Neobank app development is transforming the banking sector, with traditional banks being overshadowed by digital-first alternatives. Neobanks, like those supported by KMS Solutions, offer internet-only financial services, eliminating the need for physical branches. By leveraging advanced technology, KMS Solutions enables banks to deliver superior, innovative neobanking experiences that are revolutionizing the financial industry.

1. What are Neobanks?

Neobanks, also known as digital-only banks, are financial technology firms that offer internet-only financial services without traditional physical branch networks. These banks operate solely online, utilizing advanced technology to provide a variety of banking services via mobile apps and web platforms. Neobanks offer a smooth and intuitive banking experience designed for tech-savvy consumers seeking convenience and innovation in their financial transactions.

The Importance of Neobanks in Modern Banking

Neobanks play a crucial role in the modern banking landscape by addressing the evolving needs of today’s consumers. They offer superior banking experiences by eliminating the need for physical branches, which significantly reduces operational costs. These savings are often passed on to customers through lower fees and better interest rates.

Furthermore, neobanks leverage advanced technologies like AI, ML, and RPA to offer personalized services, enhance security, and streamline operations. This focus on technology and customer experience has made neobanks a game-changer in the financial industry, setting new standards for what customers expect from their banking services.

2. The Rise of Neobanks

Historical Context and Evolution

Neobanks emerged in the early 2000s to meet the growing demand for more accessible and user-friendly banking services. Early pioneers like Ally Bank and Simple offered basic banking services without the overhead costs of physical branches, passing on savings to customers through lower fees and higher interest rates.

The 2008 global financial crisis further accelerated the shift towards neobanks, as consumers sought alternatives to traditional banks that offered greater transparency and efficiency.

By leveraging advancements in mobile technology, cloud computing, and data analytics, neobanks were able to provide seamless and personalized banking experiences that resonated with tech-savvy consumers.

Throughout the 2010s, neobanks experienced rapid growth due to the widespread adoption of smartphones and increasing consumer comfort with digital financial services. Prominent players such as Revolut, N26, Monzo, and Chime emerged, each specializing in various aspects of financial services.

The neobanking market has since expanded significantly, with its global market value projected to reach USD 394.6 billion by 2026, driven by cost-effective models and the rising demand for digital financial services. This evolution highlights technology’s impact on banking. (Wikipedia) (Jupiter Community) (PwC)

Key Drivers of Neobank Popularity

- Technological Advancements The rapid advancement of technologies such as artificial intelligence (AI), machine learning (ML), and Open Banking APIs has played a crucial role in the popularity of neobanks. These technologies enable neobanks to offer personalized services, enhance security, and streamline operations.

- Changing Consumer Preferences Modern consumers expect banking services to be as convenient and accessible as other digital services. Neobanks cater to these expectations by providing 24/7 access to banking services, real-time notifications, and user-friendly interfaces.

- Cost Efficiency: Neobank apps significantly reduce operational costs by leveraging digital infrastructure. This efficiency allows banks to offer lower fees and better interest rates, providing greater value to their customers.

3. Key Features of Neobank Apps

Electronic Know Your Customer (e-KYC)

Neobanks leverage electronic Know Your Customer (e-KYC) processes to authenticate users’ identities and verify documents remotely. This digital approach eliminates the need for physical branch visits, making the onboarding process faster and more convenient. e-KYC ensures compliance with regulatory requirements while enhancing customer experience through seamless and secure verification. By adopting e-KYC, neobanks can efficiently mitigate fraud and streamline customer acquisition.

Real-Time Notifications

Real-time notifications keep customers informed about their account activities, helping them stay on top of their finances. Whether it’s a transaction alert or a reminder to pay a bill, these notifications enhance financial management.

Advanced Security Measures

- Biometric Authentication: Neobanks use methods like fingerprint and facial recognition to secure account access. This technology provides an additional layer of security, protecting users from unauthorized access.

- Two-Factor Authentication: Two-factor authentication (2FA) adds another level of security by requiring users to verify their identity through a second method, such as a text message or an authentication app, in addition to their password.

Integrated Payments and Transfers

Neobanks excel in offering integrated payments and transfers, enhancing the convenience and efficiency of financial transactions. By integrating with multiple payment gateways, neobanks facilitate seamless peer-to-peer payments, enabling users to transfer funds instantly to friends and family. QR code payments are another standout feature, allowing quick and secure transactions by simply scanning a code, making it ideal for in-store purchases and online payments.

Additionally, neobanks integrate with mobile wallets, providing users with the flexibility to manage their finances and make payments directly from their smartphones. This integration ensures that users can access a wide range of payment options, making financial management more straightforward and efficient.

Account Management

Neobanks offer robust account management features that enhance user convenience and control over their finances. Users can easily check balances, view transaction histories, and transfer funds within a few taps on their mobile devices. This functionality ensures users have real-time access to their financial information, allowing for better financial planning and decision-making. The ability to manage accounts seamlessly, combined with features like integrated payments and transfers, positions neobanks as a superior alternative to traditional banking methods.

Read more: Custom Banking App Development that Boost Customer Engagement

4. Benefits of Neobank Apps

Convenience and Accessibility

Neobank apps provide 24/7 access to banking services, allowing users to access banking services anytime, anywhere with an internet connection. This accessibility is particularly beneficial for individuals who may not have easy access to physical bank branches.

Cost-Effectiveness

By operating without physical branches, neobanks can significantly reduce operational costs. Customers typically benefit from these savings through reduced fees and improved interest rates on savings accounts and loans.

Personalized Financial Services

With the help of AI and ML, neobanks can provide tailored financial recommendations and personalized services. For instance, AI-powered chatbots can provide personalized financial advice tailored to a user’s spending habits and financial objectives.

Global Reach and Multi-Currency Support

Many neobank apps support multiple currencies and international transactions, making them ideal for travelers, expatriates, and international business professionals.

5. 7 Steps to Develop a Neobank App

Step 1: Define Business Objectives

The initial step in developing a neobank app is to clearly define the business objectives. This involves identifying the primary goals, such as user acquisition, enhancing the existing user experience, increasing brand recognition, and promoting financial inclusion. A well-defined objective provides a clear direction for the development process.

Step 2: Market Research and Analysis

Conduct Thorough Market Research: Conduct thorough market research to understand the target audience, analyze competitors, and identify market trends. This step is crucial for gaining insights into user preferences and identifying gaps in the market that the neobank app can address.

Define the Core Features: Once the market research is complete, the next step is to define the core features of the neobank app. This includes essential functionalities such as account management, transaction capabilities, and security measures.

- Build the Core of Neobank: At the bare minimum, you will need API, card processing app, and back-office tools. These elements form the foundation of your neobank, ensuring smooth operations and effective service delivery.

- Neo-banking App Features: Incorporate essential and user-friendly features that enhance the banking experience. These should include savings accounts, credit/debit cards, payments, transaction history, budgeting tools, and investing options. These features cater to the basic and advanced financial needs of the users.

Define Unique Selling Proposition (US): Define the USP and identify the problems the neobank will solve for customers. For instance, if targeting millennials, create a bank that prioritizes features that enhance budgeting and offer real-time spending insights. Understanding what sets the neobank apart from traditional banks and other digital competitors is vital for its success.

Step 3: Prioritize Compliance and Security

Ensure Robust Regulatory Compliance: Developing a neobank app from scratch involves navigating the complex landscape of banking and fintech laws and regulations. Compliance is crucial for building trust and avoiding legal pitfalls. The required standards vary depending on the region where you plan to launch your neobank app. For instance:

- European Union: PSD2, GDPR, EBA regulations

- United Kingdom: FCA, OBIE, PRA regulations

- Australia: APRA, ASIC regulations

Adhering to these regulations ensures that your neobank system operates within legal boundaries, maintaining the integrity and trust of your customers and stakeholders.

To-Do List for Banks:

- Prioritize Compliance with Financial Regulations: Implement and maintain robust KYC (Know Your Customer) and AML (Anti-Money Laundering) processes. These are essential for preventing fraud, ensuring the legitimacy of transactions, and complying with regulatory requirements.

- Stay Informed About Data Protection Regulations: Ensure your neobank adheres to data protection standards such as PCI DSS (Payment Card Industry Data Security Standard). This compliance is crucial for safeguarding sensitive financial information and maintaining customer trust.

- Invest in Robust Cybersecurity Measures: Implement advanced cybersecurity measures to protect customer data from potential threats. This includes employing encryption, multi-factor authentication, regular security audits, and monitoring for suspicious activities. Investing in cybersecurity not only protects your customers but also enhances your neobank’s reputation for reliability and safety.

By prioritizing compliance and security, neobanks can build a solid foundation of trust and reliability, which is essential for gaining and retaining customers in the competitive digital banking landscape.

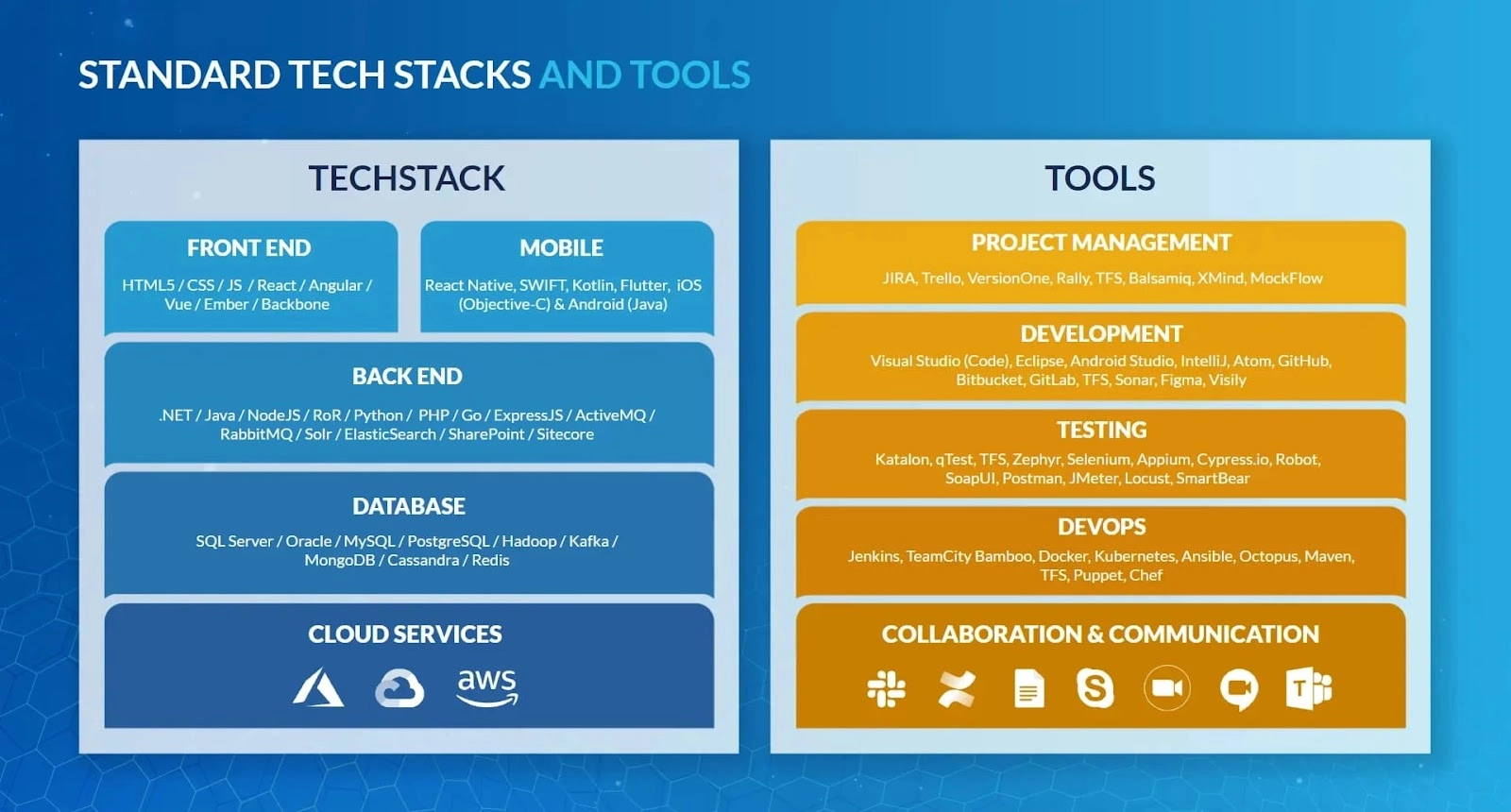

Step 4: Choosing the Right Technology Stack

Selecting the appropriate technology stack is crucial for the development of a robust and scalable neobank app. This involves choosing the right programming languages, frameworks, and tools that align with the app’s requirements.

- Front-end Development: HTML5, CSS, JavaScript, React, Angular, Vue, Ember, Backbone

- Back-end Development: .NET, Java, NodeJS, Ruby on Rails (RoR), Python, PHP, Go, ExpressJS, ActiveMQ, RabbitMQ, Solr, ElasticSearch, SharePoint, Sitecore

- Database Management: SQL Server, Oracle, MySQL, PostgreSQL, Hadoop, Kafka, MongoDB, Cassandra, Redis

- Cloud Services: Microsoft Azure, AWS, Google Cloud

These technologies and tools ensure that the neobank app is not only efficient and user-friendly but also scalable, secure, and compliant with industry standards. By leveraging these technologies, developers can create a comprehensive and competitive neobank app.

Step 5: Design and User Experience

The design phase emphasizes crafting an intuitive and visually appealing user interface. User experience (UX) design principles should guide the process to ensure that the app is easy to navigate and use.

Step 6: Development and Testing

By leveraging these technologies, your neobank software can ensure a robust, scalable, and secure development environment that accelerates the delivery of business value.

Cloud Computing

- Examples: Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP).

- How It Works: Cloud computing facilitates the hosting of your neobank’s infrastructure on remote servers, which ensures scalability, flexibility, and cost efficiency. This technology allows for efficient handling of large data volumes and rapid scaling to meet customer demands.

- Parameters for Selection: When selecting a cloud provider, consider aspects such as data security measures, compliance with regulatory standards, scalability options, and the ease of integration with existing systems.

API Integration

- Examples: RESTful APIs, GraphQL.

- How It Works: APIs enable seamless data exchange between your neobank app and other financial institutions, payment processors, or third-party services. This connectivity is crucial for enhancing customer service and operational efficiency.

- Parameters for Selection: Opt for APIs that offer robust security features, comprehensive and developer-friendly documentation, and compatibility with the programming languages used in your’ tech stack.

Artificial Intelligence (AI) and Machine Learning (ML)

- Examples: TensorFlow, PyTorch, scikit-learn.

- How It Works: AI and ML can be leveraged to detect fraud, automate customer support, and provide personalized financial insights. These technologies enhance the functionality and security of your neobank.

- Parameters for Selection: Assess the capabilities of different AI/ML libraries, the availability of pre-trained models, and their suitability for your specific applications.

DevOps Tools

- Examples: Jenkins, Docker, Kubernetes.

- How It Works: DevOps tools support continuous integration and continuous delivery (CI/CD), enabling more efficient and reliable software development and deployment processes. These tools help streamline workflows and reduce the time to market.

- Parameters for Selection: Key considerations include ease of use, scalability, and compatibility with your cloud infrastructure, which are critical for maintaining a robust development environment.

Rigorous testing is conducted to identify and fix any bugs or issues, ensuring that the app operates smoothly and securely. Here are some essential tests that QA team should perform to ensure a flawless neobank app:

- Unit-testing

- API testing

- Security testing (including penetration tests)

- User acceptance testing

- Regression testing

- Load testing (user base spikes)

Step 7: Deployment and Maintenance

Once the app is developed and tested, it is deployed to the market. Ongoing maintenance and updates are essential to keep the app secure, add new features, and address any user feedback.

6. Challenges in Neobank App Development

6.1 Regulatory Compliance

Compliance with financial regulations is one of the biggest challenges in neobank app development. Banks must ensure that they adhere to all relevant laws and regulations to avoid legal issues and build trust with users.

6.2 Data Security Concerns

Data security is critical in the financial industry. Neobanks must adopt strong security measures to safeguard user data and mitigate cyber threats. This involves utilizing encryption, secure authentication methods, and conducting regular security audits.

6.3 Building Trust with Users

Trust is essential in banking. Neobanks must diligently build and uphold trust with their users through transparent communication, dependable customer support, and consistently fulfilling their commitments.

7. Future Trends in Neobank Development Solutions

- Increased Adoption of AI and ML: The use of AI and ML in banking is expected to grow, enabling neobanks to offer more personalized services, enhance fraud detection, and improve decision-making processes.

- Expansion into New Markets: Neobanks are poised to expand into new markets, reaching underserved populations and providing innovative financial services to a broader audience.

- Enhanced Financial Inclusion: Neobanks have the potential to enhance financial inclusion by providing accessible and affordable banking services to individuals who are unbanked or underbanked.

Conclusion

Neobank app development is transforming the banking industry by offering convenient, cost-effective, and personalized financial services. Through advanced technologies and a focus on user experience, neobanks are reshaping the future of banking. As technology continues to evolve, neobank apps will become even more sophisticated, offering new features and capabilities that further enhance the customer experience and drive financial inclusion. The future of banking is digital, with neobanks at the forefront.

Looking for a reliable neobank development company to transform your banking experience? KMS Solutions offers cutting-edge technology and expert teams to create innovative digital banking solutions tailored to your needs. Partner with us to leverage advanced technologies like AI, ML, and Open Banking APIs for a seamless and personalized customer experience. Get in touch with KMS Solutions today and take the first step towards revolutionizing your banking services.