In 2023, banks have increased their technology investments significantly by 5.2%, emphasizing the sector’s strong dedication to digital lending. This investment is essential as more than 70% of BFSI companies have either adopted or are in the process of implementing digital loan origination for personal loans. Furthermore, according to Allied Market Research, the digital lending platform market is anticipated to expand from USD 12.6 billion to USD 71.8 billion by 2032, growing at a CAGR of 19.4%.

As evidenced by a surge in investments and market growth, digital lending solutions are gaining traction in the financial industry. Among a diverse array of e-lending platforms, the Bureau Lending System stands out as a prominent solution for banks and financial institutions to gain a competitive edge and delight borrowers with end-to-end digital lending experiences.

What is a Bureau Lending System?

The Bureau lending system facilitates financial institutions to streamline the lending process and provide users with the ease of self-service digital loan interactions. Designed to simplify loan origination, the solution transforms lending into a fast and seamless cycle, maintaining customer-centric digital experiences on a large scale. This system substitutes conventional loan procedures with flexible application flows, ultimately enhancing customer conversion rates.

In terms of production, bureau lending services concentrate on expediting turnaround times and enhancing operational efficiency. Banks can focus on their core competencies while the platform automates the loan process, spanning from application and service to post-disbursement.

How Does Bureau Digital Lending System Benefit Businesses?

Recently, more BFSI businesses have contemplated transitioning from the traditional, paper-based lending method to digital lending platforms. Bureau digital lending solutions may enhance profitability and efficiency within a business. Some of the advantages comprise the following:

1. Loan Application Capture Efficiency

The traditional loan application processes were cumbersome and involved many steps. However, with this digital lending solution, customers can originate loan applications within seconds via digital devices from any location.

It’s essential to understand that customers won’t hesitate to abandon the loan application and move on to another lender if they have a negative experience, which is tough to satisfy. Therefore, this digital lending solution helps improve user experience by accelerating the loan application process while ensuring accuracy.

2. Maximizing Resources

Paperless, automated loan processes not only free up valuable lender resources for exploring new opportunities but also lead to substantial cost savings ranging from 30 to 50%. Bureau lending platforms help process a larger number of loan applications and minimize the number of systems involved in lending practices.

These emerging services offer a seamless and efficient experience for both lenders and borrowers by eliminating the need for multiple bank visits, endless document submissions, and tedious form-filling.

3. Error-Free Evaluation

Banks and financial institutions can eliminate sources of human error by leveraging AI/ML evaluation for greater consistency in both the credit approval process and portfolio management.

Additionally, the systems offer highly configurable workflows and automatic decision rules to make sure that the applicants are assessed in accordance with the relevant risk limits and loan terms. This ensures a process free from human bias or errors, as the platforms simply follow pre-configured rule sets to maintain consistency in loan origination and credit policies.

4. Compliance-Driven Processes

Bureau loan origination systems are predictable, repeatable, and auditable, keeping banks and credit unions in compliance with business lending regulations. The systems also integrate with other third parties via API to assist with compliance, risk, payments, etc., while connecting lenders with credit bureaus, alternative data, and other data sources.

Bureau Digital Lending Service Modules

We have provided more digital lending services to serve consumers and adhere to regulatory requirements. Here are some of our main digital lending solutions:

1. Digital Lending Application

Rather than relying on traditional paper-based methods, digital loan apps incorporate automated workflows, allowing for faster and more efficient processing and providing borrowers with a more convenient and accessible experience. Mobile lending apps typically offer a user-friendly interface, allowing borrowers to complete the entire loan application process, from onboarding, servicing, and disbursement to collections.

Digital lending app ideas that financial institutions should consider while developing include payday loan apps, personal mobile loan apps, business loan apps, P2P loan apps, and bank/ credit union loan apps.

Key features of mobile lending apps may include secure login mechanisms, real-time loan approval, fund disbursement, repayment tracking, and notifications. Some software also incorporates advanced technologies such as biometric authentication or AI to enhance security and streamline lending processes.

2. Loan Origination System (LOS)

This system helps businesses simplify the lending experience by streamlining the documentation process, from loan application to loan disbursal phases. It prioritizes compliance and security in handling sensitive customer data.

Additionally, the LOS is built to automate and manage the loan origination and disbursal processes, hence enabling lenders to handle higher application volumes with minimum manual errors. This solution not only pledges to revolutionize services for banks and credit agencies but also significantly enhances the service experience for borrowers.

Some essential features that loan origination software supports include:

- Security Framework: For the systems to function effectively, they should be equipped with tight cybersecurity measures. A LOS that embraces a security framework ensures that the institution adheres to regulations and helps minimize the risk of significant data breaches.

- API and Third-party Integration: Such integration API allows compatibility and makes the LOS limitlessly efficient. Integrating with other systems, such as credit bureaus or document management platforms, also strengthens the LOS.

- Automated Underwriting: With this feature, banking institutions can set custom loan approval rules to make quicker and more precise approval decisions.

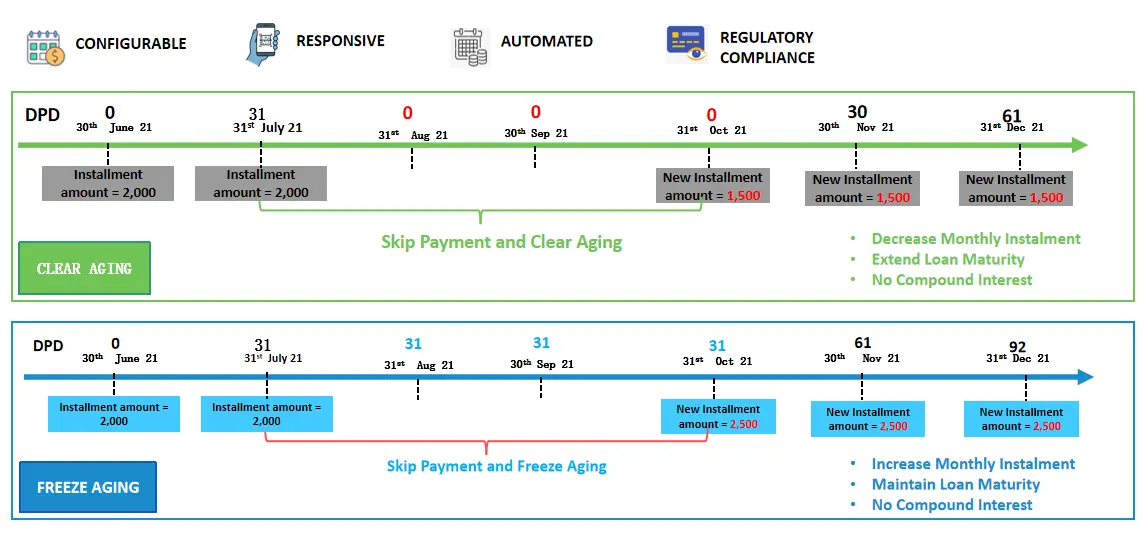

3. Loan Moratorium

Loan Moratorium serves as a resilient option in response to difficulties and challenges faced by borrowers in loan installment services, at the same time helping to control and manage non-performing loans for lenders.

4. Customer Lending Software

This service caters to both consumer and wholesale lending needs, offering a diverse range of financial products to meet the unique requirements of individuals and businesses alike, from mortgages, revolving lines of credit, term loans, secured and unsecured loans, installment loans, and syndicated loans.:

- Consumer Credit Transformation: This platform can help banking financial institutions make their credit operations more effective, innovative, and disruptive.

- Modern Target Operating Model: Distinctive and growth-driving lending nowadays requires digital, adaptable, dynamic, and customer-centric credit operating models.

- Residential Mortgage Lending: Incumbent banks can draw on modern processes to improve the speed and efficiency of their mortgage operations.

The customer lending software also concentrates on loan servicing, which includes multiple facilities per borrower, draws per facility, collateral per facility, flexible charging, real-time funds available upon disbursement, flexible repayment schedules, and inquiries and reports.

5. Delinquency Management

Oversee accounts throughout the debt recovery process, issuing timely reminders for overdue payments. Some features of delinquency management software include:

- Overdue Reminders: A reminder will be generated and sent to the customers via letter, email, or SMS once the account is overdue.

- Non-Performing Loan (NPL) Classification: The account will be classified as NPL or by Aging Group when it is overdue for a specific duration of months. It will be declassified accordingly when the customer makes a payment.

- Specific Provision: Generating various percentages of Provisioning to the value of the loan based on the duration the account has been out of order.

- Debt Restructuring & Trouble Debt Restructuring: Able to reschedule the loan term, interest rate, or payment schedule.

6. Collaterals/Limits Management

Optimize risk management with seamless integration and inclusion of collateral data from core banking, trade finance, and loan origination systems. Gain real-time, management-level insights into risk exposure. Establish automated alerts, monitor limits, and configure streamlined approval processes for enhanced efficiency.

7. Microlending Services

Microlending, also known as microloans, refers to the practice of providing small-scale financial services. Bureau digital lending service models play a crucial role in facilitating microlending by providing efficient and technology-driven solutions for assessing creditworthiness, streamlining application processes, and managing risk.

Steps to a Seamless Digital Lending Process

Achieving a seamless digital lending process is crucial for enhancing efficiency, reducing delays, and providing an optimal experience for both lenders and borrowers. Here are key steps to ensure a smooth digital lending journey:

Step 1: Loan Origination

This phase contains three main activities, including choosing a loan origination system, reviewing the loan origination process, and configuring the loan origination solution. Read more about the digital loan origination process here!

Preapproval is the first point of interaction for lenders with potential borrowers. During this part of the loan origination process, customers will need to provide specific personal and financial documents for credit checks. The pre-qualification process of the bureau lending services is automated and hassle-free to ensure a seamless customer journey.

Step 2: Application and Data Capturing

To transition to an effective e-lending crediting model, it’s worth considering these areas:

- Online application form: offers a fully digital, customer-driven lending experience, reducing the need to come to the branch.

- Customer identification process: comply with Electric Know Your Customer (e-KYC) and Anti-Money Laundering (AML) regulations.

- Data entry: banks and financial institutions will need to verify information regarding borrowers and co-borrowers, credit requests, financials, collaterals, and other relevant documents. It’s essential to ensure your lending platform can handle large volumes of loan documents swiftly and accurately.

- Digital verification process: verify for proof of customer (i.e., income and repayment capability)

With the bureau lending services, the BFSI companies won’t have trouble processing many more loans than before. By utilizing deep neural networks, banks can get much more insight from customer data and can approve more of the right loans instantly.

Step 3: Underwriting / Decision Making

During loan processing and underwriting, financial institutions will need to analyze the borrower data and make the right credit decision based on it. The bureau lending system offers fully digital, automated underwriting approaches for gauging risks quickly and accurately.

Underwriting usually entails numerous stages of data analysis, including:

- Credit Scoring

- Pricing

- Re-payment schedule simulation

- Credit Decision

Moreover, you can provide the system with your own set of decision rules and change the scorecard settings to evaluate the data points precisely. For security reasons, besides using the data provided by the client, the system accesses information from synchronized databases, such as credit bureaus.

Step 4: Documentation

During this phase, the necessary loan documents, including any transaction-specific paperwork are signed, and funds are disbursed in accordance with the approval. Typically, copies of all the documents signed will be provided to both the lender and the applicant.

The offer notification can be sent via the system to get customer acceptance and ensure the credit decisions are approved.

Step 5: Loan Booking

In the lending platform, the loan booking process is a critical stage that involves various components to ensure efficiency and accuracy. Loan booking often includes: Straight through processing and automatic decisions. multi levels approvals, and more.

Step 6: Disbursement

When banks go through different steps, including obtaining the borrower’s data, completing all origination processes, and having the application authorized by an underwriter, the final step is disbursement.

Any good digital lending automation system will interface with payment software and deliver money to the borrower automatically once all of your checks are finished and the loan is cleared for disbursement.

Sum Up

In a digital-first world, the lending landscape is witnessing a paradigm shift toward digitization and automation. Banks and financial institutions that wish to gain competitive advantages by providing consistent customer experience can consider bureau lending systems. These systems represent a pivotal advancement in the financial landscape, revolutionizing the way lending institutions assess credit, manage risk, make decisions automatically, and verify data effectively.

With the help of the KMS Solutions development team, financial institutions can benefit from cutting-edge solutions that streamline lending processes, enhance risk management, and foster financial inclusion. Contact us for your next lending software development project!