Data serves as the vital resource that empowers organisations worldwide with the insights needed for growth and informed decision-making. Financial services companies must implement data management practices at every level of their organisation to ensure that these decisions are made with greater precision.

One crucial aspect of these practices is data integration.

But what exactly does this entail?

In this comprehensive guide, our experts at KMS Solutions will explore the role data integration plays in the financial services sector, particularly with Fintech solutions. We will delve into its workings, the different integration methods, the challenges and advantages it presents, contemporary strategies, and much more.

What is Data Integration?

Data integration strategies involve consolidating data from various sources into a cohesive and accessible format, facilitating easier ongoing data management and analysis. In the financial services sector, businesses often utilise a multitude of systems and applications, each generating its own data sets. These data sets frequently remain isolated in silos, spread across multiple databases, cloud services, and applications, making it difficult to extract meaningful insights.

Consider a financial services firm that uses separate software for customer relationship management (CRM), transaction processing, and risk management. Each system holds vital information pertinent to the firm’s operations, such as client profiles, transaction histories, and risk assessments, but without effective data integration, these systems function in isolation, leading to fragmented data and operational inefficiencies.

A robust data integration solution addresses these challenges by synchronising data from diverse sources, ensuring consistency, accuracy, and timeliness throughout the organisation. This unified approach allows financial service providers to develop comprehensive data analytics, unlocking valuable insights that enhance decision-making and boost operational efficiency.

Key Benefits of Data Integration for the Financial Services Industry

Improved Decision-Making: By combining real-time data from various sources, financial institutions can respond more quickly to market changes and adopt more agile business strategies. For example, integrated data allows brokers to analyse market trends and user preferences and, from that, make more accurate technology investment decisions.

- Enhanced Customer Experiences: Integrating customer data from multiple touchpoints allows for personalised services, which can lead to more tailored financial advice and improved customer satisfaction.

- Operational Efficiency: Streamlining processes by reducing data redundancy and ensuring data consistency across systems can cause significant cost savings and improved productivity.

- Faster Responses Time: Data integration streamlines access to customer information, enabling front-line employees to respond more quickly and accurately to customer inquiries and issues. This improved efficiency can significantly enhance customer satisfaction and loyalty.

- Reduced Data Silos: One of the most significant challenges in financial services is the existence of data silos-isolated data repositories that prevent efficient data sharing. Data integration breaks down these silos, fostering seamless data flow across departments and improving overall operational efficiency.

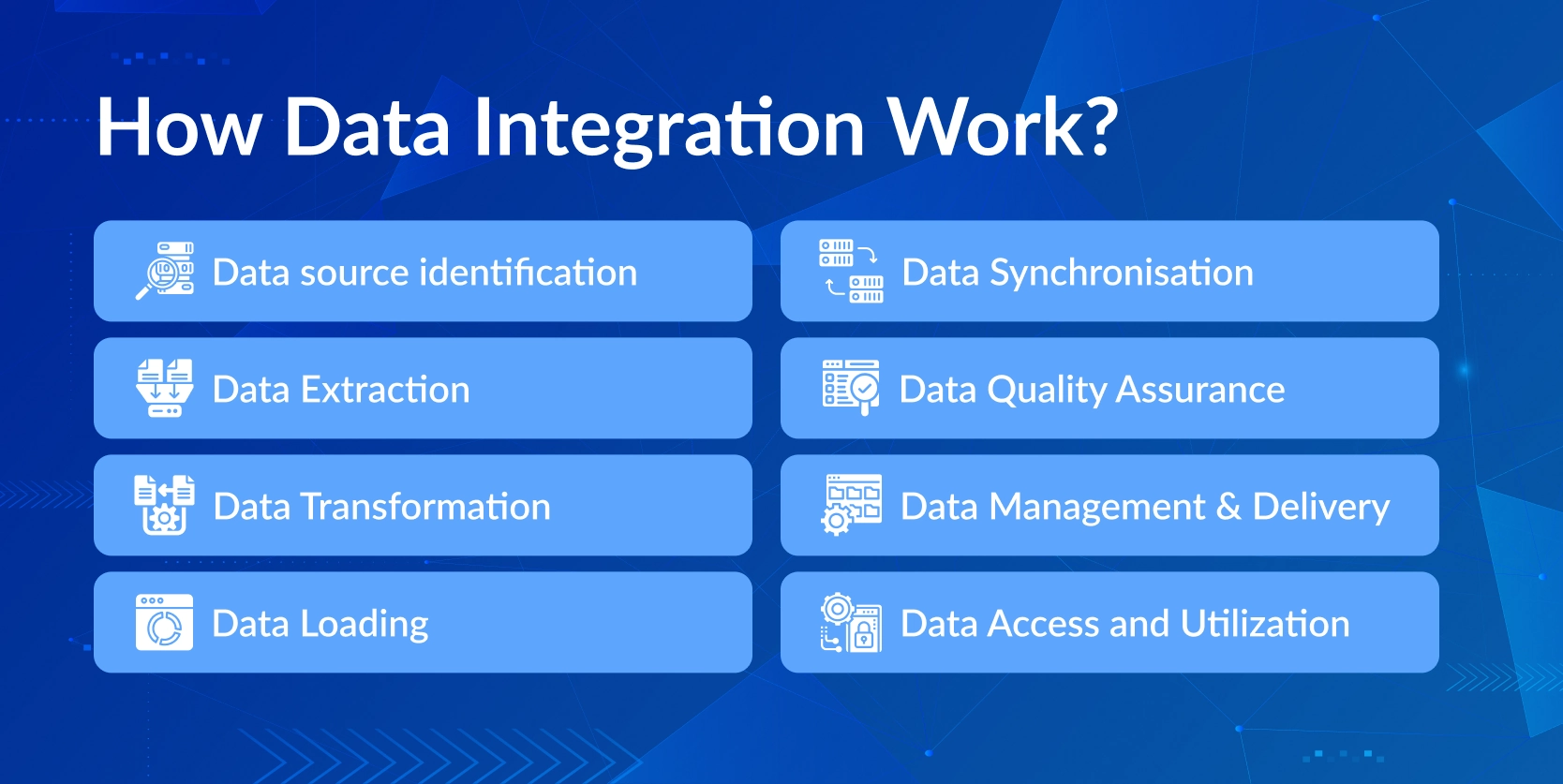

How Does Data Integration Work?

The data integration process enables financial service providers to make well-informed decisions based on comprehensive information through the following steps:

- Data source identification: The initial step in the process is defining various data sources that need to be integrated, including databases, spreadsheets, cloud services, APIs, legacy systems and others.

- Data Extraction: Data is gathered from diverse sources such as databases, applications, files, and other repositories. These sources could include:

- Databases: SQL and NoSQL databases.

- Cloud Services: Data stored in cloud platforms like AWS, Azure, or Google Cloud.

- Enterprise Applications: CRM, ERP, and other business applications.

- Flat Files: CSV, Excel, and other file formats.

- Data Transformation: The extracted data is converted into a common format or structure to ensure uniformity and compatibility. This step includes cleaning, filtering, aggregating, and converting the data to meet the organisation’s standards. During transformation, several activities may occur:

- Data Cleaning: Removing or correcting any errors or inconsistencies in the data.

- Data Mapping: Aligning data fields from different sources to a common schema.

- Data Enrichment: Adding additional data or context to make the data more useful.

- Data Loading: The transformed data is then loaded into a target system, such as a data warehouse or central database. This step may also involve indexing and organising the data to optimise storage and retrieval.

- Data Synchronisation: To ensure that the integrated data remains up-to-date, continuous synchronization between source and target systems is often required. This involves regularly updating the data in the target system with changes made in the source systems.

- Data Quality Assurance: Measures are implemented to guarantee data quality, including validation, deduplication, and error handling, to maintain the integrity and reliability of the integrated data.

- Data Management & Delivery: The unified data is made accessible to users or applications via reports, dashboards, APIs, or data services, enabling real-time analysis and decision-making.

- Data Access and Utilization: Once data is integrated, it becomes accessible for various business needs, such as:

- Business Intelligence (BI): Analytics and reporting tools can use the integrated data to generate insights.

- Machine Learning: Integrated data sets can serve as training data for machine learning models.

- Operational Systems: Business applications can use integrated data to improve functionality and user experience.

By integrating data through these steps, financial service providers can achieve a unified and consistent view of their information, enhancing their ability to derive actionable insights and make strategic decisions.

What are Some Methods of Financial Data Integration & Governance?

ETL (Extract, Transform, and Load)

ETL is a traditional data integration method that involves extracting data from various sources, transforming it into a suitable format for the target system, and then loading it into a target database or data warehouse.

ETL, a tried and tested method, excels in batch processing large volumes of data. Its true strength lies in its ability to thoroughly clean and enrich data during the transformation stage thoroughly, instilling confidence in data analysts. However, it’s important to note that ETL’s batch-processing nature can introduce latency, and implementing complex transformations can be a challenge, requiring significant upfront design and planning.

This approach is ideal for cases where historical data needs to be consolidated, and BI applications require clean and transformed data for analysis. Financial institutions typically deal with data from various sources, such as transactional systems, trading platforms, CRM systems, and more. ETL processes consolidate this disparate data into a unified data warehouse or database, providing a comprehensive view of financial operation

ELT (Extract, Load, Transform)

ELT, a variation of ETL, offers a different approach. Here, data is first extracted and loaded into the target system before being transformed. This method empowers data engineers by providing the flexibility to store raw data for future analysis. By leveraging the computational power of modern data warehouses, ELT simplifies the integration process by separating the extraction and loading stages from the transformation stage.

Just note that this method may require more storage space for raw data and can make transformations more complex as they need to be performed within the target system.

ELT is particularly useful in big data analytics and data lakes where unstructured and semi-structured data are stored for further processing.

Middleware or iPaaS (Integration Platform as a Service)

Middleware and iPaaS solutions offer a platform for integrating different applications and systems. These solutions often come with pre-built connectors and integration workflows, making connecting and synchronising data between systems easier.

Middleware and iPaaS provide a unified platform that supports both real-time and batch data integration scenarios, reducing development time with pre-configured connectors for popular applications. However, these solutions can be costly, especially for large-scale integration needs, and may require customisation for complex integration scenarios.

They are ideal for cloud application integration where on-premises and cloud applications need to be connected and for businesses looking for quick and efficient low-code integration solutions.

API Integration

API integration involves using Application Programming Interfaces (APIs) to enable different systems to communicate and share data in real time. This method supports real-time data exchange and synchronisation, providing flexibility in integrating diverse systems and applications.

API integration ensures secure data transmission through authentication and authorisation protocols. However, implementing and maintaining APIs requires significant development effort, and additional costs may be associated with API usage. Performance can also be affected by network latency and API rate limits. API integration is commonly used to connect SaaS applications and enable mobile apps to interact with backend services.

Data Virtualisation

Data virtualisation allows applications to access and manipulate data from various sources without moving or replicating the data. This method provides a unified view of data across the organisation, simplifying data access and management.

It supports real-time data integration and availability, making aggregating data from different systems for comprehensive business intelligence reporting easier. However, it can introduce latency in data access and requires careful management of data access and security policies. The complexity of the virtualised data environment can also affect performance.

Data virtualisation is particularly useful for integrating data for real-time analytics and providing a consolidated view of customer data to enhance customer service.

Explore Fintech Solutions Related to Data Management & Integration with KMS Solutions

Data integration is a vital component of modern financial services, offering numerous benefits including improved decision-making, operational efficiency, and regulatory compliance. By understanding how data integration works and its method, financial institutions can leverage the right technologies to achieve their business goals.

Are you a financial services provider needing help developing data integration strategies? Embark on your data integration journey with confidence, and transform your financial services organization into a data-driven powerhouse with KMS Solutions today!