The banking and financial services sector is undergoing a technological revolution through open banking, transforming the traditional approach to more convenient activities. This movement allows banks to enhance customer experiences by integrating services and products from various third parties, thereby expanding their capabilities in delivering a more comprehensive range of services.

According to Custom Market Insight, the global API banking market size is anticipated to increase from 3.5 billion in 2022 to 17.5 billion by 2032, at a CAGR of roughly 23% during the forecast period. What frightens the API future is that the rise in open banking trends requires enterprises to prioritize API testing. Although integrating more APIs can be straightforward, the addition of just one additional API can substantially elevate the complexity of test cases. This heightened complexity is necessary to ensure accurate validation of the ever-evolving UI and data layers within a multistep API flow.

In this article, we delve into the implications of open banking API testing and analyze the best strategies to leverage secure, cloud-based API tests to address the unique challenges that businesses often encounter.

What is Open Banking and Its Benefits?

The term “Open banking” involves the sharing of financial information and data between banks and third-party financial service providers. It enables customers to share their financial data securely with authorized third-party providers through the use of open, publicly available APIs (Application Programming Interfaces). By providing users more choice and control over their financial information and services, open banking seeks to improve the overall customer experience.

Open banking brings advantages that extend beyond consumers. Financial institutions can utilize open banking to tap into a wider array of financial products and services, facilitating business growth and enhancing competitiveness in the market. Through the integration of third-party products and services, financial institutions can harness consumer data to innovate and develop new products and services.

Why is API Testing in Open Banking Crucial?

API testing holds paramount importance in the context of open banking, and here are why:

- Quality Assurance: APIs are the backbone of open banking, facilitating data transfer across diverse systems and software. Thus, any substantial malfunction in an API may significantly affect the customer experience, leading to potential reputational harm for the banking institution.

- Security & Compliance Verification: Banks are obligated to adhere to a multitude of regulations and standards, such as PCI DSS (Payment Card Industry Data Security Standard) and Consumer Data Right (CDR), which require the assurance of security and privacy of customers’ data. API testing is worth considering to ensure compliance with these regulations.

- Scalability and Performance: It is essential to guarantee that APIs remain stable and responsive under increased loads and can scale efficiently to meet increasing customer needs. Conducting API testing aids in detecting potential performance issues and bottlenecks before they affect end users.

Advantages of API Testing

SPER Market Research predicts that the Global API Testing Market will reach USD 6.98 billion by 2032 with a CAGR of 20.62%. This demonstrates that API testing is extensively embraced by enterprises across various sectors, notably within the banking industry. Some advantages of API testing include:

- Early Detection of Bugs and Issues: Automated API testing empowers software development teams to identify bugs and issues during the initial stages of development. This means that defects can be analyzed and fixed before they become more costly and time-consuming.

- Increased Test Coverage: API testing offers a broader scope of testing compared to other methodologies like GUI testing. By scrutinizing the fundamental functionality of APIs, API testing ensures comprehensive testing of all system components simultaneously.

- Elevated automation testing tool: API testing is well-suited for automation, facilitating the execution of automated tests at a quicker and more consistent pace than manual tests. Automated tests are executed faster and more consistently than manual tests, reducing the possibility of human error and enabling teams to test frequently.

- Enhanced Scalability: APIs are designed to be scalable. Testing APIs guarantees that APIs function optimally across various load levels, ensuring software applications can handle diverse levels of traffic and user demand.

- Improved Security: API testing is instrumental in bolstering software application security. By scrutinizing APIs for vulnerabilities like injection attacks and cross-site scripting, teams can detect and rectify security concerns proactively, averting potential problems.

Some API Testing Types in Open Banking

1. Data Validation Testing

In open banking, several different forms of data can be retrieved through an interface. This encompasses information about the customer, deposit, loan details, transaction information, and real-time batch process information. Therefore, a vast amount of random data should be input into the system to investigate if there are any forced crashes or negative behaviors.

2. Load Testing

Load testing is essential in identifying the limitations of a banking system under realistic loads. Additionally, it contributes to maximizing resource utilization while guaranteeing open banking’s reliability, scalability, and consistent performance. Considering aspects like response time, scalability, downtime, and infrastructure expenses, load testing monitors the system’s performance at both normal and peak conditions.

Load testing encompasses several scenarios:

- Baseline Test: This assesses the API’s performance against anticipated regular traffic under standard usage conditions.

- Theoretical Maximum Traffic: This validates the API’s response during peak load periods, ensuring it handles the expected volume efficiently.

- Overload Test: This examines the API’s maximum capacity based on theory, then adds 10-20% more on the peak traffic.

3. Security Testing

Authentication and authorization play pivotal roles within banking APIs. Testers must ensure rigorous multi-factor authentication is conducted before permitting APIs to execute designated functions.

Moreover, security testing also comprises further steps like validation of encryption methodologies and evaluation of the API access control design. It also entails managing user rights and validating authorization.

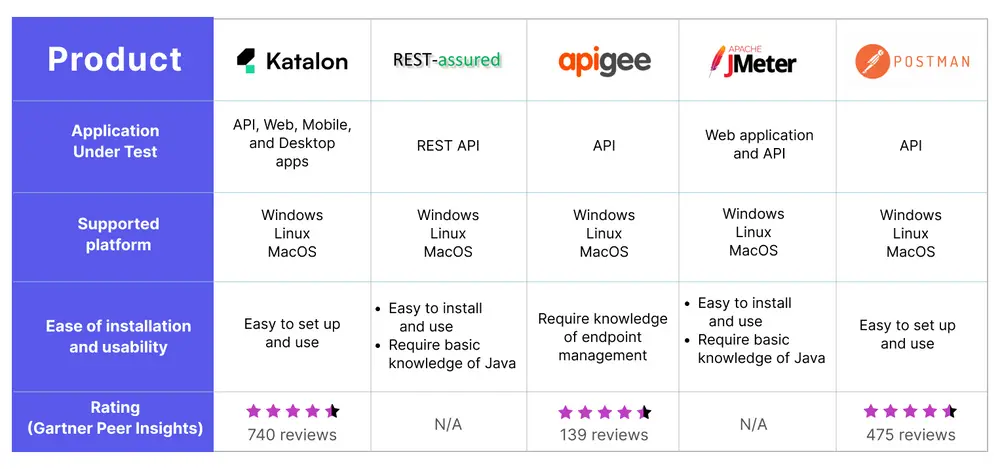

Top 5 API Testing Tools Available that Banks Should Consider

1. Katalon

Katalon Studio is an integrated environment developed for test automation. It provides a comprehensive set of features for various testing needs, including automated testing of APIs, web applications, mobile apps, and desktop applications. It offers a user-friendly interface and enables testers with different levels of expertise to create and execute automated tests efficiently.

Key Features Overview:

- Intuitive UI and productivity-focused features for projects of all sizes

- Seamless integration with native CI/CD platforms (Jenkins, Azure DevOps, CircleCI, Dockers, etc.)

- Compatibility with REST, SOAP requests, and SSL client certificates

- Facilitates API test data setup through UI testing

- Utilizes data-driven testing methods to enhance test coverage and reliability

- Free API testing courses and tool tutorials via Katalon Academy

2. REST-assured

Rest-Assured is a Java-based library used for testing RESTful APIs. This library simplifies the validation of HTTP responses, allowing testers to create robust and comprehensive API tests by supporting various HTTP methods and assertions.

Key Features Overview:

- Provides an array of built-in features facilitating codeless practices for users

- Integrates with the Serenity automation framework, enabling the combination of UI and REST tests within a singular framework and generating detailed reports

- Supports BDD Given/When/Then syntax for test scripting

- Supports various HTTP request methods, including POST, GET, PUT, DELETE, OPTIONS, PATCH, and HEAD

3. Apigee

Apigee serves as a versatile cross-cloud API testing tool that empowers users to assess and evaluate API performance and facilitate API construction and support while also ensuring compliance with security standards such as PCI, HIPAA, SOC2, and PII for applications.

Key Features Overview:

- Enables the creation, monitoring, implementation, and expansion of APIs.

- Identifies performance concerns by monitoring API traffic, error rates, and response times.

- Create an API proxy based on open API specifications and deploy it in the cloud.

4. JMeter

JMeter is a powerful tool primarily used for load testing and performance testing of APIs. It allows users to simulate various user scenarios, generate heavy loads, and measure an API’s performance under different conditions.

Key Features Overview:

- Work with CSV files automatically, hence allowing the team to swiftly generate distinct parameter values for API tests.

- Facilitates seamless inclusion of API tests within CI pipelines

- Available for both static and dynamic resource performance testing

5. Postman

Postman is a widely used collaboration platform for API development. Originally a Chrome browser plugin, this tool is extended to an on-premise solution for both Mac and Windows.

Key Features Overview:

- Offers a rich interface that allows developers to design, test, and document APIs efficient

- Provide many integrations like support for Swagger & RAML formats

- The latest version of Postman helps users smartly organize the collections and API elements (mock servers, monitors, tests, and documentation).

Summary

API testing has become a pivotal element in open banking, driven by the continual efforts of financial institutions to enhance customer services and security. With the expanding realm of open banking and its offerings, API testing emerges as an indispensable practice. As a result, third-party providers may perceive API testing as an ongoing necessity rather than a singular undertaking.

To assist banks and fintech companies in executing API testing seamlessly, KMS Solutions’ enterprise testing team offers comprehensive expertise and tailored solutions. With a dedicated focus on the unique requirements of financial institutions, KMS Solutions delivers strategies and frameworks that facilitate robust API testing, empowering these organizations to navigate the evolving landscape of open banking confidently.