The financial services world is changing fast, and Fintech app development companies are at the forefront of this revolution. These corporations leverage cutting-edge technology to provide a wide range of financial services expertise, from creating secure payment solutions to developing advanced banking applications that cater to the evolving digital demands of consumers and businesses.

As we look ahead to 2024, certain firms stand out for their exceptional contributions and leadership in the fintech space. In this article, we will highlight the top 15 fintech app development companies that are leading the charge in this dynamic industry.

Overview of The Fintech App Development Companies Market In 2024

In 2024, the market for fintech app development services is experiencing unprecedented growth, driven by increasing demand for faster, more convenient, and secured financial solutions. These companies are pivotal in transforming traditional banking and financial operations into seamless, user-friendly digital experiences.

As reported by Mordor Intelligence, the fintech market size is anticipated to be $228.4 billion in 2024 and is expected to grow to $397.24 billion by 2029. This profitable industry draws the attention of startups and mid-sized companies, which have recently invested in fintech app development services to tap into growth opportunities.

The market is characterized by intense competition, with firms striving to differentiate themselves through specialized services such as API integration, AI/ML, cybersecurity, RPA, open banking, and many more. These companies are also are competing to providing customizable solutions to cater to diverse client needs, from cutting-edge mobile banking apps, and frictionless payment solutions, to AI-based trading platforms.

Additionally, partnerships between traditional financial institutions and fintech startups are becoming more common, fostering a collaborative ecosystem that accelerates technological advancements and broadens market reach. Overall, the 2024 landscape is marked by rapid technological advancements, heightened regulatory scrutiny, and an increasing emphasis on user-centric design, with the participation of both tech giants and innovative startups.

List of fintech app development companies in Australia 2024

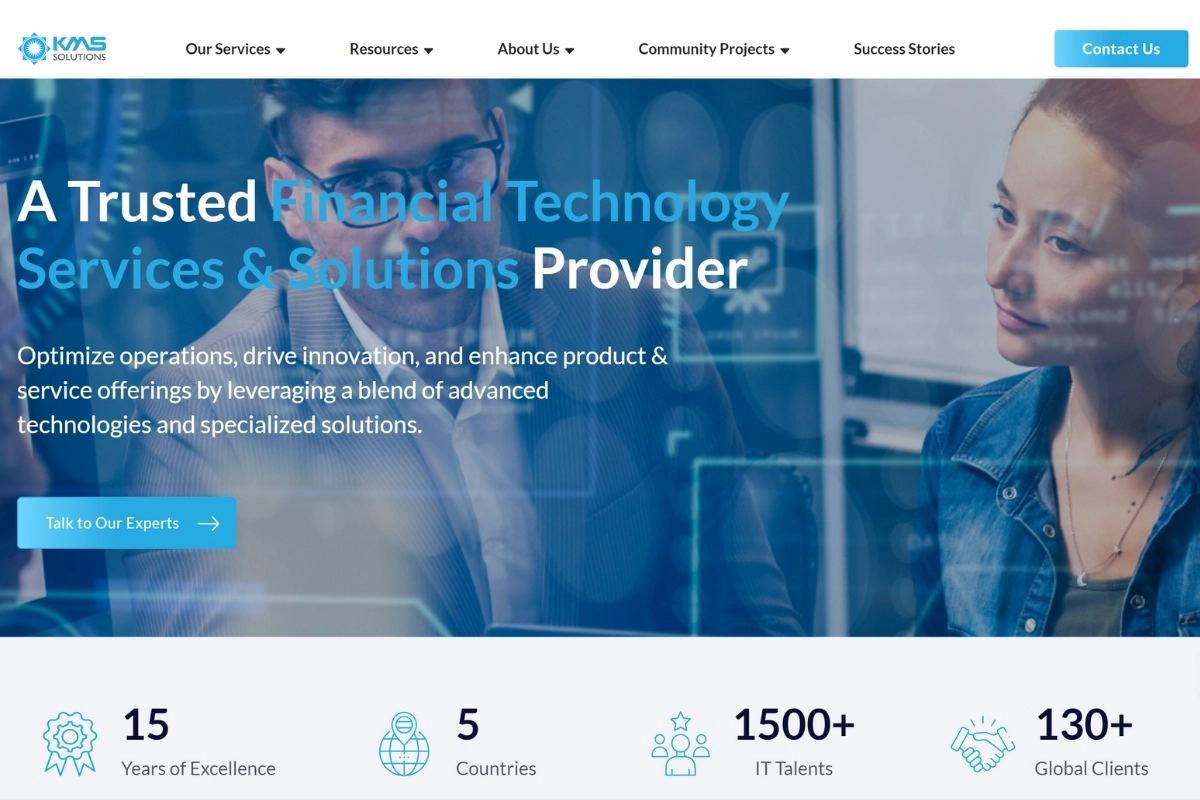

1. KMS Solutions

Founded in 2019 as a verticalized business of KMS Technology, KMS Solutions revolutionizes the delivery of financial services in the digital age. Specializing in comprehensive software testing, KMS Solutions ensures the quality, functionality, security, and performance of financial applications.

With the main focus on the BFSI industry, KMS Solutions provides a broad spectrum of Fintech solutions including mobile banking apps, trading and insurance platforms, crowdfunding platforms, wealth management software, digital lending platforms, Fintech MVP software, e-wallets, etc.

Our expertise includes automation, security, performance, mobile, accessibility, and API testing across various platforms. Supporting financial projects throughout the software development lifecycle (SDLC), from requirements to user acceptance testing, we ensure apps are polished and ready for launch.

The company receives significant recognition for its client-focused strategy and adeptness in incorporating emerging technologies, such as AI/ML RPA, open banking, API integration, cloud computing, cybersecurity, etc.

Integrating smoothly with Agile and DevOps methodologies, KMS Solutions provides continuous integration/continuous development (CI/CD), adapting to any development process. We have collaborated successfully with major BFSI companies worldwide, including Asia Commercial Bank (ACB), TPBank, a top Australian “Big Four” bank, Discovermarket, HDBank, GIC, and others.

- Clutch Rating: 4.8

- Established In: 2019

- Min Project: $100,000+

- Employees: 1,600+

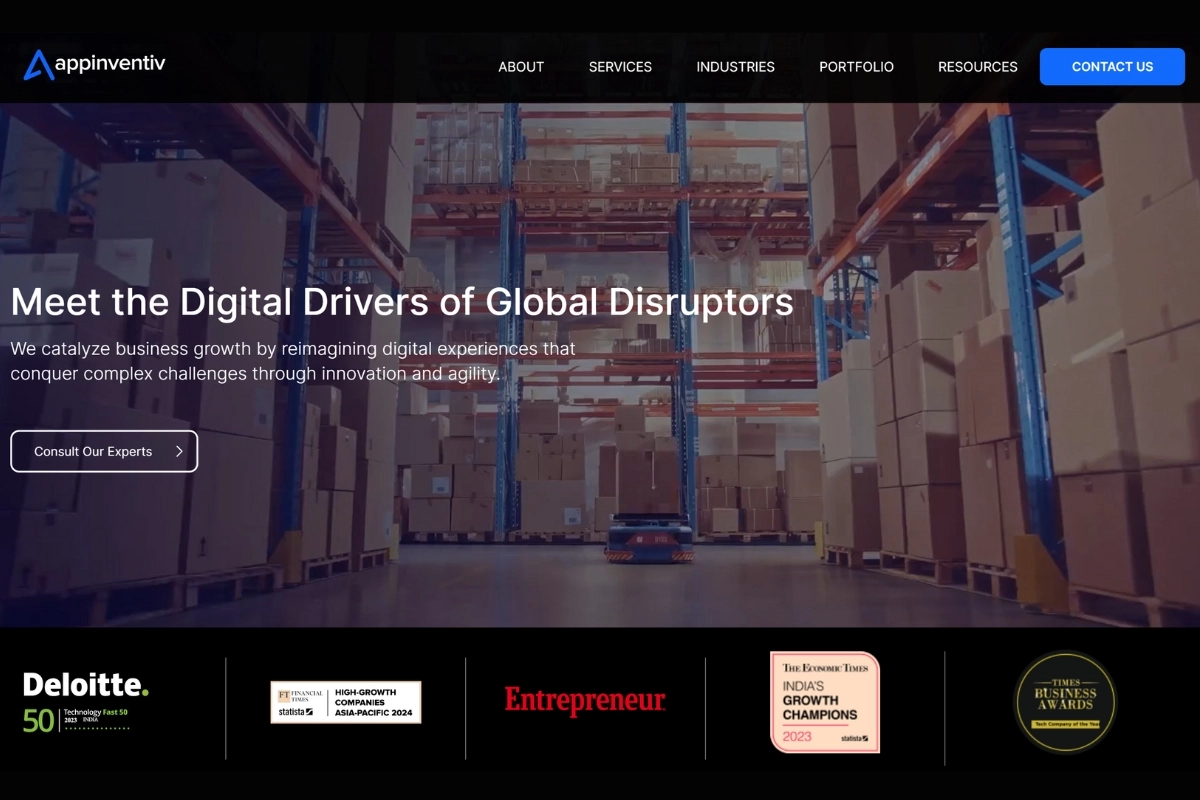

2. Appinventiv

Appinventiv excels in creating cutting-edge fintech apps known for their user-centric design and superior functionality. They are a fintech mobile app development company that ensures intuitive interfaces and reliable performance, enhancing the user experience.

- Clutch Rating: 4.7

- Established In: 2014

- Price: $25 – $49/ hr

- Min Project: $50,000+

- Employees: 1000+

3. Fueled

Fueled stands out for its creative approach to fintech app development, blending sleek design with advanced technology. They specialize in crafting personalized fintech app development solutions that resonate with users, driving engagement and loyalty.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $150 – $199/ hr

- Min Project: $75,000+

- Employees: 50 – 249

- Time Zone Availability: AGT, BET, CST, EST, GMT, IST, MST, PST

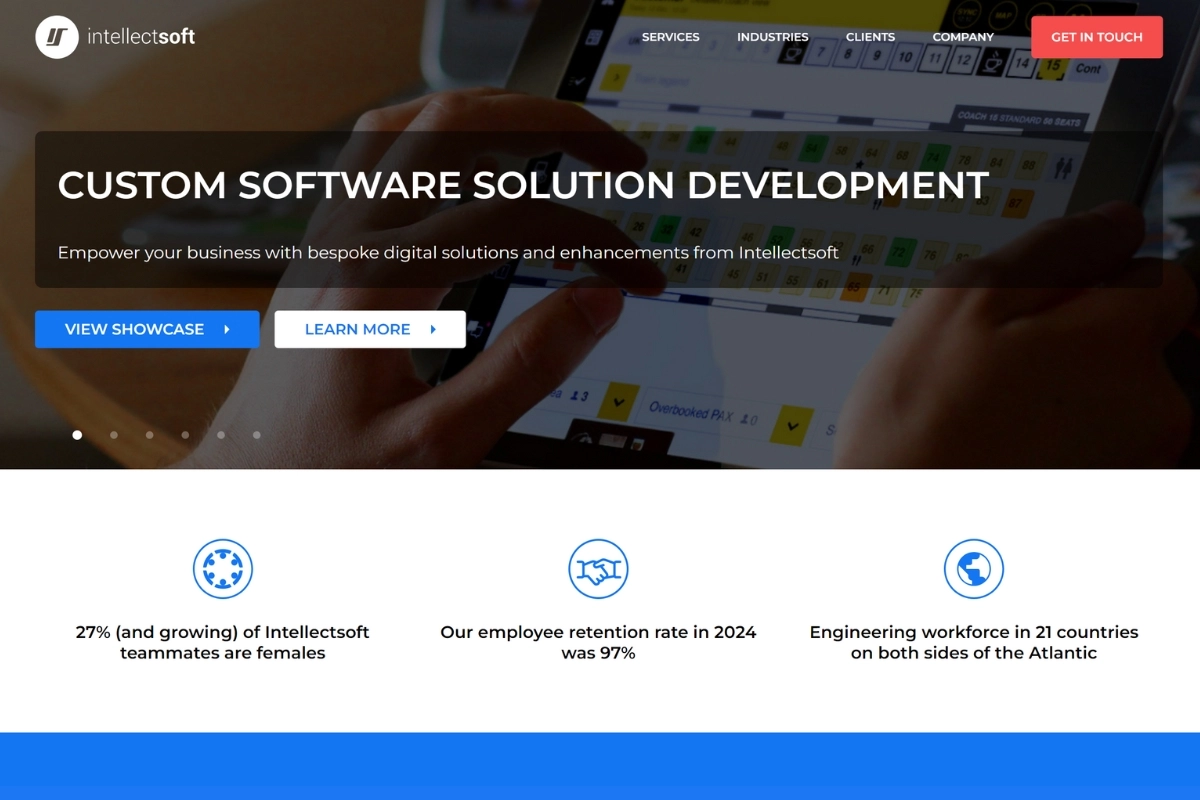

4. Intellectsoft

Intellectsoft is recognized for its comprehensive fintech services, offering end-to-end solutions from ideation to deployment. Their strength lies in leveraging AI and blockchain to deliver secure and scalable applications that redefine financial services.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $50 – $99/ hr

- Min Project: $50,000+

- Employees: 50 – 249

5. WillowTree

WillowTree is known for its proficiency in UX/UI design for fintech apps, creating intuitive interfaces that enhance usability and customer satisfaction. They prioritize user research and data-driven insights to optimize app performance.

- Clutch Rating: 4.9

- Established In: 2007

- Price: $150 – $199/ hr

- Min Project: $250,000+

- Employees: 1000+

6. KindGeek

KindGeek differentiates itself through mastery of UX/UI design and strong development methodologies for FinTech apps. They emphasize user experience and security, ensuring apps are both intuitive and robust in functionality.

- Clutch Rating: 4.8

- Established In: 2013

- Price: $50 – $99/ hr

- Min Project: $50,000+

- Employees: 50 – 249

7. Cleveroad

Cleveroad excels in cross-platform fintech mobile app development services using React Native and Flutter. Their agile approach allows for rapid deployment of scalable solutions that cater to diverse market needs, ensuring cost efficiency and flexibility.

- Clutch Rating: 4.9

- Established In: 2011

- Price: $25 – $49/ hr

- Min Project: $10,000+

- Employees: 50 – 249

- Time Zone Availability: CET, EET, MET, PST, PNT, MST, CST

8. Miquido

Miquido specializes in creating AI-driven fintech solutions that streamline financial processes and enhance decision-making. They combine machine learning with intuitive design, enabling clients to leverage data for competitive advantage.

- Clutch Rating: 4.9

- Established In: 2011

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 50 – 249

9. Dataart

Dataart offers expertise in building custom fintech solutions that integrate seamlessly with existing systems. They focus on scalability and interoperability, providing tailored solutions that meet specific business objectives and regulatory requirements.

- Clutch Rating: 4.9

- Established In: 1997

- Price: $50 – $99/ hr

- Min Project: $100,000+

- Employees: 1000+

10. Netguru

Netguru is known for its expertise in agile fintech development, delivering responsive and scalable applications. They prioritize collaborative development processes and continuous improvement, ensuring clients stay ahead in a competitive market.

- Clutch Rating: 4.9

- Established In: 2008

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 250 – 999

- Time Zone Availability: GMT, CET, EET, EST

11. Inoxoft

Inoxoft specializes in secure fintech app development, focusing on robust cybersecurity measures and regulatory compliance. They ensure data integrity and user trust, making them a reliable partner for sensitive financial applications.

- Clutch Rating: 5.0

- Established In: 2014

- Price: $25 – $49/ hr

- Min Project: $25,000+

- Employees: 50 – 249

- Time Zone Availability: PST, CET, CST, EST

12. ELEKS

ELEKS offers comprehensive fintech solutions powered by innovation and technology. They excel in digital transformation for financial services, leveraging emerging technologies to drive efficiency and customer engagement.

- Clutch Rating: 4.8

- Price: $59 – $99/ hr

- Min Project: $50,000+

- Employees: 1000+

13. ArcTouch

ArcTouch is recognized for its expertise in creating impactful fintech apps through a user-centered design approach. They emphasize usability and performance optimization, delivering apps that exceed user expectations and industry standards.

- Clutch Rating: 5.0

- Established In: 2009

- Price: $50 – $99/ hr

- Min Project: $100,000+

- Employees: 250 – 999

- Time Zone Availability: CST, PST, PRT, MST, IET, HST, GMT, EET, CNT, CET, BET, AGT, COT, EST, IDT, MET

14. Merixstudio

Merixstudio specializes in crafting scalable fintech solutions with a focus on UI/UX excellence. They combine creative design with agile development, ensuring rapid deployment and market readiness for fintech innovations.

- Clutch Rating: 4.8

- Established In: 1999

- Price: $50 – $99/ hr

- Min Project: $25,000+

- Employees: 50 – 249

- Time Zone Availability: GMT, UTC, CET, EET, ART, MET, NET, ACT, AET, NST, PST, PNT, MST, CST, EST, CNT

15. Elixel

Elixel excels at developing secure and compliant fintech apps tailored to the needs of the financial industry. They prioritize robust security measures and regulatory adherence, ensuring clients’ apps meet stringent legal requirements and user expectations.

- Clutch Rating: 4.9

- Established In: 2012

- Price: $100 – $149/ hr

- Min Project: $25,000+

- Employees: 2-9

Choosing the Right Fintech Application Development Company

With a plethora of options available, selecting the right fintech app development company can significantly impact the success of your financial services venture. Here’s a comprehensive guide to help you navigate this process effectively.

Criteria for Selection Of Fintech App Development Services

Domain Expertise in the Fintech App Development Services

Security and Compliance

Security is paramount in fintech. Ensure the company follows best practices in data security and compliance with financial regulations like GDPR, PCI-DSS, and other relevant financial regulations in your target market.

As banking and financial services are the common targets of cybercrimes, you should look for companies that prioritize robust security measures to protect sensitive financial data and user privacy.

For instance, KMS Solutions exemplifies excellence with its array of prestigious certifications.

- We are ISO/IEC 27001:2013 certified, ensuring adherence to international standards for information security management systems (ISMS).

- Comply with the Payment Card Industry Data Security Standard (PCI DSS) and hold Certified Banking Domain Professional (CBDP) credentials, offering trusted digital banking systems.

- KMS experts with 12 AWS certifications optimize cloud infrastructure performance, while PSM knowledge enables effective Scrum framework application.

- Additionally, KMS boasts certifications such as Project Management Professional, SOC2 TYPE II, and Scaled Agile, highlighting our comprehensive expertise and commitment to quality.

Development Methodology and Technological Proficiency

Agile development methodologies offer flexibility and transparency, allowing for iterative improvements and faster time-to-market. Look for a company that embraces agile practices to adapt to changing project requirements effectively.

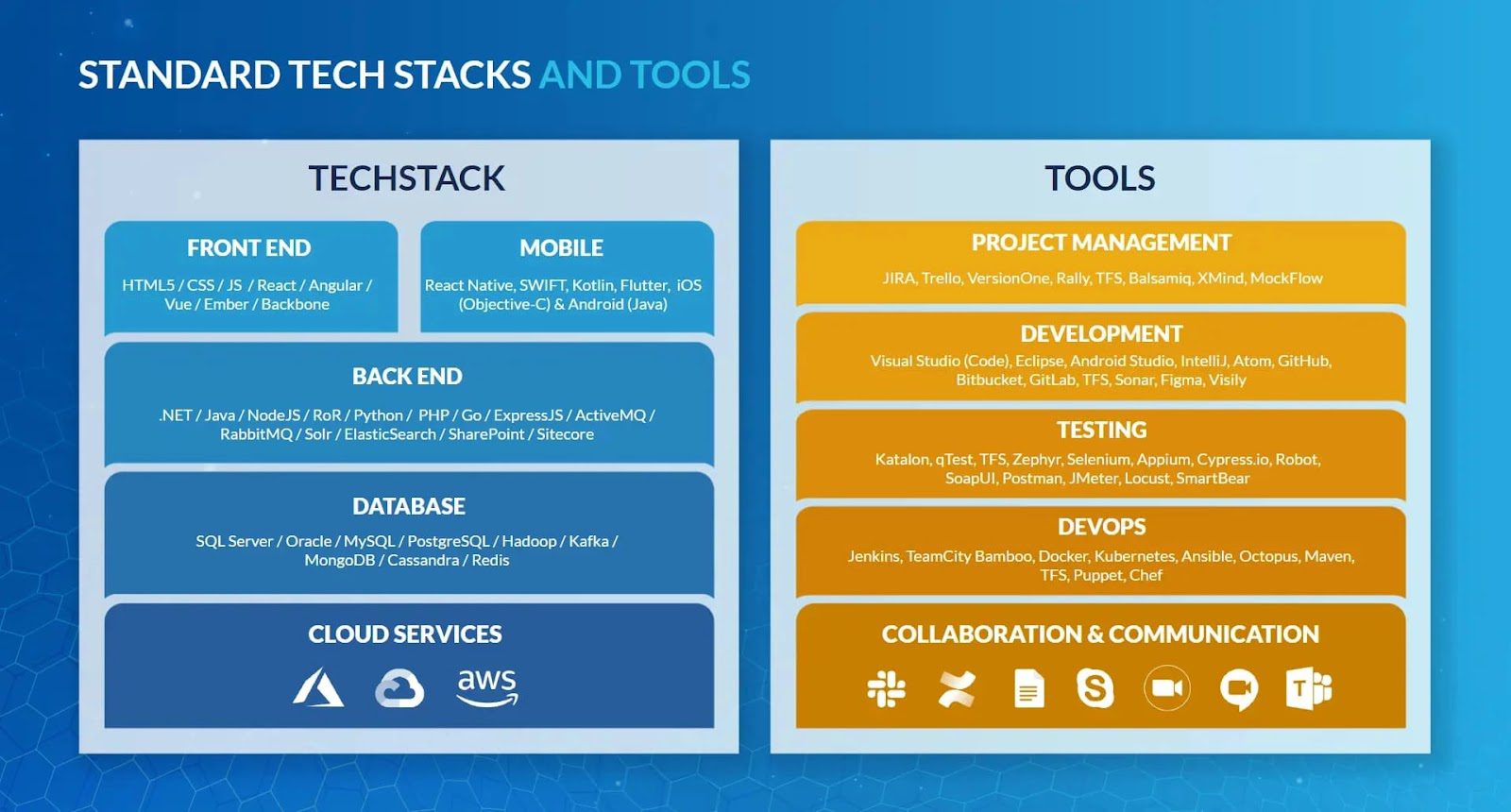

Moreover, it’s essential to assess the company’s proficiency in relevant technologies such as AI/ML, cloud computing and cybersecurity. A strong grasp of these technologies ensures they can build scalable, secure, and innovative solutions tailored to your business needs.

KMS Solutions software engineers are proficient in a wide range of programming languages and frameworks, including Java, Python, C#, Swift, and Kotlin. Moreover, the company’s development process is rooted in Agile and DevOps methodologies, promoting collaboration, continuous integration, and rapid delivery.

Communication and Cultural Fit of the Fintech App Development Services

Effective communication is essential for successful project outcomes. Choose a company that values clear communication channels, regular updates, and collaboration throughout the development lifecycle.

KMS Solutions, with headquarters in Atlanta, Sydney-Australia, and Vietnam, possesses a deep understanding of the diverse cultures within the APAC region. This strategic presence enables KMS to effectively bridge cultural gaps and cater to the unique needs and preferences of clients across these countries. Our expertise in navigating the cultural nuances of the APAC region positions us as a reliable partner for businesses looking to expand and thrive in this dynamic market.

Scalability and Future-Proofing

Consider the company’s ability to scale the application as your business grows. They should offer scalable solutions that can accommodate increased user demand and evolving technological trends. Future-proofing ensures that your application remains competitive and relevant in the long term.

For businesses seeking the optimal banking solution, KMS Solutions stands out as a reliable choice. Leveraging our deep domain expertise in financial services and a proven track record of delivering innovative solutions, KMS Solutions is adept at crafting bespoke fintech applications tailored to meet specific industry needs.

Case Studies about Fintech App Development Services

A “Big Four” Australian Bank Case Study

While developing their “Shout” fundraising platform, one of the big four Australian banks encountered several challenges: an unguaranteed time-to-market, a lack of focus on the operational process, and difficulty in building a skillful technical team in Australia. To overcome these hurdles, the bank looked for an experienced and cost-effective IT team to manage the entire software development cycle of the platform.

KMS Solutions stepped in to deliver comprehensive solutions, managing the entire software development life cycle and delineating a product roadmap for the following year. To meet the goal of expanding product offerings to serve various businesses and organizations, and to develop a new user-friendly website along with an updated mobile application, our team had grown significantly, increasing sixfold to our current size of twenty members.

To ensure a stable development process for the platform, we recommended team involvement at every stage: Requirements, Implementation, Testing, and Production Deployment. Impressed by our dedication and expertise, the bank entrusted us with end-to-end engineering solutions, from product development to operational support. This partnership has lasted over 8 years, with the bank trusting KMS Solutions to continue maintaining and upgrading the platform.

ACB Successful Story of KMS’s Fintech App Development Services

Asia Commercial Bank (ACB) aimed to attract its increasingly digital-savvy customers by prioritizing a mobile-first strategy. Before the collaboration with KMS, the bank had challenges in modernizing legacy systems and integrations, as well as attracting and engaging mobile-savvy customers.

To achieve this, ACB partnered with KMS Solutions to develop customer-centric mobile banking applications. KMS Solutions provided detailed advice on Mobile-first Design, a strategic product roadmap, and the necessary tools and personnel to execute the plan. Within just four months, the collaboration resulted in the successful release of the first version of the mobile banking app to the production environment.

Conclusion

The right fintech app development company can significantly impact the success of the company’s fintech venture. Whether you’re aiming to streamline financial services, enhance the user experience, or innovate with new technologies, choosing a reputable partner is key to achieving your business objectives effectively.

For further insights into fintech app development services and to explore cutting-edge solutions, consider partnering with KMS Solutions. We offer a range of services tailored to fintech businesses, ensuring robust, secure, and scalable applications that meet the demands of today’s digital economy.

FAQs

1. What are fintech app development services?

Fintech app development services involve the creation and customization of mobile and web applications specifically designed for financial technology (fintech) purposes. These apps can range from mobile banking solutions and payment gateways to investment platforms and financial management tools.

Many customers are also concerned and asking us “How much does it cost to develop a FinTech app?“. The total cost can vary widely based on several factors. Factors such as the app’s complexity, desired features, platform compatibility, and the development team’s expertise all play a role in determining the final price. Additionally, ongoing maintenance and updates can influence the overall expense.

2. Why choose KMS Solutions for fintech app development?

KMS Solutions stands out for its deep expertise in fintech, offering tailored solutions that prioritize scalability, security, and compliance with industry regulations. With a proven track record of collaborating with leading BFSI companies globally, KMS ensures innovative and effective fintech app solutions.

3. What services does KMS Solutions offer throughout the software development lifecycle (SDLC) for BFSI companies?

KMS Solutions provides comprehensive support across all stages of the SDLC, starting from consulting to design, development, testing, deployment, and ongoing maintenance.

Our specialized team excels in developing a range of financial software, including mobile banking apps, digital platforms tailored for the BFSI sector, trading platforms, and insurance software.

Additionally, we offer a wide array of technology expertise, such as technology consulting, digital banking systems transformation, software quality services, advanced application management, app migration, and seamless integration solutions.

This ensures that BFSI companies receive end-to-end support in implementing robust and innovative software solutions that meet their specific business needs and regulatory requirements.

4. How does KMS Solutions ensure compliance with stringent regulations in BFSI applications?

KMS Solutions excels at adhering to industry standards like PCI DSS and understands the unique compliance requirements of the BFSI sector. We emphasize our expertise in regulatory compliance to ensure our fintech solutions meet all necessary standards.

5. What are KMS Solutions' software testing partners?

KMS Solutions partners with leading software testing platforms such as Katalon and Kobiton to enhance testing capabilities for BFSI (banking, financial services, and insurance) companies.