Recent years saw the insurance industry shifting towards mobile-first technologies. This transformation has been primarily driven by the multitude of benefits that mobile apps offer to insurance agencies, including heightened customer satisfaction, cost reduction, and accelerated growth.

With the global insurtech market projected to reach a staggering $39.44 billion at a CAGR of 30.7%, as per GlobeNewswire, the industry has emerged as a prominent player in the ever-evolving digital business landscape. On the other hand, in the Q1 2023, funding for the insurtech sector achieved a noteworthy $1.39 billion, marking a substantial 37.6% increase from the previous quarter. According to Gallagher Re’s latest report, although the deal count remained steady, there is a 25.3% increase in the average deal size.

These findings indicate the continuous expansion of the insurtech industry, presenting an enormous opportunity for businesses to enter this thriving market. If you are someone who is interested in building an insurance mobile app to join the industry, this blog is for you. Here, we provide great insights into the process of developing and launching an insurance mobile app. So, without further ado, let’s delve right into it

Different types of insurance apps

When it comes to insurance apps, there are two primary categories to consider: agent-focused apps and customer-focused apps. Each type serves a specific purpose, and understanding their distinctions is essential. Here’s an overview of these two categories of insurance apps

Insurance apps for consumers

This application is designed to cater to the specific requirements of insurance policyholders by providing them with a platform where they can conveniently access insurance offerings, seek information, provide feedback on products, and avail customer support services.

The integration of push notification and in-app pop-ups empowers insurance service providers to effectively and promptly communicate information to consumers. In unfortunate incidents, clients can reach out to a representative who can provide swift instructions to mitigate the situation. Leveraging the app’s geolocation feature, agents can efficiently navigate their way to the scene when needed

Furthermore, the app employs caching and advanced data capture methods, enabling the insurance provider to analyze users’ behavioral patterns and offer personalized information. By delivering services that optimally address individual needs, consumers can enjoy a heightened level of satisfaction and engagement with their insurance provider.

Insurance app for agents

This particular app type is highly suitable for startups seeking to develop customized applications that assist agents in efficiently managing insurance services within a unified platform.

With the mobile app, the insurers can build forms and leverage caching abilities to automate the collection of user-specific information, eliminating the need for traditional paper-based approaches. Applications can also streamline insurance-related processes, including policy management, customer relationship management, claim processing and more.

Additionally, these mobile apps can be programmed to gather client reviews, which provide valuable insights to agents regarding customer pain points and areas for improvement.

By utilizing insurer apps, agents are able to streamline their tasks, allowing them to focus primarily on high-reward processes. This increased efficiency and concentration on value-added activities can significantly boost their overall productivity, leading to enhanced performance and outcomes.

Steps to develop insurance application

The development process for a custom insurance app usually involve 4 stages

1. Discovery phase

During the discovery phase, a dedicated development team conducts an extensive information-gathering process to gain a comprehensive understanding of the insurance sector as a whole to further define the development process involved. The process comprises:

Market research

To formulate an effective customer-oriented strategy, it’s crucial to have a deep understanding of the target audience’s preferences and behaviours. This includes determining methods to attract users and envisioning how policyholders will interact with the application, identifying the specific needs it will fulfill, and uncovering the motivations that would drive customers to download the app

Competitor analysis

An equally significant aspect is conducting a thorough competitive analysis. This entails studying existing offerings in the insurance market that are similar to your own in order to determine your unique value proposition and recognize your competitive advantage. By evaluating the strengths and weaknesses of these offerings, you can shape a winning strategy and envision the desired outcome of your final product.

When crafting your strategy and product vision, it is crucial to consider not only the essential functionalities but also the emerging opportunities and recent trends. Features such as telematics, chatbots and AI/ML, self-service options, APIs, cybersecurity, and more should be taken into account. Incorporating these features into your app can effectively attract users and differentiate your offering from competitors.

Cost analysis

Given the capital-intensive nature of the insurance business, it’s vital to conduct a detailed cost analysis to proactively secure the funding required for the development, marketing and maintenance processes.

2. Business Model Decision

During this stage, it is pivotal to evaluate the advantages your insurance business can gain by developing a mobile application. Several common business models exist, including offering a free app with advertisements, implementing a freemium model that combines free and premium features, charging for the app upfront, providing subscription-based services, or exploring sponsorship opportunities.

Striking a balance between attracting users and generating revenue is of paramount importance. Various monetization methods offer different approaches to earning profits. Some methods allow for immediate monetization upon the application’s release, while others focus on gradually building an audience before implementing monetization strategies. It is crucial to consider your timeline and assess whether delaying monetization to establish a user base is a viable option.

It is imperative to develop and implement a monetization plan within the application prior to its release. However, it is worth noting that combining multiple monetization methods is possible, and you are not limited to utilizing only one. This provides the opportunity to optimize revenue generation while ensuring a valuable user experience.

3. Design Phase

The design phase of the insurance app provides a clear visualization of the app’s final appearance and functionality. The project would need to start with defining the requirements, strategize the UX by establishing the architecture and create a prototype incorporating key interface features

Fast prototyping plays a significant role at this stage. It enables mobile developers to experiment with ideas, identify optimal features, and assess the functionality and feasibility of a potential product. Developing a lightweight prototype is particularly important as it helps determine if the project has access to the necessary technologies right from the outset, ensuring alignment with the application’s goals.

4. Development & Testing Phase

In this stage, the functional UI/UX design obtained from the design phase is converted into a functional mobile app. This process involves combined efforts of both backend and frontend programmers.

Once the coding process is completed, quality assurance engineers conduct a series of comprehensive tests to identify any potential vulnerabilities in the app’s endpoints and user interfaces. These tests play a crucial role in ensuring the overall security and stability of the app, providing users with a secure and reliable experience.

5. App Deployment and Maintenance

Following the development phase, the next step is to release the platform on both the Apple App Store and Google Pay. It’s essential to collect user feedback right after the product launch. By carefully studying and implementing user feedback, you can ensure swift improvements and updates whenever necessary, allowing for continuous enhancement of the platform.

How do insurance providers benefit from mobile apps?

1. Meeting customer demands

Modern clients appreciate the ability to research, purchase the most appropriate insurance packaging and manage insurance accounts using their mobile devices. Since consumer demand will most likely continue rising, digital insurance platforms become the ideal ally for satisfying these needs by making customer interactions far more meaningful.

2. Building a competitive edge

Mobile applications combined with attractive services can easily provide a competitive advantage. Let’s take the health insurance industry as an example. By creating an insurance app that is user-friendly and provides various useful features like e-prescriptions, treatment history or appointment scheduler, health insurance providers can make their services much more appealing in the long run as such ecosystem services are highly demanded by clients.

In addition to facilitating communication between an organization and its consumers, insurance mobile apps can also automate some business processes, saving time for agents to find new clients. Finally, mobile insurance solutions allow insurance companies to reach a larger customer base by advertising their mobile insurance platform in related apps.

3. Increasing customer touchpoints and loyalty

Currently, one of the biggest challenges for insurance providers is to maximize the number of touchpoints with their clients. The average interactions between insurance clients and insurers are 2.7 per year and these communications concern mostly extending the insurance or reporting damages.

In such events, an engaging and convenient insurance app is much needed for meaningful customer interaction. Logically, if the app doesn’t disappoint the users in these ‘’moments of truth’’, they may as well be inclined to check out other functionalities too. A well-made mobile application can prolong customers’ attention span and stimulate them to try more products.

4. Customer data analytics

The insurance sector can benefit from mobile analytics which allows for unprecedented analysis. With apps, companies can easily gather more information on each client

Identity data: This involves name, date of birth, home/email address, phone number, and links to social media profiles like LinkedIn or Facebook.

Quantitative data: Transactional information like credit score, payment frequencies, bank account details, etc.

Descriptive data: Users might disclose property or car ownership along with educational background

Qualitative data: Subjective/behavioral details like hobbies and favorite color can be collected

Having such detailed information, corporations operating in the insurance market can obtain better insights into customer behavior and attitudes. Subsequently, insurers can enhance the quality of personalized offers and further improve the digital customer experience.

Types of mobile insurance apps

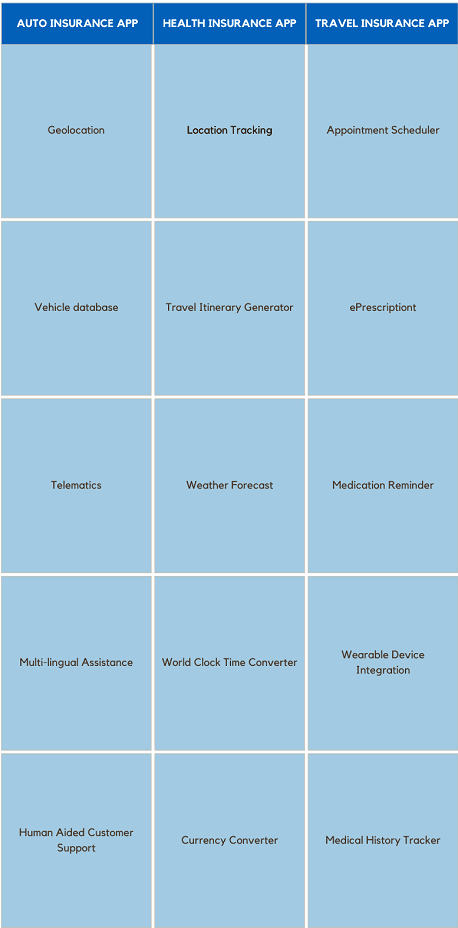

Mobile apps will differ based on the niche your insurance firm serves. Here are popular categories of mobile apps that can be built in the insurtech domain:

- Health insurance

- Car insurance

- Life insurance

- Travel insurance

App features that need to develop depend heavily on the insurance business types. Yet, there are still essential elements that can be seen in all these categories, regardless of which section of the insurance market your firm operates in. Let’s have a look at those.

Core features for successful insurance mobile apps

1. User panel

This is the opening page where details about the insured user are exhibited. It should be lean and clean together with clear call-to-action buttons. With a car insurance app, for instance, the profile page will show information related to roadside assistance, vehicle IDs, payment buttons and the ability to swap policies.

2. Policy details

This page presents information of policies, manners as well as the extent of an insurer’s benefits. Here, customers should be able to seek policies by chosen parameters, particularly if the insurance firm provides several options. Lastly, clients will surely value tailored recommendations – policies that suit them best depending on their earnings, health, premises, etc.

3. Quotes

This quote feature enables the app to fetch users’ data from its records and either directly present a policy price or connect clients to an insurance agent. With Big Data integration, insurance corporations can also pitch discounted prices or more benefits to consumers according to their regularity of exploring new policies.

4. File a claim

Building a claims-filing tab remains the most important stage of developing applications for the insurance industry. The run-around days to submit claims are long gone. Filling a claim in the event of an undesirable incident must be simple and easy. With that being said, uploading evidence should be as easy as taking a picture, either from the app scanner or the phone camera. It’s recommended that the entire procedure can be completed in a single page.

5. Payment gateway

It’s no argument that a payment gateway is extremely important for financial application development. The in-app payments shall accept payments from major service providers like MasterCard, Visa, Amex, etc. Furthermore, automated billing for EMIs or a one-click payment process should be incorporated.

6. Customer support

Chatbots are no longer exceptional. Automated answers serve as a quick fix for routine questions. But what about unplanned situations? You can’t expect a stranded client with a broken vehicle to rely on pre-programmed responses. Thus, a Request Callback or Connect with a Customer Service Representative option is highly recommended. Such in-app call capabilities fulfill the purpose of the app – a disaster-avoidance and quick reaction machinery.

7. Notifications

Insurance organizations, generally, don’t overlook chances to enter a new market sector. You will need a reason for giveaways and so do the clients for purchasing your products/services. Thus, send frequent push notifications reminding people of their outstanding balance, limited-time discounts as well as any new policies they can replace their current ones with.

8. Document Upload/Storage

How would the user submit their papers, let alone a picture, if the insurance app didn’t integrate it? The mobile application must not only support document upload from local file directories but also import from third-party services if necessary, such as emails

Besides those commonly found features in insurtech apps, here are a few in-app features for domain-specific areas at a B2C level.

How much does it cost to develop an insurance app?

There is no such thing as a one-size-fits-all solution when it comes to mobile app development. In fact, it varies widely depending on numerous components.

- App developer experience, expertise and rates: regarding app developers, price and experience usually go hand in hand. The more experienced, the higher salaries. Also, rates are determined by expertise – the specific technical skills an app developer is competent in.

- Choice of development platform: rates charged by developers might vary slightly depending on the target platform, whether it’s iOS, Android, or both.

- Type of mobile app development technologies: the tech tree you select as the base of your project of developing insurance app has a significant effect on the overall cost of the app. Selection ranges from web app, native app, hybrid app to cross-platform app and components-oriented JavaScript frameworks.

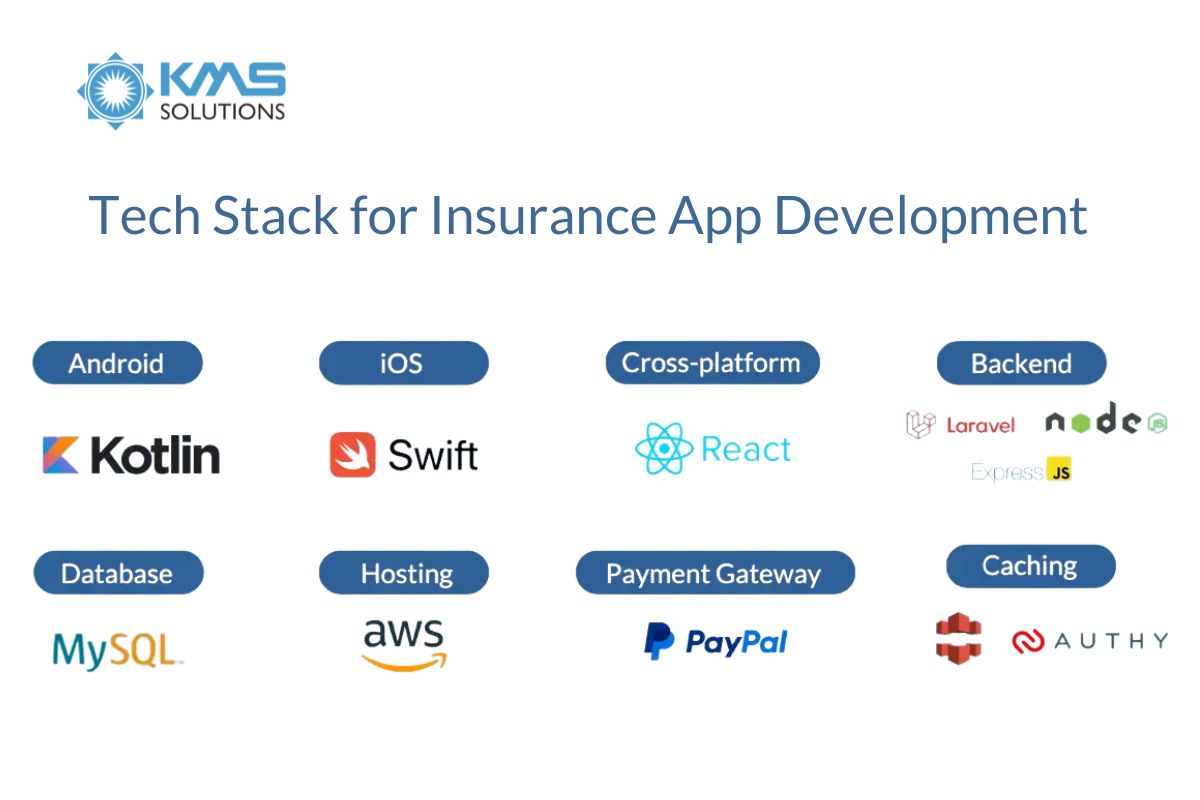

Tech stack to build an insurance app

The selection of libraries, frameworks, languages, development toolkits and programming methods heavily relies on the underlying platform chosen by the development team.

Innovative tech to elevate your insurance applications

In this section, we’ll provide you with a brief overview of the emerging technologies in insurance app development that can greatly enhance your app’s capabilities

Artificial Intelligence (AI)

Insurtech companies extensively leverage this technology to import and aggregate vast volumes of consumer data, enabling them to assess risks, streamline claims processing, and automate underwriting procedures. Artificial Intelligence (AI) powered tools play a crucial role in delivering a personalized user experience, expediting user verification, and detecting fraudulent activities.

For instance, a Chinese insurance company, Ping An, successfully implemented machine learning, resulting in a remarkable 57% increase in accuracy for identifying fraudulent claims within a year. This achievement translated into an astounding $302 million in savings.

Cybersecurity

To ensure the utmost protection of clients’ sensitive data, including personally identifiable information (PII), social security numbers (SSNs), driver’s licenses, credit cards, medical records, and more, it is crucial to integrate robust cybersecurity technologies into your insurance app.

Here are some essential cybersecurity tools that can fortify your insurance app against ransomware attacks, identity thefts, and cyber fraud:

- Multi-factor authentication (MFA)

- Cloud encryption

- Defensive AI

- Context-aware security

- Blockchain

- Manufacturer usage description (MUD)

- Behavioral analytics

- Extended detection and response (XDR)

- Zero Trust

IoT for telematics

Modern consumers are increasingly open to sharing significant data about their health, exercise routines, and driving habits in exchange for personalized insurance offerings and potential rate reductions. Insurers can leverage data collected from Internet of Things (IoT) sensors integrated into smart homes, wearable devices, and vehicles to gather this valuable information.

Regarding car insurance, IoT technology enables insurers to provide clients with two types of telematics programs: “pay-as-you-drive,” which calculates rates based on the number of miles driven, and “behavior-based,” which offers reduced insurance rates for safe and eco-friendly driving habits.

Furthermore, telematics tools assist insurance companies in reducing accident rates and maintaining their profitability. For instance, Traffilog, a web-based fleet management provider, asserts that by utilizing their IoT-powered technology, insurers can potentially decrease accident rates by 5% and double their profits.

How KMS Solutions Can Help with Your Insurance App Development

At KMS Solutions, we adopt lean business operations and a customer-centric approach to generate value for our clients using industry best practices and cutting-edge technologies. To help you build a top-tier mobile application, we provide digital technology consulting that offers innovative insights into market changes, helping you seize new opportunities.

With the implementation of Lean-Agile frameworks and scalable Cloud-native architecture, KMS Solutions is well-equipped to develop next-gen mobile apps that elevate your digital strategy. Our APIs and Microservices-based approach also enables seamless integration of legacy and new enterprise systems, ensuring frictionless alignment across your business and with your customers.

Conclusion

The days when an insurance mobile app alone could impress users are over. To truly succeed, your app must be an end-to-end solution, guiding customers through every stage of their insurance journey—whether purchasing a policy or filing a claim—right at their fingertips.

Partnering with the right mobile app development team is essential to bring this vision to life. With KMS Solutions, we help you analyze potential usage scenarios and create a comprehensive roadmap for your mobile insurance app. By doing so, you can ensure that your app meets customer needs, fosters loyalty, and provides a rapid return on investment.

If this opportunity resonates with you, connect with us to start your digital transformation journey today. Our business development consultant is ready to provide you with further insights and assist you in creating a successful insurance mobile app.