The finance industry has undergone a complete transformation, with technology paving the way for finance at the fingertip with innovative features and services. The fusion of technology has not only added convenience to the ecosystem but also opened up new opportunities to cater to underserved segments.

In 2022, the global financial services software market was valued at $118.65 billion and it is predicted to increase at a CAGR of 9.2% from 2021 to 2031, eventually reaching $282.71 billion by 2031, as per Allied Market Research.

With the immense potential of fintech, it has become a hot topic among inventors, entrepreneurs, and startup enthusiasts. If you’re considering capitalizing on a fintech app idea, this article will explore some software for financial services that can help you unlock opportunities in this rapidly growing industry.

Financial Services Software Solutions Ideas to Consider

Let’s take a glimpse of some promising finance application ideas. However, keep in mind that this list serves as a mere framework for your distinct software, which must not only integrate all the cutting-edge technologies but also incorporate your unique vision. As you go through the list, you can brainstorm how to express your business ideology through it

1. Insurtech app

The insurtech sector is anticipated to experience substantial revenue growth, with estimations indicating a rise from $5.48 billion in 2019 to $10.14 billion by 2025, as per Grand View Research. The recent global insurtech report by Gallagher Re also revealed that funding for the sector surged to $1.39 billion in Q1 2023 and a significant increase in the average deal size, with a rise of 25.3%.

There are many innovative app ideas when it comes to insurtech:

Car delivery insurance

The rise of delivery services comes with the expansion of in-car delivery insurance. To develop a standout car insurance app, a winning combination can be created by integrating AI automation, advanced algorithms, motion sensors and geolocation APIs. By incorporating these features, your application can effectively analyze driving behaviors, allowing for personalized premiums tailored to each policyholder. Additionally, an option to provide add-on travel insurance policies for inter-state deliveries can further enhance the app’s offerings.

P2P insurance (aka social insurance)

P2P insurance operates as a risk-sharing network where individuals pool their funds to collectively insure against risks. This model typically involves a small group of family members, friends, or individuals sharing common interests. In the event of a loss, funds from the collective pool are utilized to cover the affected individual. Notably, each member is accountable for the entire group’s risk profile and reimbursement, which incentivizes them to maintain low individual risk in order to minimize costs for the entire group. It also allows users to benefit from lower premiums in cases where no claims are made.

Blockchain-based insurance app

This type of app offers automated claims submission, payment, and data protection processes on the blockchain network. The utilization of Distributed Ledger Technology enables InsurTech platforms to enhance cybersecurity measures, expedite payment processing, and streamline the overall insurance claims procedure.

Cybersecurity insurance

With the alarming frequency of ransomware attacks occurring every eight minutes, it becomes paramount to thoroughly assess ransomware risks when evaluating prospective clients for accurate billing. Cybersecurity insurance offers individuals a valuable policy that mitigates the potential legal liabilities associated with conducting online business. By diligently paying premiums, individuals can effectively transfer a portion of the risks to the insurance service provider, ensuring peace of mind.

One of the major hurdles in the field of cyber insurance is the scarcity of data available to underwriters for calculating premiums and developing risk models. Insufficient research has been conducted to gather real-time data on cybersecurity risks, highlighting the need for further exploration in this area. In addition to leveraging cutting-edge technologies like IoT and AI for lead capture and analysis, it is crucial to foster innovative strategies to address these challenges effectively.

When building such insurtech apps, it is crucial to engage with a proficient software development company due to the intricate technical nature of the implementation process. KMS Solutions has a proven track record of empowering numerous financial institutions, including Discovermarket, in building multi-purpose insurance platforms spanning diverse areas such as health, cyber, and parametric – all powered by cutting-edge technologies. If you have a visionary insurtech app idea that aims to revolutionize the industry, we offer invaluable guidance and insights through personalized one-on-one meetings, ensuring your concept becomes a transformative reality.

2. Regtech app

Source: Technavio

This is another highly sought-after software for financial services. The application helps businesses to comply with both local and global standards, ensuring that they adhere to the appropriate practices in finance. It also streamlines critical processes like customer identity verification, transaction monitoring, report compilation and submission.

Many financial software companies are searching for a robust accounting system that can effectively generate financial reports, visually present them, process bills and track cash flow without human intervention. In short, a RegTech app can be developed for:

- Regulatory reporting: managing large amounts of data and automating compliance processes

- Identity management: verifying the identity of every client and ensuring the authenticity of their documents

- Transaction monitoring: preventing money laundering and identifying suspicious activity

- Risk management: identifying, mitigating and analyzing all potential risks

3. Money-saving app

The idea of a money-saving app has enormous potential and can be customized to cater to a wide range of preferences and financial capacities. One interesting approach could be developing an app that automatically saves or invests 1% of every purchase the user makes, thereby creating a source of passive income.

To further enhance this idea, consider incorporating an intelligent virtual assistant that provides personalized advice to users on the most profitable investments or ways to reduce their spending. Adding a gamification feature can also be an effective strategy to help users save more easily, fostering trust and growth for your enterprise.

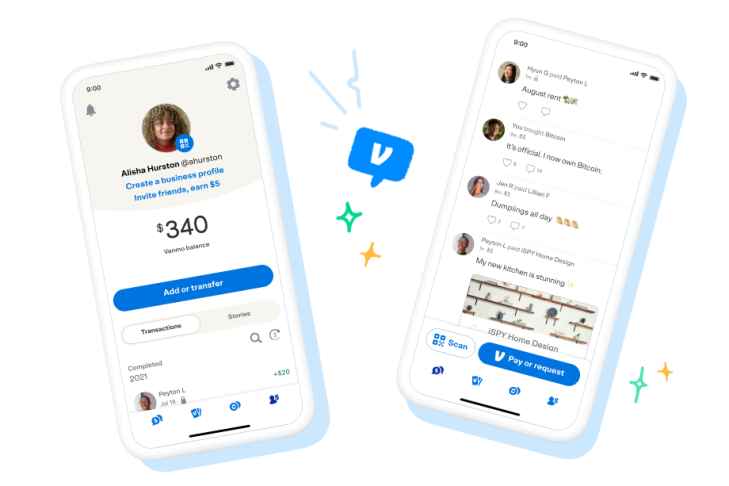

4. Digital wallet (e-wallet)

Source: Venmo

The practice of e-wallet money transfer has experienced a significant surge in recent years due to its ability to facilitate instant transfers between bank account holders without the need for third-party intervention or commission fees. According to Juniper Research, the global number of digital wallet users will surpass 5.2 billion in 2026, accounting for over 60% of the world’s population.

With a consistent growth trend, this platform is poised for a bright future, presenting tremendous potential for advancement in the financial industry. Although there are big players in the market like Venmo, Zella, PayPal, and Google Play, there is still room for faster and more secure e-wallets, especially since these apps have regional limitations regarding money transfers. You can further enhance the sophistication of the digital wallet solution by incorporating cutting-edge features such as NFC, voice-enabled transfer, and blockchain integration.

With a robust tech infrastructure and rich financial expertise, KMS Solutions can help you develop your very own secure and feature-rich e-wallet platforms. We prioritize security with encryption and advanced authentication mechanisms. Seamlessly integrating essential functionalities such as digital payments, peer-to-peer transfers, loyalty programs, and banking systems, our e-wallet solutions offer a frictionless user experience. Contact us for a meeting where we can propose out-of-the-box ideas to unlock the potential of your e-wallet vision together.

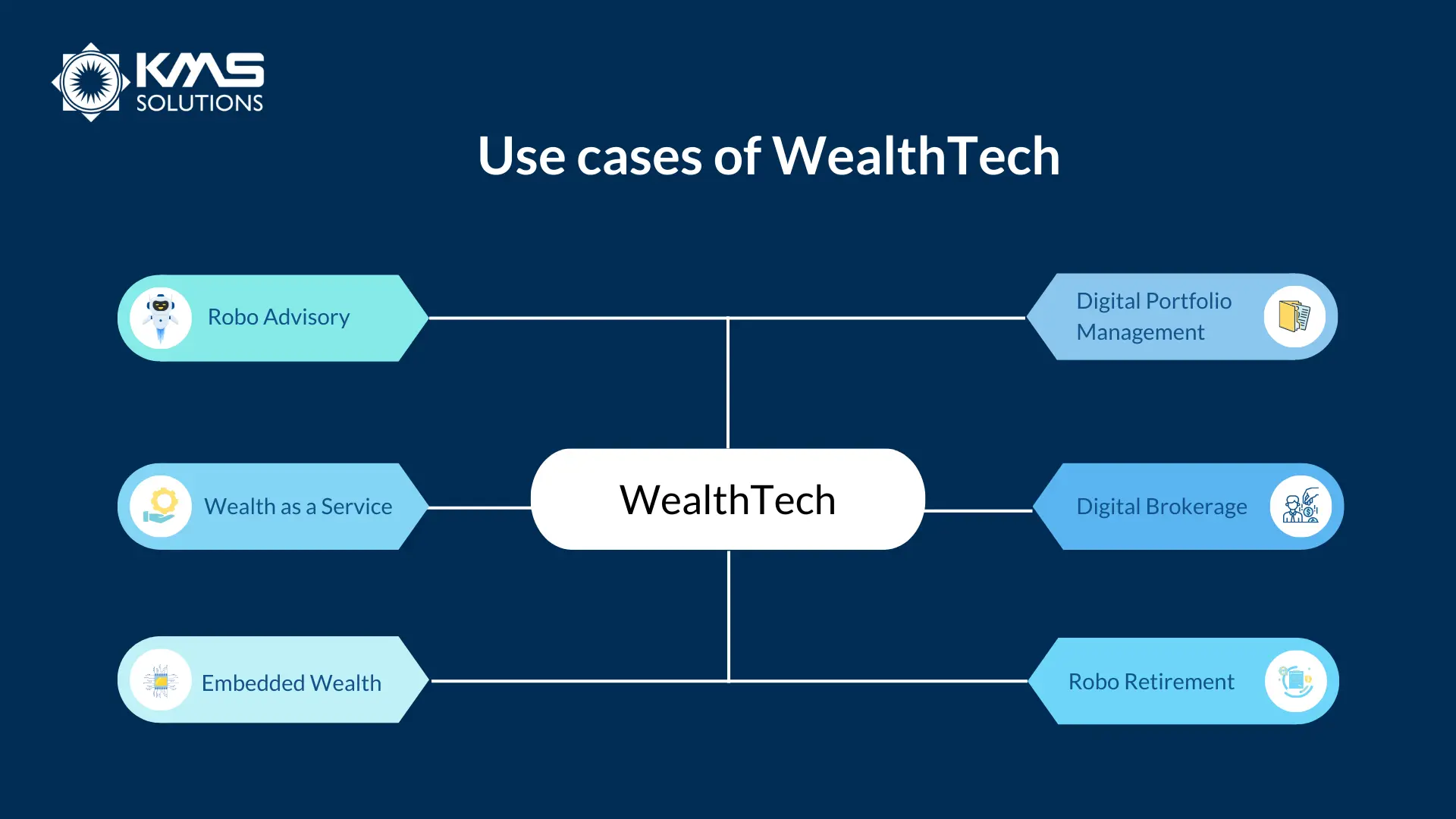

5. Personal finance app (WealthTech)

As consumers become more conscious of their finances and desire guidance to make informed investment decisions, financial advisory services are gaining widespread acceptance, sparking increased interest from startups and investors. In response to this need, you can develop an app that provides easy access to financial advisory services. This concept especially appeals to younger generations, such as Gen-Z and Millennials, who are accustomed to utilizing mobile devices for various purposes.

With features like automatic data synchronization and payment reminders, the solution empowers users to manage their income and expenses in real-time, providing valuable insights into how to better control their finances. To ensure ease of use, it’s crucial that the app presents information in a visually appealing and intuitive manner

Moreover, powered by machine learning, the robo-advising solution can analyze users’ spending habits and income, providing insights and advice on managing finances and optimizing spending. With AI/ML integration, the product can even offer investment suggestions and calculate tax returns. As automation is increasingly popular in the industry, such apps are expected to become more prevalent in the coming years, enabling users to better manage their finances and gain a clearer picture of their financial activities.

6. Payday Loan app

Source: Technavio

This financial services software provides users with a specific loan amount to help them in times of monetary crisis, such as bill payments, medical expenses, or loan repayments.

By entering their work information and connecting their bank account, users can access cash when needed, with the app tracking their working hours to determine the loan amount. The app deducts the loan amount from their next paycheck, ensuring a hassle-free repayment process.

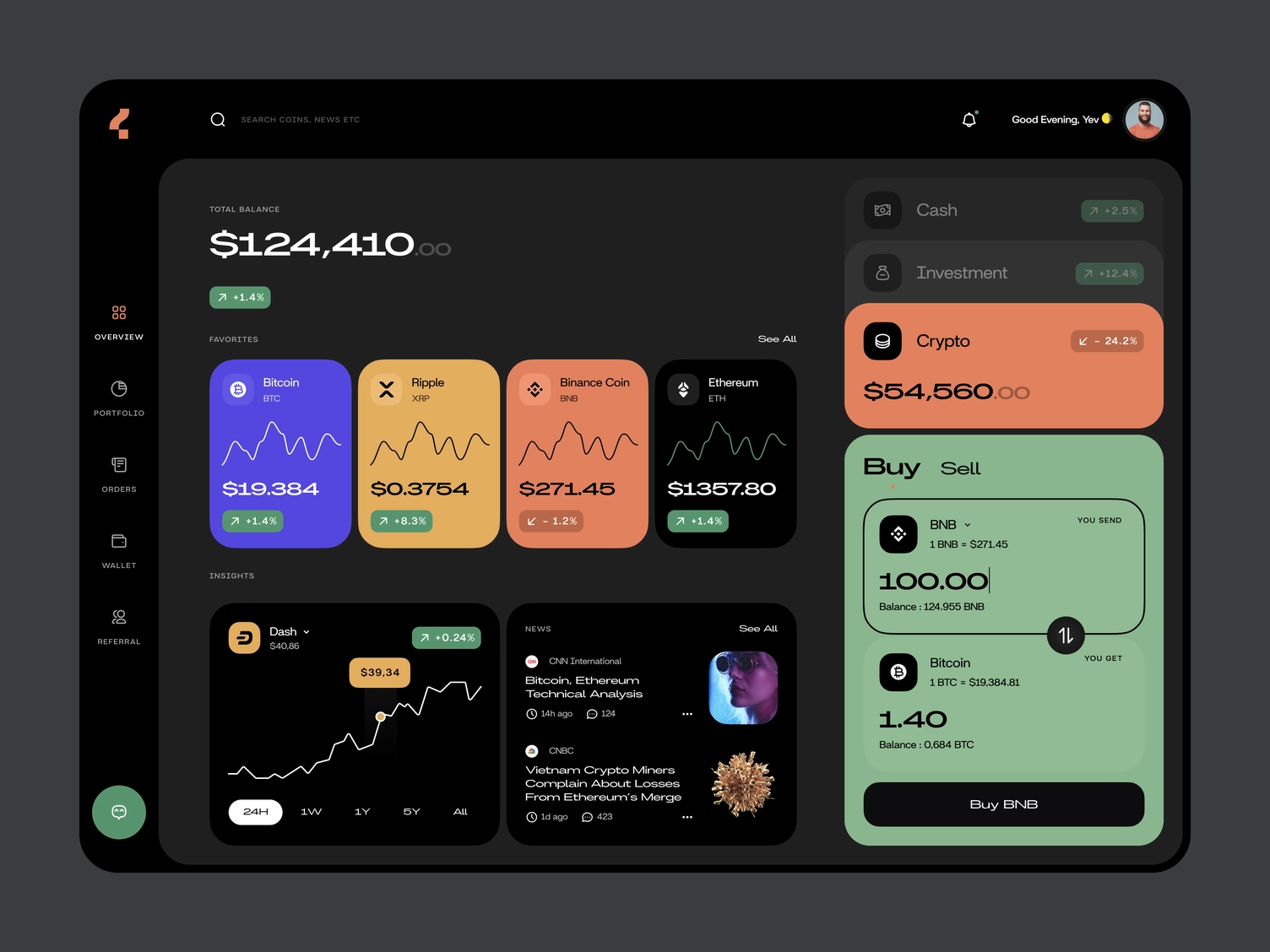

7. Cryptocurrency trading platform

Source: Yev Ledenov

Finally, creating a trading platform can be a lucrative financial venture, especially given the current market value of $9.2 billion.

These platforms enable users to trade cryptocurrencies in a decentralized market for other assets, such as fiat or digital currencies (Bitcoin, Ripple, Litecoin and others). In addition to reduced fees and faster transaction processing, users can benefit from enhanced security and transparency, making it an attractive option for investors and cryptocurrency enthusiasts.

A trading platform can stand out by incorporating innovative features that enhance the user experience and provide unique advantages. Some examples of such features include:

- Advanced charting tools like customizable chart layouts, technical analysis tools and drawing tools

- Social trading: allows users to follow and copy the trades of successful traders, fostering a sense of community and facilitating knowledge sharing

- AI trading assistance: provide personalized trading recommendations, identify potential trading opportunities, and help users make informed decisions based on historical data and market trends

- Risk management tools: Stop-loss orders, trailing stops, and risk calculator capabilities to assist traders in managing their risk exposure, setting predefined risk limits, and protecting their capital.

- Virtual trading or demo accounts: provide users with the option to practice trading with virtual money or a demo account.

- Integrated News and Market Analysis: Offer real-time news updates, economic calendars, and market analysis within the trading platform

Conclusion

The rapidly growing fintech industry has introduced numerous financial services software, but not all businesses are able to capitalize on these opportunities. Developing high-quality products that combine expertise, creativity, trust, and technology can be a challenging journey. That’s where KMS Solutions comes in.

With over 14 years of experience in financial software development, our team of 1,600+ IT engineers has helped numerous financial institutions, including Prudential, ACB, MB Bank, TP Bank, and OCB, create MVPs to validate their product-market fit or build full-fledged products that integrate cutting-edge technology to stand out in the market.

If you’re in need of a dependable and knowledgeable IT partner to manage your app development process, don’t hesitate to reach out to our team of experts for strategic planning and development.