The banking sector is on the brink of a digital revolution, driven by significant advancements in UX/UI design. As 2024 approaches, financial institutions are increasingly prioritizing user-centric software development to enhance customer satisfaction and engagement. This article delves into the top 12 design trends that are set to redefine the user experience in banking software, providing a roadmap for institutions aiming to stay ahead in this dynamic landscape.

More Vibrant Color Design

Historically, banking software has often adhered to a more conservative and subdued color palette, emphasizing trustworthiness, stability, and professionalism. However, designs are changing. From neutral tones, we’ve seen much more in the way that banks and financial institutions adopt bright and eye-catching colors to appeal to younger generations, who are increasingly becoming the primary users of mobile banking apps.

Here are some critical aspects of the trend towards using bright colors in banking app UI design:

- Captivate customers’ attention and create a visually appealing experience.

- Vibrant hues can distinguish essential buttons or calls to action

- When appropriately employed, these colours can convey positivity, energy, and dynamism to users, establishing an emotional connection between the user and the fintech app.

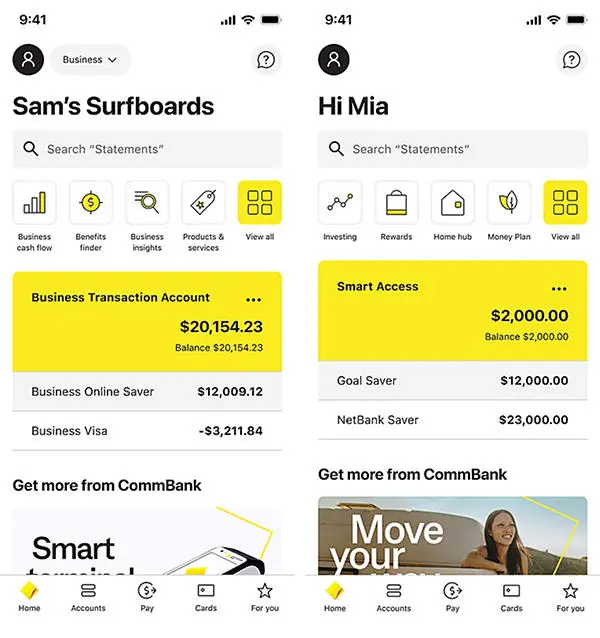

It is essential for designers to strike a balance between vibrancy and usability, ensuring that these colors enhance the overall user experience without compromising on functionality and professionalism. The Commonwealth Bank has adopted this trend in its banking app’s latest version to deliver a superior user experience:

Key Takeaway: Embracing vibrant colors in banking software can create a more engaging and intuitive user experience.

Data Visualization and Progress Bars

Any financial app processes a multitude amount of information, including account balances, transaction histories, investment portfolios, and more. When this data is illustrated in bulk, it may confuse users and affect their financial decisions.

Stemming from the minimal design philosophy, the BFSI businesses should reduce the cognitive load by using simplified charts and graphics offered in a digestible manner. Whether it’s visualizing investment portfolios, tracking expenses, or monitoring market trends, simplicity in design ensures that users can quickly interpret and act upon the data presented. This visual clarity empowers users to make informed financial decisions and stay in control of their finances.

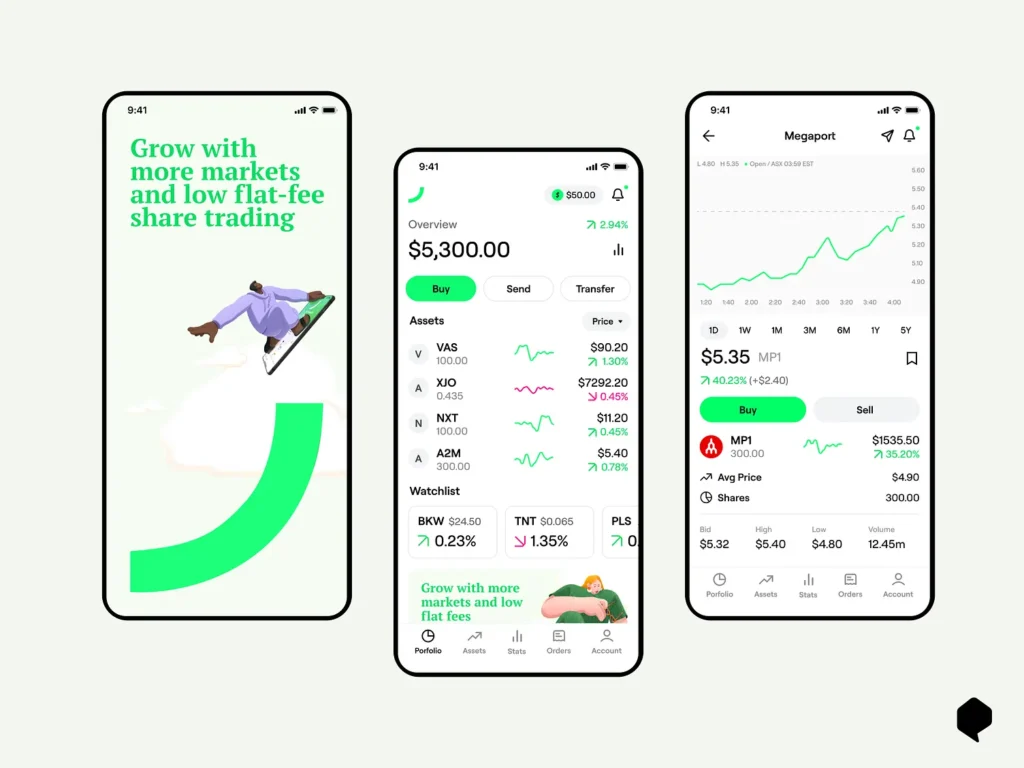

As an example, the Selfwealth trading app concentrates on displaying real-time market data through candlestick charts and line graphs, providing insights into trading volumes and stock trends.

Key Takeaway: Data visualization and progress bars in banking software enhance user understanding and motivation.

Artificial Intelligence (AI) Design

Artificial Intelligence (AI) is revolutionizing UX/UI design in banking software by introducing highly personalized and efficient features that transform the user experience. AI technologies such as chatbots, predictive analytics, and personalized recommendations are becoming integral to modern banking applications.

Chatbots powered by AI can provide instant customer support, handling a wide range of inquiries from balance checks to transaction disputes. These virtual assistants are available 24/7, offering users a convenient and immediate solution to their problems. Besides, AI could contribute an additional $1.2 trillion to the global banking industry by 2025, thanks to its ability to improve operational efficiencies and customer service (Accenture statistics).

Key Takeaway: AI in banking software enables highly personalized user experiences and efficient customer support.

Microinteractions Design

Microinteractions in a banking app refer to the small, subtle, and often imperceptible animations, visual cues, or feedback mechanisms that improve the overall customer experience.

Interactive design elements go hand in hand with animations. While they may seem minor, this trend plays a significant role in guiding users, providing feedback, and creating a more enjoyable and efficient banking app experience.

Some examples of microinteractions in banking and fintech apps include:

- Button Animations: A subtle animation, such as a button press effect or color change can be applied when a user taps into a button to confirm that the action has been registered.

- Loading Spinners: While waiting for data to load, a spinning icon or progress indicator lets users know that the app is working, preventing them from feeling frustrated during brief delays.

- Confirmation Sounds: Auditory cues, such as subtle notification sounds or vibrations, can confirm successful transactions or receipt of important messages.

Key Takeaway: Microinteractions improve user satisfaction by providing clear, responsive feedback.

Personal Financial AI Assistant

The BFSI industry is witnessing a surge in AI adoption, particularly in the development of digital voice or text-based assistants. Given customers’ demand for immediate interaction, maintaining 24/7 customer support is essential. Since user inquiries can be countless and repetitive, banks and fintech corporations will need to move beyond traditional customer support to AI assistants.

AI-based conversation chatbots in banking apps can handle customer queries, provide account information, assist with transactions, and offer financial recommendations personalised for different contexts. By leveraging Natural Language Processing (NLP) and ML algorithms, these chatbots can understand customer intent and deliver accurate responses, same as Apple’s Siri or Microsoft’s Cortana.

Recently, Westpac introduced a virtual assistant, “Red”, to help the bank serve up to 4.9 million digital customers’ requests, reduce the number of enquiries coming into its call centres and help drive down costs spent in the customer services team. These AI assistants enable users to send texts or pose questions from “Send $100 to my mother” to “Find the nearest ATM.”

Key Takeaway: Personal financial AI assistants offer tailored financial advice and automate routine tasks.

Fast and Imperceptible Authorisation

Users seek swift access to essential functionalities such as urgent bill payments, quick balance inquiries, or sending money. Nowadays, biometrics authentication is developed to grant instant access to services with an acceptable security level, making traditional authentication via passwords a throwback.

To maximise security, we recommend the use of multi-factor security solutions. You may request two of the following varieties of ID verification:

- A known PIN or password

- Verification using a mobile phone, card reader, or one-time passcode device

- Biometric verification, e.g. fingerprint scanning or facial verification.

- For high-sensitivity functions such as security settings, changing limits, or transfer of large sums, additional authorisation would be needed.

As the first automatic transaction chain in Vietnam, the LiveBank app of TPBank allows customers to conduct transactions 24/7 using biometrics. Due to the utilisation of AI, LiveBank can reliably identify millions of customers’ identities in just 3 seconds, issue cards after 5 minutes of registration, and eliminate the need to carry personal papers, bank cards, or remember passwords when conducting transactions.

Key Takeaway: Fast and imperceptible authorization methods enhance security and convenience.

Gamification And Behavioral Banking

Gamification such as rewards, challenges, and leaderboards can be an advantage for banks to use in motivating users. They will engage more actively with their financial goals.

On the other hand, behavioral banking leverages insights from behavioral economics to design features that encourage positive financial habits. For instance, banks might use nudges and incentives to encourage users to save more, invest wisely, or reduce debt.

Key Takeaway: Gamification and behavioral banking techniques make financial management more engaging and effective.

Biometric Technologies

Biometric technologies, such as fingerprint scanning, facial recognition, and voice authentication, are standard features in banking software. These technologies offer a high level of security and convenience, addressing the limitations of traditional authentication methods.

These technologies enhance security by providing unique and hard-to-replicate identifiers, reducing the risk of unauthorized access. They also improve user convenience by eliminating the need to remember and enter passwords.

Key Takeaway: The integration of biometric technologies in banking software enhances user convenience.

Cross-Platform UX

Cross-platform UX has become a consideration as users interact with banking services on various devices, from smartphones to desktops.

Responsive design techniques and unified design systems are key to achieving cross-platform consistency. Responsive design ensures that the banking app adapts fluidly to different screen sizes, while design systems provide a cohesive look and feel across devices.

Key Takeaway: Cross-platform UX ensures a unified and seamless experience across different devices.

Location-Based UX

Location-based UX leverages users’ geographical data to offer more personalized and contextually relevant banking services.

For example, a banking app might use GPS to direct users to the nearest fee-free ATM or provide real-time alerts about nearby promotions. Deloitte’s study shows that 72% of consumers are open to sharing location data for personalized services, making this a valuable tool for banks.

Key Takeaway: Location-based UX enriches banking services by offering personalized, context-aware features, but requires careful handling of user privacy and data security.

Voice Processing

The rise of voice assistants like Amazon’s Alexa and Google Assistant has set a precedent for voice interaction. Voice-activated features enable users to perform tasks such as checking balances, making transactions, or even receiving financial advice using simple voice commands.

Voice interfaces offer convenience and accessibility, especially for users on the go or those with disabilities. Implementing accurate and secure voice processing requires sophisticated natural language processing capabilities to ensure effective and safe interactions.

Key Takeaway: Voice processing enhances banking software by offering a convenient, hands-free interaction method.

Focus on Typography

Modern banking apps are paying close attention to typefaces, font sizes, and text spacing. Choosing the right typography can significantly impact user perception and brand identity.

Clean, legible fonts improve accessibility for users with visual impairments, while distinctive typefaces can reinforce the brand’s character. 65% of people believe typography influences their perception of a brand’s credibility (Typeform report).

Key Takeaway: Emphasizing typography in banking software enhances readability, visual appeal, and brand identity.

Develop Your Next-Gen Banking Apps With KMS Solutions!

Since we move forward in the digital age, the collaboration between innovative UI design and technology will remain pivotal in meeting the evolving needs and expectations of users. These trends not only improve the aesthetic appeal of these apps but, more notably, they contribute to the functionality, security, and overall user experience.

If you want to develop cutting-edge financial products for a significant competitive edge in the digital era, get in touch with us now! Leveraging the capabilities of financial UI design trends and emerging technologies, KMS Solutions can assist you in transforming your business into a beloved financial brand that forms a deep emotional bond with your clients, leading to success, high demand, and enduring customer loyalty.