech disruptions continuing to reshape the industry, the need for faster, more reliable, and secure software deployment has become imperative.

However, relying solely on manual testing in fast-paced release cycles makes achieving complete test coverage highly challenging. This growing complexity has driven the need for test automation service packages—an emerged approach that aligns with your business testing strategy and optimizes testing costs while improving deployment speed.

In this article, we will explore how automation testing packages can help banks drive cost savings and faster releases and how KMS Solutions can help banks maximize ROI with the right automation services.

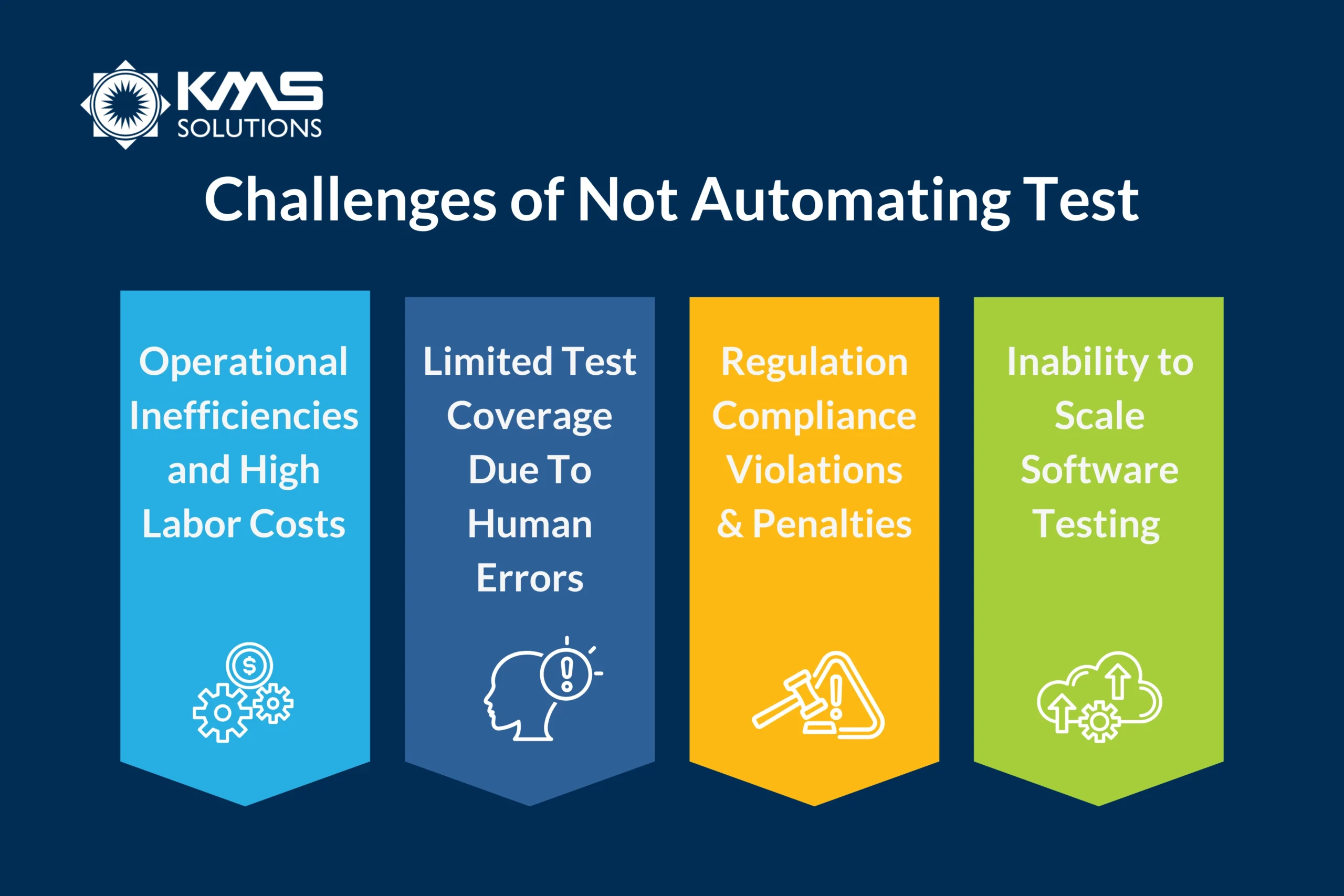

Key Reasons Behind Development Backlog Challenge

When it comes to banking app development, rigorous testing is essential to ensure security, compliance, and seamless customer experiences. However, when banks rely solely on manual testing, they expose themselves to unnecessary costs, inefficiencies, and financial risks. Banks experience losses in the following areas:

1. Operational Inefficiencies and High Labor Costs

Recent research indicated that 26% of annual IT budgets in banking and finance are allocated to QA and testing. Manual testing requires a large workforce of quality assurance (QA) testers to execute test cases, detect bugs, and validate software functionality. For banks with complex IT infrastructures, which include core banking, mobile apps, online portals, loan processing, and fraud detection systems, testing efforts can be enormous.

According to Capgemini’s World Quality Report, businesses that fail to automate testing spend 30–50% more on QA and maintenance compared to those using test automation. Particularly in the banking sector, test automation is valuable for long-term projects, especially in regression and confirmation testing. It ensures that when code changes are made, no unexpected issues or negative impacts will arise.

2. Limited Test Coverage Due To Human Errors

Given the repetitive and complex nature of testing in banking, manual testing is more likely to miss critical defects due to inconsistent test execution and limited test coverage.

Besides, manual testers are prone to errors and inconsistencies, leading to missed defects that can cause system crashes, security vulnerabilities, or transaction failures. The Tricentis study found that software failures in the banking sector cost companies an estimated $1.7 trillion annually due to downtime, fraud, and security breaches.

Test automation ensures comprehensive test coverage, continuous validation, and early bug detection, significantly reducing financial risks associated with software defects.

3. Regulatory Compliance Violations and Penalties

The financial sector is heavily regulated, and banks must comply with industry laws such as GDPR, PCI-DSS, Sarbanes-Oxley, and Basel III. Non-compliance due to inadequate testing can result in fines and legal penalties. For instance, in 2020, Capital One was fined $80 million for a security breach due to poor software testing. This has severely affected the bank’s reputation, eroding customer trust and leading to loss of business.

Unlike manual testing, which can overlook critical compliance checks, automation ensures consistent validation of regulatory requirements across all banking applications. By performing continuous security and compliance testing automatically, banks can avoid legal disputes before each release.

4. Inability to Scale Testing for Digital Transformation

As banks expand their digital ecosystems, they must accelerate the development process while ensuring banking apps perform seamlessly across multiple devices, operating systems, and third-party integrations. However, manual testing cannot keep up with the scale and complexity of modern banking systems. By automating the testing process, banks can improve the efficiency of different testing types.

- Mobile app testing: accelerating validation across multiple devices

- API testing: validating integrations with payment gateways, loan origination systems, and third-party fintech apps.

- Performance testing: simulating high transaction volumes to prevent system crashes during peak usage.

How Automation Testing Package Helps Deliver Cost Savings & Faster Releases

Banks operate in a highly dynamic and regulated environment where software reliability, security, and efficiency are critical. Given the increasing complexity of banking apps, adopting automation testing packages can provide significant benefits:

- Accelerated Time-to-Market: The testing package helps accelerate the QA process by automating repetitive tasks, reducing time needed. With faster testing cycles, banks can expedite the release of new features and services, gaining a competitive edge in the market.

- Faster Implementation with Pre-Built Frameworks: Automation testing packages often offer pre-configured testing frameworks that are widely recognized automation tools in the industry. This eliminates the need for banks to spend time setting up and configuring frameworks, allowing them to quickly integrate automation into their testing processes.

- Automated Test Cases with Maximum Coverage: With a set of pre-built test cases ready to be implemented instantly, the testing packing can ensure thorough coverage of critical banking app functions—including transactions, loans, fraud detection, and compliance validation.

- Cost-effective Testing Approach: By utilizing custom automation frameworks and the on-demand automated testers, BFSI businesses can reduce the need for ongoing manual effort and costly post-release bug fixes.

Test Automation Service Packages Available for Businesses

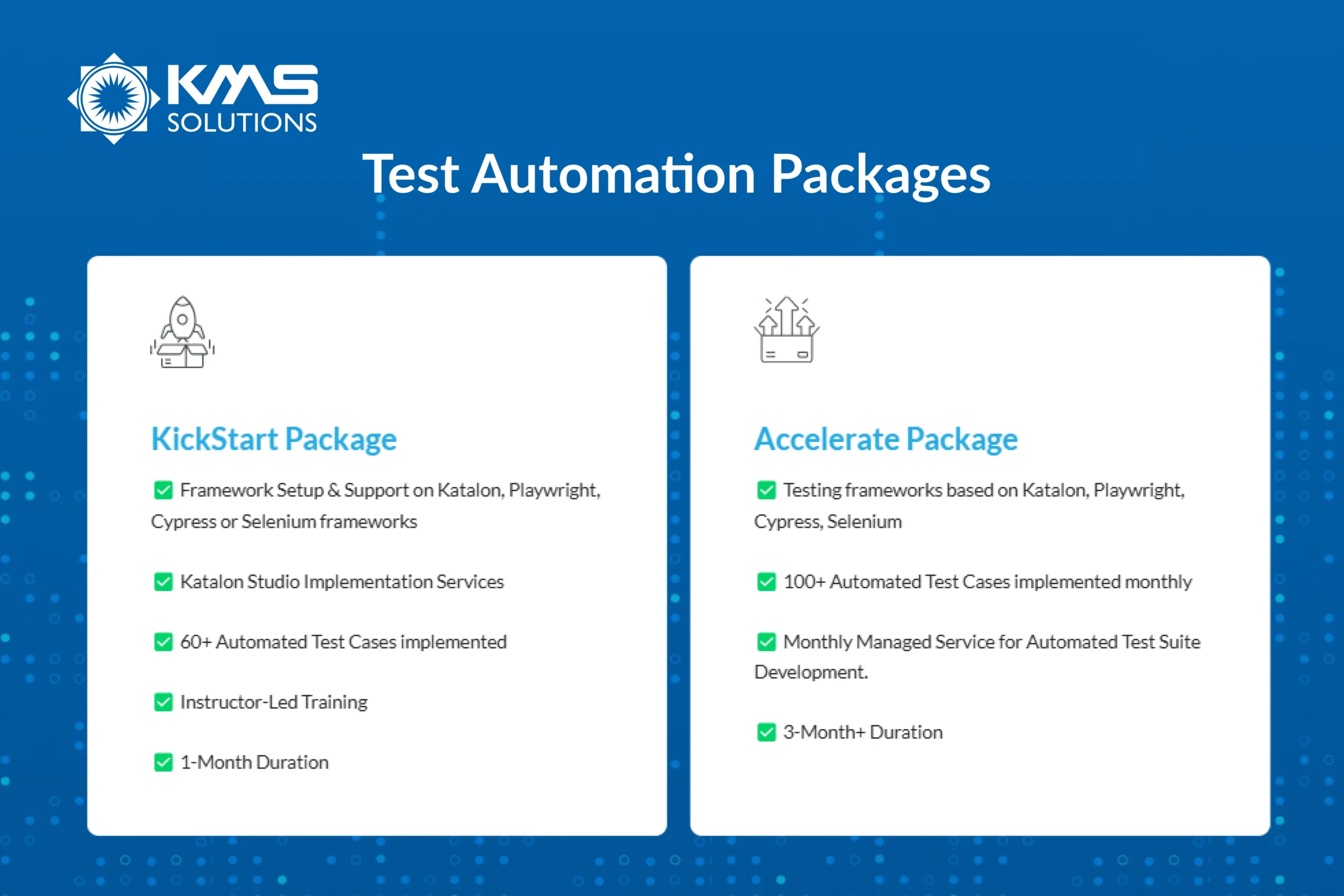

The automation testing packages provided by KMS is a comprehensive service bundle that includes a structured approach to test automation, covering everything from test strategy development, automation framework setup, test case generation, testing tool implementation, and testing training sessions.

We offer two Test Automation Service Packages—KickStart Package and Accelerate Package—each designed to suit different types of businesses.

1. KickStart Package: Quick Setup for Immediate Results

The KickStart Package is designed for banks that are looking to implement automation testing quickly with minimal upfront commitment. It provides a structured yet flexible approach to setting up a robust automation framework while training in-house teams to maintain long-term testing efficiency.

Key Features:

- Dedicated Automation Engineers: Experts to guide you through the setup and execution of automated tests.

- Framework Setup & Support: The package supports popular automation frameworks, including Katalon, Playwright, Cypress, or Selenium.

- Katalon Studio Implementation Services: Get specialized support for implementing and optimizing Katalon Studio, ensuring a seamless experience in automating test cases.

- 60+ Automated Test Cases Implemented: A robust suite of initial tests to cover core functionalities. such as user authentication and login, fund transfers and payments, etc.

- Instructor-Led Training: The package includes professional training for internal teams, equipping them with knowledge and best practices to continue expanding automation capabilities.

- 1-Month Duration: A short-term, high-impact engagement to enable rapid deployment of automation testing without long-term commitments.

Best Suited For:

- Financial institutions that are beginning their digital transformation journey can quickly integrate automation into their existing processes.

- Banks that look to validate automation benefits before a larger-scale rollout.

- When a bank needs automation for a specific process or application module, such as mobile banking, transaction processing, or risk assessment.

- Those that require rapid results with a shorter engagement period and lower initial investment.

2. Accelerate Package: Scalable, Continuous Automation for Large Banks

The Accelerate Package is a comprehensive, ongoing managed service designed for banks that require a continuous and scalable approach to automation. It is particularly beneficial for large financial institutions that have complex application landscapes and need frequent updates and releases.

Key Features:

- Comprehensive Testing Frameworks: Includes all the industry-standard frameworks supported in the KickStart Package (Katalon, Playwright, Cypress, and Selenium).

- 100+ Automated Test Cases Implemented Monthly: Continuous expansion of test coverage across critical banking functionalities.

- Monthly Managed Service: Ongoing support for automated test suite development and maintenance, ensuring that the test automation framework remains up-to-date and adapts to changes in the banking application landscape.

- 3-Month+ Duration: Designed for long-term engagement, allowing banks to scale their test automation strategy while maintaining system reliability and compliance.

Best Suited For:

- Enterprises handling high transaction volumes monthly and complex digital services require ongoing automated testing to maintain stability.

- Banks and financial institutions subject to strict regulatory compliance requirements can use continuous automation to ensure adherence without manual overhead.

- Banks seeking long-term cost savings on testing.

Both packages offer robust, reliable solutions that can dramatically improve testing efficiency, reduce manual errors, and ensure high software quality. By selecting the package that best fits your institution’s size, complexity, and strategic goals, you can accelerate digital transformation and maintain a competitive edge in an increasingly digital world.

How KMS Helps Banks Maximize ROI with the Right Test Automation Packages

KMS Solutions specializes in delivering tailored test automation packages that enable banks to maximize their ROI on test automation through enhanced software quality and accelerated release cycles.

- Expertise in Banking Systems: KMS possesses deep industry knowledge, understanding the unique challenges banks face, and offers solutions that address specific pain points.

- 300+ Skilled Testing Professionals: Our testing professionals offer a wide array of test automation testing services, including functional and performance testing, API testing, mobile app testing, and regression testing. By automating these processes, banks can achieve up to 90% test coverage, ensuring robust product quality and reliability.

- 50+ Custom Automation Frameworks: We’ve built many custom automation frameworks tailored to different banking needs. The pre-configured framework can accelerate testing implementation, reducing the time and costs associated with building automation solutions from scratch.

- Over 500,000 Automated Test Cases: Our test cases allow banks to eliminate repetitive manual testing tasks and significantly reduce test execution time.

Investing in KMS’s test automation packages ensures faster releases, lower testing costs, and a seamless banking experience for customers. Connect us today for the exclusive offer!