In the fast-paced world of technology, payment gateways have emerged as indispensable tools for businesses, facilitating secure and seamless transactions. It happens around the world as the Global Payment Gateway Market Size is anticipated to reach 162.68 billion by the year 2031.

Especially in Australia, over 15.3 million cards were registered to mobile wallets in 2022, as per the report of the Australian Banking Association in 2023. Additionally, from 2023 to 2027, the total transaction value in digital payments is anticipated to grow at a CAGR of 14.89%.

Hence, these new gateways play an important role in the modern world across different industries, from financial services, trading, e-commerce, retail, etc. There are a number of payment gateways on the market with different pros and cons. In this article, we will examine each type of gateway to choose one that fits your software.

Payment Gateway’s Components and Workflow

A payment gateway, which includes further explanation on the differences between payment gateway and payment processor, is an online service that enables businesses to receive payments from customers via their websites or mobile apps. It serves as an intermediary connecting a merchant and the financial institution processing the payment.

This payment gateway encompasses more than just a physical card reader or a point-of-sale device used in traditional brick-and-mortar stores; it also encompasses a payment processing terminal seamlessly integrated into a digital platform.

Before distinguishing between different types of payment gateways, it’s vital to go through the key components and basic workflow of a payment gateway from when the user checks out until completing the transaction.

1. Components

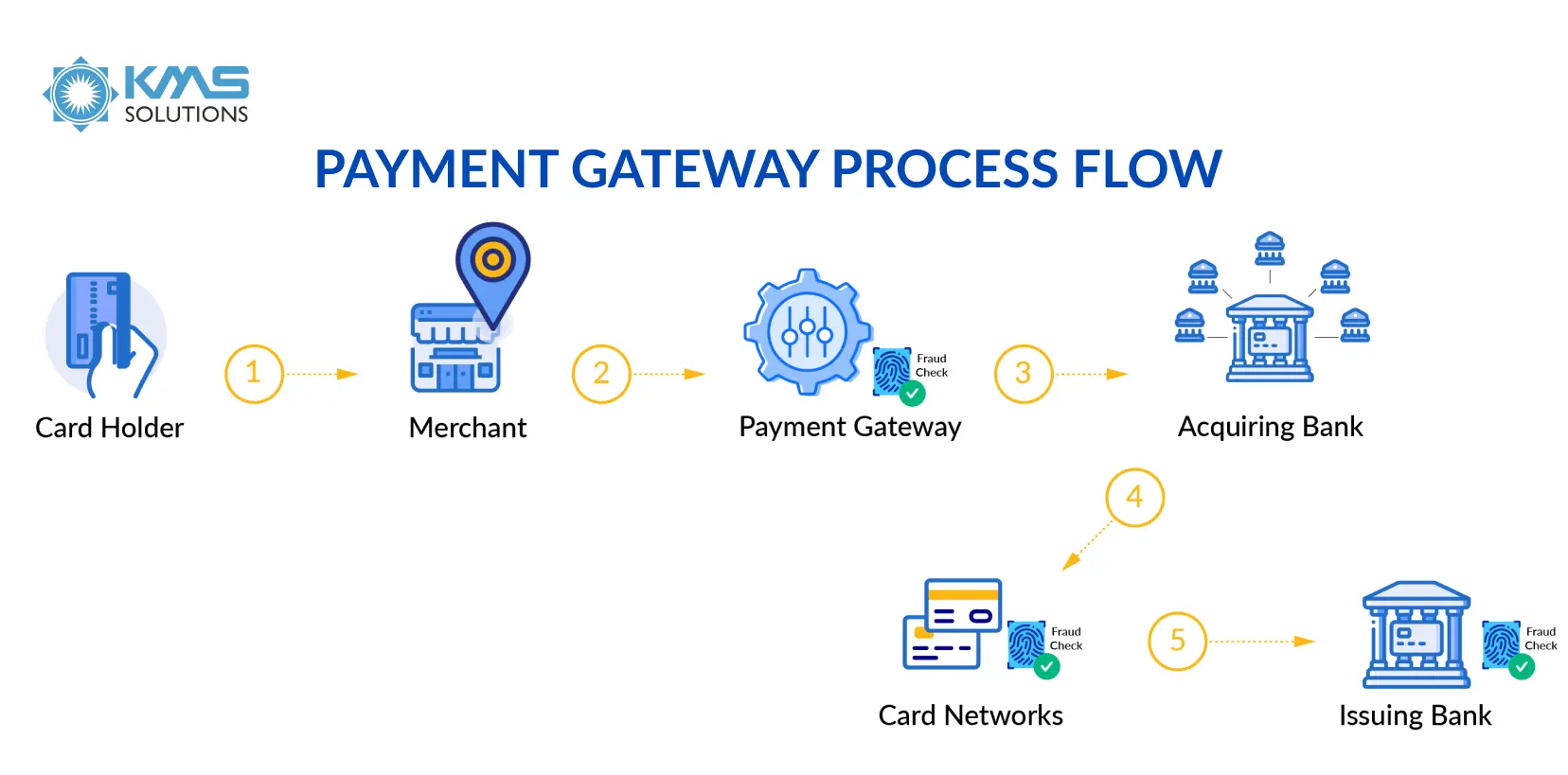

In a card payment system, several components work together to facilitate transactions. These components include cardholders, merchants, acquiring banks, issuing banks, and payment networks.

- Cardholder: The user who decides to pay for goods or services on your website. Individuals or businesses that hold payment cards like credit, debit, or prepaid cards. They use these cards to initiate transactions by making purchases.

- Merchant: Businesses that accept card payments from customers. They have point-of-sale terminals or online payment gateways connected to acquirers.

- Acquiring bank: The bank that handles the backend processing of transactions processes card payments for merchants.

- Payment networks: such as Visa, Mastercard, American Express, or Discover, connect issuers and acquirers. They develop network rules, facilitate funding exchanges between parties, and handle aspects like fraud prevention.

- Issuing bank: The bank issues payment cards to users and businesses. They manage cardholder accounts, set credit limits, collect fees and interest, and process authorization and settlement.

2. Workflow

Here are the roles and interactions of each component in facilitating a card payment transaction.

- Step 1: When checking out, the users (cardholders) initiate purchases by providing their card details to merchants.

- Step 2: The card information and transaction details are sent from the merchant to the payment gateway securely (how the merchant transfers card data may differ depending on which payment gateway type it chooses).

- Step 3: The payment gateway encrypts card information and fraud checks and sends card data to the acquiring bank.

- Step 4: The acquiring bank then forwards card data to card networks for fraud checks and routes to the issuing bank according to card information.

- Step 5: The issuing bank authorizes and settles the payment. Finally, it returns the transaction status back to the merchant for fulfillment and notifies the user whether his order is successful.

Each component plays a crucial role in facilitating the transaction, ensuring the smooth flow of information and funds between cardholders, merchants, acquirers, issuing banks, and payment networks.

Types of Payment Gateways

Before choosing the payment gateway that adapts well to your business requirements, it’s essential to think about your business needs and infrastructure. There are three common types that you can consider: re-direct payment gateway, offsite payment gateway, and on-site payment gateway.

1. Re-direct payment gateway

The re-direct payment gateway works by directing the customer away from your checkout page. This approach fully hosted the payment page, which includes collecting the user’s card information, settling the payment, and highly aligning with the PCI security standards. More particularly, when the user clicks on the ‘Pay now’ button, the user is navigated to the host or payment service provider (PSP) page. After the payment is made, the user is navigated back to the business site to complete the order.

This payment gateway is suitable for businesses that have limited resources and want to focus on developing other aspects of their website.

2. Offsite payment gateway

One step further, the payment gateway offsite gives you the ability to customize your payment page and collect card information directly from your site. This data is then sent to the backend site for payment processing with a third-party payment gateway.

What distinguishes offsite from re-direct is that offsite does not navigate users to separate sites. This method helps enhance the user experience because of the flexibility of customizing the payment page. In addition, this method improves the user checkout process by integrating the payment gateway seamlessly on the backend site.

3. On-site payment gateway

This type of payment gateway allows merchants to have the end-to-end user experience of payment on their website. Merchants who have large-scale systems and very specific requirements will use this method.

When installing an onsite payment gateway, you are responsible for its security. Your team has to guarantee the system’s PCI compliance and pay for the SSL certification.

Comparison Between Three Types of Payment Gateways

Pros | Cons | Example payment gateway | |

Re-direct | Easy to register and integrate. Fully PCI compliant. High security helps protect customers’ sensitive data and decreases the probability of chargeback incidents. | Navigating to another page may annoy the user. Not fully customize the payment page. | PayPal, Google Pay, Stripe Checkout, Amazon Pay |

Offsite | Better user experience. Faster checkout experience for customers as the transaction occurs solely on the merchant site. Gain full control over customer metrics. | Need to maintain good security when transferring user data to the backend site. May introduce bugs because handling the payment process by yourself. | Stripe, Checkout.com |

Onsite | Fully customizable end-to-end user experience API-hosted payment gateways offer complete flexibility. | Extra fee to maintain PCI compliant and SSL |

Conclusion

Understanding the attributes of each payment gateway type is crucial as we can choose the appropriate approach by considering the balance between price, security, business needs, the current stage of your product development, and the capacity of your team etc.

In fact, multiple payment types can exist in a system. For example, you may operate an offsite payment gateway for Credit Card, PayPal, and Google Pay at the same time. On the other hand, a payment product can support multiple payment types, such as Stripe, which supports both re-direct & offsite payment. Meanwhile, there are mobile payments that only work with required devices. Apple Pay is available on Apple devices, and Samsung Pay is available on select Samsung devices.

In KMS Solutions, we offer seamless integration solutions, making the process of selecting and incorporating payment gateways more efficient. Connect with us to see how we helped Axi Trading improve customer experience through seamless payment gateway integration.