According to Forbes, there is a severe shortage of around 40 million skilled developers globally. And the number is likely to increase to 85.2 million by 2030, which can cost corporations worldwide $8.4 trillion in revenue lost. Consequently, it’s getting harder and harder for you to put together a complete in-house development team.

Hiring a dedicated software development team is a great alternative to circumvent this issue. The idea is that you collaborate with a tech vendor to establish a digital team that works for you. Thus, avoiding the tiresome hiring process.

What Is a Dedicated Software Development Team?

A dedicated software development team is a model where external developers are fully dedicated to your software project for an extended period. Unlike outsourcing or hiring freelancers, these teams work as an extension of your in-house staff, fully integrating into your project environment.

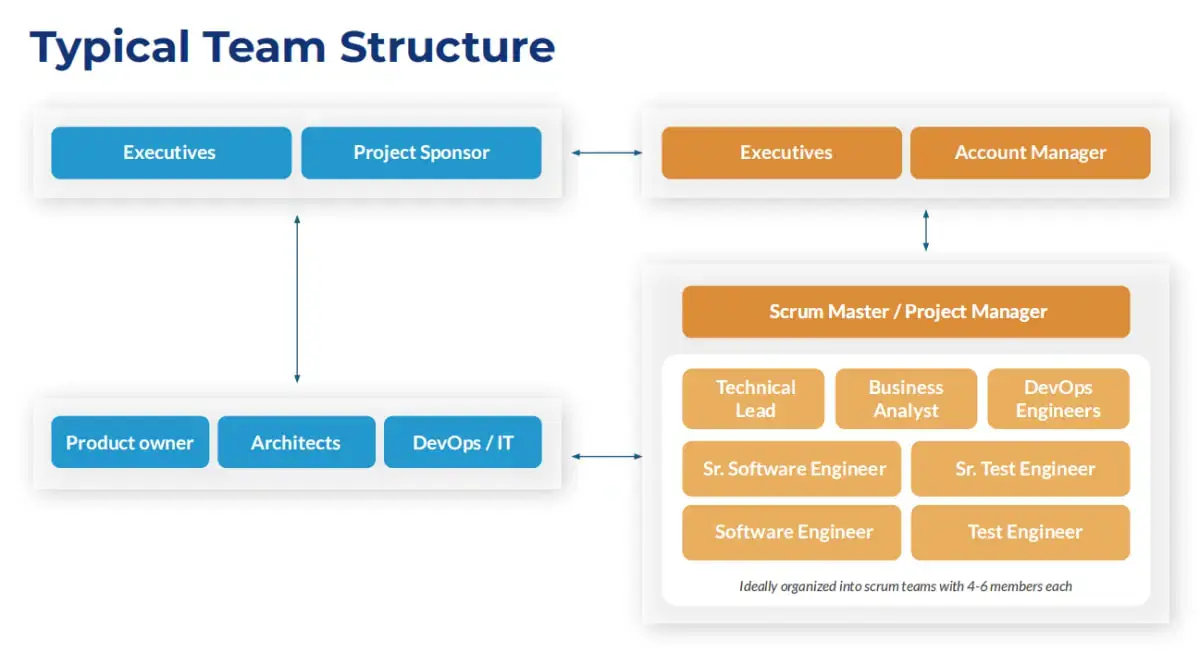

At its core, a dedicated team is typically composed of developers, designers, project managers, and quality assurance specialists. Their full-time commitment ensures that they work only on your project, resulting in deeper immersion, stronger collaboration, and faster results.

Why Banks Need the Right Team Structure?

There are many reasons a business needs a dedicated offshore team, consisting of minimizing costs and improving efficiency. Still, for incumbent organizations in the BFSI sector, it is also about keeping current and competitive in a growing and changing industry.

Since security is a mandatory priority in the banking industry, it is essential to have an appropriate dedicated software development team with relevant skills and experience to deliver solutions based on their requirements. Mobile banking app development requires each role in a dedicated software development team to have specific skills in areas such as big data and advanced analytics, agile processes, digital customer experience, risk and security management, and online payments.

A good grasp of a dedicated software development structure for banking app development can assist you in effectively building projects while cutting down the expenditure on unnecessary roles, especially when you already have an in-house development team.

Key Roles in a Dedicated Software Development Team

When searching for a dedicated software development team to build a mobile banking app, the initial step should be identifying which specialists will handle your project and how many of them are needed. Besides, as there are numerous positions involved in the dedicated software development team, understanding the duties and responsibilities of each role will assist you in finding the niche ones that genuinely contribute to the project.

As the size of a desired software team depends laboriously on the complexity and scale of the project, let’s start with the typical team structure for developing a practical online banking app.

1. Project Manager / Scrum Master

When banks come to the software service provider with the app idea, there will be a Project Manager (PM) who performs as a bridge between the project sponsor and the entire development team. PM is accountable for a project’s delivery from inception to completion, according to the agreed-upon budget, timeframe, and quality.

For the Agile project, the Scrum Master will lead an Agile development team to ensure the scrum framework is followed. This position usually possesses robust soft skills, proven experience in managing IT-related projects, and comprehensive knowledge of bank policies. Responsibilities of the project manager or scrum master include:

- Hand out assignments to team members, establish sprint goals and periods, and prioritize tasks;

- Understand the scope and boundaries of members’ accountabilities.

- Manage issues and risks;

- Ensure quality and time-to-market of the project.

2. Product Owner

A Product Owner (PO) plays an essential role in an agile project, responsible for bringing an app idea to practice and maximizing the product’s value. This expert will need to discover customers’ ever-changing needs, understand bank policies, and have a certain level of technical knowledge to ensure the product is launched successfully. A product owner is a strategist who:

- Analyze the market, research customer requirements, and understand any regulations related to the banking sector;

- Compile the product roadmap and define necessary features;

- Set release requirements and product updates.

3. Business Analyst

Business Analysts (BA) have emerged to have a critical role in working with the scrum team to execute the product vision. They will need to analyze and validate the banks’ requirements and translate them into detailed documentation by breaking down high-level product features into user stories with the appropriate amount of detail.

Comparing PO and BA, PO is more business and customer-oriented (is generally perceived as the voice of the customer), while BA acts more like the representative of the dedicated software development team.

4. Software Architect / Data Architect

A Software Architect takes care of planning and organizing the app system. This person gathers banking requirements, dictates coding standards, and designs high-level architectural diagrams for the online banking system.

Besides, a Data Architect will offer data access to improve decision-making with a 360-degree picture of customer interactions throughout the organization. This role is especially important in the BFSI sector as it can assist in providing data-fuelled, hyper-personalized experiences in real-time for banks to define data strategy and update their digital banking services to fulfill customers’ unmet needs.

5. UX/UI Designers

Nowadays, many digital banking platforms are built around a customer-centric approach and emphasis on design. The UX/UI Designer will need to work closely with the product owner and technical engineers to deliver a good-looking app interface.

The work of a designer within a dedicated software development team takes place in such a sequence:

- Create a user persona, consider the user flow and sketch app wireframe;

- Prepare app prototypes;

- Build app interface and make changes in response to user feedback and testing data.

To complete those responsibilities, UX/UI designers should be proficient in using design tools and can adopt best practices for design in banking apps to ensure the product is intuitive, user-friendly, and attractive.

6. Technical Lead

In Agile environments, Technical Leaders concentrate on delegating authority and fostering self-organization among team members to create added value for the banking project. It’s crucial to have a technical leader in mobile banking app development as this person will have sufficient knowledge and experience to solve roadblocks when the dedicated software development team can’t find a way out.

7. Software Engineer / DevOps

Software engineers include iOS/Android developers and back-end developers responsible for:

- Develop and sustain reusable, dependable, and high-performance code;

- Ensure the high quality, performance, and responsiveness of the mobile app;

- Correct app drawbacks and fix bugs;

- Constantly maintain and update the digital app.

For mobile banking apps, the back-end role will help manage payment systems that can access and securely store data to enable customers’ in-app transactions.

Otherwise, a DevOps engineer is an IT generalist who should have broad-ranging knowledge of development and operations, including coding, infrastructure management, system administration, and DevOps toolchains.

8. Test Engineer

The QA Specialist (or simply Tester) is an imperative mobile app team member. This is a professional who has the responsibility of reducing risks in any software development project. The tester provides comprehensive software testing solutions to ensure the app is bug-free, adapts to diverse devices and browsers, and satisfies all the requirements. The general duties of an app tester include:

- Perform both manual and automation testing;

- Design test scripts and record test progress;

- Tack bugs through testing and report to the team for an instant fix.

Benefits of Hiring a Dedicated Software Development Team

Investing in a dedicated software development team brings numerous advantages. Let’s explore the top benefits:

Cost-Effectiveness and Scalability

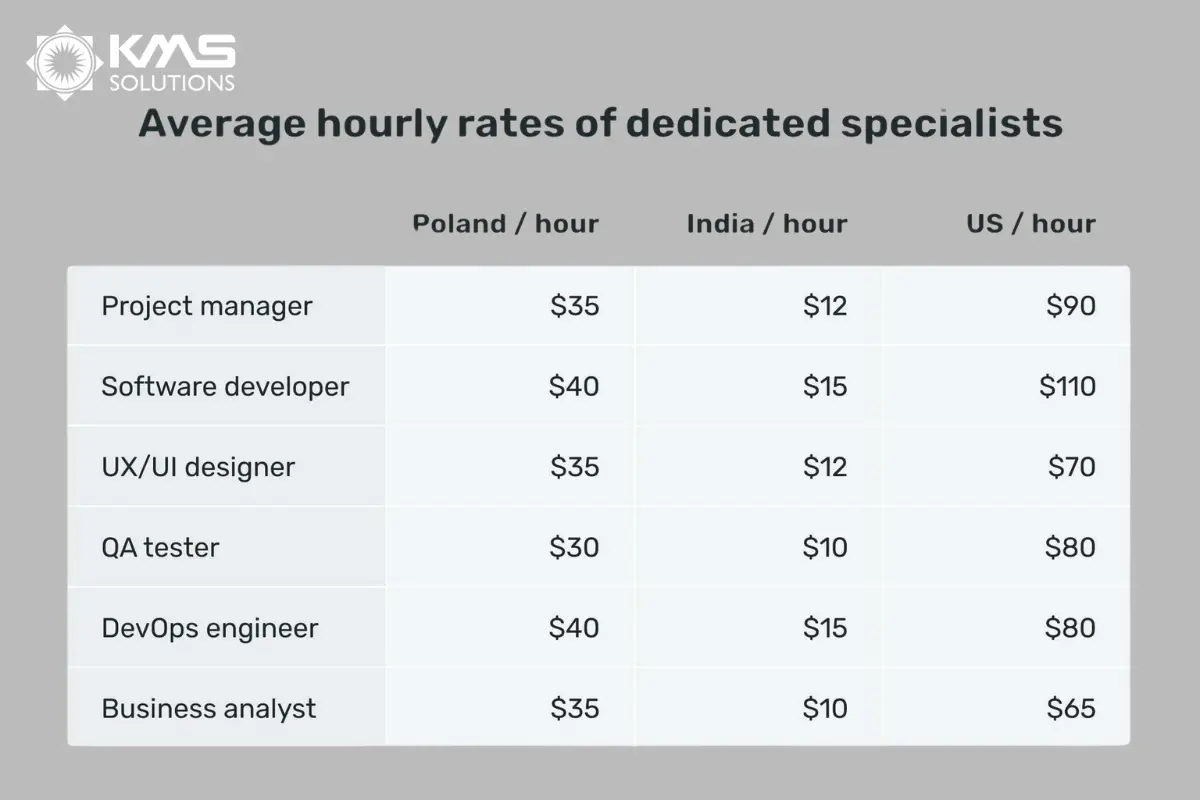

Hiring a dedicated software development team can be more cost-effective than building an in-house team. You avoid overhead costs such as equipment, office space, and onboarding expenses. In countries like Vietnam and the Philippines, businesses can access highly skilled software engineers at a fraction of the cost when compared to hiring locally. Both countries have become top destinations for offshore software development due to their competitive pricing models, robust tech ecosystems, and highly skilled workforces.

In Vietnam, the average cost of hiring software engineers is considerably lower than in Western countries. A dedicated software development team in Vietnam can provide high-quality services while reducing overall operational costs. With over 480,000 skilled IT professionals, Vietnam has cultivated an ecosystem that is highly attractive to international businesses seeking affordable yet top-notch tech talent.

Similarly, in the Philippines, the cost of hiring a dedicated software development team is highly economical. Whether you’re launching a small startup or scaling an enterprise-level application, Vietnam and the Philippines offer scalable solutions that maximize both efficiency and savings.

Additionally, a dedicated team offers scalability—you can easily adjust the team size based on your project’s needs, adding or reducing team members without long-term contracts.

Access to Specialized Skills

Dedicated software development teams also bring specialized skills to the table. Whether you need expertise in a specific programming language or industry-related knowledge, these professionals come with years of experience in their respective fields. This ensures that your project is handled by experts who are deeply familiar with the nuances of the technologies they use.

For example, companies like KMS Solutions in Vietnam have carved out a niche in developing custom software solutions specifically for BFSI sectors. The dedicated software development teams are well-versed in industry-specific technologies and compliance standards, ensuring that projects are executed with precision and security. The company experts are ISO/IEC 27001 certified, and comply with PCI DSS, CBDP, and SOC2 to ensure the safeguarding of user data.

Full Focus on Your Project

A dedicated team has one focus—your project. This concentrated attention leads to faster development times and higher-quality outcomes. Since they’re not distracted by other assignments, you’ll receive undivided focus, which directly impacts the project’s success.

How to Hire the Right Dedicated Development Team?

1. Have a clear product vision in mind about a quality dedicated development team

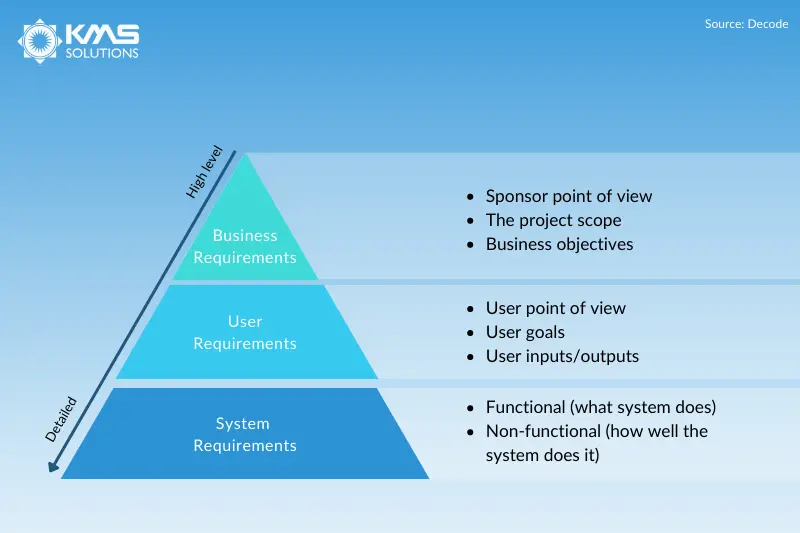

Business requirements portray the why of the project. What does your product want to accomplish, and why is it essential? This is where you connect the app’s objective to your company’s goals, like enhancing profit or boosting brand recognition.

Following are the user requirements. This section addresses the who of the app – its end users. You’ll have to identify what issues the app is attempting to address and how users engage with it.

For a mobile banking app, for instance, the user requirement may be to enable people to transfer money easily anywhere at any time.

The software requirements can be implied as the what of the app. This phase is where you list out the product’s specific features and functional needs. Another critical element is non-functional criteria that describe system functions, like expected performance and portability. For instance, the app’s load time should be less than 3 seconds.

Once the project’s requirements are defined, the next step is determining its scope. In this stage, you will establish the goals, activities, timelines, resources, and deliverables for your team to work toward. Doing so can help you perceive what roles you need for your development team and the jobs you plan to assign them. This makes the following stage – market research – a lot easier.

Set your budget and deadlines

Having a clear vision for your product can also help you have a more precise calculation of the total costs. By laying the expenses out ahead of time, you can determine a preliminary budget and choose the team that best suits it.

2. Market research vendors

This phase entails browsing the vendor market and seeking a potential fit. Here are a few ways you can look for remote development team:

- Your network: referrals are a great way to find tech talent. It can be worthwhile to reach out to someone you know who has experience in hiring outsourced software development vendors. This is particularly beneficial when their company is in the same industry as yours.

- Google Search: Paid and organic results can both be useful. Try to enter a few terms or keywords pertinent to your software development needs and look for businesses that offer software development services. Doing so allows you to discover their offerings and determine whether their portfolio of finished projects matches your project idea.

- IT companies & software listings: there are many reliable platforms to employ when you seek a committed dedicated team of software developers. Some popular company directories are Clutch, GoodFirms, and Design Rush. Your search can be made easier with any of these listed tools using their easy-to-use filters which permit you to sort enterprises by country, hourly rates, industry, etc.

Read more: How to Successfully Manage an Offshore Software Development Center

3. Vendor evaluation

After using these approaches to study the market, you can make a list of five to ten corporations that merit further consideration. It’s highly recommended to create a checklist in which you can jot down important vendor evaluations and scoring points. Some criteria you should look out for when shortlisting prospective partners are:

Established security protocol

Cybersecurity threats have continued to rise in recent years, from infrastructure vulnerabilities, and phishing attacks to data breaches and malware. To avoid such risks, a provider with an established security policy is worth considering. Your vendor should conform to international security standards like ISO, PCI, and HIPAA to ensure the safety and security of your confidential data.

Streamlined Agile procedures

Agile methodology is arguably the most popular and effective approach for most software projects. Agile practices, like sprint planning, daily stand-up, retrospective, and product backlog, make it easier and more effective to manage your outsourced developers. Hence, selecting a vendor with optimized Agile processes ensures improved productivity and flexibility while decreasing costs and time-to-market. Using this methodology, KMS Solutions has managed to help Asia Commercial Bank (ACB) launch its business banking mobile app in just 4 months.

Solid communication and project management skills

The process of developing software is intricate, and communication issues will make it more challenging at every stage. Your selected technology partner should be able to provide a proper communication process and make an effort to keep you informed about the project’s progress and updates. These details imply that the provider is keen to discuss all the specifics and nuances with you to avoid misunderstandings. This capability is essential in a time of remote.

Furthermore, your communication tools should be able to cover these key areas: communication, issue tracking, and version control. Examples involve Slack, Trello, Jira, and G Suite. Some platforms, like Jira, have a learning curve for engineers who are new to the tool. Hence, it’s advised that everyone agrees on which tools to utilize.

Besides communication tools, your dedicated software development team can adopt project management templates to create an action plan, predict the project’s duration, and measure workload capacity.

Project history & portfolio

Most providers with sufficient experience typically have a solid portfolio that features in-depth case studies on the project that has successfully delivered or is in progress. Such examples offer insights into the vendor’s methodologies and tech stack that were deployed to accomplish clients’ requirements and objectives. Browsing through a few of them can give you an overview of the procedures and determine whether the vendor will mesh well with your team.

Pay close attention to projects similar to yours. If the vendor has already worked on something similar, it strongly indicates that they have the experience and skills you require. By examining the outcome, you can draw conclusions about what you’d like to execute differently. Partnering with an experienced team can also help you benefit from time and money savings (as opposed to if you teamed up with novices in your industry).

Testimonials

It’s a good idea to explore the viewpoint of other client corporations like yourself before recruiting a dedicated software development team. Besides testimonials that are displayed on the provider’s website, you can check reviews on the above-mentioned IT software listings to evaluate their professionalism and workplace culture.

Investigate as much feedback as you can and take note of the strengths and weaknesses that people brought up. This will give you a better sense of the business and how your potential partnership might progress. If the IT provider is receiving numerous rave reviews from satisfied customers, it is likely that your experience with them will also be positive.

Budget

The two most common pricing models are the fixed-price and the time & material model.

| Fixed-price | Time & Material |

|

|

4. Interview prospective vendors

The next phase is interviewing the candidates. Face-to-face meetings or online video calls can be arranged to discuss the project, get to know the vendor, and perhaps even the project manager or the entire development team.

Prepare a set of questions and specify the deliverables. You might enquire about the organization’s previous experience with similar projects and how they plan to tackle yours. Raise questions like team size, data privacy, tech stack, preferred communication tools, and which solutions they propose.

5. Assemble your team

After selecting a suitable vendor and signing a contract, you can start creating your own dedicated team using their internal talent pool. Some of the essential roles in a digital team are:

- Project manager: monitors the entire project processes from task distribution, delivery, and team communication to performance reports.

- UX/UI designer: generates wireframes and the overall aesthetic of the product

- Software developer: turns the design into a functioning and usable solution

- QA/QC specialist: handles code testing and detects bugs

Bear in mind that the composition of a digital team can differ from project to project. Some projects may require additional roles, like business analyst, solution architect, or cybersecurity specialist. Furthermore, certain niches, such as financial institutions, would need subject matter experts to aid in compliance.

6. Onboarding and knowledge transfer

During this phase, the dedicated software development team fully grasps the product idea and plans resources accordingly. Here is how the product knowledge transition operates:

- Product exploration (2 – 4 weeks): In this stage, the team is expected to familiarize themselves with the product overview, goals, and roadmap. Regarding the technical aspects, they also acquire the product architecture overview, the deployment topology as well as the infrastructure.

- Product in-depth (2-4 weeks): Once the digital team has a basic understanding of the product concept, they will go into further details of the product functionalities with the product’s feature mind-map, flow diagram, themes, epics, and user-story mapping

Hands-on (4 weeks): With all the necessary information at hand, the team can now start creating product features and fixing bugs complying with the agreed development methodology (such as Agile/Scrum)

Challenges and Solutions in Managing a Remote Development Team

Managing a remote dedicated development team comes with its unique challenges. However, by addressing these issues head-on, you can turn them into opportunities.

Time Zone Differences

One of the most common challenges is dealing with time zone differences. A team that operates halfway across the globe may have limited overlap in working hours with your in-house team.

Solution: Schedule regular meetings at times that work for both parties and use collaboration tools to ensure seamless communication. Tools like Slack and Zoom can help mitigate communication delays and foster better team collaboration. Moreover, by leveraging tool like Jira, the team can manage tasks and ensure the software development process.

Maintaining Quality Control with Remote Teams

When working with remote teams, maintaining quality control can be a concern. Since the team isn’t physically present, tracking progress and ensuring high standards may seem difficult.

Solution: Set up clear quality control processes from the start. Define key performance indicators (KPIs), create detailed specifications, and schedule regular quality checks to ensure your remote team meets your expectations.

How is KMS Solutions Banks’ Perfect Choice for Having Dedicated Software Development Teams?

Nowadays, many businesses in the BFSI sector need dedicated software development team to help them conquer the dream of digital transformation. With the assistance of high-performing teams, they can achieve their goals effortlessly.

At KMS Solutions, we concentrate on building an effective digital team that is effectively tailored to your business team size and specific requirements. We have provided all three main digital team models that can be suitable for your projects, even the most complicated ones. Just contact us and let our consulting team connect you with the right solution.

Conclusion

Hiring a dedicated software development team can be a game-changer for your business. It offers access to specialized skills, cost-effective solutions, and a full focus on your project. Whether you’re in banking, healthcare, or any other industry, the right team can elevate your business to the next level.

By carefully evaluating the team’s technical skills, cultural fit, and project management experience, you’ll ensure you hire a team that’s not only effective but also a great long-term partner. When it comes to choosing the best, KMS Solutions stands out as a top choice for businesses looking for reliable, scalable, and flexible software development teams.