Did you know that human errors in the banking industry may lead to over $878,000 in wasted time and labour annually? Implementing robotic process automation (RPA) is a practical step, given the significant financial impact of human errors in the BFSI industry.

According to a McKinsey report, by utilizing RPA and AI, up to 30% of tasks across banking operations can be automated, allowing staff to concentrate on strategic activities while boosting productivity and cutting costs. The drive to automate redundant tasks and empower end users is expected to propel the industry forward in the coming years.

So, in this article, we will analyze how to implement RPA in banks and the best use cases of it in the BFSI industry.

What is RPA?

Robotic Process Automation (RPA) is a technology that uses software robots (often referred to as “bots”) to perform repetitive office tasks that were previously done by human workers or computers. These tasks can include things like data entry, moving files, copying and pasting data between software, and generating reports.

RPA is particularly essential in the banking industry. Every day, banking staff need to handle large amounts of customer data, and manual processes are often error-prone. The extensive data extraction and manual handling of banking operations can lead to mistakes. By using bots, manual tasks such as validation of customer information between two systems can be completed in seconds.

Implementing RPA can reduce processing costs by 30% to 70%. Additionally, automating several processes in banks can free up staff to focus on more essential tasks.

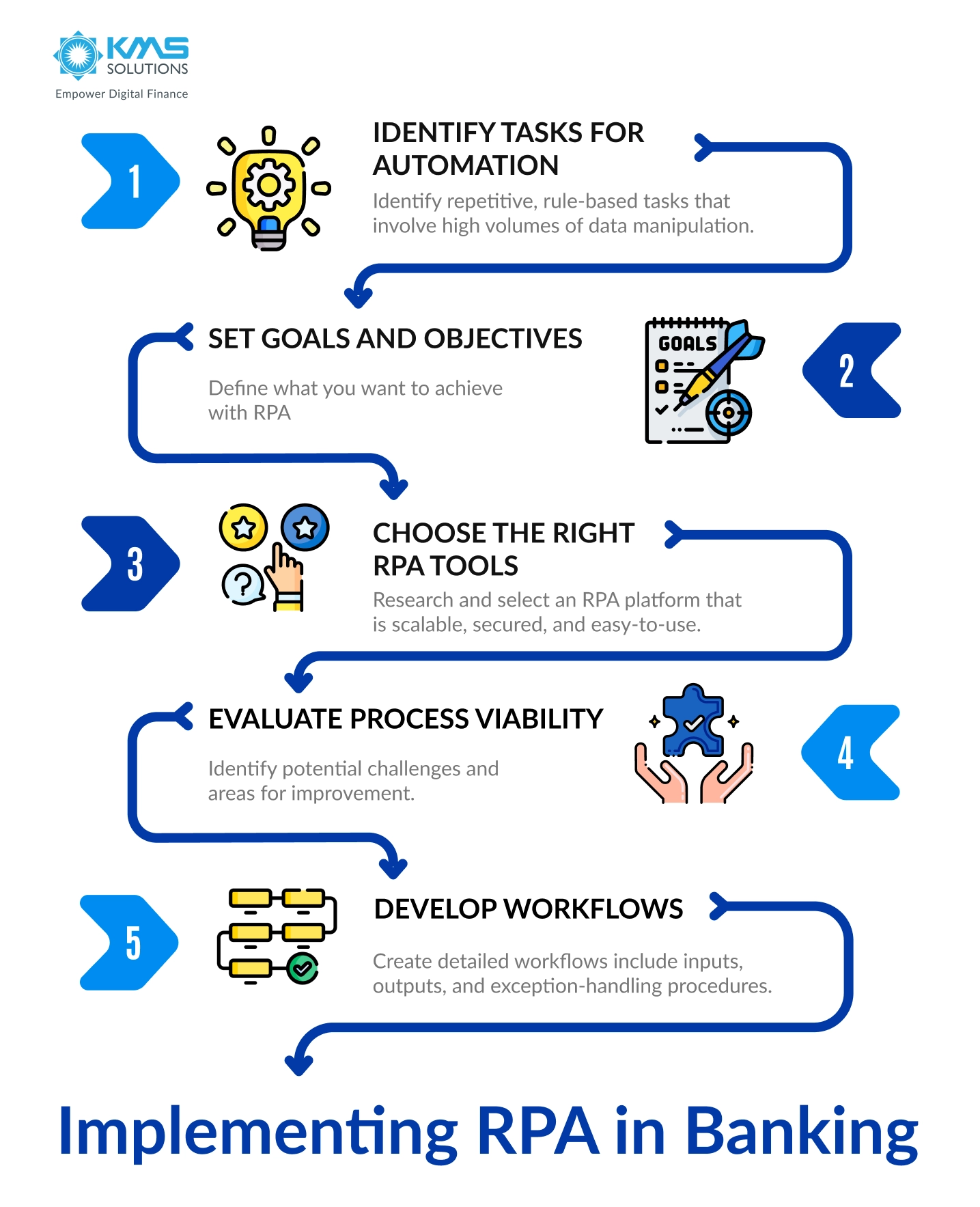

How to implement RPA in Banking

Implementing Robotic Process Automation (RPA) in banking can significantly improve efficiency and accuracy. Here’s a breakdown of the key steps:

1. Identify tasks for automation

Conduct a thorough analysis to identify repetitive, rule-based tasks that involve high volumes of data manipulation across multiple systems. Examples include account onboarding, loan processing, regulatory compliance tasks, and data entry.

This process may include prioritizing processes that will deliver the highest return on investment (ROI) when automated.

2. Set goals and objectives

Implementing RPA without clearly identified goals may result in dispersion and inefficiency. Thus, defining what you want to achieve with RPA is essential. Is it to increase team productivity, reduce processing time, improve accuracy, or free up employee time for more strategic work?

Having clear objectives helps measure success. It’s necessary to make your goals easier to track and evaluate.

3. Choose the right RPA tools

Research and select an RPA platform that integrates well with your existing banking systems. Consider factors such as scalability, security, and ease of use.

Banks and financial institutions can also conduct pilot programs with selected tools to assess their effectiveness in some specific environments.

4. Evaluate process viability

Analyze the chosen tasks to assess their suitability for RPA. This may involve process mapping to identify potential challenges and areas for improvement.

Also, in this phase, you should also define the scope, timeline, and milestones for the implementation and assign responsibilities for the right staff.

5. Develop workflows

Create detailed workflows that outline the steps the RPA software will follow. This includes defining:

- Inputs: the data and information required by the bot to perform specific tasks. These inputs can come from multiple sources and can be structured or unstructured. The inputs can be customer data, transaction data, email and attachments, API calls, etc.

- Outputs: the results or processed data generated by the bot. These outputs are used for further processing, compliance reporting, customer communication, or record-keeping. Examples of outputs include: processed transactions, financial reports, API responses, and more.

- Exception-handling procedures: ensure the bot can manage errors or unexpected situations effectively, minimizing disruption and maintaining process integrity.

What are RPA Use Cases in the Banking Industry?

Customer Services

Customer Services

Every day, banks have to deal with tons of regulatory requirements when onboarding new clients. Besides personal and financial data, bank employees are faced with various verification and approval processes. By implementing this technology, banks can automatically populate, and verify client information into multiple systems without the need for manual data entry, significantly reducing the costs and time of manual processes.

Fulfilling e-KYC Requirements

Typically, in most banks and financial institutions, the costs of performing the e-KYC process can be significant. According to Infosys, US$52 million a year is the average amount that a bank spends on KYC compliance, and this number is respectively higher in some large banks and FIs.

With RPA adoption, many manual tasks can be done effectively.

- Background Checks: RPA can automate the process of performing background checks on customers by accessing public records, handwritten customer input, and scanned documents to perform required e-KYC checks.

- Accelerating processing times: For regular cases, RPA bots help automate repetitive and time-consuming tasks, reducing the time taken to onboard new customers and verify their identities.

- Improving security and compliance: By reducing the need for human intervention, RPA decreases the risk of data breaches by employees. Meanwhile, it also ensures that processes are executed according to regulatory requirements consistently.

- Minimizing error rates: Automating data entry and processing minimizes the risk of human errors, ensuring the accuracy and integrity of data.

Chatbot

RPA, integrated with NLP and Generative AI, can develop innovative interactive experiences for both banking customers and middle-office employees.

By leveraging RPA, banking app chatbots can handle a wide range of customer service tasks, such as providing 24/7 support, managing account inquiries, processing transactions, and assisting with loan applications. These chatbots also offer personalized banking services by analyzing user data to provide tailored financial advice and product recommendations.

Invoice/Payment Processing

The high volume of invoice processing involves repetitive manual tasks, often leading to delays and incorrect payments. Invoice processing faces challenges such as handling diverse formats and consolidating data from multiple sources into a single financial database. RPA handles data input, reconciles errors, and even performs decision-making tasks required for invoice processing, reducing the need for human intervention.

Moreover, the RPA approach can also automate the receipt and payment process. Bots can schedule payments based on due dates, cash flow status, and payment terms to optimize payment timing.

Financial Products

Loan Processing and Validation

Loan and appraisal requests often come as PDFs buried in emails. Extracting data from these applications, verifying them against various ID documents, and then assessing creditworthiness are all time-consuming manual tasks that slow down the process.

RPA bots with AI can be the secret weapon. These intelligent software RPA assistants can automatically extract data from those PDFs, eliminating manual work. Additionally, AI capabilities allow them to verify the extracted data against ID documents, streamlining the process further. This frees up valuable time for loan officers and helps them make faster, more informed decisions.

Trade Finance

Trade finance requires coordination among multiple international parties to ensure the proper delivery of goods and payments. Banks and businesses communicate through various documents, including letters of credit (LC) and bank guarantees (BG), which need to be processed efficiently.

RPA can automate the end-to-end process of issuing, amending, and advising letters of credit. Bots can check the compliance of presented documents with the terms of the LC, reducing the time and effort required for manual verification.

Financial Services Software Development

Code Generation and Deployment

Developers can now generate code using AI and leverage RPA to automatically generate code templates and manage code repositories, which streamlines the coding process. For deployment, RPA bots handle tasks such as code compilation, environment configuration, and orchestrating deployments across multiple platforms, ensuring consistency and accuracy, which are prioritized in financial services software.

RPA can extract and transform data from legacy systems, facilitating seamless migration to new platforms while performing rigorous validation checks to maintain data integrity. It also integrates data across various financial services systems, enabling real-time synchronization and consistent data flow. By consolidating customer data from multiple sources into a centralized repository, RPA enhances data quality through cleaning and deduplication processes.

Continuous Integration and Continuous Deployment (CI/CD)

This technology approach also plays a crucial role in enhancing CI/CD processes in the BFSI sector. By automating routine and repetitive tasks, RPA ensures the seamless integration and deployment of banking software, reducing the potential for human error and accelerating testing cycles. This includes performing automated unit tests, integration tests, and regression tests to validate code changes, thus maintaining high-quality standards.

Audit & Compliance

Regulatory Compliance

Banks are burdened not only by mountains of reports but also by frequent post-trade compliance checks and calculating expected credit loss (ECL). RPA can automatically collect data from various sources like government websites, news outlets, and even federal agencies. Based on that, it can scan regulatory announcements for future changes, catch changes early, or access the latest updates as new information is released in real time. This automation can significantly accelerate the process and reduce associated costs.

Traditionally, the quality assurance process for payments involved manual checks, only covering a limited sample of data. This approach left room for errors to slip through the cracks. RPA changes the game. With robotic testing automation, banks can analyze almost all critical payment data, including transactions prone to errors and those involving money. This comprehensive approach allows businesses to catch anomalies much faster. The result? Fewer errors in payments, leading to happier customers.

Data Processing & Verification

Back-Office Operations

RPA bots handle data entry and management by automatically inputting customer information, transaction details, and other relevant data into banking systems, minimizing human errors and speeding up processes.

Additionally, in account reconciliation, bots efficiently compare bank statements with internal records, swiftly identifying and resolving discrepancies to ensure financial accuracy.

Conclusion

Applying RPA in banking offers a compelling path towards a more efficient, accurate, and customer-centric banking experience. By automating repetitive tasks, RPA frees up employees for higher-value activities, reduces errors, and streamlines processes. This translates to faster turnaround times, improved data quality, and, ultimately, happier customers. As RPA technology continues to evolve, its applications within the banking sector are poised to expand further, shaping the future of how banks operate and serve their clients.

Being a leading RPA company for many businesses in the BFSI industry, KMS Solutions empowers banks to harness the full potential of RPA through a comprehensive and tailored approach. If you want to transform back-office operations or enhance customer service, contact us now for a personalised consultation to help you adopt RPA effectively!