Back in 2009, Apple’s viral slogan “There’s an app for that” was believed to create a remarkable trend in mobile application development worldwide. Since then, digital apps have multiplied tremendously and become indispensable to every phone. The constant rise in demand for new, convenient apps has given birth to one outstanding idea – the “Super App”

As customers need super apps for a better, faster, and more seamless experience of financial functions streamlined, along with a range of other services, traditional banking apps will soon become outdated. In response to this situation, incumbents of banks and financial services are considering developing a one-stop tech app for all the banking requirements of consumers. Let’s see whether the super app is the bank’s opportunity or threat concerning more digital user engagement.

What is a Super App?

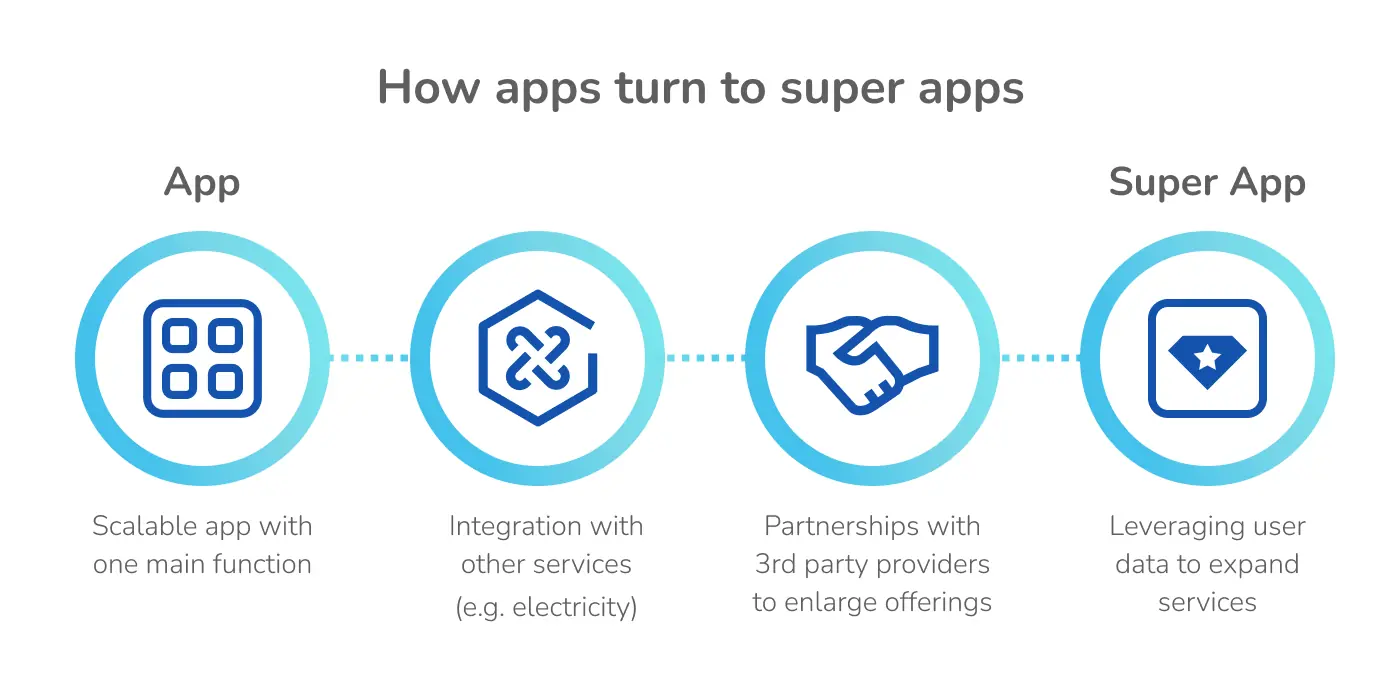

A super app is an umbrella app that provides a comprehensive system tailored to customers’ daily demands via a single integrated interface or platform. It often entails a marketplace of third-party offers that are wholly integrated into the ecosystem and utilize vast amounts of data to engage consumers and provide a broad range of experiences and services.

Payments and financial services functions included in super-app: Cashless payments, Mobile payments, Investment platforms, Insurance, Credit and loans, QR code payments, etc.

How is Open Banking Powering Super Apps?

The global expansion of Open Banking enables super-apps to use financial data from various sources to target users’ needs and deliver financial products. This will provide platforms with more significant opportunities to offer a variety of financial services and to deliver the appropriate services to each user.

Here’re some benefits of Open Banking to super apps:

- Increased personalization: by offering a proactive eco-system, open banking assists platforms in leveraging consumers’ data and creating genuinely tailored experiences for them.

- All financial functions are integrated into one platform: by accessing Open Banking data, the platforms can give customers the ability to make payments, check account balances and perform other typical banking activities from the app’s digital wallets.

- Connecting with the appropriate partners: since Open Banking expands further into open finance and open data, super apps can access and connect with other partners.

Super Apps and Impact on Banking Sector

Research from KPMG postulated that super apps could be one of the most disruptive influences in the finance sector.

Compared to Western users, people in the Asian market have quickly adapted to using a single portal to access a range of different services, including texting, booking, payments, and many more activities. The growth of super apps unhesitatingly benefits customers; however, it has both side effects on banks and financial institutions.

1. The opportunities for Banks

Super apps integrate financial services into their platforms to provide users with a more convenient and straightforward experience. The integration has a significant meaning as it expands banks’ outreach to prospects through various platforms. Due to the consumers’ rising demands for super apps for their daily transactional activities, banks can connect with their customers more frequently. This engagement helps banks create trust in services and build a brand reputation by delivering a unique and seamless customer experience (CX).

Additionally, super apps also allow banks to enhance their analytics capabilities and data management. Implemented effectively across the super app’s service areas, banks can grasp a more comprehensive perspective of their users and, based on that, tailor offerings suited to customers’ needs, enhancing their experience. Those insights can benefit support processes such as digital onboarding by providing electronic Know Your Customer (eKYC), unifying authentication, biometrics, and facial recognition to enable users’ self-service.

By connecting with super apps, banks can shift their concentration from simply conducting transactions to building long-term relationships, resulting in increased user acquisition, satisfaction, and subsequently, stronger brand loyalty.

Some digital banks have joined the super-app ecosystem by offering unbranded “banking as a service” to the applications, enabling this seamless integration. As the regulatory framework around financial services is onerous, some super apps delivering loans, insurance products, investment platforms, and other services are forming strategic partnerships with banks and fintech in their core market to deliver these services.

2. The threats to Banks

Considering the impact of super apps on banks, experts in KPMG say, “While the emergence of super apps in the East has been considered as a fairly peripheral trend to the banking industry, they can disrupt it.” Despite the undoubted convenience for service users, super apps present some disadvantages to banks and the finance sector:

- Super apps are disintermediating banks from their users: some super apps like Wechat (from China) and Momo (from Vietnam) have provided various basic banking, saving, and investment services to consumers. In fact, these products are being originated and underwritten by traditional banks and financial institutions; they may find their activities become purely perfunctory whilst super apps gain user loyalty through experiential incentives.

- Better CX delivered from the super apps compared to traditional banks: super apps not only have the capability to access an unprecedented amount of customer data, but they also know how to use it to deliver better experiences to users. Although banks can have their data to improve operational processes, it’s still behind the flexibility of super apps since they can quickly adapt to customers’ needs.

What should banks do now?

In responding to the rise of the super apps, banks generally have three options: accept, extend and compete. Let’s examine each of these options in further deep:

1. Staying with their own product offerings

Banks that choose this option will need to accept market changes and try to stay competitive by promoting their own offerings. However, a drawback of this choice is it will restrict the banks’ growth, regardless of the fact that well-established banks with a substantial client base and proprietary data may be able to maintain their market share. Gradually, banks may discover that even their most loyal clients use super-apps for part of their financial demands, potentially chipping away at profits.

2. Embedding services to super apps

This is the approach that many banks will likely consider. Banks can extend their reach by embedding services (possibly unbranded) within super-apps or other digital platforms. Banks may continue to leverage their brand, utilizing the platform to improve CX. Still, as the number of super apps is limited, banks are in the race to act instantly or face the risks of having no one left to partner with.

3. Compete against super apps

Banks can compete with super apps by releasing their own comprehensive super apps encompassing financial and non-financial offerings. This approach will attract the boldest banks – those who are willing to re-analyze their business model and adjust the vision to embrace the challenges of creating their ecosystem. To compete with rising and well-known super-apps, banks will need to:

- Establish a vision: Before undergoing the transition to becoming a financial service ecosystem, banks must determine their position in the new age. Banks that fail to carve themselves a distinct niche risk becoming obsolete.

- Embrace open data: Super-applications thrive on the free flow of information between entities. Banks will need to investigate open data architecture and application programming interfaces (APIs) to remain competitive.

- Become a data player: To harness the value of their own data and third-party data, as well as to create new customer experiences and journeys, banks will need to concentrate on Data Analytics and data management skills.

It can be difficult if banks try to compete in China against many giant super apps such as WeChat and Alipay. However, in markets where no market-leading super app has yet to emerge like Vietnam, Singapore, and Australia – there is still time and opportunity for banks to take the lead. As having comprehensive data analytics is necessary for banks to compete with super apps, they can rely on trusted service providers – KMS Solutions to build a data & analytics platform that is powerful and scalable.

You may want to read: 7 Elements For Successful Digital Banking Transformation

Conclusion

It is supposed that, at least for the next decade or so, the trend among users and businesses is toward super apps. The crucial concern is if banks comprehend how they will supply value in a future controlled by super apps and whether they possess the agility to adapt before super apps become a considerable disruption.