As the financial industry rapidly evolves, driven by technological advancements and shifting customer expectations, banks must update their outdated systems to stay competitive and secure. Legacy banking apps, often deeply embedded in a bank’s infrastructure, can be cumbersome to overhaul due to their complexity and the risk of disrupting essential services.

However, modernization is essential for enhancing security, ensuring compliance with ever-changing regulations, and fostering innovation. Understanding the revamping process is not easy, this article will explore the intricacies of legacy systems, approaches to select the appropriate modernization strategy and best practices.

Challenges of Legacy Banking Applications

In the banking industry, legacy software presents significant challenges due to its outdated technology, obsolete business practices, and non-compliance with new regulatory requirements.

1. Technical Challenges

Integration Issues: Legacy systems often have hardware and software limitations that make it difficult to integrate with new technologies, resulting in reduced efficiency and increased downtime.

Manual Processes: Many legacy systems require manual data entry and other manual processes, which increases the likelihood of errors and creates backlogs of transactions.

Performance and Scalability: Outdated technology may not be able to handle the growing volume of transactions or provide the necessary speed and performance, leading to slow processing times and system crashes.

Security Vulnerabilities: Older systems are more susceptible to security threats due to outdated security measures. This increases the risk of data breaches and cyber-attacks.

Conduct a thorough analysis to identify repetitive, rule-based tasks that involve high volumes of data manipulation across multiple systems. Examples include account onboarding, loan processing, regulatory compliance tasks, and data entry.

This process may include prioritizing processes that will deliver the highest return on investment (ROI) when automated.

2. Business Challenges

Innovation Barriers: Legacy systems often lack the flexibility and infrastructure needed to support new products, services, and market expansion, leading to delays and increased costs when attempting to innovate. For instance, in the payments industry, some outdated systems may not support newer payment methods such as digital wallets, contactless payments, or instant bank transfers.

Operational Inefficiency: Antiquated systems can lead to inefficiencies in operations, requiring more time and resources to manage routine tasks. This impacts overall productivity and profitability.

Customer Experience: Outdated user interfaces and slow performance can negatively affect the customer experience, making it difficult to meet the expectations of modern banking customers who demand seamless and efficient service.

3. Regulatory Challenges

Compliance Issues: Legacy systems may not be equipped to meet current regulatory requirements. This can result in compliance issues, potential fines, and reputational damage.

Reporting and Auditing: Outdated systems often struggle with the complex reporting and auditing requirements of modern regulations, making it difficult to maintain accurate and timely records.

Adaptability to Regulatory Changes: Legacy systems may lack the flexibility to quickly adapt to new regulatory changes, increasing the risk of non-compliance.

4. Cost Challenges

Maintenance Costs: Maintaining and supporting legacy systems can be expensive due to the need for specialized skills and the frequent occurrence of system failures. Deloitte reports that 79% of business leaders struggle to find talent with expertise in legacy systems. This shortage makes tasks such as debugging, maintenance, and integration harder, resulting in slower responses and increased errors.

Upgrade Costs: Upgrading legacy systems to integrate with modern technology often requires significant investment in custom code and workarounds, making the process time-consuming and costly.

Resource Allocation: The high costs associated with maintaining legacy systems can divert resources away from innovation and strategic initiatives, hindering business growth.

How Modernizing Legacy Systems Navigate the Banking Industry

The banking industry relies heavily on technology to deliver efficient and secure customer service. However, many banks still operate with outdated legacy systems that present significant challenges.

Updating these systems is crucial to keep pace with the rapidly evolving technology landscape and meet customer expectations. Some key reasons for revamping outdated banking systems include:

Improved Operational Efficiency

Revamping these systems can streamline operations, automate processes, and minimize manual intervention, leading to enhanced efficiency and cost savings. Modern systems come equipped with advanced technologies that enable real-time transaction processing, making banking operations faster and more efficient.

Cost Savings

Outdated banking platforms often incur extra costs, including specialized onboarding and the necessity for 24/7 customer service to resolve end-user issues.

Modernizing banking apps can drastically reduce these costs by minimizing human intervention and utilizing newer, more reliable technologies that need less frequent and less intensive maintenance.

Enhanced Customer Experience

Customer experience is also greatly improved through modernization. Modern banking systems provide enhanced functionality, user-friendly interfaces, and greater accessibility. Features such as real-time transaction processing, personalized services, and faster response times contribute to higher customer satisfaction and retention.

Regulations Compliance and Improved Security

Modern systems are equipped with advanced security protocols that offer robust protection against data breaches and security threats. This ensures the safety of sensitive customer information and helps maintain the trust and confidence of clients.

Additionally, these systems are better equipped to meet the latest regulatory requirements, such as the Payment Card Industry Data Security Standard (PCI DSS), which is crucial in the banking industry.

Innovation and Competitiveness

Modernized systems can be developed using standard, off-the-shelf software components and contemporary methods, simplifying the process of making changes and reducing costs. Moreover, revamping legacy banking apps can help you easily integrate with advanced technologies such as AI/ML open banking API, etc. enabling banks to innovate and offer cutting-edge services.

With modern infrastructure, banks can develop and launch new products and services more quickly, responding promptly to market demands and staying ahead of competitors.

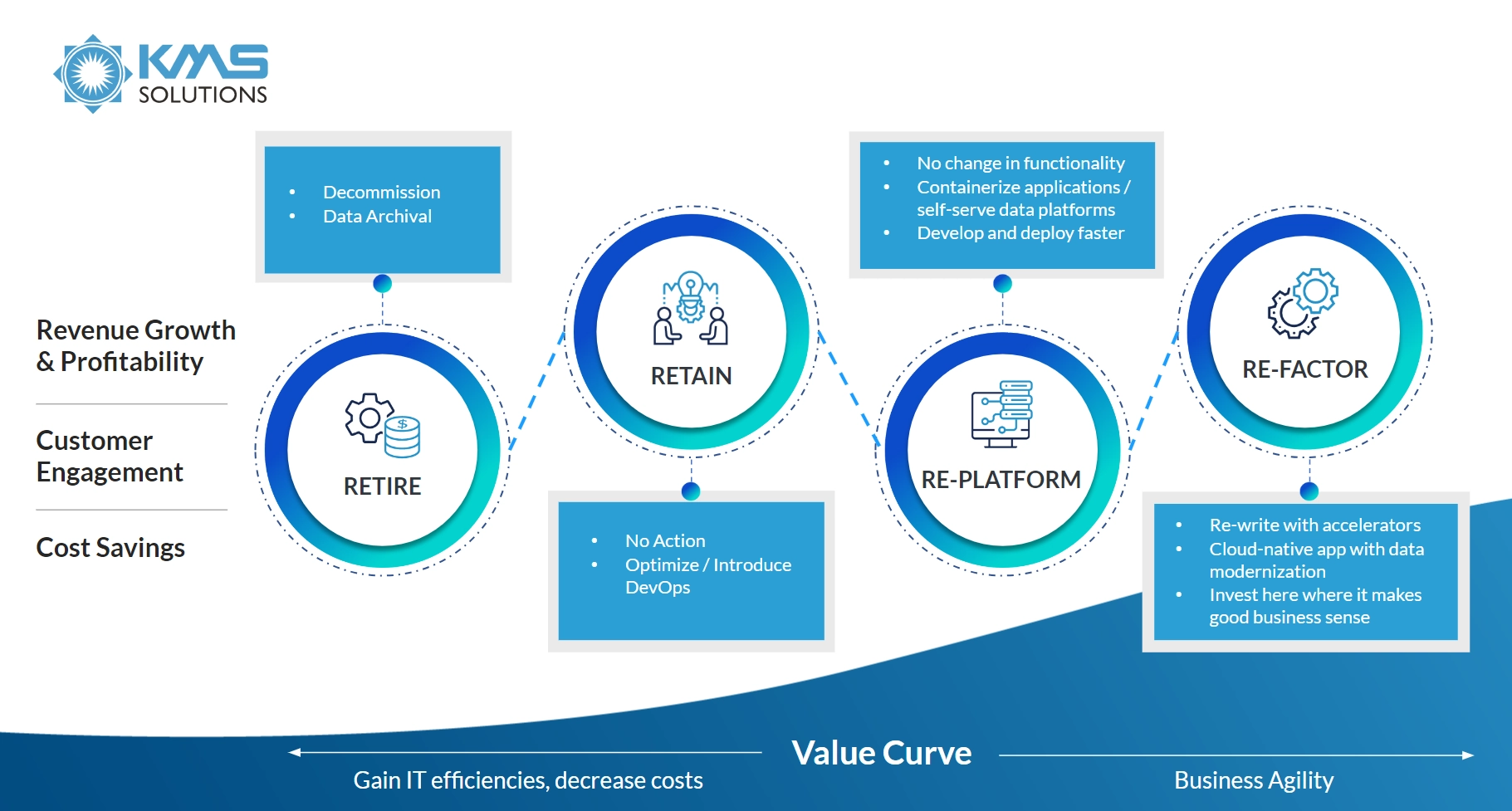

Modernization Approaches for Banking Applications

When it comes to modernizing legacy systems in the banking industry, businesses can choose from several approaches. Here are key approaches to modernizing mobile banking apps:

1. Retiring

Retiring a system involves decommissioning a legacy application or component that is no longer needed or redundant. This step is often taken when a system has outlived its usefulness, and either no longer serves a purpose or has been replaced by more modern technology.

Benefits:

- Reduces operational and maintenance costs.

- Frees up resources and minimizes technical debt.

Challenges:

- Potential data migration or archival requirements.

- Ensuring no critical business processes depend on the retired system.

2. Retaining

This approach involves keeping the system in its current state without modification, typically when the system is still functional and modernization would be too costly or unnecessary for the time being.

Benefits:

- Avoids immediate modernization costs.

- Keeps stable systems running without disruption.

Challenges:

- May lead to increased technical debt and maintenance costs over time.

- Future integration challenges as newer systems are implemented.

3. Rehosting (Lift and Shift)

Also known as “lift-and-shift,” rehosting involves moving an application from one environment to another (e.g., from on-premises to the cloud) without making any changes to the codebase or architecture. The core application remains unchanged, but it operates on a different platform.

Benefits:

- Faster migration to the cloud with minimal disruption.

- Reduces infrastructure management costs and improves scalability.

Challenges:

- Does not address the limitations or inefficiencies of the legacy system.

- Limited long-term benefits as the application itself remains unchanged.

This method is similar to rehosting, but replatforming involves moving the entire application stack from one technology platform to another with minimal changes to the functionality

Benefits:

- Allows for incremental improvements in performance and efficiency.

- Develop and deploy faster

Challenges:

- Core limitations of the legacy application may remain.

- Requires technical expertise to avoid compatibility issues during migration.

5. Rebuilding (or Rewriting)

Rebuilding includes developing a new application from scratch to replace the existing banking legacy system. While this approach is more time-consuming and costly, it provides the opportunity to use modern technologies and create a more scalable and flexible system.

Benefits:

- Incorporates the latest technologies and best practices.

- Fully aligns with current and future business requirements.

- Enhances user experience and performance.

Challenges:

- Resource-intensive and time-consuming.

- High upfront costs and potential project delays.

6. Re-architecting

Re-architecting involves changing the application’s architecture to make it more modular, scalable, and flexible. This approach focuses on breaking down the application into smaller, more manageable components.

Benefits:

- Improves scalability and flexibility.

- Facilitates easier updates and integration with other systems.

- Reduce the complexity of legacy banking systems.

Challenges:

- Requires significant effort and investment.

- Potential disruption to ongoing operations during the transition.

7. Refactoring

Re-engineer or rewrite parts of the application to improve scalability, performance, and maintainability, often by breaking monolithic systems into microservices or using cloud-native architectures.

Benefits:

- Improves flexibility and long-term sustainability.

- Aligns with modern development practices like DevOps and CI/CD pipelines.

Challenges:

- Can be time-consuming and resource-intensive.

- Higher upfront costs and potential risk of operational disruptions during the refactoring process.

Main Technologies for Legacy Banking App Modernization

Modernizing legacy banking systems is a complex balance of incorporating advanced technologies while maintaining compatibility with current infrastructures. Here are some emerging technologies that bank should consider:

Cloud Computing: Enhancing Infrastructure

Cloud computing offers a powerful platform that improves legacy systems by providing scalability and flexibility. Institutions like Capital One have migrated significant parts of their operations to the cloud, resulting in enhanced agility and innovative capabilities. This transition allows banks to respond to the ever-changing demands of the digital era, such as implementing Open Banking, while preserving the integrity of their legacy systems.

AI: Transforming Customer Engagement and Risk Management

Artificial Intelligence (AI) integrates advanced analytics and automation into legacy systems. It can significantly enhance customer service through intelligent chatbots and risk assessment tools, similar to those utilized by Wells Fargo or NFG, providing personalized assistance and evaluating creditworthiness while also boosting operational efficiency. Additionally, AI-powered risk management solutions enable banks to analyze large datasets, forecast market trends, and detect potential fraud, thereby strengthening their legacy systems against modern challenges.

Microservices Architecture: Improving Agility

Transitioning from monolithic applications to a microservices architecture is another critical approach in modernizing legacy systems. This architecture divides applications into smaller, independent services that can be developed, deployed, and managed separately.

Moreover, updating or modifying a single microservice is simpler than altering a large monolithic application, reducing maintenance efforts.

RPA is a technology that automates repetitive, rule-based tasks traditionally performed by humans. By implementing RPA, banks can streamline operations and reduce operational costs.

When modernizing banking apps, RPA helps perform high-volume tasks quickly and accurately, significantly reducing processing times and decreases the likelihood of human errors in routine tasks.

Choosing KMS Solutions to Modernize Your Legacy Banking System

Revamping a legacy banking system can be a complicated and demanding endeavor. At Yellow, we have a wealth of experience in successfully modernizing legacy networks for our clients in the banking sector. We recognize that the modernization journey necessitates a carefully planned strategy that caters to the specific requirements of each organization.

Our team of specialists possesses in-depth knowledge of the latest technologies and modernization techniques, collaborating closely with our clients to ensure that their legacy systems are upgraded both efficiently and effectively.

Wonder how we can help your development team modernize legacy banking apps? Discuss your challenges with us and let our professionals provide you with a customized modernization strategy.