In today’s digital era, core insurance software is the cornerstone for driving efficiency, growth, and customer satisfaction in the insurance industry. The global core insurance software market is projected to grow at a CAGR of 8.5% from 2021 to 2028, reaching approximately $15 billion by 2028, driven by the increased adoption of digital-first strategies and a shift towards cloud-based solutions. The need for an agile, scalable, and customer-centric core system has never been greater as insurers face rising customer expectations, new regulatory pressures, and increasing competition from both traditional players and insurtech companies.

Core insurance systems must be aligned with digital insurance strategies to effectively support customer experience, operational efficiency, scalability, and compliance. Insurers looking to stay competitive must modernize their core systems to unlock new levels of performance, ensure compliance with evolving regulations, and provide personalized services at scale.

What is Core Insurance Software?

Core insurance software refers to the foundational systems that manage key insurance processes, including policy management, claims processing, underwriting, and billing. These systems serve as the foundation of an insurer’s operations, supporting key workflows and transactions that define the customer experience.

Modern core insurance software platforms extend beyond basic functionality, offering integrated, digital-first experiences that are increasingly essential in a customer-driven market.

Research from McKinsey shows that insurers who have modernized their core systems have seen operational costs decrease by up to 30%, while enhancing speed-to-market by over 40%. Transitioning from legacy systems to more modern platforms is critical for insurers seeking to enhance their agility, launch new products quickly using modern insurance software products, and leverage advanced technologies.

The Role of Core Insurance Software in Digital Transformation

Core insurance software plays a pivotal role in digital transformation by integrating with digital channels and ensuring seamless engagement across touchpoints. A recent survey found that 70% of insurance customers prefer to interact with their insurers through digital platforms. Modern core systems play a crucial role in enabling these interactions and supporting omnichannel engagement. For modern insurers, enabling customer-centric journeys involves leveraging core systems to support personalized products and services.

By incorporating real-time processing capabilities and self-service platforms, core insurance systems ensure that customers can access services whenever they need them, without friction. Integration with digital channels, such as mobile apps and online portals, is essential for delivering the omnichannel experiences that today’s policyholders expect.

Top Core Insurance Software Platforms Compared

KMS Solutions: The Digital Innovation Leader

KMS Solutions distinguishes itself in the insurance software market through its comprehensive approach to digital transformation and customer experience. Their core insurance platform excels in providing tailored solutions that combine robust functionality with innovative features. The platform’s modular architecture allows insurers to select and implement specific components based on their needs, from policy administration to customer engagement tools.

What sets KMS Solutions apart is their deep expertise in integrating advanced technologies like artificial intelligence and machine learning into core insurance operations. Their platform offers unique features such as:

- AI-powered underwriting automation

- Real-time data analytics and reporting

- Advanced customer engagement tools

- Seamless multi-channel integration

- Customizable workflow automation

Guidewire InsuranceSuite: Insurance software platforms

Guidewire InsuranceSuite stands as one of the most trusted platforms in the insurance industry, serving over 300 Property & Casualty (P&C) customers worldwide. The platform excels in providing end-to-end insurance processes across all business lines. Its unified approach combines policy administration, billing, and claims management into a seamless ecosystem. What sets Guidewire apart is its comprehensive coverage of the entire insurance lifecycle, from product definition to claims servicing. The platform’s strength lies in its robust market presence and proven track record in handling complex insurance operations.

Duck Creek Suite: Insurance software platforms

Duck Creek Suite has revolutionized the insurance software landscape by addressing a critical industry challenge: system fragmentation. The platform’s unique value proposition lies in its single-point-of-change architecture, where modifications made in one area automatically reflect across the entire ecosystem. This integrated approach significantly reduces maintenance costs and eliminates inconsistencies across different business functions. Duck Creek’s end-to-end visibility and intersystem balancing capabilities make it particularly attractive for insurers seeking operational efficiency and transparency.

Insurity Sure Suite: The Speed-to-Market Champion

Insurity’s Sure Suite distinguishes itself through its rapid deployment capabilities and cloud-native architecture. The platform enables insurers to launch new products in as little as 30 days, setting it apart in an industry where speed-to-market is crucial. Its comprehensive suite includes seven integrated products, from policy management to AI-assisted underwriting. The platform’s ability to reduce risk assessment time by 50% and accelerate claims processing by up to 75% demonstrates its focus on operational efficiency.

Majesco P&C Intelligent Core Suite: The AI Innovator

Majesco’s platform stands out for its sophisticated integration of artificial intelligence and machine learning capabilities. Built specifically for P&C insurance providers, the suite empowers insurers to optimize operations while enhancing customer experiences. The platform’s strength lies in its API-first architecture and pre-built content designed with industry best practices. Majesco’s focus on digital transformation and scalability makes it particularly suitable for insurers looking to modernize their operations.

ALIP (Accenture Life Insurance Platform): The Digital Transformation Expert

Accenture’s Life Insurance and Annuity Platform (ALIP) focuses on modernizing life insurance operations through advanced digital capabilities. Recognized by Gartner for excellence in individual business onboarding and new product development, ALIP excels in automation and ecosystem partnerships. The platform’s cloud-first approach and robust digital user support have made it a preferred choice for insurers prioritizing digital transformation.

Comparative Analysis – Insurance Software Platforms

| Platform | Core Strengths | Digital Innovation | Implementation Flexibility | Customer Experience Focus |

|---|---|---|---|---|

| KMS Solutions | High customization, Modern architecture, Local expertise | Advanced AI/ML integration, Real-time analytics | Modular approach, Scalable implementation | Strong focus on digital engagement, Omnichannel capabilities |

| Guidewire | Enterprise-scale operations, Comprehensive coverage | Established integration patterns | Extensive but complex | Traditional with digital additions |

| Duck Creek | System integration, Single point of change | Cloud-native capabilities | Moderate complexity | Strong policy management focus |

| Insurity | Rapid deployment, Efficiency | AI assistant features | Quick implementation | Process automation emphasis |

| Majesco | AI innovation, P&C specialization | Strong API architecture | Cloud-focused deployment | Digital transformation oriented |

| ALIP | Life insurance focus, Automation | Cloud-first approach | Moderate to complex | Digital user support |

The future of insurance core systems lies in their ability to adapt to changing market needs while maintaining robust operational capabilities. KMS Solutions’ focus on innovation and digital transformation, combined with their understanding of local markets, positions them well for emerging insurance industry needs. Their platform offers a compelling alternative to traditional providers, particularly for organizations seeking a balance between comprehensive functionality and innovative digital capabilities.

For insurers evaluating these platforms, KMS Solutions presents a strong value proposition, especially for those prioritizing digital transformation, customer experience, and scalable growth in the Asia-Pacific region. Their combination of technical expertise, local market understanding, and innovative approach makes them a compelling choice for modern insurance operations.

Insurance Software Trends: Digital Transformation in 2025

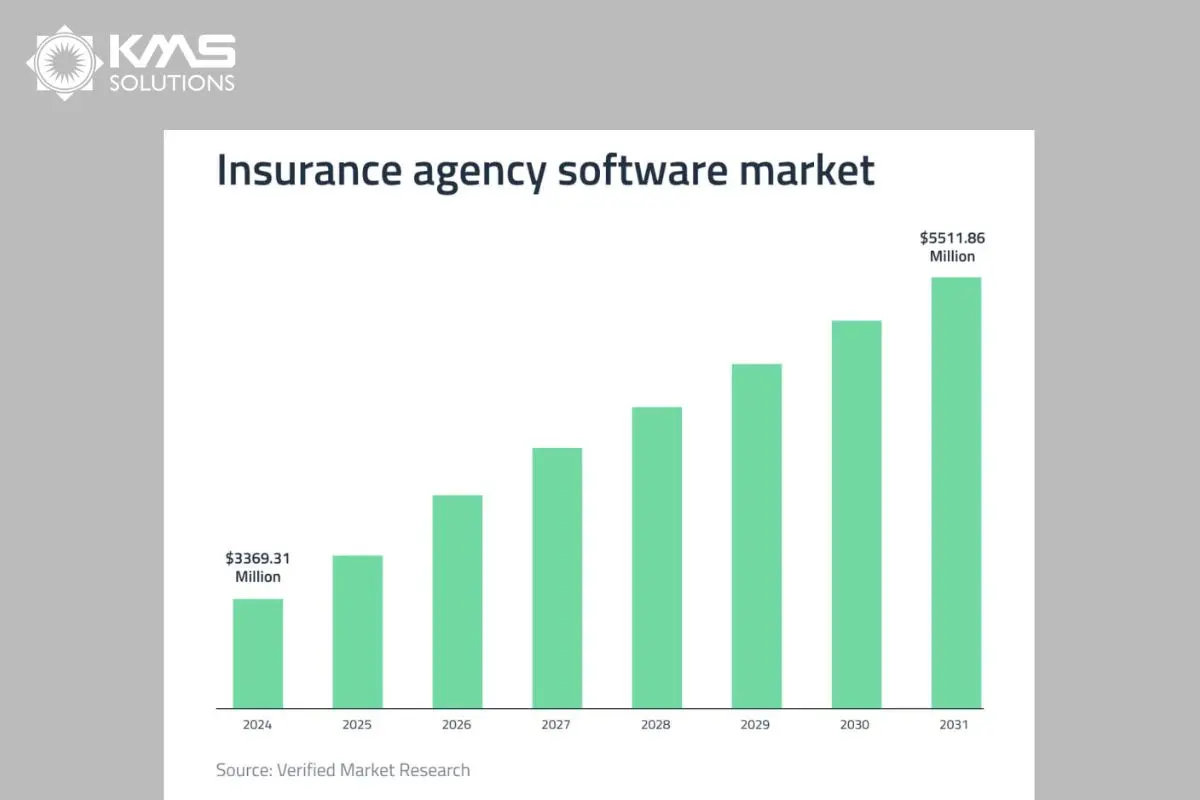

The insurance industry is experiencing a profound digital transformation, with technology reshaping how insurers operate and serve their customers. As the insurance software market continues its explosive growth, projected to reach $5511 million by 2031, several key trends are emerging that define the future of insurance technology.

The Digital Communication Revolution

The insurance sector is witnessing a fundamental shift from traditional communication channels to digital platforms. Modern policyholders increasingly prefer seamless digital interactions over conventional methods. Insurance companies are responding by developing comprehensive digital ecosystems that include mobile applications, web portals, and AI-powered chatbots. These digital channels not only provide instant service but also reduce operational costs by minimizing the need for human intervention in routine transactions.

Automation and Artificial Intelligence

The days of paper-heavy insurance processes are rapidly fading. Advanced technologies, particularly artificial intelligence and machine learning, are automating complex insurance operations. For instance, Optical Character Recognition (OCR) technology is revolutionizing document processing by automatically extracting and processing information from digital documents. Similarly, AI-powered image recognition tools can now assess damage claims by analyzing photographs submitted through digital channels, significantly speeding up the claims process.

Customer-Centric Innovation

Insurance software is increasingly focused on enhancing customer engagement through innovative features. Modern insurance platforms now offer unique capabilities such as digital wallets for insurance policy cards, telemedicine integration, and preventive medicine modules. These features transform insurance from a purely protective service into a comprehensive wellness and lifestyle tool, creating more touchpoints with customers and improving retention rates.

Data-Driven Decision Making

Insurance software is becoming more sophisticated in its use of data analytics. Modern platforms incorporate advanced analytics capabilities that help insurers make more informed decisions about risk assessment, pricing, and fraud detection. This trend is particularly evident in underwriting processes, where AI-driven analytics can assess risk factors more accurately and quickly than traditional methods.

Integration and Ecosystem Development

The future of insurance software lies in creating seamless ecosystems that connect various stakeholders – from customers and agents to healthcare providers and third-party services. Modern insurance platforms are being designed with robust integration capabilities, allowing them to connect with multiple systems and services while maintaining data consistency and security.

The Road Ahead – Insurance Software Platforms

As we look to the future, the evolution of insurance software will likely continue to be driven by customer expectations and technological advancement. The successful insurance companies of tomorrow will be those that embrace these digital trends while maintaining the personal touch that has always been central to the insurance industry.

These transformations are not just about adopting new technologies; they represent a fundamental shift in how insurance companies operate and serve their customers. As the industry continues to evolve, we can expect to see even more innovative solutions that make insurance services more accessible, efficient, and customer-friendly.

Key Elements of Core Insurance Software

Before diving into the details, let’s explore the key functions of core insurance software, which are essential for optimizing operations, ensuring accuracy, and enhancing flexibility to meet the evolving demands of the insurance industry.

Insurance Policy Management

This component is responsible for overseeing the full lifecycle of an insurance policy. It includes tasks such as policy creation, modifications, renewals, and cancellations. The system helps insurers manage vital details like coverage terms, effective dates, and policyholder information, ensuring everything is well-documented and up-to-date. Efficient policy management supports operational flow and ensures accuracy in policy data handling.

Claims Processing and Administration

Claims processing is at the heart of customer experience in insurance. This function automates and manages the entire journey of a claim, from initiation to final settlement. The system evaluates claims, processes assessments, and releases payments. Additionally, it helps insurers track and manage loss reserves, providing a clearer view of financial impacts. By streamlining claims workflows, insurers can reduce errors and improve service speed.

Risk Evaluation and Underwriting

Underwriting management evaluates the risk associated with insuring individuals or assets. It involves analyzing a range of factors like the applicant’s personal details, previous claims, and external risks (e.g., property condition, location). The system helps underwriters calculate appropriate premiums by leveraging historical data and predictive models. Automated underwriting tools enable insurers to make quick, data-driven decisions while maintaining profitability.

Premium Billing and Financial Oversight

Billing and financial management functionality handles all aspects of premium invoicing and payment collection. It ensures that premiums are calculated accurately and that payments are processed timely. This component also plays a critical role in financial tracking, including generating statements, auditing transactions, and ensuring compliance with both internal policies and regulatory requirements. It provides transparency and helps insurers manage their financial health effectively.

Data Insights and Performance Analytics

This component empowers insurers to extract actionable insights from their data. By analyzing performance metrics, such as claims frequency, customer retention, and underwriting efficiency, the system provides powerful tools for strategic decision-making. With business intelligence features, insurers can track operational performance, identify trends, and optimize strategies. Real-time analytics allow insurers to make informed decisions and adapt quickly to changing market conditions.

Document and Information Control

Document management is critical to organizing and safeguarding the vast array of information related to insurance policies. This function ensures that all policy documents, claims records, and financial statements are securely stored and easily accessible. It streamlines workflows by providing a centralized repository for documents and facilitating fast retrieval when needed. A robust document management system enhances compliance, boosts productivity, and reduces the risk of missing or misplaced files.

The Strategic Value of Core Insurance Software

The significance of core insurance software cannot be overstated. It provides substantial benefits to insurers, policyholders, and the entire insurance ecosystem, ensuring streamlined operations, compliance, and adaptability in a rapidly changing industry.

Maximizing Operational Efficiency

Core insurance software is instrumental in streamlining operations by reducing manual workflows and automating routine tasks. This leads to enhanced efficiency and productivity, allowing insurers to deploy their resources more strategically. According to a McKinsey report, insurers leveraging automation can increase productivity by up to 40%, underscoring the value of core software solutions in optimizing operations (McKinsey & Company, 2023).

Empowering Data-Driven Decisions

Data is the backbone of the insurance sector. Core software manages vast datasets securely and leverages data analytics for actionable insights, trend detection, and informed decision-making, positioning insurers to make more strategic choices. A report by PwC highlights that insurers using advanced analytics experience a 30% increase in underwriting accuracy (PwC, 2022). This makes core insurance systems an essential component for maintaining a competitive edge.

Ensuring Compliance and Mitigating Risk

The insurance industry is governed by stringent regulatory frameworks. Core systems are critical in helping insurers maintain compliance with constantly changing regulations, thereby reducing risks related to non-compliance and potential penalties. Gartner’s recent research indicates that insurers using compliance-focused core systems have seen a 20% reduction in regulatory penalties (Gartner, 2023).

Elevating Customer Experience

Effective core insurance software significantly enhances the customer experience. Policyholders benefit from faster claims processing, accurate policy information, and responsive support—contributing to increased customer satisfaction and loyalty. A study by Deloitte found that insurers who adopted modern core systems experienced a 25% improvement in customer satisfaction metrics (Deloitte, 2023). This highlights the direct correlation between technological investment and positive customer outcomes.

Adaptability as a Competitive Advantage

Insurance is an ever-evolving industry. Core insurance software must adapt to changes, whether by incorporating new product offerings, integrating emerging technologies, or aligning with shifting market needs. Accenture points out that adaptability is key for insurers, with 70% of industry leaders citing software flexibility as a crucial factor in responding to market demands (Accenture, 2022).

Navigating the Digital Transformation

The insurance sector is undergoing a digital transformation led by insurtech advancements. Modern core insurance systems are increasingly cloud-based, enriched with artificial intelligence, and equipped with advanced API integrations for seamless connectivity with third-party solutions. These capabilities help insurers remain competitive, optimize their internal processes, and address the evolving demands of digital-native customers. According to Forrester, insurers leveraging cloud-based solutions can reduce IT costs by up to 30%, while enhancing system scalability and reliability (Forrester, 2023).

CoverGo: Revolutionizing Core Insurance Systems

CoverGo is a digital cloud-based core platform designed to either integrate with or replace existing systems. By adding a layer of digital modernity to insurers’ current processes, CoverGo facilitates a seamless upgrade path, enabling insurers to optimize efficiency without significant operational disruption. Its comprehensive suite of features includes AI-driven analytics, ensuring that insurers can access real-time data to make informed decisions and improve customer outcomes.

See CoverGo in Action

Book a demo today to explore how CoverGo can enhance your core system, foster business growth, and save costs in the process. Let us help you adapt to the evolving insurance landscape and stay ahead of industry trends.

Challenges in Core Insurance Software Transformation

- Integration with Legacy Systems: Legacy systems are often deeply embedded in an insurer’s operations, making integration complex and requiring careful planning to minimize disruption.

- Data Migration Complexity: Moving data from legacy systems to modern platforms requires meticulous attention to data accuracy and integrity, making it a resource-intensive process. Data migration typically accounts for 30-40% of the total cost of a core system modernization project, with migration timelines ranging from 6 months to over a year, depending on data volume and legacy infrastructure.

- Data Security and Privacy: Ensuring robust data protection and compliance with privacy regulations is critical when modernizing core systems, especially given the sensitive nature of insurance data.

- Regulatory Challenges: Navigating changing regulatory landscapes is an ongoing challenge that requires flexibility and agility in system capabilities.

- Cost and Resource Requirements: The cost of transformation, including investments in new technologies, personnel training, and system integration, can be significant, requiring clear financial planning and justification. The total cost of modernizing core insurance software can range from $5 million to $30 million, with 70% of insurers requiring 18-24 months to complete the transformation, depending on project scope and scale.

Key Success Factors for Core Insurance Software Transformation

Leadership and Vision: Executive buy-in and a clearly defined digital vision are essential for successful transformation. Leaders must champion change and align the transformation with broader organizational goals.

Phased vs. Big Bang Approach: A phased approach allows for gradual improvements and reduced risk, while a big bang transformation can yield quicker results but carries higher risks. According to PwC, phased approaches to core insurance transformation have a 70% higher success rate compared to big bang transformations, primarily due to reduced risk and better change management. Choosing the right strategy depends on the insurer’s risk appetite and resource availability.

Technology Partnership: Selecting the right technology partner can make or break the transformation process. Insurers should work with partners who have expertise in insurance technology, a deep understanding of compliance, and a track record of successful implementations.

Change Management: Training staff, managing stakeholder expectations, and maintaining clear communication are vital components of change management. Ensuring that everyone understands the goals and benefits of the transformation is key to its success.

Future Trends in Core Insurance Software

The landscape of core insurance software is evolving rapidly, with several key trends that will shape the industry in the coming years:

Cloud-Native Solutions and Flexibility

Cloud-native platforms are becoming the backbone of modern core insurance software. The shift towards the cloud offers greater scalability, cost-efficiency, and the ability to scale operations quickly. Cloud infrastructure allows insurers to innovate faster, integrate more easily with external services, and manage data more securely, providing a significant edge in an increasingly competitive market.

Low-Code and No-Code Platforms: Accelerating Innovation

Low-code and no-code platforms are emerging as essential tools in the insurance industry. These platforms enable insurers to build and modify applications rapidly without requiring deep technical knowledge. This democratization of application development speeds up innovation and reduces reliance on specialized IT teams. As a result, insurers can quickly adapt to market needs, create personalized products, and deploy solutions faster, significantly enhancing agility.

API-Driven Ecosystems

APIs are at the heart of a more interconnected insurance ecosystem. Core systems are increasingly being built with open API architectures that allow seamless integration with third-party technologies and platforms. This enables insurers to enhance their offerings with minimal disruption, rapidly integrate new services, and improve customer satisfaction by providing a more comprehensive, connected experience.

Artificial Intelligence and Automation

The use of AI and automation is growing in insurance operations, from underwriting and claims management to fraud detection and risk assessment. AI-driven systems can analyze vast amounts of data to make better predictions, automate repetitive tasks, and improve overall decision-making. By leveraging machine learning, insurers can anticipate customer needs, optimize processes, and provide personalized services at scale.

Personalization Through Data Analytics

With the increasing availability of data, insurance companies are moving towards a more customer-centric approach. By utilizing advanced analytics, insurers can better understand their customers’ behaviors and preferences. This data-driven insight allows for the creation of more personalized products and services, tailored pricing models, and enhanced customer engagement. The trend towards personalized insurance offerings helps insurers boost customer loyalty and improve retention rates.

Greater Emphasis on Cybersecurity

As insurers continue to digitize their operations, protecting sensitive customer data becomes a higher priority. With increasing reliance on digital channels, cybersecurity measures must evolve to safeguard against new types of threats. Advanced encryption, secure APIs, and real-time threat detection systems are essential to ensure the integrity and security of insurance data.

Simplification of the Insurance Process

Consumers are seeking greater simplicity in their insurance experiences. Insurers are responding by adopting tools and platforms that streamline processes such as claims handling, policy management, and customer interaction. The focus is on making insurance easier to understand and more accessible to consumers, driving increased customer satisfaction.

These trends emphasize a strong move towards more flexible, agile, and technology-driven core systems. By embracing these innovations, insurers can remain competitive, improve their operational efficiency, and deliver better outcomes for their customers.

Conclusion

Core insurance software transformation is a critical enabler of digital transformation for insurers. It plays a central role in enhancing operational efficiency, driving innovation, and providing the agility needed to adapt to changing customer needs and regulatory requirements. The journey to a future-ready core system is not without challenges, but the benefits far outweigh the risks, making it a strategic imperative for insurers.

Partnering with experienced technology providers like KMS Solutions can significantly ease this transformation journey. KMS Solutions specializes in core insurance modernization, offering expertise in cloud migration, API integration, and customer-centric solutions to help BFSI institutions thrive in the digital era.

To explore how KMS Solutions can assist in your transformation, explore our Insurance Software Development Services.