Finding the banking software development services is essential when you need to build custom software for your bank or fintech business. Yet, many BFSI organizations find that choosing the banking IT provider is more challenging than anticipated.

This guide delves into the critical factors to consider, such as technical expertise in banking IT, domain knowledge, and the ability to deliver secure and scalable banking software solutions. By understanding these elements, you can make an informed decision that aligns with your banking software development goals and requirements.

1. Factors to Keep in Mind When Choosing Banking Software Development Companies

Choosing the ideal banking software development firm is a crucial decision for financial organizations seeking to optimize their technology solutions. Here are some key factors to consider before making a final decision on engaging with the technology services provider.

1.1 Expertise in Financial Software Development

The most important thing to consider is the skill sets of the banking IT service providers you want to partner with. It’s worth ensuring the company is up to date with the latest technologies such as AI, Machine Learning, Open Banking API, RPA, and Cybersecurity to drive innovation and maintain a competitive edge in the financial sector.

Due to the ever-changing dynamics of the financial sector, banking software development firms need to grasp the present financial environment while also having the insight and analytical expertise to foresee future trends in the BFSI industry and make strategic decisions accordingly.

Your chosen partner should seamlessly integrate with your existing systems while also developing software that caters to your unique financial business requirements.

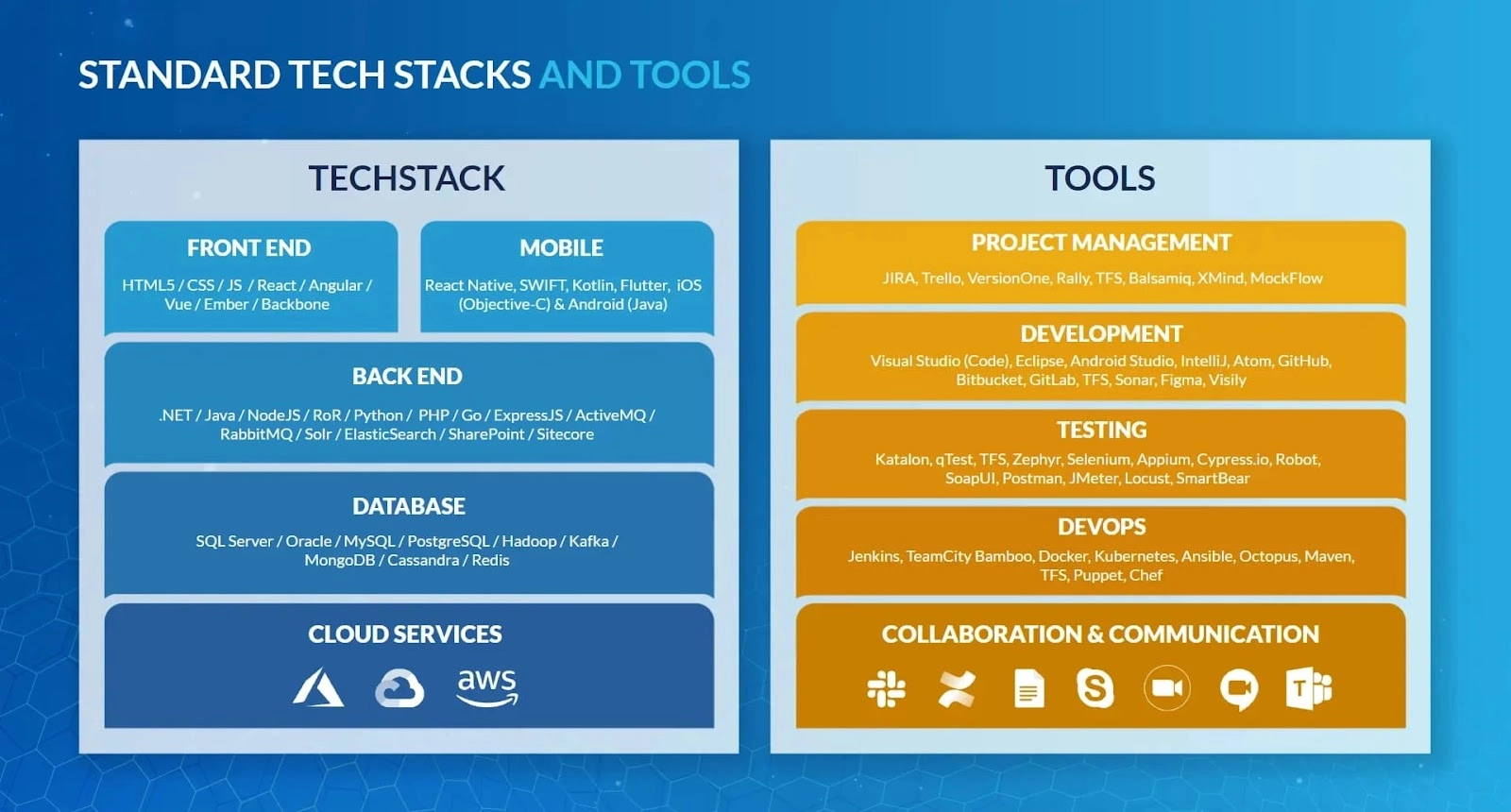

1.2 Technology Stack and Innovation - Software Development In Banking

Evaluate the company’s technology expertise and its approach to innovation. The banking industry is rapidly adopting advancements like AI/ML, cloud computing, cybersecurity, Open Banking APIs, and RPA. Choose an IT company with a robust technology stack tailored for banking and a commitment to staying current with the latest advancements.

A modern, adaptable technology stack ensures that the developed software is robust, scalable, and seamlessly integrates with other systems and technologies.

- Programming Languages: The company should be proficient in multiple programming languages such as Java, Python, C#, and Swift.

- Frameworks and Libraries: Look for expertise in popular frameworks like Spring for Java, Django for Python, and .NET for C#.

- Cloud Platforms: Ensure the company has experience with leading cloud platforms such as AWS, Azure, and Google Cloud, enabling them to offer scalable solutions

1.3 Security and Compliance - Software Development In Banking

Security is a prerequisite when it comes to banking and finance software development. Therefore, when hiring a banking software development company, you need to ensure they have excellent security measures in place to ensure the safety of data and financial transactions.

A reputable financial services software development company will openly share details about their security measures, as this demonstrates their commitment to authenticity and trustworthiness. Automating these measures helps improve customer satisfaction, employee productivity, and overall business performance.

Ensure the company follows best practices in data security and compliance with financial regulations like GDPR, PCI DSS, CBDP, etc. and possesses certifications for security.

1.4 Customization and Scalability - Software Development In Banking

Every financial institution has unique needs based on its size, customer base, and requirements. Choose a banking software development company that offers customizable solutions that meet your specific requirements.

Additionally, the capacity to scale software effectively is essential for managing growing demand and adapting to technological advancements. Look for a company that emphasizes architectural scalability and cloud integration, allowing the software to scale as user traffic increases. This ensures that your system can expand with your business while maintaining optimal performance.

1.5 Support and Maintenance - Software Development In Banking

Choose a company that offers 24/7 support services, including troubleshooting, updates, and enhancements,etc. to keep banking systems up-to-date.

Support and maintenance services are crucial to ensure continued performance, security, and relevance, including:

- Ongoing Technical Support: Continuous technical assistance to address any issues or bugs that arise, ensuring smooth operation and minimizing downtime.

- Regular Updates and Patches: Timely updates and security patches to address vulnerabilities, enhance features, and ensure compatibility with evolving technologies and regulations.

- Compliance and Security: Regular security audits and updates to ensure the software remains compliant with industry regulations and standards, protecting against emerging threats.

- Feature Enhancements: Implementation of new features and improvements based on user feedback and changing business needs to keep the software aligned with your goals and market demands.

- Bug Fixes and Optimization: Addressing any bugs or performance issues that may arise and optimizing the software to enhance efficiency and user satisfaction.

- Scalability and Upgrades: Assisting with scaling the software and integrating new functionalities or technologies to support your evolving requirements as your business grows.

KMS Solutions is known for providing reliable support and maintenance services after the launch of bespoke fintech software, ensuring ongoing performance, security, and relevance.

1.6 Client References - Software Development In Banking

Research the company’s reputation within the industry. Read reviews and testimonials from previous clients to gain a perspective on the company’s work ethic, communication style, and ability to meet client expectations.

Positive feedback from satisfied clients highlights their reliability and professionalism. Directly contacting references provides important information about the company’s strengths and weaknesses, helping you make an informed decision.

To identify reliable IT vendors, platforms such as Clutch, GoodFirms, and Top Firms are excellent starting points. These resources provide valuable insights into vendors’ services, ratings, and client testimonials.

For instance, KMS Solutions receives:

- 4.8/5 points on Goodfirms

- Top App Development Companies and Leading Software Developers for Financial Services in Vietnam on Clutch

- Top Software Development and Top Mobile App on Top Firms.

1.7 User Experience Design - Software Development In Banking

Opting for a company that emphasizes User Experience (UX) design principles is essential for ensuring customer satisfaction. Look for a company that focuses on creating intuitive and seamless banking interfaces, benefiting both customers and internal users alike.

Moreover, security is a crucial aspect of UX in banking software. The design should incorporate robust security measures, such as encryption, two-factor authentication, and secure transactions, to protect user data and build trust.

1.8 Soft Skills

Effective communication is crucial for success, and this principle holds true for banking software development services as well.

The days when financial software developers were considered nerdy programmers who were good at coding are over. In the modern and ever-evolving world of technology, it is essential for developers to have high analytical abilities, good time management, flexibility, innovative thinking, and problem-solving abilities. Additionally, having up-to-date knowledge of both fields, finance and technology, is important to ensure project success.

1.9 Cost Efficiency

Outsourcing development allows businesses to leverage top talent and advanced infrastructure without the fixed costs of an in-house team, such as annual salaries, setup expenses, and training.

Often, software development companies are based in regions with lower labor costs, like Vietnam or Malaysia, which helps in significantly reducing expenses related to salaries, benefits, office space, and equipment. By outsourcing to these regions, companies can significantly reduce expenses related to salaries, benefits, office space, and equipment.

There are some prominent technology firms providing banking software development services such as KMS Solutions, FPT Software, Axiata Digital, etc. As a leading name among banking software development companies in the ASEAN region, KMS Solutions exemplifies this model, offering high-quality development services while helping clients save on these costs through its strategic global operations.

2. The Importance of Partnering with the Right Banking Software Development Companies

Banking software features a broad spectrum of applications and solutions crafted to cater to the distinct needs of financial institutions. These solutions can include core banking systems, digital lending software, mobile banking applications, etc. The right software can streamline internal processes, improve customer interactions, and ultimately drive profitability.

By partnering with a banking software development services agency and banking software development company, financial institutions and banks can get access to critical expertise, allowing their dreams to become realities. Plus, choosing the right banking IT company allows financial institutions to tailor applications to meet their unique needs.

3. Advantages of Utilizing Banking Software Development Services

3.1 Adaptability

In a constantly evolving regulatory landscape, organizational adaptability is essential for survival. By integrating the latest fintech trends and solutions, businesses can enhance their existing systems to be more adaptive and responsive.

Opting for flexible banking software development services helps financial institutions keep their solutions up-to-date, efficient, and capable of addressing both current and future needs. This approach ultimately boosts operational efficiency, enhances customer satisfaction, and strengthens their competitive position.

3.2 Customization and Flexibility

Personalized banking software solutions are essential for meeting the specific needs and challenges of both banks and their customers. Custom solutions and strong integration capabilities allow financial institutions to streamline their processes, adjust to regulatory changes, and improve customer service.

Flexibility in software development is equally crucial. Financial institutions need software that can adjust to shifting regulatory environments, evolving business requirements, and changing market conditions. An adaptable banking software solution should facilitate easy updates and modifications with minimal downtime and cost, ensuring it remains aligned with the institution’s growth and the evolving financial landscape.

3.3 Security

In today’s landscape of heightened cybersecurity threats, safeguarding sensitive customer data from bank accounts to social security and credit card information is paramount.

Specialized development companies can implement advanced security protocols and offer robust security measures, including fraud detection and comprehensive cybersecurity risk management. Innovations in AI and cloud computing further bolster data privacy protections, ensuring unparalleled security for financial institutions.

3.4 Cost and Time Efficiency

Hiring outsourced banking software development companies in the Asian region, such as those in Vietnam and Malaysia, can be highly cost-efficient. These companies provide top-tier talent and infrastructure at a lower cost compared to maintaining in-house teams. This approach allows banks to focus on their core competencies while saving on salary, benefits, and overhead costs. Furthermore, the time zone advantage can lead to around-the-clock development cycles, speeding up project completion and enhancing efficiency.

3.5 Innovation

4. Banking Software Development Challenges - Overcome These With KMS Solutions

4.1 Legacy Systems Integration

Many banks and financial institutions are struggling with outdated systems, creating challenges in adapting to evolving technology and business needs, including banking system integration.

These legacy systems were developed decades ago with outdated technology platforms, often suffering from functional limitations, poor performance, and security vulnerabilities.

The level of complexity increases when it comes to transferring data from these legacy systems to modern databases or platforms without compromising integrity or security, emphasizing the complex nature of banking system integration.

KMS Solutions can ensure seamless API integration and data migration, while ensuring that new and legacy systems work harmoniously, avoiding disruptions and maintaining operational continuity. By leveraging its extensive expertise in modern technologies, KMS Solutions guarantees that APIs are integrated smoothly into existing banking infrastructure, enabling efficient data exchange and enhancing overall system functionality.

4.2 Regulatory compliance

Software development and testing for financial institutions and banks must comply with numerous regulations and standards related to data security, financial reporting, and consumer protection. This adds a layer of complexity to financial software development, making it essential for software development teams to have the right tools and processes in place to navigate this regulatory landscape.

With KMS Solutions, we highlight our expertise in compliance with industry standards and regulations, such as PCI DSS (Payment Card Industry Data Security Standard), and our understanding of the unique compliance requirements of the banking sector.

4.3 Evolving Technologies and Rapid Innovation

In the financial industry, with the development of Artificial Intelligence (AI) and Machine Learning (ML) algorithms, high-speed trading and automated trading platforms are becoming increasingly popular.

Our KMS emphasizes the ability to adapt our testing methods to suit emerging technologies such as AI/ML, open banking, cybersecurity, cloud computing, etc.

4.4 Data Sensitivity and Security

The financial services industry always faces unpredictable threats from security vulnerabilities. With just a small mistake, these violations can cause heavy financial damage, even causing the bank to “go bankrupt”. To prevent this, having the right tools to manage banking data, monitor security requirements, test systems and handle errors is essential.

Besides, source code security also plays a key role in preventing vulnerabilities and security breaches. KMS provides specialized security testing services, using penetration testing methods, vulnerability assessments and secure coding practices to identify and address potential security risks.

Conclusion

In the fast-paced world of banking, choosing the right banking software development companies can make a significant difference in efficiency, customer satisfaction, and regulatory compliance. Investing in a reputable banking IT company ensures your institution remains competitive in the dynamic financial landscape, leveraging cutting-edge technology to drive innovation and operational efficiency.

At KMS Solutions, our goal is to consistently surpass the expectations of our clients. We bring demonstrated proficiency in various industries, assembling skilled teams equipped with cutting-edge expertise. With a proven track record in delivering innovative solutions and robust support, KMS Solutions stands ready to empower your institution with cutting-edge technology solutions.

If you are looking for an experienced and reliable banking software development company, visit KMS-solutions.asia today.

FAQs

Do banks need software development companies?

The necessity for banking service firms to employ software developers internally depends. Larger financial institutions may have sufficient resources to permanently hire developers, enabling them to independently manage their projects.

However, smaller banks may not need to expand their workforce with software developers. Instead, they can collaborate with financial software development companies to oversee their projects and ensure ongoing support.