In recent years, FinTech companies are increasingly investing in skilled software developers to enhance their technological capabilities and build cutting-edge financial solutions. A well-equipped FinTech development team serves as the backbone of digital transformation, enabling businesses to drive innovation and maintain a competitive edge.

However, hiring the right team is no easy task since they must possess both deep domain knowledge and strong technical expertise. They need to be proficient in financial technologies such as AI/ML, open banking APIs, and e-KYC, as well as have a solid grasp of industry regulations, including PCI DSS, GDPR, and AML compliance.

Given the complexity of financial software development, having a well-defined hiring strategy is crucial. In this guide, we will explore the essential steps and key technology considerations for hiring a FinTech software development team that aligns with your business goals and drives long-term success.

Key Steps to Hire a FinTech Software Development Team

Hiring a FinTech software development company requires meticulous due diligence to ensure alignment with your business objectives and regulatory requirements. The following steps outline a strategic hiring process that helps you minimize certain hurdles when hiring an on-demand engineering team.

1. Understand Project Requirements

Clearly defining your project’s objectives, scope, and desired outcomes is the initial step for your Fintech business to find the right software development team. This step often takes at least 1-2 months to complete since there are several key areas to verify, including:

- Specify the problem your FinTech solution aims to solve

- Identify key features, technology stack, platforms, and applicable financial regulations

- Establish budgets, timeline, and scalability demands to manage expectations

2. Decide on the Collaboration Models

Choosing the right collaboration model is crucial for the strategy of hiring a FinTech software development team. By assessing budget constraints, project scope, and specific requirements, businesses can determine the most suitable engagement approach.

- Hire Internal Fintech Developers: Building an in-house FinTech development team provides greater control over the project. However, it comes with ongoing costs, including salaries, benefits, and other operational expenses. Additionally, managing the project requires leadership and technical oversight. If you lack technical expertise, coordinating tasks among developers and ensuring project efficiency may be challenging.

- Engage with an External FinTech Development Team: Another approach is to hire an external development team for a Fintech project. IT outsourcing allows you to focus on business growth while a dedicated external team handles development. Moreover, it provides access to a larger talent pool at more cost-effective rates, ensuring high-quality solutions. Today, this collaboration model is widely adopted by global companies like Google, Slack, and Skype.

3. Identify Key Selection Criteria for Fintech Software Team

Before searching for the right development team, it’s necessary to consider their specialized skills in Fintech. This means businesses need to determine each of the following in advance:

- Programming Languages: Building Fintech software demands proficiency in various programming languages or finance & fintech, including back-end, front-end, and mobile app frameworks and languages.

- Financial Technology Trends Adaptability: It’s advisable to outsource to a Fintech software development team that has expertise in critical financial technology areas, such as AI/ML, open banking APIs, and data analytics.

- Security and Compliance Knowledge: A strong understanding of security best practices and financial regulations is a major advantage for fintech developers. The team should be familiar with key compliance standards, such as PCI-DSS, GDPR, SOC 2 Type II, and ISO 27001. You can discover more on the article: Understanding Key Mobile Banking Compliance Regulations in 2025

- Industry Experience: Having domain knowledge in Fintech plays a crucial role in the efficiency and success of fintech software development. Hiring developers with several years of industry expertise ensures a smoother and faster development process, as they can anticipate and mitigate common challenges.

- Proven Fintech Development Track Record: With experience in developing seven fintech products, our team offers end-to-end financial software development services. Explore our solutions to see how we can help bring your fintech vision to life.

- Cultural Compatibility: Aligning with developers who share your work culture and values can accelerate the development process. Many banks and Fintech companies in Australia, Singapore, and Malaysia prefer working with development teams in Vietnam since they have similar working hours to ensure better communication and collaboration.

4. Research & Shortlist the Candidates

You can find potential Fintech developers through reputable B2B review platforms, which provide authentic client feedback and project insights. Here are some channels to search for a potential Fintech software development team:

- Clutch/Goodfirms: These are two of the most popular independent business directories that feature top Fintech app development companies. By browsing these review sites, you can filter developers based on their ratings, expertise in fintech technologies, portfolio, and client testimonials. This helps ensure that you choose a trusted fintech development partner with a proven track record in building secure and scalable financial solutions.

- Referrals: Referrals remain one of the most effective ways to hire fintech designers and developers. Just like recruiting in-house talent, you can leverage your professional network to get recommendations for reliable outsourcing partners.

Based on your requirements, create a shortlist of applicants and potential candidates. Reach out to them to express your interest in collaborating on a fintech development project. During your discussions, clarify their availability, compensation expectations, and any other relevant details to ensure a smooth working relationship.

5. Conduct Interviews with Fintech Software Developers

Arrange interviews—either virtually or in person—with the shortlisted candidates. Use this opportunity to assess their technical expertise, working process, and overall experience by asking questions regarding their previous projects and their solutions proposed for your specific requirements.

This process will help determine whether they are the right fit for your company culture and project requirements.

6. Hire the Fintech Software Development Team

The above steps are necessary for businesses to find the right Fintech software development team. Once you have evaluated all candidates, extend an offer to the most suitable ones.

The best practice here is that before committing to a long-term contract, consider starting with a proof-of-concept (POC) project. This allows you to assess the team’s capabilities, responsiveness, and compatibility with your business.

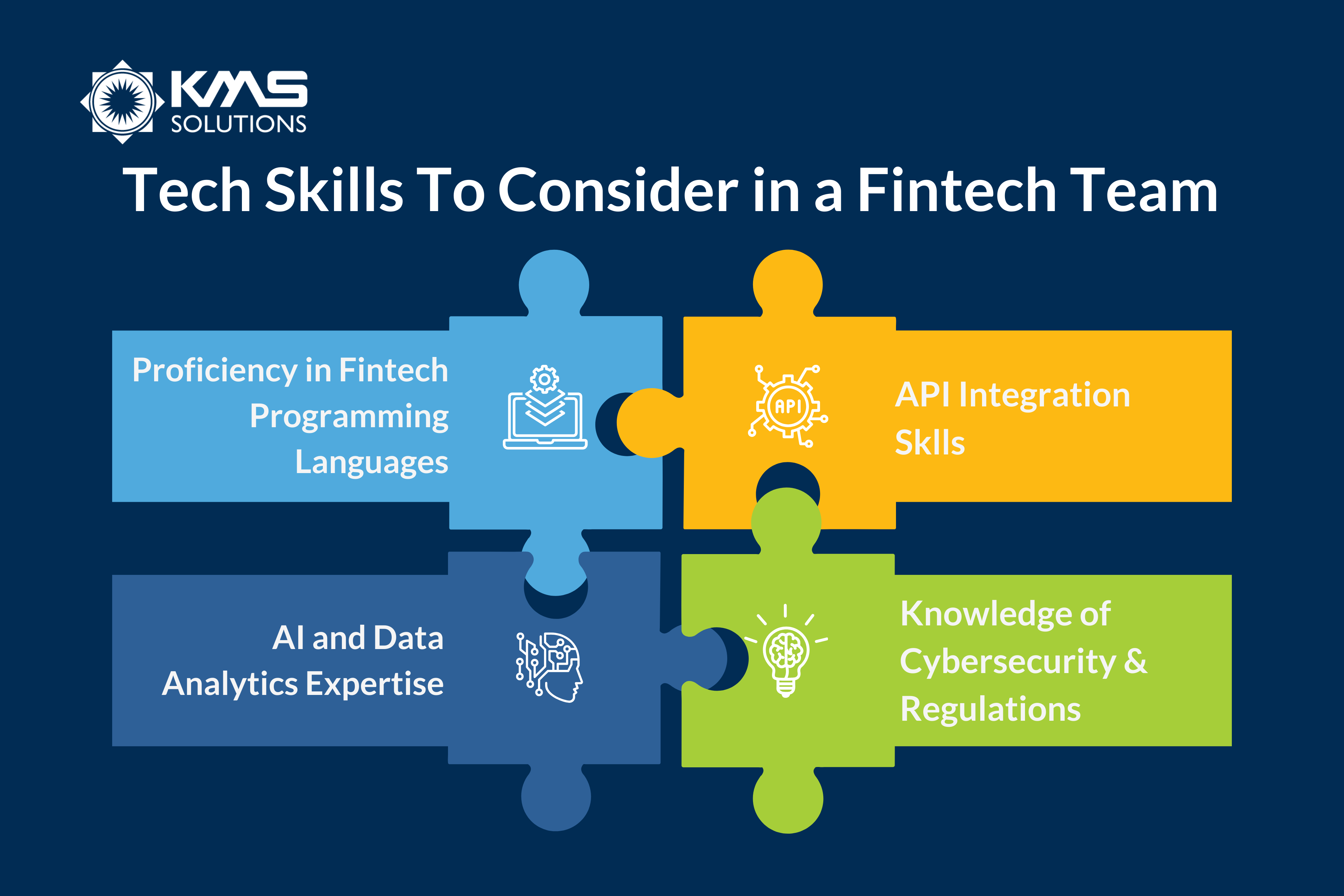

Technology Skills To Consider in a Fintech Software Development Company

Let’s discover the necessary skills that Fintech software developers provide. The skills comprise proficiency in Fintech programming languages, a deep understanding of financial systems, and knowledge of financial regulations.

1. Proficiency in Fintech-Specific Programming Languages

Fintech solutions are built using various programming languages to handle the complexity, security needs, and performance requirements of the product. This means the Fintech software development team should be proficient in:

- Back-end programming languages: Mastery of programming languages like Java, Python, and C++/C# is vital for creating robust back-end systems, handling large datasets, and ensuring high performance

- Frontend programming languages & frameworks: JavaScripts, React.js, Angular, and Vue.js are essential for building interactive, responsive, and high-performance fintech web applications.

- Mobile app development languages: While Swift is required for developing iOS-based banking and payment apps, Kotlin is the official programming language for Android-based fintech apps. React Native and Flutter are preferred for cross-platform fintech app development.

2. AI and Data Analytics Expertise

Nowadays, many Fintech products increasingly rely on artificial intelligence (AI) and data analytics for informed financial decisions, fraud detection, and risk management. Look for fintech developers who have expertise in:

- Fraud detection algorithms: AI-based financial systems for detecting fraudulent transactions and identity theft.

- Predictive analytics: insights to improve user behavior and business operations through predictions.

- Natural Language Processing (NLP): used in AI chatbots, customer support automation, and document analysis.

- Robotic Process Automation (RPA): helps automate manual financial processes such as KYC verification and compliance checks.

3. API Integration Skills

Fintech platforms need seamless integration with banks, payment providers, and third-party services. Therefore, strong API integration skills are required for connecting financial services into a cohesive system, ensuring seamless and efficient online transactions.

- RESTful & GraphQL APIs: used for integrating financial services, payment gateways, and external financial data sources.

- Open banking APIs (PSD2 compliance): allows fintech applications to securely connect with multiple banks and financial institutions.

- Payment gateway integration: expertise in integrating some widely-used payment service providers such as Stripe, PayPal, Square, Apple Pay, Google Pay, and Visa/MasterCard APIs.

4. Knowledge of Cybersecurity & Financial Regulations

Security is non-negotiable in fintech applications due to the sensitivity of financial transactions and confidential user data. A fintech software development team must implement robust cybersecurity measures and adhere to global financial regulations to ensure secure operations.

- Data encryption: ensure financial data is encrypted both in transit and at rest.

- Regulatory compliance: the team must comply with Know Your Customer (KYC) regulations, PCI-DSS for securing credit card transactions, GDPR for data privacy and protection, and ISO 27001 for information security management systems.

Top Fintech Software Development Companies in Australia that You Should Look For

1. KMS Solutions

Established in 2019 as a specialized division of KMS Technology, KMS Solutions focuses on transforming digitalization in the Asia Pacific region, with focus areas in Australia, Singapore, Malaysia, and Vietnam. With a strong focus on comprehensive software testing, the company guarantees the quality, reliability, security, and performance of fintech applications, ensuring seamless user experiences and regulatory compliance.

With a strong emphasis on the BFSI industry and a team of 1,500+ IT experts, KMS Solutions delivers a comprehensive range of fintech solutions, including mobile banking applications, trading and insurance platforms, digital lending platforms, and fintech MVP development.

The company specializes in automation, security, performance, mobile, accessibility, and API testing, ensuring seamless functionality across multiple platforms. Recognized for its client-centric approach, the company excels in integrating cutting-edge technologies, including AI/ML, Robotic Process Automation (RPA), open banking solutions, API integrations, cloud computing, and cybersecurity.

Seamlessly aligning with Agile and DevOps methodologies, KMS Solutions facilitates Continuous Integration/Continuous Deployment (CI/CD), ensuring adaptability to any software development process. The company has successfully collaborated with leading BFSI enterprises worldwide, including Asia Commercial Bank (ACB), TPBank, a top Australian “Big Four” bank, Discovermarket, HDBank, GIC, and other financial leaders.

2. Appello Software

Based in Sydney, Australia, Appello specializes in fintech software development, catering to enterprises looking to scale and undergo digital transformation. With a strong portfolio of digital products and services in the financial sector, the company delivers end-to-end software solutions, guiding clients from the design phase to full-scale deployment.

Their Fintech software development services include Fintech UX/UI design, financial applications, and custom financial software.

3. TatvaSoft

TatvaSoft is a leading fintech application development company, specializing in crafting high-quality, customized financial solutions for businesses across the globe. With over 21 years of industry experience, the company has built a strong reputation for delivering cutting-edge financial software development and tailored solutions that meet the evolving needs of the fintech sector.

Backed by a dedicated team of 900+ IT professionals, TatvaSoft brings expertise across a diverse range of FIntech technologies and platforms through the proficiency in Microsoft, .NET, Java, Node.js, and PHP.

Sum Up

Selecting the right fintech developers is crucial for successfully building and launching financial products. Every stage, from determining the type of developer needed to the onboarding process, plays a key role in finding the most qualified professionals for the job. This article has outlined various reliable sources to help you connect with skilled programmers for your fintech project.

At KMS Solutions, we specialize in fintech software development, with a team of experts proficient in cutting-edge technologies and automation testing frameworks to create engaging and flawless fintech applications. We also offer flexible collaboration models tailored to your business’ specific needs through our on-demand engineering team that helps you accelerate the development backlog rapidly.

Get in touch with us for a consultation on fintech app development, and we’ll provide a custom project estimate to bring your vision to life.