As we enter the digital era, developing a mobile banking application is no longer an option. Most banks now have at least one application for each customer segment. However, releasing an application that can receive good customer feedback and stand out from competitors takes work. Many projects, unfortunately, ended up in failure. Poor digital experience can also lead to lower brand loyalty and customer satisfaction.

In this post, we will highlight three major mistakes that most banks fall into when developing mobile banking apps and how to avoid them.

1. User is not put in the center of the design

Effortless experience, user convenience and availability of features are keys if you know what customers expect from your banking app. If the user can perform a specific task comfortably, he will continue using the solution. Here are a few things you need to care about:

Extensive features set

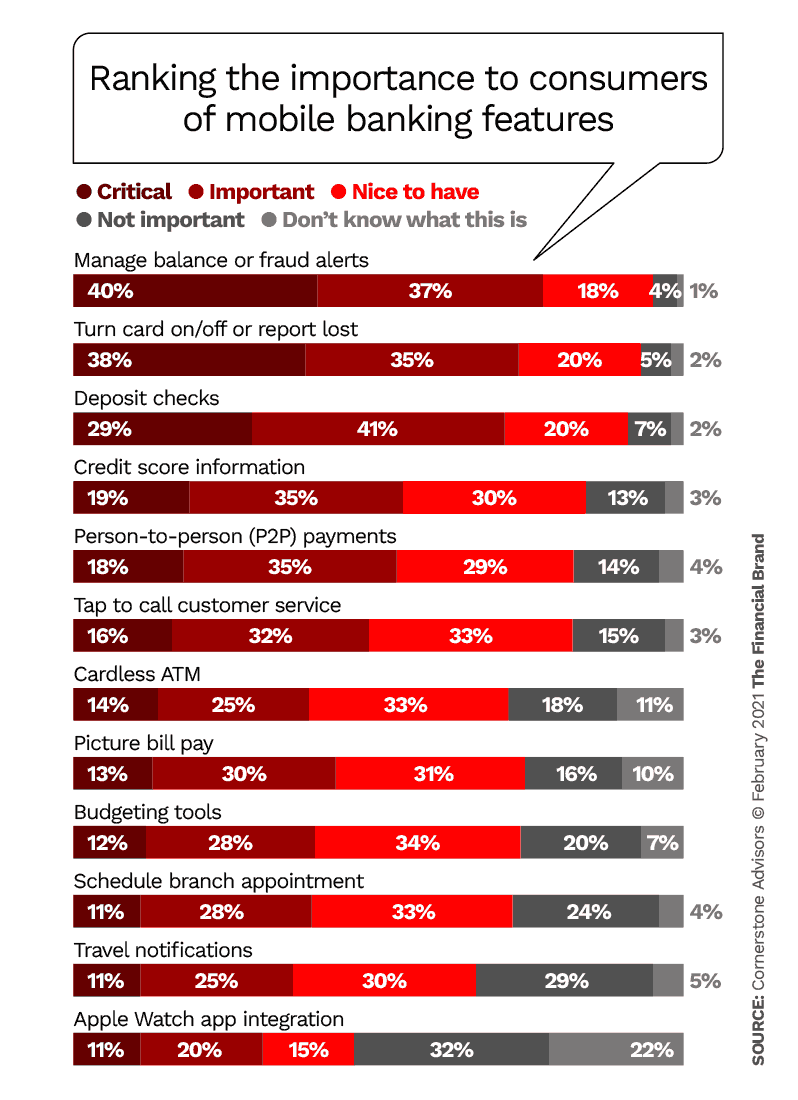

Long gone is the day when mobile banking apps only have the bare minimum of functionality like checking account balances, transfers, and history transactions. However, as technology evolves, so do customer expectations. Nowadays, clients treat mobile banking apps as a regular or even primary banking channel.

Hence, merely providing online card accounts and simple transfers is no longer sufficient for banks to attract and retain customers. Instead, mobile banking must enable users to perform practically all banking-related functions. Some advanced mobile banking app features that might interest your clients include:

- Expenses trackers: allows users to monitor and categorize their expenses, giving them a good idea of their purchasing behavior.

- Personalized offers: special offers, investment services, and savings plans suited to users’ financial situations can help strengthen customer relationships and enhance customer trust while driving more sales.

- Chatbot or voice assistant: for informational and transaction purposes, voice-powered chatbots are great complementary to deliver an engaging and conversational user experience.

- Cardless ATM access: Permit your users to withdraw cash even if they don’t have their cards with them. Alternatively, demand account verification via banking apps

- eKYC: by digitizing the customer onboarding process, banks can eliminate the need for customers to visit an offline branch to open a bank account.

Mobile banking apps can also incorporate non-obvious offerings like flight/hotel booking, phone billing, and ticket purchasing. Furthermore, with the rising trend of wearable technology, it’s worth considering facilitating payments, displaying banking information, and delivering notifications using smartwatches.

Reviews of apps can be a great feedback mechanism to guide financial institutions on what features to build next. As users make suggestions and requests in their comments, you can identify real issues, and utilising the remarks is much cheaper than holding focus groups.

For instance, a new feature release is shortening your average session duration. When checking reviews for more information, you find that many users are complaining that they now get an error upon opening the banking app; you immediately know there’s a pressing problem your engineers must address.

Do not bring your webpage to mobile.

Sometimes, the easiest way to implement a feature is to copy what is running for now on your website to mobile.

User behavior on mobile is relatively different than on the website. The mobile phone’s screen is much smaller and works in a different environment. Not only will you have to adjust the UI to make them big enough for fingers, but you also must adapt to all the processes and functions so that they can be completed comfortably on mobile devices.

Besides that, several features can be implemented only on a mobile device:

- Login using biometrics (TouchID, FaceID)

- Location navigation and services

- QR Code scanning

- Direct call

- Push notifications

2. Untrusted security

Security concerns lie among the most crucial challenges financial institutions must keep an eye on. Studies show that a data breach can cause 65% of consumers to lose trust, while 85% would stop engaging with the brand. Without ensuring the right level of security, your mobile banking app is nowhere near success.

Besides the solutions required by law, banks can execute app-specific security features to prevent attacks such as keyloggers, mobile banking trojans, overlay attacks, etc.

Advanced multi-factor authentication

Two-factor authentication offers an extra layer of security by implementing an additional identification method different from the primary one.

These security measures ensure that the user is granted access to the systems only after providing two or more pieces of evidence of their identity. These control methods involve:

- Physical objects: tokens, electronic chips, NFC chips, etc.

- Biometric traits: facial recognition, fingerprint, voice recognition

- Alphanumeric password: numeric PIN, answers to questions that only the user knows

- Graphic password: line patterns, set of tactile movements

- Single-use password: aka one-time password – OTP, a code that can be obtained by SMS or email to which only the particular user has access.

Prevent information leakage using end-to-end encryption

It is a security mechanism that encrypts messages transmitted between users so that only the sender and recipient can read them. The messages can’t be read by anyone or any computer program in between. Mobile banking apps with end-to-end encryption rely on TLS/SSL certificate-based authentication to establish a secure connection.

Timely security alerts

Push notifications can play a significant role in the field of mobile banking app security. They are a valuable tool to alert bank customers to potential fraud. Nevertheless, the warning should be conveyed in a way that doesn’t terrify users.

-

Alerts concerning account changes

This is one of the most common mobile alerts which inform users of changes to their accounts. Banking apps send an immediate notification whenever there is an update in the client’s data, like password, email, phone number, or address.

-

Alerts concerning irregular activity

Similar to the above-mentioned alert, it informs app users of suspicious account activity. This type of notification can contain specifics on unusual purchases made from dubious locations.

3. Boring experience

Banking customers are becoming digital-savvy. Born in the digital era, younger consumers have a high standard when it comes to mobile experience. Delivering a robust and engaging digital banking solution is essential to keep them coming back to it and even recommending it to their friends.

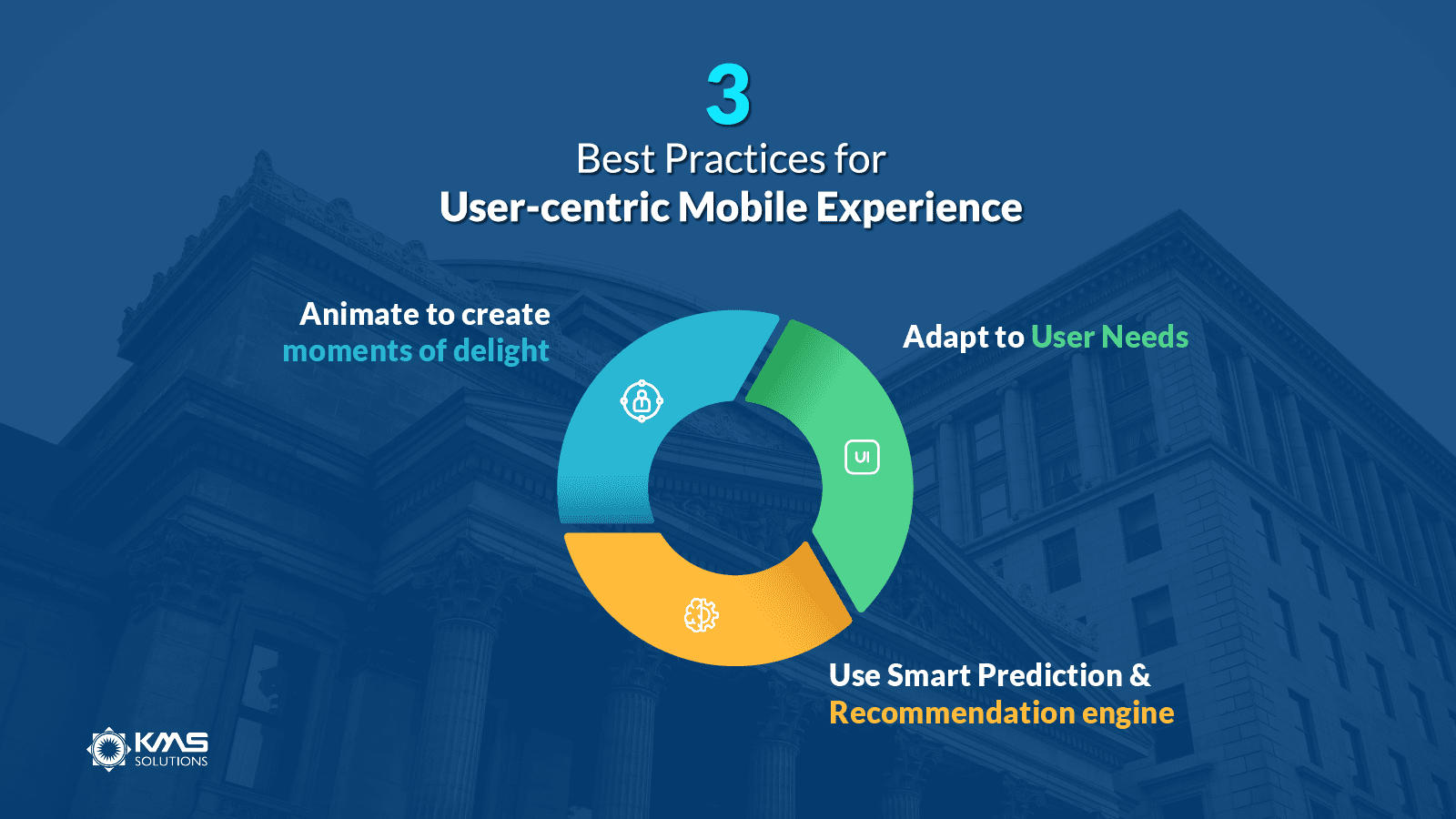

Here are 3 key metrics that deliver a WOW factor:

Adapt to User Needs

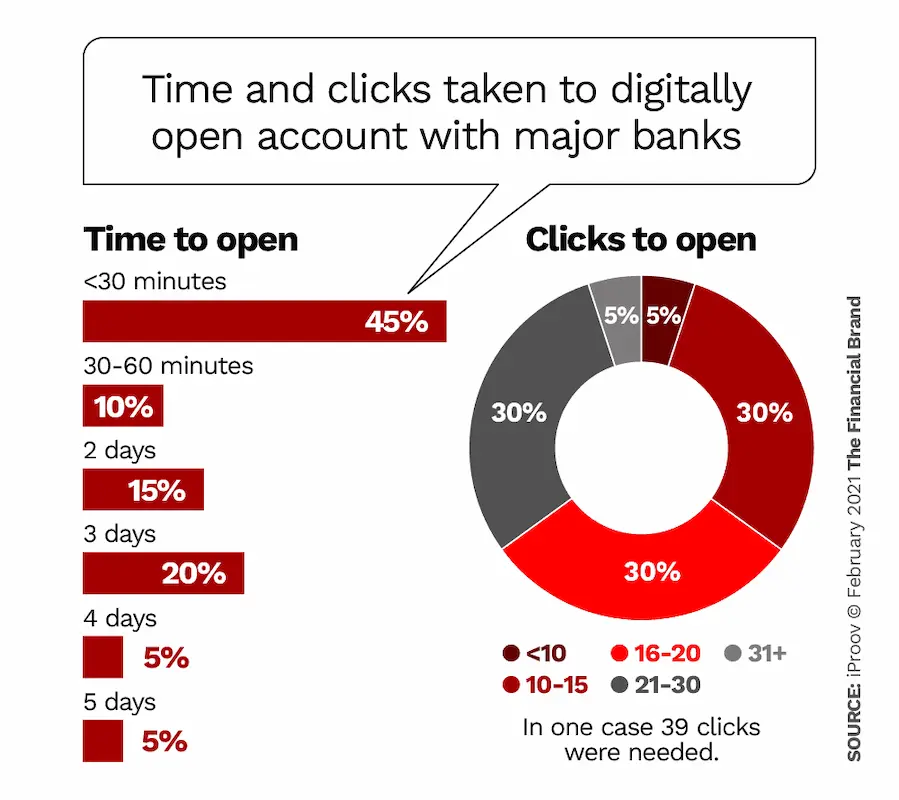

Customers always love solutions that satisfy their needs. There should be no obstacles in your user flow. In other words, customers should have no trouble performing different tasks in your mobile banking app. Obstacles are where users stop and think about what they should do next.

The lack of ease in opening accounts digitally has long been a persistent problem. iProov found that 65% of major U.S. financial institutions enabled accounting openings in 20 clicks or less. However, as the pie chart below illustrates, of the remaining 35%, a small number took over 31 clicks. Typically, the additional click arises from having to close several popup notifications after they are read (or ignored), while others emerge from required document reading.

Delivering personalized experience

According to J.D.Power’s 2022 U.S. Retail Banking Satisfaction Study, customers are unhappy with the level of personalization they receive during interactions with their banks.

The research also discovered that only 44% of banks actually deliver personalized support to their customers, despite the growing demand for personalization among respondents. More clearly, clients expect a personalized mix of financial advice, hands-on assistance with issue resolution, and suggestions on how to grow their money.

Anti-fee measures are highly sought-after features in personalization, with 46% of participants saying they want financial institutions to assist them in avoiding fees, while 37% express interest in receiving notifications for their own accounts.

To enhance customer retention, banks can invest in data analytics solutions to have a better overview of their users’ spending behavior. From there, businesses can incorporate AI to generate offerings/advice tailored to the user’s financial findings based on the collected data.

Animate to generate moments of delight

Leading solutions are always appreciated for their efficiency, usability, and enjoyable motion design. The animations must be meticulously planned. To astound users, you need to anticipate the moments of delight; for example, animations are only implemented when users finish the transfer or open a new savings account.

These additional details determine the high quality of your product. Even though they might require extra development days, they are worthwhile.

Animations are also a way to tell users that their actions have an impact. Effective motion design gives visual cues that help the user complete their activities. It’s clear that animations are not only about aesthetics but also about adding value to users.

Important: You may interested in seeking the experts sharing how to build a delightful mobile banking app

Summary

Today, mobile banking apps are a must for banks. Therefore, they should be designed and implemented with the highest quality. The tips from this article will help you identify customer pain points and suggest solutions.

Great mobile banking UI/UX leads to a win-win where users love the solution, and the company is satisfied with the results.

If you would like to build a mobile banking app from scratch with fast time-to-market while delivering a user-centric experience, KMS Solutions can help.