As we move deeper into 2024, Australian fintech companies are not just reacting to industry changes but actively forecasting and shaping the future of finance.

From implementing cutting-edge technologies and an intensified emphasis on automation testing to the seamless distribution of banking features and custom software development, each company assumes the role of innovator spearheading a sector revolution driven by groundbreaking advancements and strategic foresight.

In this article, our specialists at KMS Solutions will delve into some pivotal trends poised to redefine the narrative of the fintech ecosystem in 2024.

What is a Fintech Company?

Let’s define fintech.

The core of fintech is simplifying areas like banking, investing, financial management, and insurance for consumers and businesses. Fintech companies utilise custom software development and other advanced technologies to improve traditional financial service delivery methods.

These companies employ emerging technologies such as AI, open banking, data analysis, automation testing, etc., to create innovative solutions, Hence, technology trends play an essential role in influencing the strategies, product offerings, and business models of fintech companies. Companies that are responsive to emerging trends can position themselves as market leaders, gain a competitive edge, and capitalize on new opportunities.

Below are some fintech trends that BFSI businesses in Australia should consider.

Financial Trends #1: AI – Continue Staying in Trends

Artificial intelligence (AI) is set to permeate every aspect of our lives, and the integration of AI into fintech operational workflows is no exception. In fact, global artificial intelligence in fintech is expected to grow from 12.32 billion in 2023 to 45 billion by 2032.

AI has emerged as a transformative force within the BFSI sector, fundamentally altering how financial institutions engage with their customers. By analysing customer data, AI can identify patterns, preferences, and behaviors, enabling banks to offer personalized services that enhance customer satisfaction. Some use cases of AI in banking technology include:

- GenAI with Large Language Models

- Advanced Data Collection and Analysis

- Credit Scoring and Loan Approval

- AI in robotic process automation (RPA) for customer support process

- and more

Financial Trends #2: Greater Emphasis on Data Collection, Analysis & Application

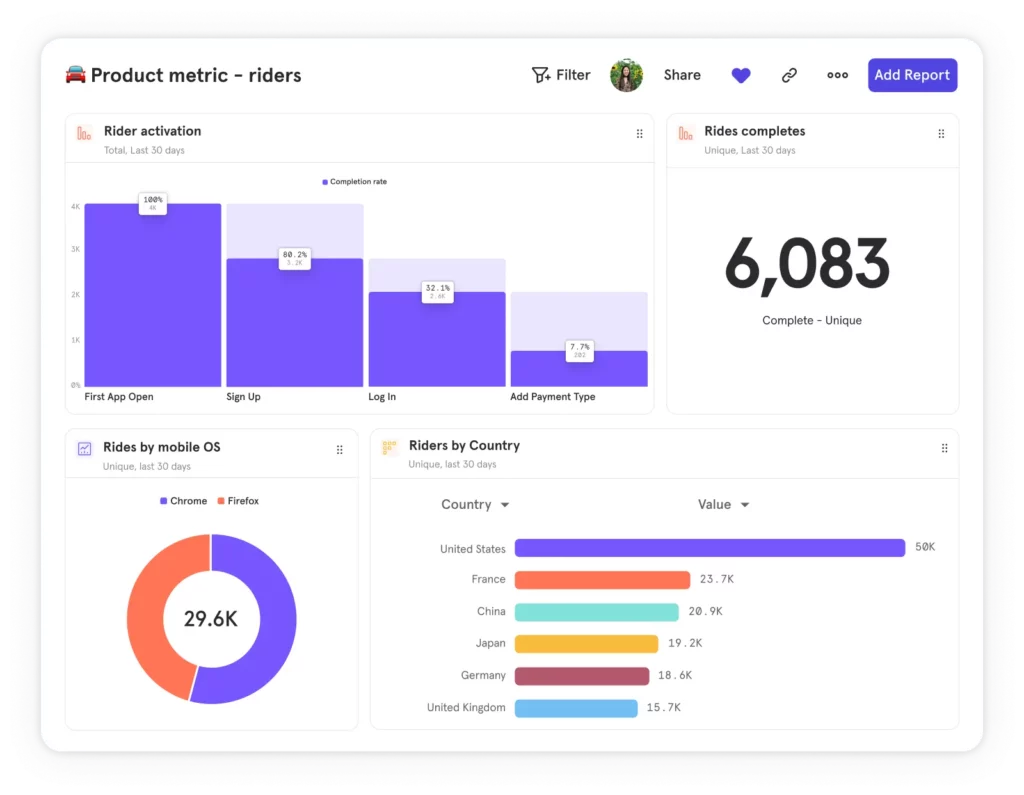

Larger enterprises face mounting pressure to deliver comprehensive financial analytics to their leadership teams, but often lack the time to sift through multiple tools and spreadsheets to manually compile relevant data.

Moreover, smaller enterprises are struggling with the resources and expertise required to develop in-house financial dashboards, which hampers their capability to harness analytics for strategic decision-making.

Experts estimate that, in 2024, we will see an increased emphasis on custom software development and fintech solutions that offer business-to-business (B2B) clients more efficient access to tailored financial insights. These solutions will likely furnish vital information that simplifies risk assessment and performance during customer onboarding processes and the ability to rapidly analyse payment patterns and trends.

Predictive analytics derived from this integration are expected to illuminate the potential future creditworthiness of business partners, as well as ensure companies are better equipped to proactively address financial risks and execute thorough due diligence on their clients.

Financial Trends #3: Advancements in Cybersecurity

Australians are increasingly conscious of the risks associated with cybercrimes, especially when it comes to their finances. With the growing threat of cyberattacks, fintech firms are expected to invest in cybersecurity measures to protect customer data and financial transactions. This may include:

- Security testing: helps businesses focus on identifying vulnerabilities and weaknesses in a system’s security measures. Its primary objective is to assess the system’s ability to protect data, maintain functionality, and prevent unauthorized access, breaches, or attacks.

- End-to-end encrypt sensitive data: All sensitive data, such as user credentials and financial transactions, should be encrypted at various levels, including data transmission, storage, and user authentication.

- Compliance with Regulations: Ensuring compliance with relevant cybersecurity regulations and standards, such as PCI DSS, GDPR, and industry-specific regulations, to protect customer data and maintain trust.

Financial Trends #4: The Emergence of Open Banking API

In recent years, the Australian financial technology sector has experienced notable expansion, with numerous key players emerging as frontrunners in the realm of open banking API.

By taking advantage of APIs, financial service providers can leverage their complementary strengths, allowing for broader consumer reach and better-personalised products to offer for users.

Nonetheless, the major challenge to applying open banking is the absence of regulations governing open APIs, along with the lack of uniform standards for IT systems, data storage, security, and connectivity. Hence, a comprehensive regulatory framework around open banking is necessary for financial institutions to fully embrace the concept.

Financial Trends #5: Shift to External Custom Software Development in Fintech

As fintech companies strive to innovate within the financial sector, many are partnering with an external custom software development company to boost growth and technological prowess. This trend, driven by the need to stay competitive and agile, involves not just outsourcing but tapping into specialised knowledge and cutting-edge technology unavailable in-house.

These partnerships with offshore development teams enable fintechs to focus on core competencies while expert developers handle complex challenges like blockchain integration, AI for predictive analytics, and tailored cybersecurity. Such collaborations enhance product innovation, operational efficiency, and market speed, providing a crucial competitive edge.

As the demand for sophisticated, user-friendly financial services grows, reliance on these partnerships is expected to increase, marking a key trend for 2024 and beyond.

Bolster the Power of Your Fintech Organisation with Support from KMS Solutions

Digital banking is rapidly advancing, and with the rise of fintech and challenger banks, traditional banks are facing a make-or-break situation to undergo digital transformation.

However, the shift to newer technologies is a very costly process and requires strategic plans to adapt to emerging technologies. With over 13 years of experience working with numerous financial institutions worldwide, KMS is confident it has the expertise to help your business successfully execute new initiatives and reach your desired ROI.

Ready to expand your offerings and improve your daily operations? Speak with our experts at KMS Solutions today.