In the highly competitive banking sector, offering customers seamless, secure, and efficient payment options can give your business a competitive edge. But what technology lies behind these smooth transactions?

The answer is found in Payment Gateway API Integration – Technology enabling banks to process payment information, authorize transactions, and ensure funds are transferred safely. This article today will take you inside the world of Payment Gateway APIs, offering a comprehensive look at what they are, how they function within the financial sector, and the advantages they bring to both banks and their customers.

1. What is a Payment Gateway API Integration?

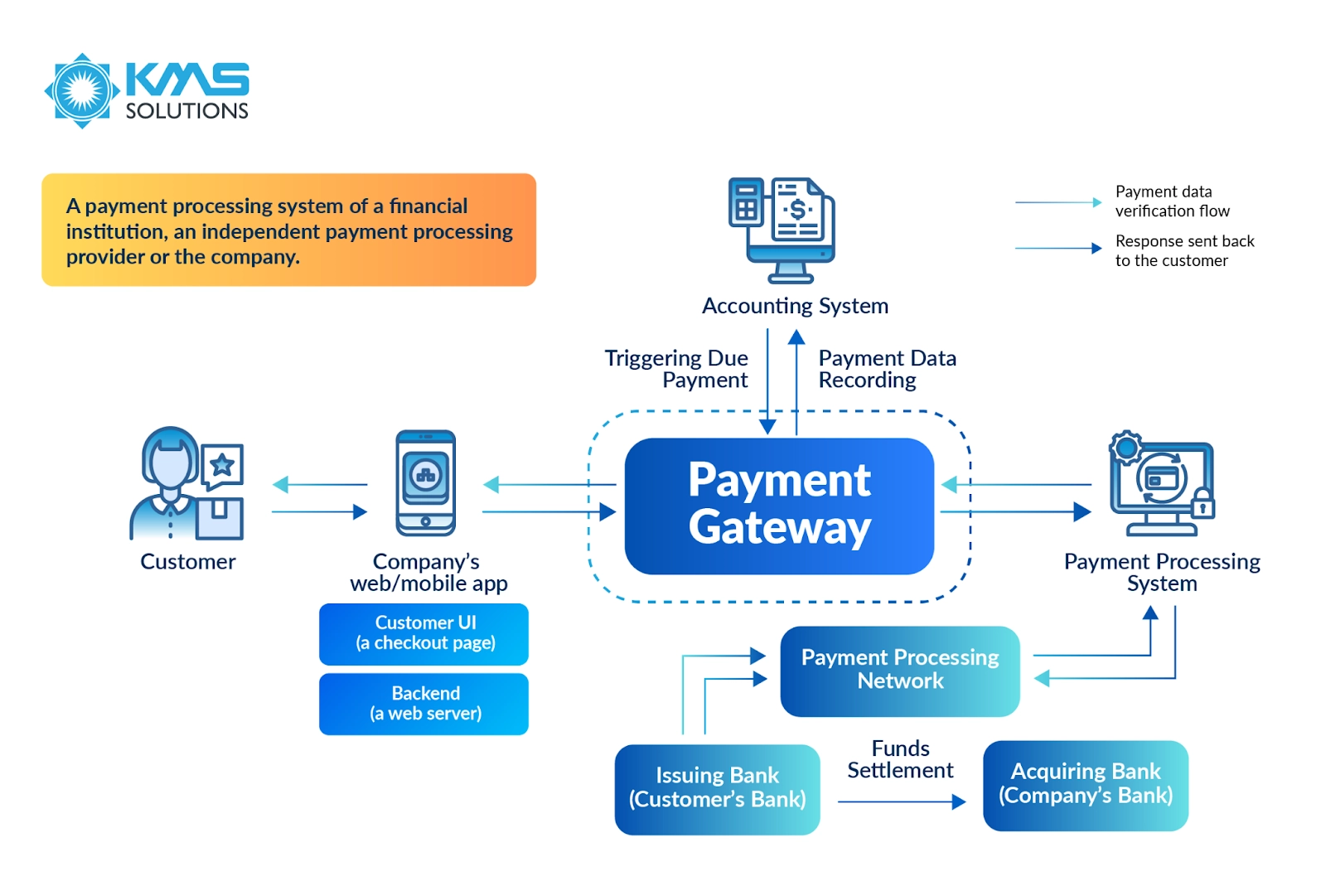

A payment gateway API is a collection of protocols that enable developers to incorporate payment processing features into their applications. It serves as a bridge between business software and the financial institutions handling the transaction, facilitating the authorization and processing of payments.

During an online transaction, the payment gateway API integration securely transfers payment details—like credit card numbers or digital wallet information—from the website or app. The API then assists in the authorization process by enabling the payment processor to validate the transaction, ensuring factors like sufficient funds and the authenticity of the card are verified.

2. How Does Payment Gateway API Integration Work?

At its core, integrating a payment gateway API is akin to establishing a high-security financial conduit that facilitates smooth transactions between customers, merchants, and banks. This process can be completed in the following steps:

2.1 Initialization

The payment process begins when a customer decides to make a purchase on a merchant’s website or mobile application. This phase, known as Initialization, starts with the merchant’s platform generating a payment request.

This request contains essential details such as the transaction amount, customer information (like name, billing address, and email), and the chosen payment method (e.g., credit card, debit card, or digital wallet). The merchant’s application then securely transmits this payment request to the payment gateway API. The secure transmission is typically ensured through encrypted connections, such as HTTPS, to protect the data during its journey.

2.2 Tokenization

Once the payment request reaches the payment gateway API, the process moves to Tokenization. This step is crucial for securing sensitive payment information.

Tokenization involves converting the customer’s sensitive payment data, like credit card numbers, into a unique, secure token. This token acts as a placeholder and is used throughout the transaction process instead of the actual payment details. The real payment information is stored securely by the payment processor or payment gateway, not by the merchant, thereby reducing the risk of data breaches and fraud.

2.3 Authentication

2.4 Authorization

In this phase, the API forwards the transaction details to the acquiring bank, which is the merchant’s bank. The acquiring bank then routes these details to the issuing bank, which is the customer’s bank. The issuing bank performs a series of checks, including verifying the availability of funds and assessing the transaction for potential fraud.

2.5 Transaction Processing

2.6 Settlement

3. What Can Payment Gateway APIs Do?

Next, what can payment gateway APIs do and benefit the system? We’ll delve into the comprehensive functionalities of payment gateway APIs which make any businesses succeed in the digital marketplace:

3.1 Process Payments

One of the primary functions of a payment gateway API is to facilitate the seamless processing of payments in real-time. When a customer initiates a payment, the API quickly communicates with the customer’s bank to authorize and complete the transaction. This instant processing confirms a smooth checkout experience, reducing cart abandonment rates and increasing overall customer satisfaction.

Moreover, the ability to process payments instantly provides businesses with immediate access to funds, which is critical for cash flow management. This efficiency extends beyond just card payments since payment gateway APIs can also handle bank transfers, mobile payments, and even cryptocurrency transactions, depending on the provider.

3.2 Secure Transactions

Payment gateway APIs incorporate strong security features to safeguard both businesses and their customers against potential risks. These APIs utilize encryption to check that sensitive data, such as credit card numbers and personal information, is transmitted securely over the internet.

Tokenization is an additional advanced security feature offered by payment gateway APIs. This process replaces sensitive data with unique tokens that can be used for transactions but are meaningless if intercepted by malicious actors.

3.3 Support Multiple Payment Methods

In today’s global marketplace, customers always want to have more than one payment method. Payment gateway APIs are designed to support multiple payment methods, including credit and debit cards, digital wallets like Apple Pay and Google Wallet, bank transfers, and more.

For businesses, supporting multiple payment methods can also lead to higher conversion rates. Different regions and demographics have varying payment preferences, and by accommodating these preferences, businesses can tap into new markets and reach a wider audience.

3.4 Support Recurring and Subscription Payments

The subscription-based business model is becoming increasingly popular. These APIs can be configured to handle recurring payments, allowing businesses to automatically charge customers on a regular basis for services such as subscriptions, memberships, or installment plans.

3.5 Provide Fraud Protection

Lastly, fraud prevention is a concern for any business handling online transactions, and payment gateway APIs are equipped with a variety of tools to protect against fraudulent activity. They include features such as fraud detection algorithms, which analyze transaction data in real-time to identify suspicious patterns that may indicate fraud.

For instance, payment gateway APIs can flag transactions from unusual locations, multiple payment attempts with different cards, or purchases that deviate significantly from a customer’s typical behavior. Catching these red flags early helps businesses to prevent fraudulent transactions from being processed.

4. Payment Gateway API Flexibility

Businesses that want to offer a seamless, personalized payment experience to their customers will need to look at the payment gateway API flexibility due to significant key benefits:

- Wide Integration Capabilities: Flexible APIs are structured to integrate with various platforms, CRM systems, and other business tools, enabling businesses to streamline their operations.

- Support for Multiple Payment Methods: A flexible payment gateway API integration supports a broad range of payment options, including credit and debit cards, digital wallets, bank transfers, and even alternative payment methods like cryptocurrencies.

- Customizable Payment Experiences: They allow businesses to create customized payment flows that match their branding and user experience goals.

- Scalability and Global Reach: As businesses expand, flexible APIs can easily scale to handle increased transaction volumes and support global operations, including multi-currency processing and compliance with international regulations.

- Reporting: Comprehensive reporting features in flexible APIs provide detailed insights into transaction data, allowing businesses to track performance, manage reconciliation processes, and gain valuable analytics to inform strategic decisions.

- Compatibility: A flexible payment gateway API ensures compatibility with a wide range of devices, operating systems, and payment platforms. This compatibility helps businesses reach a broader audience and provides a consistent payment experience across different touchpoints.

5. Factors to Consider for the Payment Gateway API

There are different aspects of payment gateway API that can significantly impact your operations, customer satisfaction, and overall business success. When selecting one, be mindful and carefully review these:

- Security Features: A top-tier payment gateway should offer a robust suite of security features. PCI DSS compliance is non-negotiable; it ensures the gateway adheres to the highest security standards for handling cardholder information. Tokenization is another consideration since it replaces sensitive payment details with a secure token.

- Ease of Integration: A gateway with well-documented APIs, including clear instructions and sample code, can significantly reduce the time and effort required for integration. Many providers offer SDKs and libraries in multiple programming languages, simplifying compatibility with your existing technology stack. Some payment gateways also provide plug-and-play solutions or pre-built plugins for popular e-commerce platforms like Shopify or WooCommerce.

- Fees for Transactions: Understanding the fee structure of a payment gateway helps you manage your business’s costs effectively. Most payment gateways charge a fee per transaction, which typically includes a percentage of the transaction amount plus a fixed fee. For instance, a common fee structure might be 2.9% + $0.30 per transaction. These fees can add up quickly, so it’s important to compare rates across different providers.

- Payment Methods Accepted: At a minimum, your payment gateway should support all major credit and debit cards, including Visa, MasterCard, American Express, and Discover. However, as digital wallets like PayPal, Apple Pay, Google Pay, and Samsung Pay gain popularity, especially for mobile transactions, it’s important that your gateway also supports these options. Depending on your target market, you may need to offer alternative payment methods.

- Customization Options: For businesses with unique requirements, the ability to create custom payment workflows—such as handling split payments, recurring billing, or managing subscriptions—can be invaluable. Additionally, if your business operates internationally, localization features that support multiple languages, currencies, and region-specific payment preferences are crucial for optimizing the customer experience.

- Customer Support: No one can win without reliable customer support, as any issues directly affect your revenue and customer satisfaction. Ideally, your payment gateway provider should offer 24/7 support. Additionally, understanding the average response time for support requests is important, as timely resolutions are vital to minimizing downtime and maintaining smooth operations. A payment gateway that also offers a vibrant user community, forums, and comprehensive online resources can empower you to troubleshoot independently.

6. Example API Calls with Payment Gateway APIs

To adapt the functionality for a trading platform handling sale and refund transactions, the API workflow would be modified to reflect the nature of financial transactions within a trading environment. Here’s an example of how the API calls can be structured:

1. Create a Trade Transaction

Endpoint: POST /v1/trades

Functionality: This API call initiates a new trade transaction. The trading platform sends the transaction details, including the trade amount, currency, and payment method information (e.g., bank account details), to the payment gateway. The API processes this information, tokenizes sensitive data, and returns a response with the transaction status and a unique transaction ID.

Example Trade Transaction Request:

{

"amount": 10000,

"currency": "USD",

"payment_method": {

"type": "bank_account",

"bank_account": {

"account_number": "9876543210",

"routing_number": "123456789",

"account_type": "savings",

"holder_name": "Robert Johnson"

}

},

"trade_details": {

"trade_type": "buy",

"asset": "AAPL",

"quantity": 10

}

}

Example TradeTransaction Response:

{

"id": "trade_567890123",

"status": "completed",

"amount": 10000,

"currency": "USD",

"trade_details": {

"trade_type": "buy",

"asset": "AAPL",

"quantity": 10

}

}

2. Cancel Trade Transaction

Endpoint: POST /v1/trades/{trade_id}/cancel

Functionality: Cancels a previously initiated trade transaction. The trading platform specifies the trade ID and the reason for cancellation. The API processes the request and updates the trade status accordingly.

Example Cancel Trade Request:

{

"reason": "User requested cancellation"

}

Example Cancel Trade Response:

{

"id": "trade_567890123",

"status": "cancelled",

"reason": "User requested cancellation"

}

3. Retrieve Trade Details

Endpoint: GET /v1/trades/{trade_id}

Functionality: Retrieves detailed information about a specific trade transaction using the trade ID. The API returns all relevant details, including trade status, amount, and trade specifics.

Example Retrieve Trade Details Request:

GET /v1/trades/trade_567890123

Authorization: Bearer <API_KEY>

Example Retrieve Trade Details Response:

{

"id": "trade_567890123",

"status": "completed",

"amount": 10000,

"currency": "USD",

"trade_details": {

"trade_type": "buy",

"asset": "AAPL",

"quantity": 10

}

}

7. How KMS Solutions Help Integrate the Seamless Payment Gateway API?

The market for payment gateway API providers is vast and diverse, requiring careful research to identify the best fit for your business needs. KMS Solutions offers comprehensive support for Payment Gateway API integration, ensuring secure and efficient payment solutions that meet the unique needs of each business.

By focusing on risk and compliance, KMS helps ensure that all transactions adhere to the latest regulatory standards, protecting businesses from potential legal and financial risks. Our integration also includes performance metrics and monitoring, allowing organizations to track and optimize transaction speed and reliability.

With support for international and multi-currency transactions, KMS enables businesses to expand their global reach while providing localized payment options. Additionally, our payment gateway API integration service ensures an intuitive and smooth user experience on the integrated front end, boosting customer satisfaction and retention.

By incorporating modern payment methods beyond traditional options, such as mobile wallets and cryptocurrencies, KMS equips businesses with the flexibility to cater to diverse customer preferences. Overall, KMS Solutions’ expertise in Payment Gateway API integration ensures a robust, secure, and user-friendly payment infrastructure that helps businesses scale and adapt to the changing financial environment.

FAQs

1. What is a payment gateway API?

A payment gateway API allows developers to integrate payment processing services into websites or mobile apps, enabling secure transactions.

2. Is integrating a payment gateway difficult?

3. How long does it take to integrate a payment gateway API?

Integration can take anywhere from a few hours to several days, depending on the complexity of your application and the payment gateway.